After months of drama, a high-profile app found a U.S. solution and brought an old-school tech partner back into focus. The pop is real, but the smarter move favors dips, not hype, but see how we would play it below.

Breakout Tension Rising (Sponsored)

After reviewing thousands of companies, analysts isolated the 5 Stocks Set to Double based on accelerating performance, improving fundamentals, and strong technical signals.

This newly released report breaks down why these five picks may be positioned for significant moves in the coming year.

While results cannot be guaranteed, past reports uncovered gains reaching +175%, +498%, and +673%.

Access is free until midnight.

See the 5 Stocks Set to Double. Free Access.

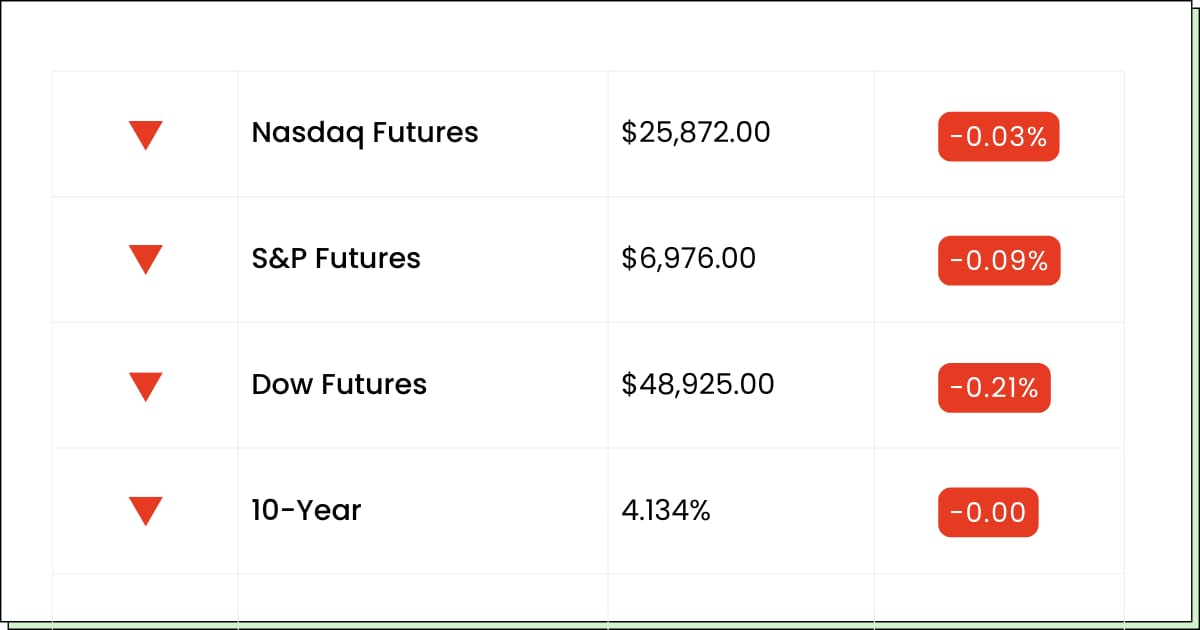

Futures at a Glance📈

Futures are treading water as traders shake off the holiday break, but the week is shaping up as a winner. Stocks are coming off fresh record highs, and the year-end tailwind is still in play. With seasonality on their side, bulls are hoping this quiet open turns into a Santa-friendly finish.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

OceanPal Inc. [SVRN]

FG Merger II Corp. [FGMC]

Namib Minerals [NAMM]

ClearOne, Inc. [CLRO]

Foresight Autonomous Holdings Ltd. [FRSX]

Greenwave Technology Solutions, Inc. [GWAV]

Scinai Immunotherapeutics Ltd. [SCNI]

Economic Reports:

None scheduled

Technology Hardware

Lumentum Holdings Is Riding the AI Train and It Has No Brakes

Lumentum Holdings Inc (NASDAQ: LITE) has gone from wallflower to life-of-the-party in a hurry. Lumentum has been ripping higher as data centers bulk up for AI workloads, and suddenly everyone wants a piece of the lasers, cables, and gear that keep those servers talking to each other.

The move feels justified, but also crowded. When a stock runs this far this fast, the easy money is usually already in the room ordering dessert. That does not mean the story is broken. It just means expectations are now doing a lot of the heavy lifting.

Zoom out, and the setup is still solid. AI infrastructure is not slowing down, but stocks that sprint tend to need water breaks. Chasing after a near-vertical move is how people pull hamstrings.

My Take For You: If you missed it, wait for a pullback that looks boring before thinking about a starter position. If you’re already in, trimming some here makes sense.

My Verdict: Great trend, overheated price. Let gravity help you instead of fighting it.

Enterprise Software

ServiceNow Keeps Buying Toys, and the Market Wants Proof It Works

ServiceNow Inc (NYSE: NOW) keeps shopping like it’s got a rewards card. Another big deal hit the tape, this time beefing up its security lineup as companies panic about protecting AI-heavy systems. On paper, it makes sense. On the chart, the stock shrugged.

That reaction tells you something. Investors are less impressed by deal headlines and more interested in whether all these pieces actually snap together cleanly. Buying growth is easy. Making it hum in harmony is harder.

The bigger picture is still strong. Big companies are not cutting back on workflow tools or security. They just want reassurance that this turns into smoother operations, not a Frankenstein platform.

My Take For You: Let the dust settle. If shares stay calm and don’t bleed lower, it’s a reasonable place to start nibbling.

My Verdict: Solid long-term story, but wait for the market to nod back before committing.

Legacy Systems Break (Sponsored)

A quiet technological shift is racing ahead - and most investors are completely unprepared.

This breakthrough could mint new millionaires as Silicon Valley and Washington scramble to back it.

But if you're not positioned before Jan. 1, you may miss the entire early wave.

Click now before the window closes.

Cloud & Big Tech

Oracle Finds A New Dance Partner and the Stock Likes the Music

Oracle Corp (NYSE: ORCL) popped after stepping into the spotlight with a high-profile role tied to TikTok’s U.S. operations. The headline gave the stock a sugar rush and reminded everyone that Oracle is still very much in the middle of big, messy tech deals.

This helps the narrative. Oracle has been under pressure as investors question AI spending and cloud competition. A deal that keeps data flowing and governments calm checks a lot of boxes at once.

Still, this is not a victory lap yet. The stock has been choppy, and optimism tends to fade fast if execution stumbles. Momentum is back, but it’s fragile.

My Take For You: If you’re interested, think in months, not days. Small positions make sense on dips, not after spikes.

My Verdict: Improving the story with a headline helps. Worth watching closely, but don’t chase the confetti.

Poll: Which money phrase do you secretly hate?

Movers and Shakers

Sigma Lithium Corp [SGML]: Premarket Move: +7%

Lithium caught a fresh bid, and this one’s running like it heard EV demand whispered nearby. Revenue optimism is pulling in momentum money fast.

Just remember: after a big run, these names can reverse on a dime.

My Take: If you’re in, trim on strength. If you’re not, don’t chase, wait for a calmer pullback.

Coupang Inc [CPNG]: Premarket Move: +6%

Stock’s bouncing after the company pointed to an ex-employee in the data breach mess, which sounds like progress and damage control at once.

Relief rallies are fun, but they can fade when the next headline hits.

My Take: Trade it, don’t date it. Take quick profits on green and keep it small.

Biohaven Ltd [BHVN]: Premarket Move: −14%

A Phase 2 miss is basically biotech stepping on a rake. The market’s not debating nuance; it’s hitting sell.

There may be other shots on goal, but today’s tape is all about the whiff.

My Take: Avoid for now. Let it settle and only revisit if the next catalyst is real, not wishful.

Decision Time Now (Sponsored)

The next leg of AI growth is set to emerge from advanced data infrastructure, a segment gaining powerful momentum beneath the surface.

Leaders in this space are showing strong operational expansion, increasing government interest, and growing enterprise adoption.

These developments are quietly creating high-probability setups for early movers.

As demand accelerates, positioning inside this sector could produce significant compounding potential.

A FREE report highlights all nine opportunities poised to benefit from this surge.

Download your FREE Report Now.

Everything Else

Nvidia is reportedly circling a massive AI deal, with chatter around a Groq buy heating up as chip competition gets even more intense.

Foreign smartphone brands quietly staged a China comeback in November as buyers looked beyond local names.

A well-connected Silicon Valley dealmaker helped broker a political lifeline that steadied Intel when confidence was thinning fast.

Rare earth and critical mineral players are enjoying a moment in the sun as magnet makers suddenly find themselves back in demand.

Investors are debating whether emerging markets can keep leading into 2026 after a strong run that’s turned plenty of heads.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.