Three very different stories, one very similar temptation: chasing the pop. We’ll break down what actually moved each name, where the hype usually cools off, and the simple levels to watch so you can take a smart bite without paying the headline tax.

New Threat (Sponsored)

On Behalf of Integrated Quantum Technologies Inc.

“Harvest now, decrypt later” means data stolen today can be exposed later.

A tiny public company is positioning a quantum resilient layer that protects AI pipelines by transforming data before training.

It is pitched as security that does not slow AI down.

Reveal the name and symbols here

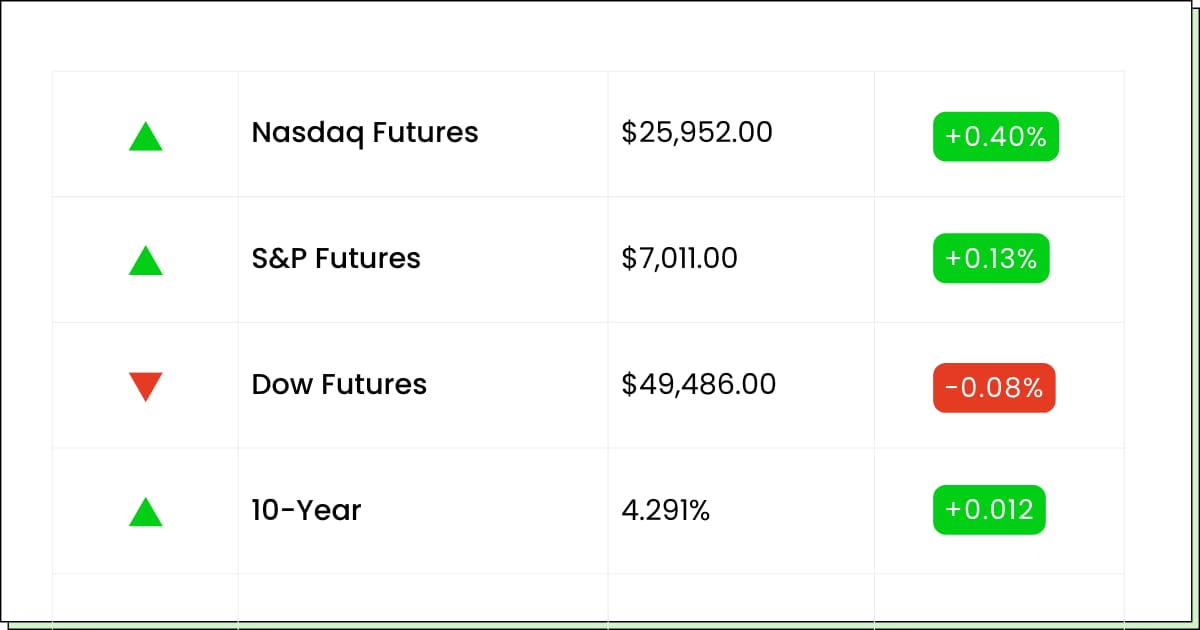

Futures at a Glance📈

Futures are edging higher after a strong start to February, with tech still setting the pace. A couple of big post-close jumps are keeping the AI mood upbeat, even as crypto weakness and last week’s metals whiplash linger. Now it’s back to earnings as traders look for proof the hype can pay the bills.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

Merck & Company, Inc. [MRK]

Pfizer, Inc. [PFE]

Eaton Corporation, PLC [ETN]

TransDigm Group Incorporated [TDG]

Earnings (Aftermarket):

Advanced Micro Devices, Inc. [AMD]

Amgen Inc. [AMGN]

Chubb Limited [CB]

Emerson Electric Company [EMR]

Economic Reports:

Job openings (To be rescheduled): 10:00 am

S&P final U.S. services PMI (Jan): 9:45 am

ISM services (Jan): 10:00 am

Software

Palantir Gets A Gold Star and The Stock Does A Victory Lap

Palantir Technologies Inc (NASDAQ: PLTR) just got upgraded to Outperform, and the stock reacted like it found an espresso button labeled more please. When a well-known shop says you are a clear AI winner, momentum traders basically hear a dinner bell.

The feeling here is simple: business is accelerating, cash flow is improving, and the market loves a clean story it can repeat at parties. The not-so-fun part is the price tag, because this one already walks around like it knows it is popular.

So the move is not to chase the fireworks at the open. If you want in, wait for a calmer pullback or a boring day when nobody is screaming AI on TV. This is the kind of stock that can hand you a great week and then take it back in one headline.

My Take For You: Start small on dips, add only if it holds gains after the initial hype fades, and keep a tight leash if it starts giving back the pop.

My Verdict: Momentum-friendly, but treat it like a high-voltage tool. Useful, just do not grab it with wet hands.

Healthcare

DaVita Just Raised The Outlook, And Traders Hit The Snooze Button On Worry

Davita Inc (NYSE: DVA) posted a solid beat and talked up 2026 profits, so the stock jumped like it heard good news and free snacks. Dialysis is not flashy, but when guidance says steady cash, the market suddenly remembers it likes boring.

The real debate is whether the good vibes can stick once everyone gets picky about reimbursement and costs. This is a business where the story can look great on paper and then get dragged by one policy tweak or a cost flare-up.

Also hanging around in the background is the cleanup from last year’s cyber mess. Investors will be listening for how much that still costs and whether management sounds calm or sweaty about it.

My Take For You: Let the after-hours sugar rush cool off. If it holds the new level for a couple of sessions, it can be a starter buy. If it fades fast, wait for a better entry.

My Verdict: Solid defensive setup if the guidance holds, but do not over-size it. This is a slow-cooker stock, not a microwave.

Look Here First (Sponsored)

From thousands of stocks, only five stood out as having the best chance to gain +100% or more in the months ahead.

A newly released 5 Stocks Set to Double special report reveals all five tickers — free for a limited time.

While future results can’t be guaranteed, previous editions of this report delivered gains of +175%, +498%, and even +673%¹.

The newest picks could follow a similar path.

This free opportunity expires at MIDNIGHT TONIGHT.

Get the free report here

Semiconductors

Teradyne Just Printed A Big Number, And The Stock Hit Warp Speed

Teradyne Inc (NASDAQ: TER) just reminded everyone that when AI demand rises, somebody has to test all the chips before they go flex in a data center. Earnings showed the test business is booming, and the stock launched like it stepped on a rake and found a trampoline.

The fun part is that this is a picks-and-shovels-ish corner of AI without needing to guess which app wins. The not-fun part is the stock is now moving like a caffeinated squirrel, and big spikes can invite profit-taking fast.

If you missed the first move, do not chase the sprint. The cleaner play is to wait for a pullback day, then see if buyers show up again. If it keeps climbing with no breaks, you are not early; you are just fast.

My Take For You: Buy only on a dip or a tight consolidation, and take partial profits if it rips again. Keep risk small because this one can swing hard.

My Verdict: Strong trend with real tailwinds, but entry discipline matters. Great story, just do not pay peak-trend prices out of FOMO.

Poll: What’s the most expensive emotion?

Movers and Shakers

Rambus Inc [RMBS]: Premarket Move: −12%

This one tripped on a supply snag right after posting a big year, which is the market’s way of saying cool story, show me the next shipment. Traders hate uncertainty more than they hate bad news, and a surprise gap down is basically uncertainty with a megaphone.

If it keeps sliding at the open, it can turn into everyone sprinting for the same exit. If it stabilizes, you often get a bounce just from panic easing.

My Take: Don’t catch the falling toaster. Let the first 30 to 60 minutes play out. If it bases and stops making new lows, you can nibble small. If it keeps bleeding, step aside and wait for a calmer re-entry.

Gartner Inc [IT]: Premarket Move: −7%

They beat earnings and revenue, and the stock still got grumpy. Classic Wall Street behavior: you can pass the test and still get grounded because the market wanted extra credit.

After a rough year, even good results can trigger a shrug if investors were expecting a bigger redemption arc.

My Take: Let it find its footing. If it holds a steady range after the open, it can be a reasonable starter buy. If it keeps fading all morning, don’t force it. Save your ammo for a day when it stops acting allergic to good news.

Hecla Mining Co [HL]: Premarket Move: +9%

Critical minerals headlines just poured espresso into anything with a pickaxe, and miners are waking up like it’s a gold rush reunion tour. Add in the recent metals whiplash, and you get a stock that can swing on vibes before fundamentals even get out of bed.

The key is whether this move sticks once the early hype wears off and people remember mining stocks can be drama queens.

My Take: Treat it like a trade, not a tattoo. If it holds gains after the first hour, you can take a small position and trail a stop. If it fades fast, let it go. There will be another headline tomorrow.

Defensive Demand (Sponsored)

Foreign powers are challenging the dollar while global tensions continue to rise.

Markets reward preparation, not hesitation, during moments of political and economic stress.

Savings left unprotected often take the hardest hit when volatility accelerates.

This Patriot’s Tax Shield shows how physical gold has historically helped investors protect purchasing power.

A free Wealth Protection Guide breaks down how Trump’s vision could create renewed momentum for gold.

Get the FREE guide and see how to protect savings today.

Everything Else

Gold and silver tried to bounce back after last week’s faceplant, but this still feels like a hands-on-the-railing market, not a victory lap.

Rare earth names perked up on stockpile chatter, basically Washington saying let’s not run out of the stuff that makes modern life go beep-boop.

The game giant is talking up the next console, but the Switch 2 forecast reminded everyone that hype is easy and hardware cycles are hard.

The EV crew rolled out a new Model Y variant in the U.S., and the price tag says it’s courting regular humans again, not just spreadsheet warriors.

The robotaxi leader just grabbed fresh funding at a massive valuation, which is a polite way of saying the arms race is still very on.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.