A big-name suitor stepped up with real money. We’ll show you the likely numbers and a cooler entry to watch instead of buying the first spike.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

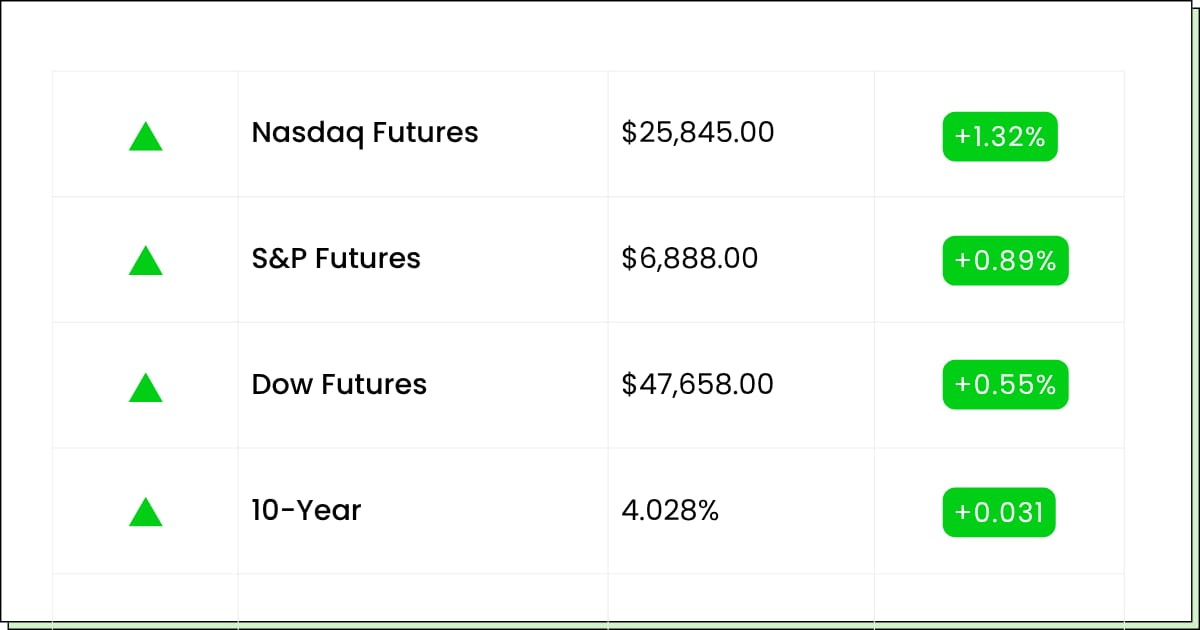

Futures at a Glance📈

Futures are perking up on fresh truce talks between the U.S. and China. Chip names are leading the premarket stretch with Big Tech jogging right behind. Traders are eyeing a possible handshake later this week, with the Canada spat lurking offstage.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Revvity [RVTY]

Aftermarket Earnings:

Welltower [WELL]

Cadence Design Systems [CDNS]

Waste Management [WM]

NXP Semiconductors [NXPI]

The Hartford [HIG]

Arch Capital Group [ACGL]

Celestica [CLS]

Nucor [NUE]

Economic Reports:

Durable-goods orders (Sept): 8:30 am

Durable-goods minus transportation (Sept): 8:30 am

Data subject to delay if government shutdown continues.

Aerospace & Defense

Boeing Strikes A Nerve While The Stock Tries To Fly Straight

Workers on strike at Boeing said nope to the latest offer, keeping the strike going and putting more delay risk on defense jets and everything downstream.

The company says it has a backup plan, but anyone who’s ever flown standby knows that’s not the same as an on-time departure. The stock’s been climbing this year, which tells you hope is alive, but headlines like this can turn smooth air into turbulence fast.

The bigger picture is trust needs rebuilding with both customers and crew, and that takes time, cash, and fewer “we’re working on it” moments.

If you’re reading this for a simple plan, here it is: let the dust settle. You want signs that the two sides are moving toward a deal or that production isn’t slipping further. Until then, treat green days like gifts and red days like reminders that this is still a fixer-upper.

My Take For You: If you’re not in, be patient and let negotiations progress. If you’re in, keep it modest and take some profits on strong days so a headline doesn’t steal your lunch.

My Verdict: Watch-list with a finger on the exit. Worth a small position only if you’re okay with news whiplash and slow repairs.

Materials

Rare Earths Lose Their Plot Twist At The Worst Time

USA Rare Earth and friends slipped after chatter that China might delay new export limits. What we’re seeing is the supply squeeze right now story cooled off, and the hot money went looking for a different campfire.

The long game hasn’t changed much, as these minerals still matter for magnets, motors, and the whole clean-tech parade, but the near-term drama just dialed down. That’s fine. Less shouting makes it easier to see who’s actually building real capacity and signing real buyers, not just waving a flag on social media.

For you, the move is to stop chasing sirens and start hunting substance. Look for actual deals, plants that are making things, and costs that behave. The sector will keep throwing plot twists, but the winners are the ones shipping product, not headlines.

My Take For You: If you’re curious, wait for calmer prices and real updates from the company. If you own it, trim a little on bounces and keep a simple I’m-out-if-it-breaks-here line.

My Verdict: Speculative with capital-S. Fun for a small swing on pullbacks, but only hold it if you can handle policy mood swings and long build times.

Market Shift Watch (Sponsored)

The difference between “nice returns” and life-changing gains often comes down to timing—and information.

Our latest research has identified 5 stocks positioned for massive growth.

These companies combine strong fundamentals with technical setups that suggest the potential for explosive upside.

Past editions of this same report have included stocks that went on to gain +175%, +498%, even +673%.¹ While the past can’t predict the future, the track record speaks volumes.

For a limited time, you can download the full 5 Stocks Set to Double report—absolutely free.

[Get your free copy before midnight tonight]

Smart investors know: when the window is short, action beats hesitation.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Biotech

Avidity Biosciences Inc Gets A Big-League Dance Partner And A Bigger Spotlight

A fresh “strong buy” and a big-name deal rumor lit the fuse, and now the stock is jumping like it heard its favorite song.

It’s easy to understand. A larger pharma wants key programs, shareholders get a cash offer with a sweetener, and the smaller company gets a louder megaphone.

That said, deals take time, rules need checking, and not every headline turns into a happily-ever-after. Expect cheering sections on both sides and a few plot twists before the final credits roll.

In the end, keep it simple. Chasing big gaps can feel like buying the last slice at a party, pricey and gone in a flash. Let it breathe. If the offer firms up and the spread makes sense, you’ll still have a shot without doing cartwheels in premarket.

My Take For You: If you’re new, let it settle and see the deal details. If you’re already long the stock, consider taking some gains and riding the rest with a calm head.

My Verdict: Good story with deal juice, but treat it like a trade until the paperwork is real. Enjoy the pop, keep expectations humble, and don’t fall in love with the first chorus.

Poll: Which is your financial pet peeve?

Movers and Shakers

American Bitcoin Corp [ABTC]: Premarket Move: +9%

Bitcoin’s perking up, and this miner just bragged about stacking more coins, so the feeling is “number go up.” Nothing fancy here. When the big coin bounces, the shovel-sellers usually smile.

Just remember, this name can move like a scooter on wet pavement, fun until it slips.

My Take: Ride the trend, don’t marry it. Small bite only, skim wins on green, and step off if the coin cools.

GameStop [GME]: Premarket Move: +8%

The meme crowd woke up again, options chatter got loud, and suddenly the retro game shop is back on your screen. Pokémon drops and holiday hype help the story, but this still trades on feelings as much as numbers. Expect pop-and-drop loops.

My Take: Treat it like an arcade. Put in a few quarters, not your rent. Take profits fast and don’t chase if it sprints.

Revvity [RVTY]: Premarket Move: −5%

They beat earnings and lifted the outlook, but the stock’s yawning anyway. Classic good news, weird reaction.

It could just be nerves in the call or folks taking chips off the table after a tough year. But the numbers looked generally good.

My Take: Let it settle. If it steadies later in the morning, you can start to buy it, if it keeps slipping, save your ammo for a calmer setup.

Durable, Profitable, Proven (Sponsored)

Every month, a handful of stocks quietly outperform the rest — and those early movers often go on to deliver double-digit gains.

We’ve identified 7 of them showing the strongest near-term potential based on proprietary screening signals.

These aren’t hype stocks or risky bets.

They’re backed by real earnings power, rising analyst sentiment, and technical strength — the kind of combination that precedes powerful rallies.

See which stocks are poised to lead the market higher over the next 30 days.

Get your free copy of this month’s 7 Market Winners.

Everything Else

HSBC’s legal tab just ballooned as it prepares a fresh hit tied to the Madoff saga, reminding banks that old ghosts can still send an earnings shiver.

Even the Oracle can underperform: Berkshire is trailing the S&P this year, proof that not every value snack becomes a market feast.

Boeing’s labor standoff keeps circling the runway as striking defense workers push back on the latest offer, so production hopes are stuck on weather delay.

Amazon is splashing serious cash in the Netherlands, betting that bigger local muscle turns Prime into the default shop button.

Toyota keeps the assembly lines humming with another month of rising output on U.S. demand—cruise control engaged for the production run.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.