The numbers beat, the stock didn’t care, and one overseas slowdown stole the spotlight. That mismatch is where opportunity usually hides. We’re not chasing the first bounce. We’re watching for the moment when fear fades, margins stabilize, and the chart stops tripping over headlines. Read on to see the signal we want before treating this pullback like a gift instead of a warning.

Smart Money Knows (Sponsored)

Volatility is not ending. It is resetting.

A little known historical pattern that surfaced before the Great Depression is appearing again right now. When this shift hits it does not hurt everything equally but it devastates specific types of stocks.

Many investors are holding exactly the wrong ones without realizing it.

A short briefing reveals the five stocks most exposed to this coming reset and why they could fall far harder than the rest of the market.

Seeing this list now matters more than timing the bottom later.

See the five stocks to avoid before this shift hits

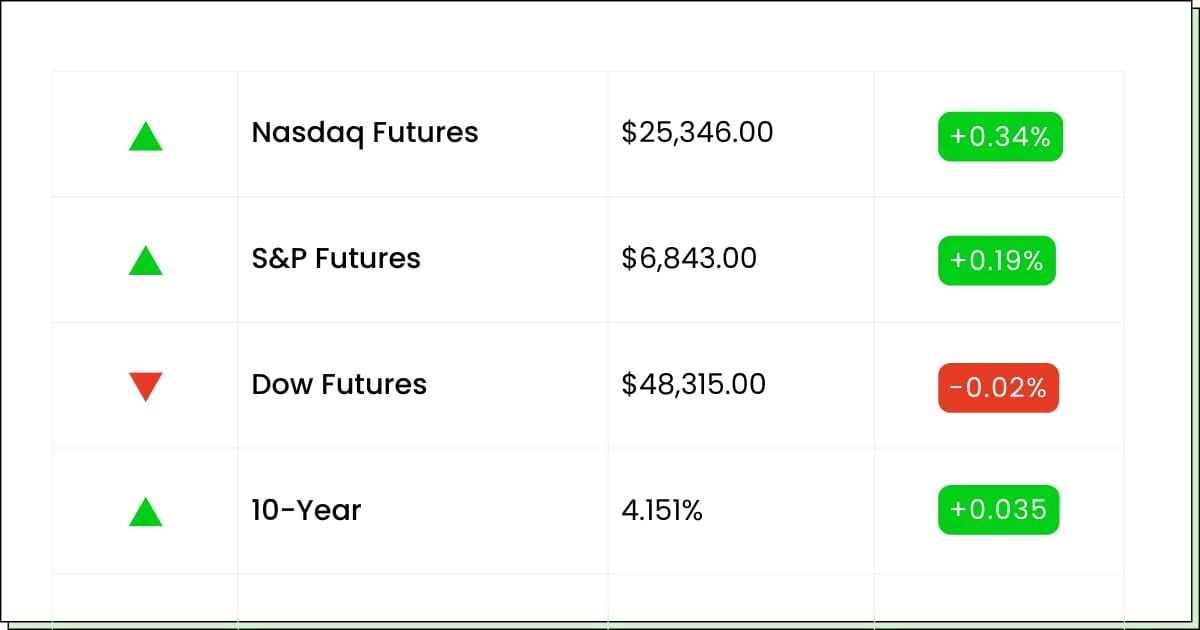

Futures at a Glance📈

Futures are catching their breath after snapping a losing streak, helped by a cooler inflation print that let tech names stretch their legs again. Chips and Big Tech led the rebound, while a late stumble in athletic wear kept things from getting too cozy. Traders are heading into Friday cautiously.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Paychex, Inc. [PAYX]

Carnival Corporation [CCL]

Carnival Corporation (ADR) [CUK]

ConAgra Brands, Inc. [CAG]

Lamb Weston Holdings, Inc. [LW]

Winnebago Industries, Inc. [WGO]

Economic Reports:

New York Fed President John Williams TV appearance: 8:30 am

Existing home sales (Nov): 10:00 am

Consumer sentiment, final (Dec): 10:00 am

Crypto

Strategy Gets A Bitcoin Credit Report Card

Strategy Inc (NASDAQ: MSTR) took another hit this year, but S&P just checked its homework and said it’s still passing. The credit rating stayed put, thanks largely to one thing: a big cash reserve that buys time when markets get cranky and bitcoin decides to nap.

The stock has been on a wild diet, dropping hard from its highs as bitcoin cooled and enthusiasm thinned out. But under the hood, the company has kept doing what it does best, which is raising money, stacking coins, and daring the market to blink first.

That reserve acts like a rainy-day fund so they don’t have to panic sell their digital treasure at the first storm cloud.

This is still a high-wire act. Strategy doesn’t really make money the normal way. Its scorecard rises and falls with bitcoin’s mood swings. When crypto rips, it looks brilliant. When prices sag, the balance sheet suddenly feels heavier. Credit agencies are basically saying this works as long as the music keeps playing.

My Take For You: If you’re new, don’t chase bounces. Treat this as a bitcoin lever, not a traditional stock. If you’re already in, size matters here. Keep it small enough that a crypto wobble doesn’t ruin your week.

My Verdict: Pure speculation with a safety net. Interesting as a trading vehicle, risky as a long-term core holding unless you really believe in the coin.

Cloud / AI Infrastructure

CoreWeave Keeps Building The Engine While The Market Watches The Fuel Gauge

CoreWeave Inc (NASDAQ: CRWV) keeps showing up in the AI conversation because it sits right where the action is. Powering the machines behind the buzzwords. Every OpenAI win, every new model, every enterprise push puts this name back on traders’ screens. The stock has been moving higher as investors buy into that proximity alone.

But this is not a clean fairy tale. CoreWeave is spending aggressively, borrowing heavily, and scaling fast. That’s exciting until the bill arrives. The company is clearly betting that demand for AI compute keeps rising faster than its debt pile. So far, the market has been willing to nod along, especially with shiny headlines about new data centers and infrastructure deals.

This week’s wobble after a convertible note raise is a reminder that dilution and leverage still matter, even in AI land. The business throws off strong cash flow, but profits are not here yet. Investors are effectively front-running a future where AI demand stays red hot and CoreWeave becomes indispensable plumbing.

My Take For You: Treat this like a momentum name, not a set-it-and-forget-it stock. If you’re buying, do it on pullbacks and keep position sizes small. If you’re already in, locking some gains on spikes makes sense.

My Verdict: High-upside, high-voltage. Great trading vehicle, risky long-term hold unless AI demand stays scorching.

Time Sensitive Insight (Sponsored)

After reviewing thousands of companies, analysts isolated the 5 Stocks Set to Double based on accelerating performance, improving fundamentals, and strong technical signals.

This newly released report breaks down why these five picks may be positioned for significant moves in the coming year.

While results cannot be guaranteed, past reports uncovered gains reaching +175%, +498%, and +673%.

Access is free until midnight.

See the 5 Stocks Set to Double. Free Access.

Retail

Nike Trips In China While Trying To Lace Up A Comeback

Nike did what it was supposed to do this quarter. It beat expectations, moved more product in North America, and showed signs that its reset plan is actually happening. And the market still sent the stock to the locker room. Why? China stumbled hard, tariffs took a bite, and investors decided this was not the victory lap moment.

The China slowdown matters because that market used to be a growth engine, not a speed bump. Add in higher costs from tariffs and suddenly those clean earnings beats don’t feel as celebratory. Nike is also mid-pivot, backing away from its direct-to-consumer obsession and crawling back toward wholesale partners it once sidelined. That takes time, trust, and a lot of inventory juggling.

The good news is this does not look like a broken brand. People still buy the shoes, the swoosh still matters, and North America showed life. The bad news is that turnarounds are rarely smooth, and this one is happening in a world full of tariffs, cautious consumers, and intense competition.

My Take For You: If you want in, patience is your friend. Let the stock stop bleeding and wait for signs that China is stabilizing. If you already own it, consider trimming into strength and keeping expectations realistic.

My Verdict: A real comeback attempt, but still early innings. Worth watching closely, not rushing into.

Movers and Shakers

Nebius Group NV [NBIS]: Premarket Move: +4%

AI names are stretching again, and this one’s acting like it smelled fresh hype. Nebius keeps riding the AI enthusiasm wave, and traders are clearly still willing to surf it, even after a monster year already in the books. When the sector wakes up, this name tends to grab a coffee and sprint.

That said, after a run like this, every green move comes with a little vertigo. This is no longer a hidden gem. It’s a spotlight stock, which means it can sprint forward or trip over its own shoelaces on the same headline.

My Take: Momentum is still in charge, but don’t chase it like a lost Uber. Small size only. If it pops early, trimming into strength beats hoping for a miracle extension.

Bloom Energy [BE]: Premarket Move: +3%

After getting tossed around like a beach ball in a wind tunnel, Bloom is bouncing again. Fuel-cell optimism and AI power chatter are back on the menu, and traders are nibbling after yesterday’s sharp shakeout.

This stock loves drama. It drops hard, rallies fast, and makes sure nobody feels comfortable for more than an hour. The story still works, but the price action has caffeine issues.

My Take: Treat this like a trading vehicle, not a road trip. Buy dips that hold, sell rips that stall. If it starts wobbling early, step aside and let it calm down.

Crocs Inc. [CROX]: Premarket Move: −2%

Revenue slipped, guidance cheered up, and the market shrugged anyway. Crocs is stuck in that awkward phase where the numbers aren’t terrible, but investors are still side-eyeing the fashion cycle and wondering if the magic clogs have lost a little swagger.

This isn’t panic selling, more like impatience. When a stock can’t rally on decent news, it usually needs time, not cheerleading.

My Take: No rush here. Let it base before touching it. If you already own it, this is a hold-your-nose-and-wait situation, not a buy-the-dip sprint.

Access It Now (Sponsored)

The next leg of AI growth is set to emerge from advanced data infrastructure, a segment gaining powerful momentum beneath the surface.

Leaders in this space are showing strong operational expansion, increasing government interest, and growing enterprise adoption.

These developments are quietly creating high-probability setups for early movers.

As demand accelerates, positioning inside this sector could produce significant compounding potential.

A FREE report highlights all nine opportunities poised to benefit from this surge.

Download your FREE Report Now.

Everything Else

Europe stocks were a bit twitchy as traders weighed France budget headlines and the latest on Ukraine aid.

In China, big Western food chains are getting the private equity treatment, with investors sniffing around growth and deal setups.

The TikTok saga is back on the menu, with the whole U.S. sale story still stuck in the China approval bottleneck.

PUBG maker Krafton is helping lead a South Korea trio into a chunky India tech bet, basically a growth road trip with a big bankroll.

Trump Media showed up in deal chatter tied to TAE Technologies, because markets apparently needed one more merger curveball this week.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.