Legal uncertainty eased, but the stock still slipped, indicating the market wants proof, not promises. The smarter play is to let it base, start with a small starter position only on weakness, and add later if launches and revenue milestones actually show up. See how we break it down below.

Unusual Pattern Forming (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing

rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

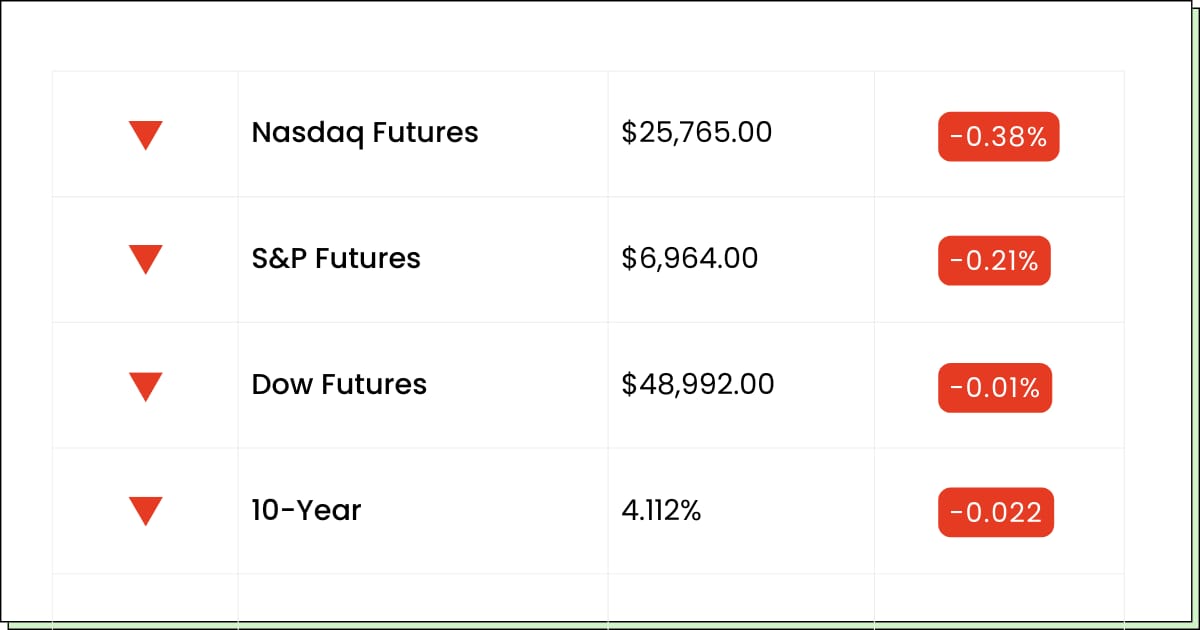

Futures at a Glance📈

Futures are easing back after the market tagged fresh record highs, with traders taking a breath after a strong year-end run. The AI trade is cooling a bit following last week’s gains, while the broader tape looks more like a pause than a panic. With data light and Fed minutes later this week, the Santa rally window is still open, just moving at a slower jog.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Lufax Holding Ltd [LU]

Daily Journal Corp. (S.C.) [DJCO]

Barnes & Noble Education, Inc. [BNED]

Ellomay Capital Ltd. [ELLO]

RCI Hospitality Holdings, Inc. [RICK]

Kandi Technologies Group, Inc. [KNDI]

Zenvia Inc. [ZENV]

Cemtrex Inc. [CETX]

DEFSEC Technologies Inc. [DFSC]

Economic Reports

Pending home sales (Nov): 10:00 am

Biotech

Liquidia Gets A Fresh Price Target, and the Confetti Comes Out

Wall Street just slapped a higher price target on Liquidia Corp (NASDAQ: LQDA) and optimism spilled everywhere, and the stock popped like it just won a group chat argument. After an already wild year, this was the spark that reminded everyone Liquidia is still very much on the radar.

But here’s where it gets interesting. When a stock runs this hard, upgrades can feel less like new information and more like a victory lap. Insiders have been selling along the way, which doesn’t mean the story is broken, but it does mean some folks closer to the kitchen are happy to take money off the table. That’s not bearish, it’s human.

The real question isn’t whether Liquidia is exciting. It is. The question is whether today’s price already bakes in tomorrow’s good news. Stocks in this mood tend to swing between confidence and nerves, sometimes in the same week.

The smart move is boring, and boring works. Let the stock settle, see where buyers actually show up when the headlines cool, and then decide if it fits your risk tolerance.

My Take For You: If you’re new, wait for a pullback or sideways action. If you’re long, trimming a slice makes sense.

My Verdict: Strong momentum, crowded trade. Best handled with patience, not FOMO.

Energy & Materials

Energy Fuels Takes A Breather After A Rare Earths Glow-Up

After ripping higher on rare earth excitement, Energy Fuels Inc (NYSEAMERICAN: UUUU) has entered the classic post-run pause. No fireworks, no panic, just a chart catching its breath after sprinting up the stairs. That’s not weakness, that’s digestion.

The backdrop still works. Governments want supply chains they can point to on a map, manufacturers want materials they can count on, and China's unpredictability keeps this theme alive. Energy Fuels sits right in that conversation, which is why it ran in the first place.

But short-term traders already played their hand. Once the initial rush fades, stocks like this tend to chop sideways while everyone waits for the next concrete update. That’s when emotions cool and price starts telling a more honest story.

For everyday investors, this is where discipline matters. Chasing a stock after a sharp run is like showing up late to a concert and paying double for worse seats. The better entries usually come when nobody’s yelling anymore.

My Take For You: Let it build a base before stepping in. Starter positions only, no hero trades.

My Verdict: Compelling theme, messy timing. Worth watching closely, not forcing.

Supply Shock Forming (Sponsored)

It started as a whisper - an obscure technology buried in research labs.

Then Sam Altman made his largest personal investment. Bill Gates doubled down.

Even the White House stepped in. And now a January 1st deadline could flip the switch.

The story is bigger than anyone realizes.

Watch the full reveal here.

Healthcare

Alvotech Clears A Legal Hurdle, and the Market Just Shrugs

This one feels unfair at first glance. A major legal cloud lifts for Alvotech SA (NASDAQ: ALVO), the path into the U.S. gets clearer, and the stock still slides. But this is biotech, where good news often arrives wearing a disguise.

The market isn’t arguing that progress happened. It’s debating when it matters. Clearing legal hurdles is necessary, not sufficient, and investors are still squinting at timelines, competition, and how smooth the revenue ramp actually looks. In other words, relief doesn’t equal excitement yet.

That makes this a patience stock, not a momentum one. The upside story exists, but it’s measured in quarters and approvals, not in overnight pops. If you’re looking for fast gratification, this will test your emotional endurance.

For longer-term thinkers, though, moments like this are when names quietly set up for better entries. Confusion tends to create opportunity, as long as you’re honest about how long you’re willing to wait.

My Take For You: Only step in if you’re comfortable sitting through silence. Small size, long view.

My Verdict: High potential, low urgency. Interesting, but not for the impatient crowd.

Poll: Be honest — what makes you check your bank account?

Movers and Shakers

Coeur Mining Inc [CDE]: Premarket Move: −4%

Gold and silver had a monster year, and this miner rode the wave hard. Now it’s pulling back a bit as traders lock in wins and catch their breath after a sprint that would make a Peloton instructor proud.

Nothing looks broken here, just a classic pause after a big run when shiny things cool for a minute.

My Take: Let it settle. Great trend, but don’t chase the hilltop. Buy dips, trim rips, and keep your helmet on if metals wobble.

T1 Energy Inc [TE]: Premarket Move: −3%

An analyst basically doubled the price target and Wall Street clapped, then the stock shrugged and dipped anyway. That’s what happens when a name already ran a marathon and someone yells “one more mile.”

The solar story is exciting, but this thing has moved fast and needs to digest before the next leg.

My Take: Respect the story, not the hype. Starter buys only on pullbacks and no chasing analyst confetti.

Coupang Inc [CPNG]: Premarket Move: +2%

The stock popped after the company put a big price tag on its data breach apology, handing out vouchers like an awkward make-good gift. Investors seem relieved there’s a plan, even if the bill is chunky.

Now lawmakers are circling, so this turns into a wait-and-see headline trade.

My Take: Trade the bounce. Take quick wins if it runs and step aside if politics start stealing the spotlight.

Decision Time Now (Sponsored)

The next leg of AI growth is set to emerge from advanced data infrastructure, a segment gaining powerful momentum beneath the surface.

Leaders in this space are showing strong operational expansion, increasing government interest, and growing enterprise adoption.

These developments are quietly creating high-probability setups for early movers.

As demand accelerates, positioning inside this sector could produce significant compounding potential.

A FREE report highlights all nine opportunities poised to benefit from this surge.

Download your FREE Report Now.

Everything Else

Coupang is handing out compensation vouchers after a big data-breach mess, trying to keep shoppers from rage-quitting the app.

Restaurants are leaning hard on value meals as diners get pickier, turning dinner out into a math problem again.

The rumored Nvidia–Groq situation is basically a competitive fiction plot twist, where the structure matters as much as the headline.

China’s LandSpace is lining up funding and launches to challenge SpaceX, with reusable rockets as the main flex for 2026.

Italy’s regulator told Meta to pause WhatsApp terms that could box out rival AI chatbots, turning updates into a legal headache.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.