A deep-pocketed buyer showed up, a growth story hit turbulence, and one steady operator quietly locked in more cash flow. We’ll walk through where patience pays, where a starter buy makes sense, and where letting it drift is the smarter move.

Tech Reset Begins (Sponsored)

Tesla could be on the verge of its biggest change ever.

Insiders are warning of a coming "critical inflection point" that could have ripple effects across the entire stock market.

Do NOT buy or sell Tesla stock until you see this.

Full briefing here.

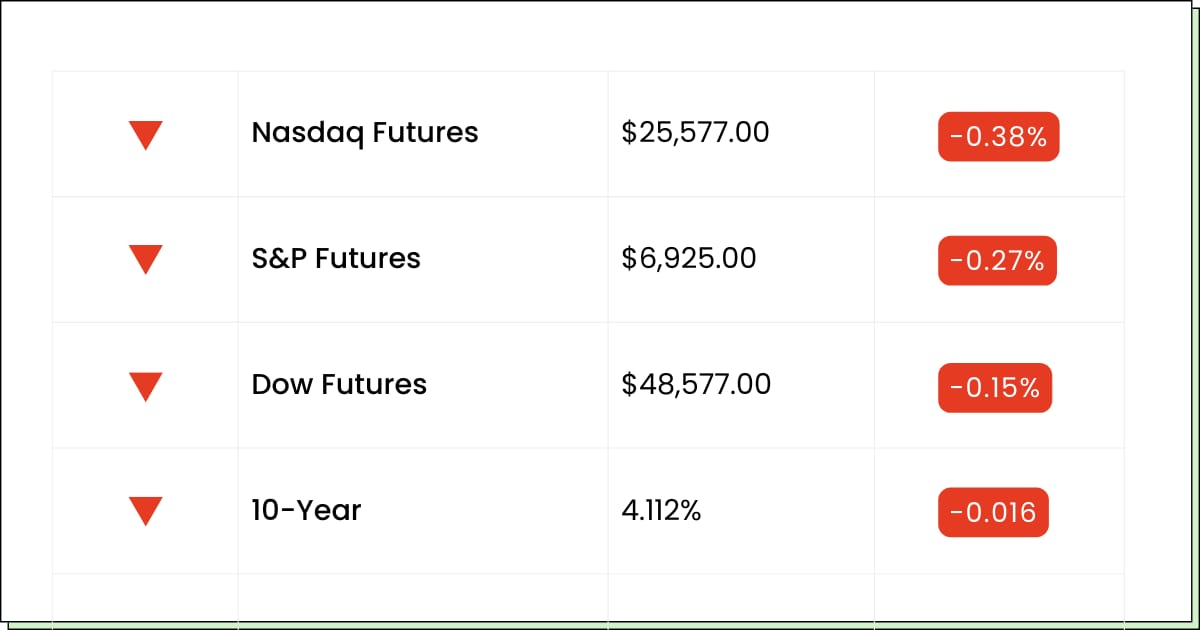

Futures at a Glance📈

Futures are basically doing the end-of-year shuffle. Stocks are coming off a few down days, the AI trade is taking a quick breather, and traders are treating the last session like the final minutes of a party where everyone’s grabbing their coat, but nobody wants to be the first to leave.

Here’s the year-end scoreboard heading into the last trading day of 2025:

Dow: +13.7%

S&P 500: +17.3%

Nasdaq: +21.3%

Russell 2000: +12.1%

Gold: +66.1%

Silver: +166.5%

WTI crude: −19.2%

Bitcoin: −5.8%

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

JBS N.V. [JBS]

Compass Diversified [CODI]

ALPS Group Inc [ALPS]

Argo Blockchain plc [ARBK]

NeuroSense Therapeutics Ltd. [NRSN]

Naas Technology Inc. [NAAS]

Economic Reports:

Initial jobless claims (Dec. 27): 8:30 am

Healthcare

STAAR Surgical Gets A Suitor, And Suddenly Everyone Squints Closer

STAAR Surgical Co (NASDAQ: STAA) just had a heavyweight investor step in and buy a very real chunk of stock, and the market did what it always does when someone shows up with conviction and a checkbook: it leaned forward. Add a pending merger vote into the mix, and suddenly this once-quiet name is back on traders’ radar.

The appeal is easy to understand. Vision correction isn’t trendy, but it’s persistent. People don’t love glasses forever, and elective healthcare tends to bounce back once wallets relax. The proposed deal offers a clear exit price, which puts a soft floor under the stock and turns every dip into a math problem instead of a guessing game.

But this isn’t a straight shot. Shareholder votes can drag, timelines can slip, and when deal chatter stretches out, stocks tend to wander while lawyers and bankers earn their keep. The recent pop doesn’t mean the finish line is tomorrow.

For everyday investors, this is about patience, not prediction. The opportunity isn’t in chasing headlines. It’s in waiting to see if the path to a close stays clean or starts collecting potholes.

My Take For You: If you’re not in, wait for quieter days or deal clarity. If you’re holding, trimming into strength is reasonable.

My Verdict: Event-driven with upside capped by paperwork. Interesting, but timing matters more than enthusiasm.

Software & Services

The Travel Platform Navan Hit Turbulence, Then Buckled Up

Navan Inc (NASDAQ: NAVN) stumbled on earnings and the market reacted the way it usually does when growth hiccups mid-flight: bags overhead, exits flashing. The stock slid, confidence wobbled, and suddenly the narrative shifted from expansion to excuses.

Then something changed. Insiders and major backers started buying. Not nibbling. Buying. That doesn’t erase a missed quarter, but it does suggest the people closest to the dashboard think the selloff went too far, too fast.

The business itself still makes sense. Companies travel. Employees expense things. Nobody enjoys paperwork. Navan sits right in that pain point, and its tools aren’t going out of style. The question isn’t relevance. It’s pace. Can growth regain its footing before patience runs thin?

For investors, this becomes a classic reset story. The hype deflated, expectations cooled, and now the stock has to earn trust again. That usually takes time and a few calm quarters, not one insider headline.

My Take For You: Start small if you’re curious. Let insider buying be a signal, not a green light.

My Verdict: Rebound potential, but still proving itself. Worth watching closely, not swinging blindly.

Tech Reset Begins (Sponsored)

Why did federal agencies receive orders to "clear the runway" for a phenomenon most Americans haven't even heard of yet?

And why are billionaires rushing in weeks before Jan. 1?

Whitney Tilson decoded the pattern.

See his private briefing here.

Biotech

Royalty Pharma Cashes Another Check And Keeps It Boring

Royalty Pharma plc (NASDAQ: RPRX) just did what it does best: quietly bought more future cash flow. By taking full control of a royalty tied to a proven drug, the company tightened its grip on a steady revenue stream and reminded investors why this model exists in the first place.

This isn’t a biotech lottery ticket. There’s no trial drama, no FDA cliffhanger, no all-or-nothing press release. It’s closer to owning the toll booth than the highway. Patients keep using the drug, sales keep coming in, and the royalty checks keep landing with very little fuss.

That’s exactly why the stock didn’t explode. Predictability rarely does. But in a market full of noise, that calm has value. Investors looking for income and measured growth don’t need fireworks. They need consistency.

The trade-off is speed. You’re unlikely to wake up to a double overnight. But you’re also unlikely to wake up to a 30% haircut because a study missed a checkbox.

My Take For You: This works best as a pullback buy, not a breakout chase. Think accumulation, not adrenaline.

My Verdict: Steady, dependable, and intentionally boring. A solid anchor for portfolios that prefer sleep over sizzle.

Poll: If cash disappeared tomorrow, how would you feel?

Movers and Shakers

Nike Inc [NKE]: Premarket Move: +2%

Nike’s up after another Hold-style nod from analysts. No fireworks, just a reminder the turnaround is still jogging, not sprinting.

This is a patience trade. If the recovery really firms up, you’ll have plenty of time to add.

My Take: Starter buy only on dips. Add later if momentum improves, bail if it rolls over.

Jefferson Capital Inc [JCAP]: Premarket Move: −7%

JCAP slipped even with bullish coverage. Classic good note, bad stock move, usually just profit-taking or nerves.

Let it stop sliding before you try to be the hero.

My Take: Wait for it to stabilize, then nibble. If it keeps leaking, save your ammo.

Blue Owl Capital Corp [OBDC]: Premarket Move: −3%

OBDC’s lower despite big holders adding and insiders buying. The market’s basically asking, “Cool yield… but can you keep it up?”

Income names don’t sprint. They shuffle and pay you to wait.

My Take: Buy on red days, not green. Treat it like a dividend machine, not a high-octane play.

American Alternative Assets Offer (Sponsored)

They called you "deplorable."

Mocked your values.

Drained America's strength.

They'd love nothing more than for you to stay down.

But now, it's your move.

With Trump's agenda, you've got a chance to fight back and protect what's yours.

China is coming for the dollar. Wars may spread across the globe. They're counting on you to sit still while your savings take the hit.

But you're not going to let that happen.

This "Patriot's Tax Shield" lets you defend your wealth with real, solid gold.

Our exclusive, free wealth protection guide shows you how to use Trump's vision to lock down your savings—your freedom, your future.

Plus, for a few lucky individuals, we're honoring Trump's historic return with an exclusive free gift.

Grab your FREE GUIDE NOW

CLICK HERE TO GET YOUR GUIDE NOW

PS: Please don't wait—this is your moment to take action. Download your Wealth Protection Guide now, claim your free gift, and see how Trump's victory could spark major gains for gold.

Click here now to see how to stop them in their tracks!

Everything Else

Bond traders kept one eye on the 10-year yield and the other on the data calendar, because nothing says fun like rates deciding your stock’s mood for the day.

China’s silver controls are back in the spotlight, and the critical-minerals crowd is treating it like a supply-chain season finale.

Apple’s AI Siri push is getting another reality check, as the company tries to make “smarter assistant” mean helpful, not just confidently wrong.

Nvidia is reportedly tapping its foundry partner about more H200s as China demand ramps, which is great for chip hype and terrible for anyone hoping supply stays chill.

SoftBank says it’s fully funded its OpenAI check, doubling down on the idea that the best way to win the AI race is to bring a bigger wallet.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.