One stock just dropped a forward outlook that can re-rate the whole year, one is riding a metal move that can turn into a face-ripper or a trap in the same afternoon, and one is quietly stacking real-world contracts that could keep the momentum crowd fed. The key is spotting which move is real and which is just premarket sugar.

Modernization Wave (Sponsored)

A small-float cybersecurity name is positioning around multi-year contracts and AI-driven defense.

Recent materials cite tens of millions in backlog and expansion across government and enterprise clients.

The solution is designed to wrap around digital assets and screen traffic for malicious activity.

Cybersecurity demand remains resilient even in uncertain economic cycles.

Click to review the full overview.

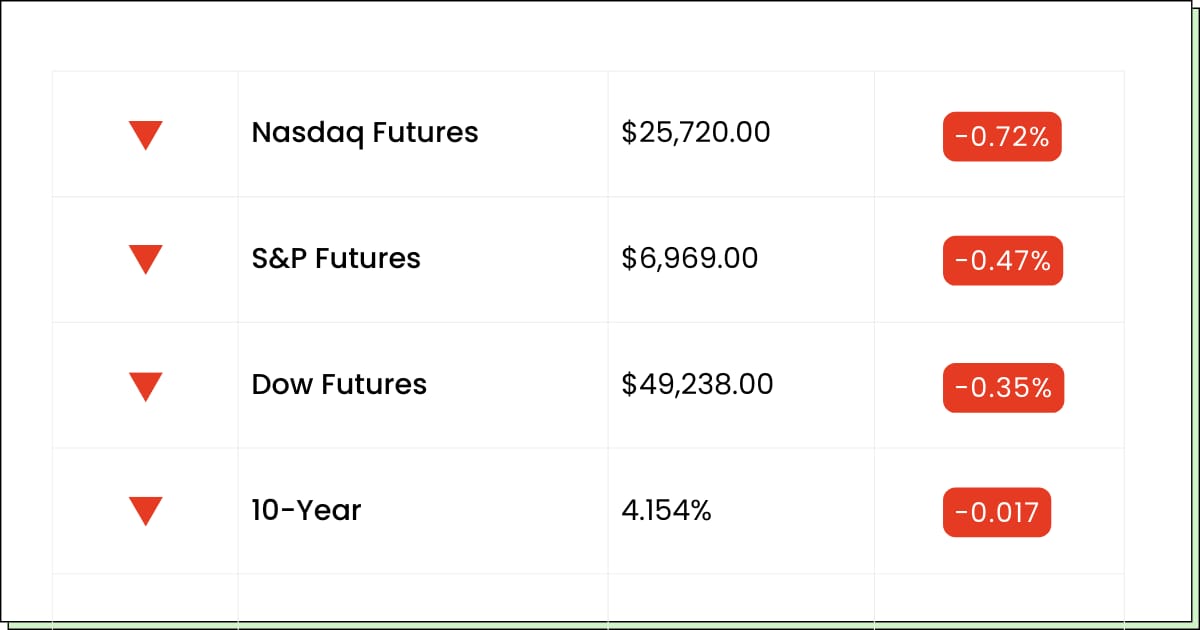

Futures at a Glance📈

Futures are slipping as Wall Street shakes off its record-high glow and braces for another wave of bank earnings. Bank of America, Wells Fargo, and Citi are up first, with PPI inflation data also on deck before the bell. If there’s a silver lining, some folks think this dip could set up cleaner entries, especially with big AI capex guidance from hyperscalers still looming.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

Bank of America Corporation [BAC]

Wells Fargo & Company [WFC]

Citigroup Inc. [C]

Earnings (Aftermarket):

Home BancShares, Inc. [HOMB]

H. B. Fuller Company [FUL]

Compass Diversified [CODI]

Economic Reports:

Retail sales (Nov, delayed): 8:30 am

Retail sales minus autos (Nov, delayed): 8:30 am

Producer price index (Nov, delayed): 8:30 am

Core PPI (Nov, delayed): 8:30 am

PPI year over year (Nov): 8:30 am

Fed Speakers:

Chicago Fed President Austan Goolsbee radio interview: 6:00 am

Minneapolis Fed President Neel Kashkari speaks: 11:00 am

Atlanta Fed President Raphael Bostic speaks: 12:00 pm

Fed Governor Stephen Miran speaks: 12:30 pm

New York Fed President John Williams opening remarks: 2:10 pm

Biotech

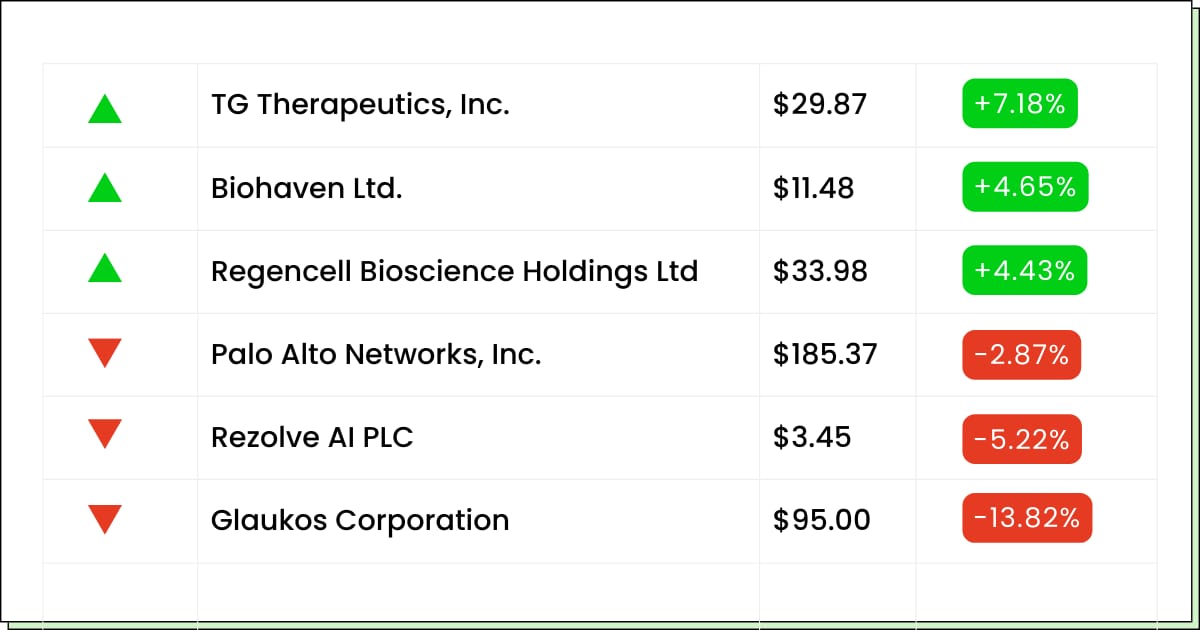

TG Therapeutics Puts 2026 On The Scoreboard And Traders Start Doing Math

A guidance pop lit the fuse, and now TG Therapeutics Inc (NASDAQ: TGTX) is ripping premarket after it tossed out a big 2026 revenue range. When a company gives the market a clear “here’s the plan” number, traders tend to stop guessing and start buying.

The simple story is that one product is carrying the team, and management is saying the pace should pick up. That is catnip for momentum money, especially when growth feels harder to find.

But gap-ups are famous for mood swings. Sometimes it opens strong, everyone high-fives, then it fades like a New Year’s resolution by lunchtime. The tell is whether it can hold most of the move after the first hour instead of leaking back into the old range.

My Take For You: If you’re not in, don’t chase the first spike. Let the open settle and look for a cleaner entry if it holds the new level. If you’re in, trim a little into strength and keep a simple stop line.

My Verdict: Good catalyst, but treat it like a trade until it proves it can stay above the new breakout zone.

Materials

Hecla Mining Rides A Silver Record Like It Just Found A Turbo Button

Silver hit a fresh record, and Hecla Mining Co (NYSE: HL) jumped like it heard the starting gun. Miner stocks tend to act like a louder version of the metal, which is great on up days and annoying on pullbacks.

This move is mostly about the tape, not a deep company plot twist. When money runs into precious metals, miners get dragged onto the dance floor whether they are ready or not. If silver stays hot, the stock can keep strutting. If silver cools, the miner can trip over its own shoelaces fast.

Your job is to watch follow-through. One big pop is fun, but the better signal is a second day of strength or a calm pullback that gets bought quickly. If it gives back the move right away, it was more sugar rush than meal.

My Take For You: If you’re new, wait for a pullback and see if buyers show up again. If you’re holding, skim some gains on strength and keep a tight risk line.

My Verdict: Momentum is real, but this is still a trade first, investment second until silver proves it can hold the breakout.

Gold’s Moment (Sponsored)

Foreign powers are challenging the dollar while global tensions continue to rise.

Markets reward preparation, not hesitation, during moments of political and economic stress.

Savings left unprotected often take the hardest hit when volatility accelerates.

This Patriot’s Tax Shield shows how physical gold has historically helped investors protect purchasing power.

A free Wealth Protection Guide breaks down how Trump’s vision could create renewed momentum for gold.

Get the FREE guide and see how to protect savings today.

Energy

Borr Drilling Books More Work And The Stock Smells Paychecks

Fresh contracts hit the stock, and Borr Drilling Ltd (NYSE: BORR) got a boost because offshore drillers live and die by one thing: staying booked. More work can mean better visibility, and the market loves visibility almost as much as it loves a good before-and-after story.

The catch is that this space can flip fast. Even with good contract news, energy names can get yanked around by oil headlines and risk sentiment. So you want the stock to act like it believes its own news, meaning it holds the move instead of doing the classic pop-then-plop.

If this is a real trend leg, it should stay above the breakout area and stop acting twitchy on every little dip. If it cannot hold, that is your sign that the market already eaten the good news and wants dessert.

My Take For You: If you want in, start small and add only if it holds the move through the morning and into the close. If you’re in, take a quick partial on strength and keep a smaller runner.

My Verdict: Constructive headline and decent setup, but size it like a trade and keep your exit plan simple.

Trivia: Which ancient city was known for standardized prices posted publicly?

Movers and Shakers

Glaukos Corp [GKOS]: Premarket Move: −14%

Glaukos just posted a sales beat and the stock still face-planted after-hours, which is the market’s way of saying cool story, now show me the next chapter.

The vibe here is expectations got too comfy, and guidance that feels merely fine can still get treated like a letdown when a stock has been running.

My Take: Let it stop wobbling first. If it finds a floor after the open, a small starter can make sense. If it keeps sliding, do not try to catch it with your face.

Rivian Automotive Inc [RIVN]: Premarket Move: −4%

Another downgrade, another reminder that cash burn is the monster under the bed for EV names. Traders love the shiny features, but the market still pays rent in dollars.

This is the kind of headline that makes people back away from the punch bowl and ask who’s picking up the tab.

My Take: Treat it like a watchlist setup, not a heroic buy. Small only on a clean bounce, and if it breaks down early, walk away and wait for a calmer entry.

Regencell Bioscience Holdings Ltd [RGC]: Premarket Move: +4%

This one moves like it’s powered by caffeine and poor decisions. Big swings, thin trading, and sudden reversals are basically the brand at this point.

If you blink, you can go from genius to bag-holder before your coffee cools.

My Take: This is for traders only. If you play it, keep size tiny, take profits fast, and use a hard line where you are out without debating it.

Macro Forces Align (Sponsored)

Liquidity is rising as the Fed shifts toward easier monetary policy.

Institutional capital continues flowing into crypto at record levels, while a pro-crypto administration accelerates favorable regulation.

Mid-term elections historically reward market-friendly policies—and after months of consolidation, conditions are aligning for a powerful move.

Nothing in crypto is ever guaranteed.

But this is one of the strongest setups seen in years—while prices remain relatively low.

Crypto Revolution reveals a disciplined system for building crypto wealth without gambling, sleepless nights, or chasing every price swing.

Get instant access to the book plus $788 in bonuses now.

© 2026 Boardwalk Flock LLC. All Rights Reserved.

2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

*The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

*Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Everything Else

Saks just hit the panic button and filed for bankruptcy protection, which is a fancy way of saying the luxury vibes are getting a little too expensive.

The World Economic Forum’s new Global Risks report is basically a 2026 bingo card of things that can break markets and ruin your mood.

Ford rolled into the Detroit auto show with the classic message: new models, big smiles, and please stop asking about margins.

Amazon is still fighting an Italian fine, even after it got reduced, per this appeal update, because apparently discounts are not the same as forgiveness.

Tesla is getting ready to sell self-driving as a monthly subscription starting Feb. 14, which means your car may soon come with a recurring bill like your streaming apps.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.