A mega-cap just wrote a very public check into the AI buildout, a tanker stock is still quietly collecting rent checks, and a chipmaker just signaled the memory squeeze may have a long runway. We’ll break down the one level that matters after the opening pop.

Claim Now (Sponsored)

Most investors assume pre-IPO opportunities are only for insiders.

But according to James Altucher, there’s a simple workaround that may allow everyday investors to gain early exposure to SpaceX—starting with just $100.

It doesn’t require special permissions or private deals.

Instead, James walks through:

The exact asset he’s using

How it fits inside a normal brokerage account

Why this approach could benefit if SpaceX goes public

He explains everything in a short, free video—so you can evaluate it yourself.

Watch the explanation here

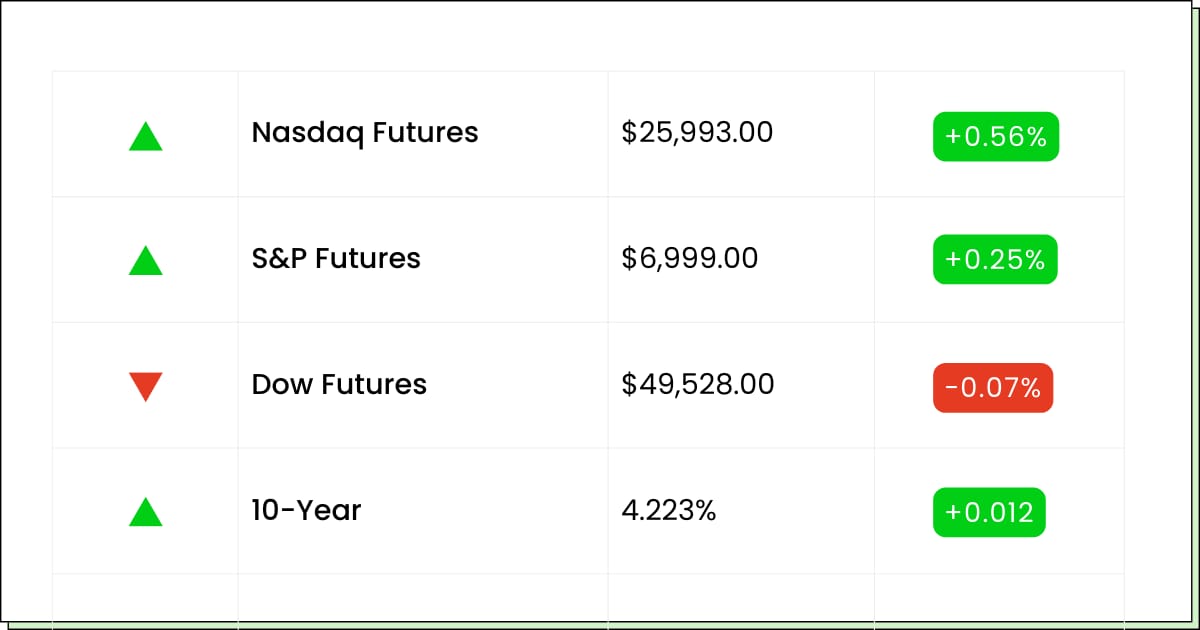

Futures at a Glance📈

Futures are inching higher as Big Tech earnings week gets rolling, with traders watching if the momentum holds into the Fed decision later this week. Tech is doing the warm-up jog, while the Dow is getting dragged by a health-insurer gut punch after the Medicare Advantage rate proposal. Tariff talk with South Korea is back in the mix too, plus today’s consumer confidence and home price data as the early-week check.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

UnitedHealth Group Incorporated [UNH]

RTX Corporation [RTX]

Boeing Company [BA]

NextEra Energy, Inc. [NEE]

Union Pacific Corporation [UNP]

HCA Healthcare, Inc. [HCA]

Northrop Grumman Corporation [NOC]

United Parcel Service, Inc. [UPS]

General Motors Company [GM]

Earnings (Aftermarket):

Texas Instruments Incorporated [TXN]

Economic Reports:

Case-Shiller 20-city home price index (Nov): 9:00 am

Consumer confidence (Jan): 10:00 am

Tech

The AI Landlord CoreWeave Just Got A Very Rich Roommate

CoreWeave Inc (NASDAQ: CRWV) popped after Nvidia dropped a $2B investment, and the market basically yelled, oh so we are doing this again. When the biggest kid in the AI cafeteria buys you lunch, everyone suddenly wants to sit at your table.

This matters because CoreWeave is still in full expansion mode, and building AI data centers is not exactly a lemonade stand budget. The cash buys time, credibility, and a little extra oxygen for the growth story. The catch is it also reminds everyone that this business is expensive and the stock can move on sentiment faster than fundamentals can catch up.

Today’s “simple investor test” is the price Nvidia paid, around $87. If the stock holds above that area after the morning hype cools, the move may have legs. If it slides back under and stays there, you can get the classic pop-and-fade, where the headline runs out of gas and profit-takers take the wheel.

My Take For You: Do not chase the first spike. If you want in, wait for a pullback and start small. If you own it, trim into strength and keep the rest modest.

My Verdict: Great headline, wild swings. Treat it like a trade with rules, not a forever hold based on vibes.

Energy

Oil Tanker Stock DHT Is Quietly Printing Rent Checks While Everyone Chases Fireworks

DHT Holdings (NYSE: DHT) is the kind of stock that never trends on social media, but it quietly does the job and pays you for showing up. Tankers are basically floating highways for oil, and when the traffic is steady, the owners collect rent checks.

The appeal here is simple and very relatable: you do not need a miracle story. You want a business that can make money, share some of it, and not reinvent itself every quarter. DHT has been profitable, and the dividend gives investors something to hold onto when the market gets moody.

The risk is also simple: shipping is cyclical. Rates can cool, demand can wobble, and suddenly the market treats tanker stocks like last week’s leftovers. So you do not marry this one. You date it politely, enjoy the cash flow, and stay aware of the rate backdrop.

My Take For You: Starter-buy on weakness, add only if it stays firm. If you own it, let the dividend work and skim a bit on strong days.

My Verdict: Solid income watch with fewer headaches than story stocks, but still a rate-driven ride.

Market Watching This (Sponsored)

It just signed a deal to get its tech in Apple's iPhone until 2040!

Online commenters are debating if this brand-new company will be the 7th trillion dollar stock.

Details on the controversy here.

Semiconductors

Micron Just Ordered A Bigger Oven While The Memory Aisle Is Still Empty

Micron Technology Inc (NASDAQ: MU) jumped after announcing a big long-term expansion plan in Singapore. In normal-person terms, they are building more capacity because AI data centers are inhaling memory like it is a snack bowl at a party.

Right now, the market likes this because the memory supply feels tight and demand feels relentless. When that combo shows up, investors start pricing in better margins and a longer runway. The mood is bullish, and the stock acts like it drank an espresso.

But semiconductors love a plot twist. The same spending that looks smart today can create a future supply wave that cools pricing later. This is why these names can feel amazing on the way up and emotionally confusing on the way down. So the move is not to debate the technology. The move is to manage your entry. Let the headline excitement pass, then look for a calmer dip where the risk feels more reasonable.

My Take For You: Do not chase a gap. Wait for a pullback, start small, and add only if it holds up into the next earnings window.

My Verdict: Strong theme with real momentum, but it can whip around. Better as a buy-the-dip plan than a buy-the-pop impulse.

Movers and Shakers

Fastly Inc [FSLY]: Premarket Move: +4%

The CTO sold a small chunk of shares, and the market did what it always does: see insider selling, assume someone knows something, start sweating. In this case it was a pre-planned 10b5-1 sale, which is more scheduled haircut than panic exit.

With earnings coming up soon, traders are basically positioning for the next vibe check on growth and margins.

My Take: Don’t overreact to the Form 4. If it holds green after the open, you can nibble. If it fades, wait for earnings and buy the dip, not the drama.

IonQ Inc [IONQ]: Premarket Move: +4%

IonQ announced a big SkyWater deal, and the stock is doing the classic buyer reaction: congrats on the ambition, now explain who’s paying for it. Cash plus stock plus a collar means a lot of moving parts, and traders hate math before coffee.

This is a long-game move, not a one-day victory lap, so expect the stock to whip around until financing details and timelines feel real.

My Take: Treat this like a roller coaster, not a rocking chair. If you’re in, keep it small. If you want in, wait for a calmer day and scale in after the excitement cools.

Humana Inc [HUM]: Premarket Move: −14%

CMS floated near-flat Medicare Advantage rates for 2027 and insurers collectively face-planted. This is the kind of policy headline that can erase months of good behavior in one morning because it hits the whole profit math.

Now the market will spend weeks gaming out whether the proposal gets revised and what it means for benefits, pricing, and margins.

My Take: Don’t try to catch the first drop. Let it find a floor. If it stabilizes later, a starter position can make sense. If it keeps bleeding, stay patient and wait for clarity closer to the final rate notice.

Crisis Hedge (Sponsored)

Economic confidence weakens when debt rises, wars expand, and currencies lose trust.

Many investors stay frozen while purchasing power quietly slips away.

History favors those who move early when political shifts change the landscape.

This Patriot’s Tax Shield outlines how tangible gold can serve as a defensive asset in uncertain times.

A free Wealth Protection Guide explains why Trump’s return could reshape demand for gold.

Click here to download the FREE Wealth Protection Guide now.

Everything Else

South Korea is scrambling to pass a U.S. investment bill after Trump threatened higher tariffs.

TikTok’s new U.S. setup is getting messy as censorship glitches spark blowback tied to Newsom, Epstein chatter, and ICE-related posts.

Meta is about to test premium subscriptions across Instagram, Facebook, and WhatsApp, because apparently everything is a membership now.

ASML is riding the AI wave by selling laser systems that help power the giant chip-printer machines behind the boom.

Google agreed to a privacy settlement over Google Assistant, putting a $68 million price tag on “oops, our bad.”

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.