Good Afternoon!

Hey, everyone. It's Adam from Elite Trade Club.

Here’s what moved the market today.

Markets 📈

Stocks cruised to a mixed finish on Tuesday as investors awaited tomorrow’s Fed meeting & CPI report. The Nasdaq rallied, while the Russ2K sank lower.

DJIA [-0.3%]

S&P 500 [+0.2%]

Nasdaq [+0.8%]

Russell 2K [-0.3%]

A tiny stock could be positioning itself to dominate the up-and-coming domestic lithium market ahead of a potential super boom in demand.

Studies estimate 400 new mines are needed within the next 11 years to meet surging demand for TVs and energy storage batteries.

This company has potential to be a powerhouse in the growing domestic lithium market, and there’s still time to get in early.

» Want an Ad-Free Experience + Top Growth Stock Picks? Upgrade Now!

Market-Moving News 🔎

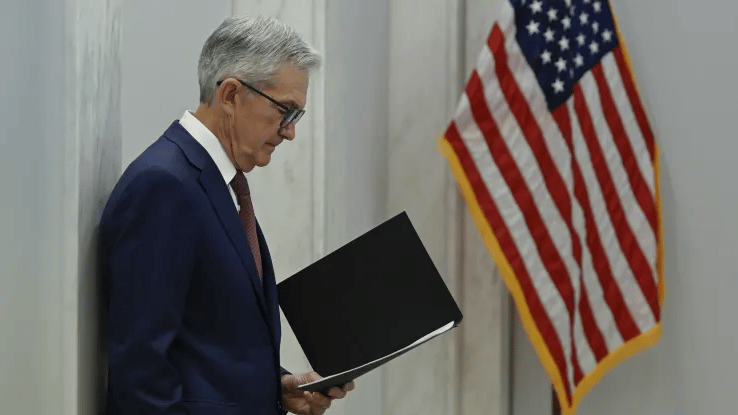

Big Wednesday Ahead: Fed Meeting & CPI 🚨

Wednesday marks a pivotal moment for economic news, with the spotlight on inflation and the Federal Reserve's strategy.

Starting with the consumer price index (CPI) reading for May and concluding with the Fed's policy meeting, investors await crucial signals about the economy's trajectory.

Anticipated Outcomes 🔮

The CPI for May is expected to show minimal month-over-month movement, with a projected 0.1% increase from April.

Core CPI, excluding food and energy prices, is forecasted to rise by 0.3% monthly and 3.5% annually. While these figures indicate persistent inflation above the Fed's 2% target, some economists believe a closer look at specific metrics might reveal a gradual shift in the right direction.

While CPI garners public attention, the Fed prefers the Commerce Department's personal consumption expenditures prices, offering a broader perspective.

Fed Forecast 🌤️

The Fed is expected to maintain interest rates, with no significant changes anticipated. Instead, focus will be on quarterly updates to economic projections, including inflation, GDP, and unemployment rates.

However, recent data, like Friday's robust payrolls report showing a 4.1% annual wage growth, suggests higher-for-longer rates may become more plausible.

Implications💡

The CPI report could shake up the trading session before it even opens, and the Fed announcement will likely create a volatility spike in the afternoon. Buckle up for tomorrow because it could be a wild trading day.

Top Winners and Losers 🔥

Airship AI [AISP] $4.62 (+47.1%)

landed a deal to supply its Acropolis Enterprise Sensor Management video & data management platform to an agency under the U.S. Deptartment of Justice.

Bluewater SPAC [BWAQ] $9.49 (+39.1%)

rebounded after a sell off that began last Friday, when it extended its deadline to close its deal with Fuji Solar from June 2nd to July 2dn.

TruGolf [TRUG] $1.38 (+34.8%)

rallied a week after launching a national franchising initiative with a regional developer model on June 4fth.

Visionary Holdings [GV] $3.40 (32.9%)

suffered losses for the second day in a row after rallying through most of last week.

Target Hospitality [TH] $7.20 (31.4%)

received a 60-day notice for termination of its South Texas family residential center services agreement.

Greenwave Tech [GWAV] $2.05 (29.5%)

entered into a deal with certain institutional & accredited investors to purchase $15.3 million worth of shares and accompanying warrants.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback from our members!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Text ELITESTOCKS to 47121 or click here to get our alerts on your mobile device, and never miss another fast-moving stock!

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.

A radical new A.I. development is about to blindside millions of Americans.

This early A.I. pioneer just issued an urgent warning explaining everything.