A federal judge just removed a major roadblock to one of the year's most-watched health-tech acquisitions, and shares exploded higher. With the deal back on the table, investors are asking: Is the real upside still ahead?

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Markets

Markets edged higher Tuesday as investors cheered signs of a pending government reopening, even as AI-linked losses in Nvidia and CoreWeave held back broader tech momentum, with the Nasdaq closing lower.

DJIA [+1.18%]

S&P 500 [+0.21%]

Nasdaq [-0.25%]

Russell 2k [+0.17%]

Market-Moving News

Retail

How Target Plans to Win Back Your Cart and Your Heart

Target (NYSE: TGT) just slashed prices on more than 3,000 everyday products ahead of the holidays; that’s not a typo, it’s a declaration.

From snacks to detergent, the shelves are turning into a masterclass in budget-friendly redemption.

The move isn’t just about discounts; it’s about Target remembering who made it a household favorite in the first place.

The company wants to win back the families, the late-night snackers, and the caffeine shoppers who stopped coming when the deals dried up.

The Comeback Aisle

After a stretch of slow traffic and lukewarm vibes, Target’s shifting gears from stylish-but-pricey to smart-and-practical.

It’s a recalibration that trades short-term profits for something more valuable, customer trust.

You can almost feel the shift in strategy; it’s less about chasing margins and more about rebuilding that emotional checkout moment when shoppers feel they scored.

That’s the Target magic they’re trying to reboot.

Holiday Redemption Arc

Walmart and Aldi already came for the bargain crown, but Target’s betting that price drops plus personality can still win the season.

Offering a Thanksgiving dinner for under $5 per person is just the appetizer for a full-on brand revival.

The question isn’t whether Target can afford these cuts; it’s whether anyone else can afford to ignore them.

If the aisles start buzzing again, you’ll know the comeback worked because you’ll probably be in one of them.

Infrastructure

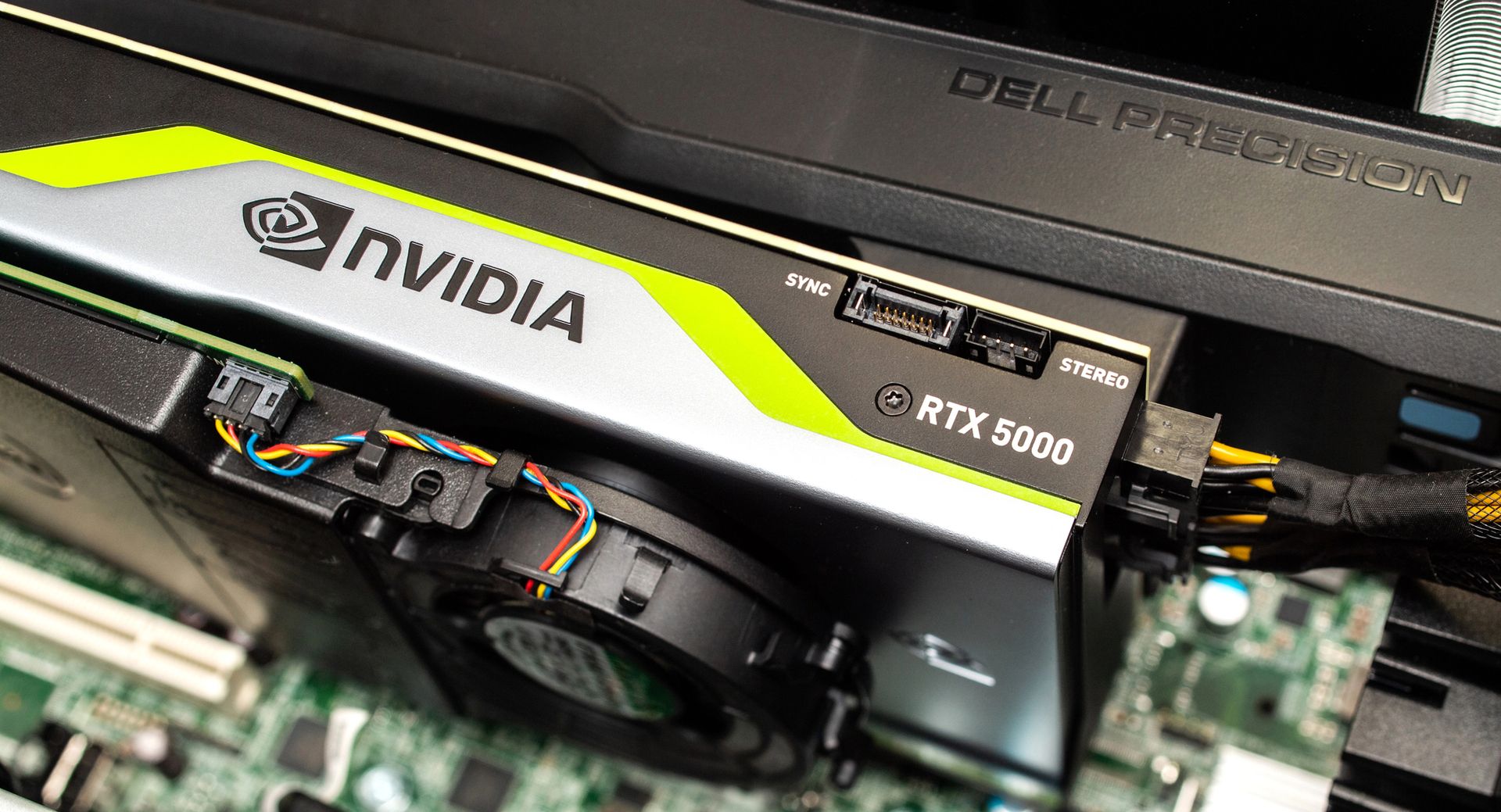

Nvidia Just Proved It Doesn't Need Anyone's Hand on the Wheel

Nvidia (NASDAQ: NVDA) just watched one of its oldest backers, SoftBank, walk away with $5.8 billion in profits.

The market barely blinked. That's how you know who's running the show.

The company isn't powered by sentiment anymore; it's powered by servers, GPUs, and data centers that every AI dream needs to survive.

You could pull a few billion out of Nvidia today, and it would still look like the world's favorite engine of progress tomorrow.

From Chips to Civilization Fuel

Call it what you want: hardware, compute power, digital oxygen.

Nvidia's tech now powers everything from national AI labs to cloud empires. The demand still outpaces supply by a country mile.

When you think about it, the company has become what oil was in the 20th century; whoever controls Nvidia's chips controls the future's horsepower.

And that's not an exaggeration, that's math.

The Billion-Dollar Goodbye That Didn't Matter

SoftBank's leaving shows how liquid Nvidia has become; it didn't need a headline to validate its staying power. In fact, the exit made room for the next wave of believers to step in.

If you're still wondering whether Nvidia's run has peaked, you might be asking the wrong question.

The better one is how long the rest of the world can keep up before Nvidia starts setting the pace for everything AI touches.

Growth Watchlist Free (Sponsored)

Markets may be uncertain but some opportunities are crystal clear.

A fresh analysis has pinpointed 5 companies displaying rare technical and fundamental signals that historically lead to outsized gains.

These stocks could be positioned for rapid appreciation as market conditions align for growth.

The full report is available for free, but access ends at midnight tonight.

[Access the 5 Stocks Upside Report – Free Download Now]

Critical Minerals

From Dirt to Devices: How USA Rare Earth Is Owning the Supply Chain

USA Rare Earth Inc. (NASDAQ: USAR) is speeding toward full vertical integration, the holy grail of modern manufacturing.

The company isn’t just mining rare earth elements anymore; it’s turning them into magnets that power everything from EVs to fighter jets.

The latest move? Buying UK-based Less Common Metals.

That deal gives USA Rare Earth the tools to turn raw materials into finished products without outsourcing a single stage.

You can sense the intent; it’s building control, confidence, and capability at every level of production.

Magnets, Momentum, and Made in America

With over $400 million in available capital, USA Rare Earth is charging ahead on multiple fronts. Its Stillwater, Oklahoma, magnet plant is expected to go live in 2026, producing rare earth magnets that could finally give the U.S. a homegrown alternative to China’s supply chain.

The numbers are impressive, but the timing is even better.

As governments pour billions into clean energy and defense tech, USA Rare Earth’s magnets are starting to look less like industrial components and more like national assets.

Where Strategy Meets Substance

The global race for critical materials isn’t slowing down; USA Rare Earth just found a faster lane.

Every ton of magnet alloy produced on U.S. soil brings the country closer to independence in tech manufacturing.

If you’ve ever wondered who’s quietly shaping the next industrial era, look no further than the company turning American minerals into the muscle behind tomorrow’s machines. That’s not hype; that’s the sound of progress grinding into gear.

Want to make sure you never miss our post-market roundup?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone right after the closing bell rings.

Email’s great. Texts are faster.

Top Winners and Losers

Surmodics Inc [SRDX] $40.94 (+49.72%)

Surmodics rose after a federal court rejected the FTC’s request to block its acquisition by GTCR, clearing a major legal hurdle for the deal to close.

Engene Holdings Inc [ENGN] $8.90 (+48.00%)

enGene surged after reporting a 63% complete response rate in its pivotal Phase 2 bladder cancer gene therapy trial, signaling strong efficacy in a high-need patient population.

PubMatic Inc [PUBM] $10.97 (+43.40%)

PubMatic climbed after delivering a surprise quarterly profit and beating revenue expectations, marking its fourth straight earnings beat.

Outset Medical Inc [OM] $6.22 (-48.47%)

Outset Medical dropped after missing both EPS and revenue expectations, extending a rough year for the medical device maker amid slowing top-line growth.

Vor Biopharma Inc [VOR] $9.84 (-47.66%)

Vor Bio plunged after pricing a $100 million public offering at a steep discount, diluting shareholders and triggering a sharp sell-off.

Endava Plc [DAVA] $6.96 (-26.19%)

Endava tumbled after missing earnings and revenue estimates and issuing weak guidance that pointed to ongoing demand softness and profit pressure.

Poll: What’s the best investment advice in six words or less?

Act Before Others (Sponsored)

The last time his indicator flashed, the market saw one of its biggest surges of the year.

Now, this veteran trader says the same signal is triggering again.

For 30 years, he’s used this tool to cut through the noise: helping him time entries and exits before the crowd even notices what’s happening.

It’s simple. It’s proven. And he’s giving it away for free.

He’s not predicting the future, he’s reacting to data. And right now, the data says: pay attention.

See what his indicator is showing and decide for yourself before this next move takes off.

[Unlock the free signal now]

Everything Else

U.S. firms have been quietly trimming payrolls, with ADP counting more than 11,000 jobs lost each week through late October—proof that the slowdown’s no longer theoretical.

Nebius is teaming up with Meta on an AI power play that could charge its stock to fresh highs, if the market’s hype engine keeps humming.

The House is back in session and staring down a shutdown fix, hoping this vote finally flips the “closed” sign on Capitol Hill.

Anthropic is racing ahead of OpenAI on the profit track, proving that in the AI boom, smaller engines can still hit turbo first.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.