One mega-cap is tightening the belt while spending big on AI, a housing rebound story just flashed signs of life, and a growth name is making a bold pivot after missing a splashy deal. Here’s how we would play it.

Just The Facts (Sponsored)

In a world flooded with AI-generated content, 1440 is different.

Every edition is researched, written, and edited by real people who care about accuracy, context, and clarity.

Their team reviews over 100 sources daily to bring you a 5-minute newsletter that explains the world without bias, spin, or shortcuts.

Trusted by over 4 million readers, 1440 delivers news made for humans, by humans.

Plus, it’s always free, factual, and refreshingly real.

Subscribe for free

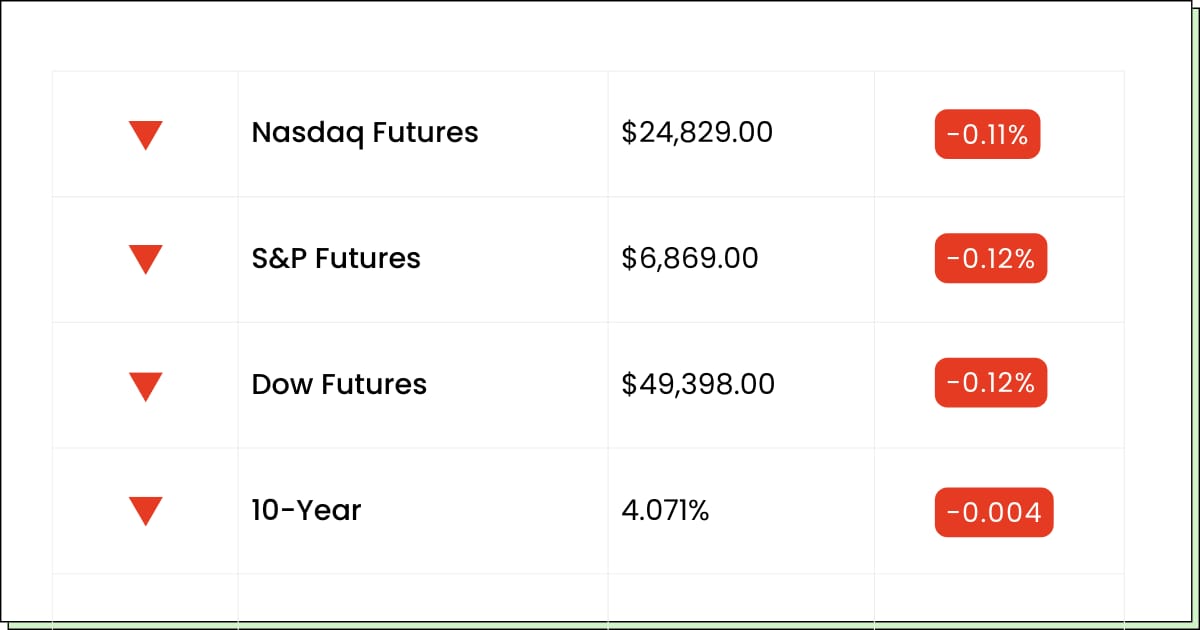

Futures at a Glance📈

Futures are nudging lower into a big morning data combo: GDP and the Fed’s favorite inflation read, PCE. The other wildcard is a possible Supreme Court call on Trump’s tariffs, which could spark a quick risk-on bounce if it goes the market’s way. Add in rising U.S.–Iran tension pushing oil up, and it’s a classic headlines and data setup.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

• AngloGold Ashanti PLC [AU]

• PPL Corporation [PPL]

• Lamar Advertising Company [LAMR]

• Hudbay Minerals Inc. [HBM]

Earnings (Aftermarket):

• Protagonist Therapeutics, Inc. [PTGX]

• Sibanye Stillwater Limited [SBSW]

• TXNM Energy, Inc. [TXNM]

Economic Reports:

• GDP (Q4): 8:30 am

• Personal income (Dec): 8:30 am

• Personal spending (Dec): 8:30 am

• PCE index (Dec): 8:30 am

• Core PCE index (Dec): 8:30 am

• S&P flash U.S. services PMI (Feb): 9:45 am

• S&P flash U.S. manufacturing PMI (Feb): 9:45 am

• New home sales (Nov, delayed): 10:00 am

• New home sales (Dec, delayed): 10:00 am

• Consumer sentiment, prelim (Feb): 10:00 am

Fed Speakers:

• Atlanta Fed President Raphael Bostic: 9:45 am

Communication Services

Meta Trims The Stock Candy While It Buys The AI Gym Membership

Meta Platforms Inc (NASDAQ: META) just tightened the employee stock-award faucet by about 5% for most staff. Think of it like your favorite restaurant shrinking the fries a bit while adding a new fancy cocktail menu. Same brand, different priorities.

The timing makes the story easy to read. Meta is spending big on its AI ambitions, which means someone, somewhere, is being asked to be a little less expensive. This is not a panic headline; it is a budgeting headline. Still, it can mess with morale, and morale can mess with execution.

For investors, the question is simple: does this turn into smarter spending with steady growth, or does it turn into a vibes problem that shows up later in retention and product speed? The stock can live with cost discipline. It struggles when focus gets fuzzy.

My Take For You: If you own it, keep it, but watch for any signs that the cost push starts hitting talent or product momentum. If you do not own it, wait for a softer entry instead of chasing a quiet headline day.

My Verdict: Hold or starter-buy on dips, as long as execution stays clean.

Consumer Discretionary

Opendoor Technologies Just Did A Better Quarter, But The Housing Hangover Is Still Real

Opendoor Technologies Inc (NASDAQ: OPEN) popped after a quarter where results beat expectations and the company pointed to a better near-term outlook. That is the good news. The very human news is that revenue still fell hard year over year, which is what happens when housing goes from party mode to couch mode.

The market likes what it saw in the direction of travel: improving losses, better cash flow, and guidance that suggests the next step is less painful than feared. It is basically a “we are not fixed yet, but we stopped making new dents” update.

Your risk is the same as always with this name: it moves fast on hope, and it can reverse fast when rates, inventory, or buyer confidence change their mood. Treat it like a progress report, not a graduation ceremony.

My Take For You: If you are not in, start small only after the pop cools and it holds those gains for a few sessions. If you are in, consider trimming a little into strength and keep the rest with a clear exit line.

My Verdict: Trade-first, invest-later. Promising traction, still headline-sensitive.

Accessible Legally (Sponsored)

While President Trump's official salary is $400,000 per year... his tax returns reveal he's been collecting up to $250,000 PER MONTH from one hidden source.

Until recently, most Americans couldn't touch the type of investment that makes up this investment.

But thanks to Executive Order 14330, that just changed. If you love investing in disruptive new companies...

Discover how to invest in the fund Trump uses to collect this income

Technology

AppLovin Missed The TikTok Train, So It’s Building Its Own Station

AppLovin Corp (NASDAQ: APP) is floating a new idea: build its own social platform after its bid for TikTok assets outside China did not land. That is a classic pivot move. If you cannot buy the party, you host your own.

The appeal is obvious. A social platform can create a firehose of user attention, and attention is basically the currency AppLovin already knows how to monetize. The risk is also obvious. Social is crowded, expensive, and full of feature copycats who run faster than you think.

So the setup is less about dreaming and more about proof. This story gets interesting only if AppLovin shows early traction, clear differentiation, and a path that does not torch margins to buy users. Until then, treat the move as a headline catalyst, not a finished product.

My Take For You: If you own it, stay in but do not add on the first excitement bump. If you want in, wait for specifics and an execution checkpoint or two before starting a position.

My Verdict: Watch-list with upside, but it needs receipts before it earns a bigger bet.

Poll: Which industry monetizes nostalgia best?

Movers and Shakers

Grail Inc [GRAL]: Premarket Move: −48%

This one just face-planted after a big trial readout didn’t hit the main goal. That is biotech for you: one data point and the market goes from future of medicine to delete the app.

Yes, there were some silver-lining notes in the release, but when the primary endpoint misses, traders usually don’t stick around to read the footnotes.

My Take: Do not try to catch this falling knife at the open. Put it on the watchlist and only consider a tiny starter if it finds a floor and starts basing for a few days.

Akamai Technologies Inc [AKAM]: Premarket Move: −10%

They beat on sales and profits, but the stock still got whacked because the outlook for profits next year didn’t wow anyone. Classic market behavior.

This kind of move is often more about expectations than execution, and it can turn into a decent dip-buy if it stops bleeding.

My Take: Let the first hour pass. If it steadies and starts to bounce, a small starter makes sense. If it keeps leaking, wait for a cleaner setup near support.

Workiva Inc [WK]: Premarket Move: +10%

Workiva just came in with a solid quarter and upbeat next-step guidance, and the stock is getting the morning applause. This is one of those moves where buyers show up early and shorts suddenly remember they have errands.

The only catch is these pops can cool off once the opening hype fades.

My Take: Don’t chase the spike. If it pulls back and holds, start small and add only if it stays strong into the afternoon.

A Historic Expansion (Sponsored)

A small U.S. government task force working out of a strip mall just completed a 20-year mission.

With almost no media coverage, they confirmed one of the largest territorial expansions in modern history — tied to resources estimated at nearly $500 trillion.

Under sovereign U.S. law, this development could open the door for American citizens to stake a claim.

Yet very few people even know this opportunity exists.

Click here to access the full briefing and see how to position yourself before the window closes.

Everything Else

Nvidia is reportedly in talks to put up to $30B into OpenAI, which is basically the AI arms race showing up with a suitcase of cash.

At India’s AI summit, Altman and Amodei took the stage as the “two heavyweights, one microphone” moment for the next phase of AI competition.

A private-credit warning light is flashing after liquidity curbs at Blue Owl, spooking investors who hate the words limited access and surprise timing.

Netflix may have more room to sweeten its bid in the Warner Bros. contest, because apparently streaming is also a contact sport now.

Amazon’s cloud unit got hit by at least two AI-tool outages, which is a rough look when everyone’s trying to sell “always on” as the whole pitch.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.