A lung drug setback knocked a major biotech off its high, a footwear chain is sprinting ahead with a bold rebrand plan, and a burger chain is sizzling after flipping back to profit. Read on to find out what’s shaking the markets today.

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

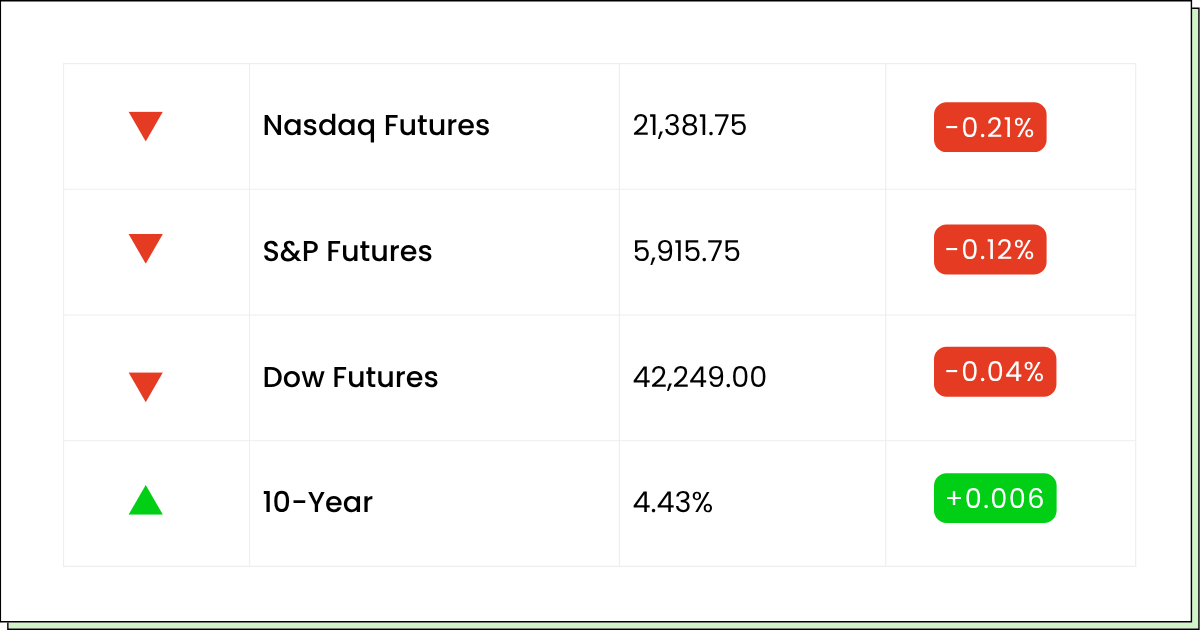

Futures 📈

What to Watch

Earnings:

None Scheduled

Economic Reports:

Personal Income [April] … 8:30 am

Consumer Spending [April] … 8:30 am

PCE Index [April] … 8:30 am

PCE (Year-over-Year) … 8:30 am

Core PCE Index [April] … 8:30 am

Core PCE (Year-over-Year) … 8:30 am

Advanced U.S. Trade Balance in Goods [April] … 8:30 am

Advanced Retail Inventories [April] … 8:30 am

Advanced Wholesale Inventories [April] … 8:30 am

Chicago Business Barometer (PMI) [May] … 9:45 am

Consumer Sentiment (Final) [May] … 10:00 am

San Francisco Fed President Mary Daly speech … 4:45 pm

High-Rated Buys (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

(By submitting your email, you’ll also get a free Profit from the Pros membership, which highlights exclusive market updates and daily Strong Buy stocks. You can unsubscribe at any time. Privacy Policy)

Biotechnology

Regeneron Shares Dip 10% After Disappointing COPD Trial Outcome

Regeneron (NASDAQ: REGN) shares are down nearly 10% in premarket trading today after trial results for its experimental lung drug, itepekimab, delivered mixed outcomes in late-stage studies.

The drug, developed in partnership with Sanofi (EPA: SAN), was tested for chronic obstructive pulmonary disease (COPD) in adults who previously smoked.

One large-scale study involving over 1,100 patients showed a 27% reduction in flare-ups compared to placebo at the one-year mark. However, a second study, which included fewer former smokers, failed to meet its primary endpoint—despite some early signs of effectiveness.

The results cloud hopes that itepekimab could rival or complement existing COPD treatments, such as Dupixent, another Regeneron-Sanofi success story. Analysts now believe Dupixent will likely remain the favored option among physicians.

COPD, often caused by smoking or long-term exposure to pollutants, affects nearly 16 million adults in the U.S., with limited available therapies. The new data may narrow the market potential for itepekimab, which was seen as a potential blockbuster.

Regeneron and Sanofi are currently analyzing the results and plan to consult with regulators on next steps.

Footwear Retail

Shoe Carnival Bets Big on Rebranding Move, Stock Soars

Shoe Carnival (NASDAQ: SCVL) announced plans to significantly expand its premium-focused Shoe Station concept today, aiming to have it represent over 80% of its total store count by March 2027—well above its previous goal of 51%.

The company’s pivot comes as sales at Shoe Station climbed 4.9% in the most recent quarter, outperforming both the company's namesake banner, which saw a 10% drop, and the broader family-footwear industry.

Despite this, overall quarterly revenue declined to $277.7 million from $300.4 million a year ago, and comparable sales fell 8.1%. Net income dropped to $9.34 million, or $0.34 per share, down from $17.3 million, or $0.63 per share.

The company attributed $0.15 of that decline to its rebranding initiative in the first quarter alone and estimates a full-year hit to operating income of $20 to $25 million, or roughly $0.65 per share.

Still, Shoe Carnival maintained its full-year forecast, projecting sales between $1.15 billion and $1.23 billion and earnings of $1.60 to $2.10 per share.

Shares are up 7% in premarket trading despite being down 44% year-to-date, a slump largely attributed to tariff-related headwinds.

AI Trade Shift (Sponsored)

As U.S.-China trade tensions rise, chip exports are being restricted—and big names like Nvidia could face major revenue hits.

But this disruption is creating space for U.S.-based AI companies with strong domestic operations and rapid revenue growth.

A new report reveals 9 under-the-radar AI stocks poised to benefit from this shift.

Download the full list today—free for a limited time.

Beauty Retail

Ulta Beauty Lifts Annual Forecast, Shares Surge

Ulta Beauty (NASDAQ: ULTA) shares are rising over 8% in premarket trading today after the company raised its full-year earnings outlook and beat quarterly expectations, fueling optimism from Wall Street.

The beauty retailer posted earnings of $6.70 per share, far exceeding the consensus estimate of $5.77. Revenue reached $2.85 billion, edging past Wall Street’s projection of $2.79 billion. Comparable sales rose 2.9%, fueled by a higher average transaction value and a modest increase in store visits.

Ulta’s net merchandise inventory grew 11.3% year-over-year to $2.1 billion, driven by new brand rollouts, category investments, and 56 additional store locations. While gross profit rose 4.2% to $1.11 billion, its gross margin slightly dipped to 39.1%, impacted by fixed costs and lower ancillary revenue.

CEO Kecia Steelman highlighted that the company’s strategic "Ulta Beauty Unleashed" plan is delivering momentum across operations and customer engagement.

Looking ahead, Ulta now expects fiscal 2025 earnings per share to land between $22.65 and $23.20, up from its prior range. Revenue projections were also raised to $11.5 billion–$11.7 billion, reflecting confidence in continued growth despite macroeconomic headwinds.

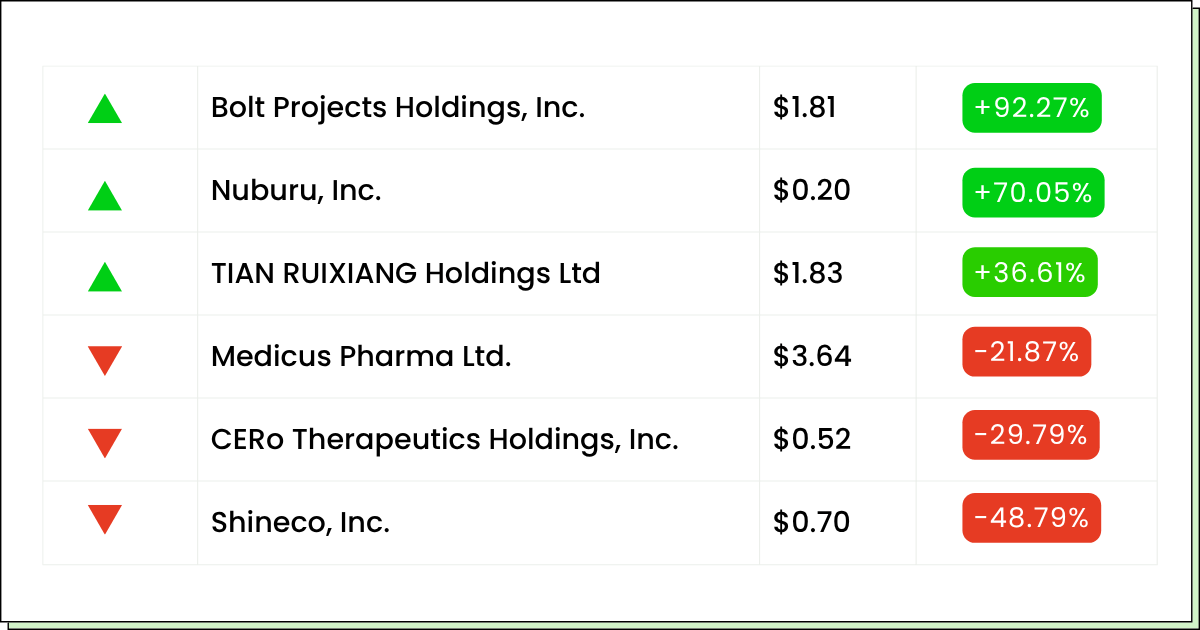

Movers and Shakers

Red Robin Gourmet Burgers, Inc. [RRGB] - Last Close: $3.13

Red Robin Gourmet Burgers Inc. is a full-service restaurant chain known for its gourmet burgers and casual dining experience. The firm has solid revenue but its net margins took a big dive in the last 3 quarters.

The 33% jump in its stock today is because RRGB reported net income of $1.2 million, or $0.07 per share in Q1, marking a return to profitability after several quarters of losses.

My Take: Red Robin's return to profitability is a positive sign. However, the company still faces challenges in a competitive casual dining market, so keep a close watch on whether the firm can sustain profitability in the coming quarters.

iQSTEL Inc. [IQST] - Last Close: $8.40

iQSTEL Inc. is a multinational telecom and technology firm offering services like VoIP, SMS, IoT, and fintech solutions. The firm has shown impressive revenue growth over the last five years (95.59% growth last year), though it has yet to attain net profitability.

The stock is rising 13% in premarket trading because the firm has announced that it will be acquiring a 51% stake in fintech firm GlobeTopper, expanding iQSTEL's footprint in B2B Top-Up solutions across multiple continents.

My Take: iQSTEL's aggressive expansion into fintech and its impressive revenue growth are promising. However, consistent profitability remains a challenge. Keep a close watch on the profitability metrics in coming quarters.

UiPath, Inc. [PATH] - Last Close: $12.94

UiPath Inc. is a leading provider of robotic process automation (RPA) software. The firm’s revenue grew by about 9% in 2024 to $1.43B. Its profitability took a hit after Q2’24, but it has recovered well in the last two quarters of the year.

Today the stock is up 13% after it reported revenue of $357 million in Q1, surpassing analyst expectations, and adjusted earnings per share of $0.11. It also raised its full-year guidance, alleviating investor concerns about potential impacts from U.S. federal spending cuts.

My Take: UiPath is a solid stock and its latest quarterly earnings prove that. RPA is a competitive but fast-growing industry, so this is definitely one stock you should keep your eye on.

Q2 Market Movers (Sponsored)

Summer market momentum is here—and these 7 tickers are at the center of it.

This free investor guide features top-ranked stocks selected for their growth potential, market trends, and expert analysis.

It’s a must-read for anyone looking to position their portfolio for a strong second half.

The list is available for FREE, but only for a limited time.

Everything Else

Trump’s tariff push gains a temporary reprieve from an Appeals court.

India powers ahead with 7.4% quarterly growth despite global uncertainty.

Costco's solid quarter highlights strong membership growth, but the market reaction remains tepid.

Dell's booming AI server sales prompt profit upgrade, even as margins stay under pressure.

Marvell’s AI chip momentum drives record revenue, but conservative guidance weighs on its stock.

Zscaler’s growing platform and billion-dollar contract wins fuel investor optimism.

NetApp’s outlook rattles investors despite a strong close to the fiscal year.

Cooper beats earnings expectations but a cautious market trims its stock value.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.