A potential buyer just circled a beaten-down software name, an OpenAI tie-up lit up a marketing platform, and a driver-assist win gave a bruised auto-tech story fresh legs. The question is not what moved. It is what can actually stick once the sugar rush fades.

Opportunity Taking Shape (Sponsored)

A quiet technological shift is racing ahead - and most investors are completely unprepared.

This breakthrough could mint new millionaires as Silicon Valley and Washington scramble to back it.

Click now before the window closes.

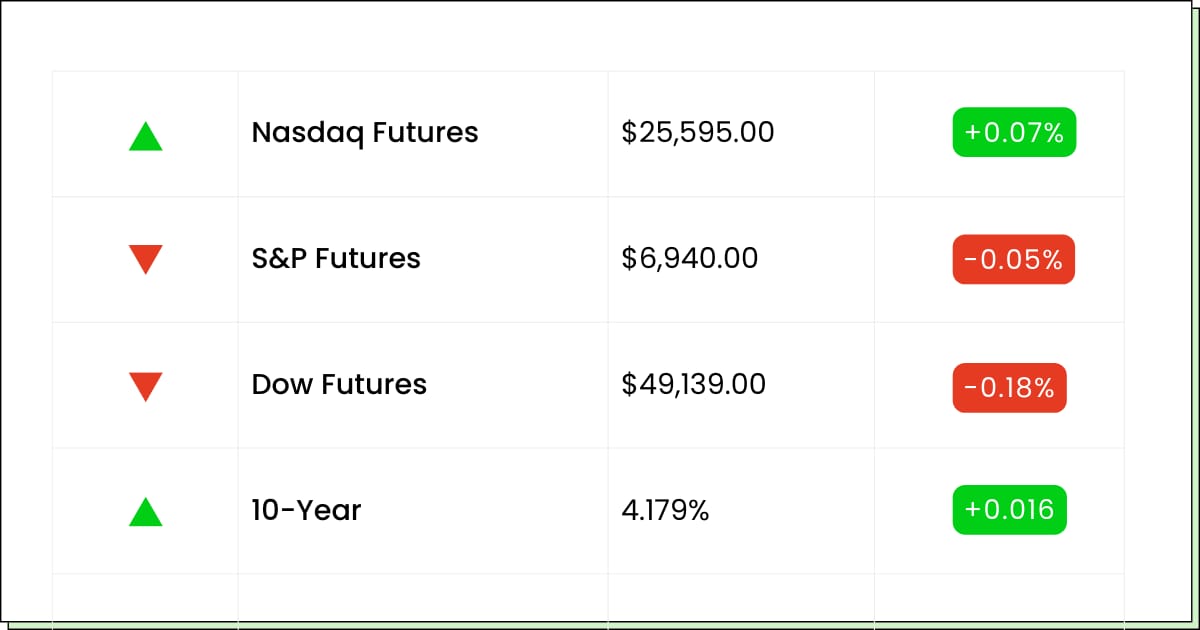

Futures at a Glance📈

Futures are basically flat this morning, taking a breather after Monday’s record-setting rally. The Venezuela shock is still in the backdrop, but traders are treating it like an energy story, with oil names staying lively as talk of U.S. investment heats up.

Now the mood is to let the dust settle. If energy keeps leading, risk-on stays intact. If it fades, expect a choppier tape and quicker profit-taking.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

AngioDynamics, Inc. [ANGO]

Aftermarket Earnings:

AAR Corp. [AIR]

Penguin Solutions, Inc. [PENG]

Economic Reports:

Richmond Fed President Tom Barkin speaks: 8:00 am

S&P final U.S. services PMI (Dec): 9:45 am

Enterprise Software

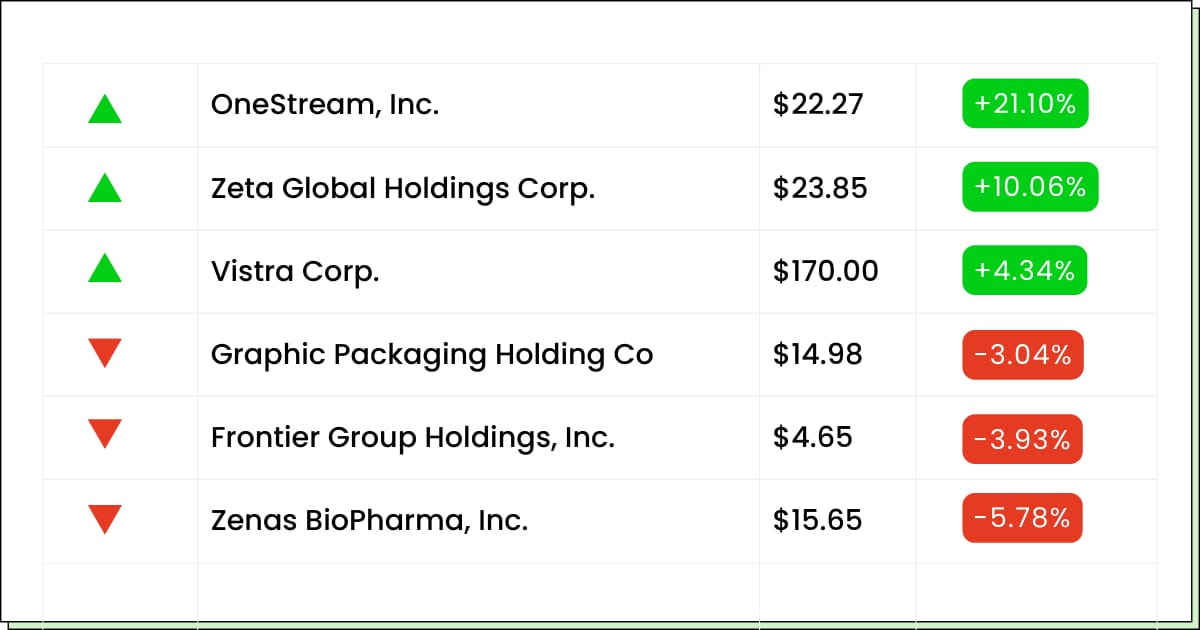

OneStream Might Be Getting Scooped Up, And The Stock Suddenly Found Its Espresso

OneStream Inc (NASDAQ: OS) bounced in premarket after reports that buyout firm Hg is in advanced talks to acquire the company. Nothing wakes up a sleepy ticker like the words advanced talks and could be announced soon.

The vibe here is simple. OneStream sells business software that helps companies keep their financial planning and reporting from turning into a monthly panic attack. The stock has been bruised over the past year, and now private equity is circling like it just spotted a slightly dented but still very useful shopping cart.

Still, do not confuse dating with a wedding. These talks can move fast, slow down, or end quietly with everyone pretending it never happened. If you chase the first pop, you might be buying excitement instead of certainty. The smarter move is to let the rumor air out and wait for something official.

My Take For You: If you are new, wait for confirmation before getting cute. If you already own it, trimming a little into strength can make the rest of the ride easier to hold.

My Verdict: Watch-list event trade. Fun headline, but it stays speculative until there is a real deal.

Marketing Tech

Zeta Linked Up With OpenAI, And Marketers Just Heard The Sound Of Shorter Meetings

Zeta Global Holdings Corp (NYSE: ZETA) popped after announcing a partnership with OpenAI to power its Athena marketing platform. The pitch is that marketers can ask plain-English questions and get useful answers faster, instead of living inside dashboards and pretending that is a personality.

This kind of news hits the market like free snacks in the office kitchen. Big name partner, big momentum, and a rollout plan that aims to bring it to more customers by the end of Q1 2026. It reads like a shortcut, and people love shortcuts, especially the kind that might make Monday feel less Monday.

The reality check is that partnerships are easy to announce and harder to translate into lasting revenue. Investors will want proof that customers adopt it, stick with it, and spend more because it works, not because it sounds cool. If the next updates are strong, the story can keep legs. If not, the hype can fade quickly.

My Take For You: If you are not in, do not chase the first spike. If you are in, consider taking a small profit and letting the rest ride.

My Verdict: Real catalyst with real hype fuel. Worth watching, but it needs follow-through.

Protect What’s Yours (Sponsored)

Economic confidence weakens when debt rises, wars expand, and currencies lose trust.

Many investors stay frozen while purchasing power quietly slips away.

History favors those who move early when political shifts change the landscape.

This Patriot’s Tax Shield outlines how tangible gold can serve as a defensive asset in uncertain times.

A free Wealth Protection Guide explains why Trump’s return could reshape demand for gold.

Click here to download the FREE Wealth Protection Guide now.

Auto Tech

Mobileye Got A New Gold Star, And The Stock Is Trying To Drive Like It Has A Plan

Mobileye Global Inc (NASDAQ: MBLY) got a lift after an Outperform rating was reiterated following new details on a major U.S. driver-assist program. The headline takeaway is that Mobileye is landing more of its tech as standard equipment, meaning it shows up in the car whether buyers click the upgrade box or not.

That matters because standard installs can be stickier. Once an automaker bakes a system into a big chunk of vehicles, switching later is not impossible, but it is annoying, expensive, and full of meetings. Nobody likes extra meetings.

The caution is that Mobileye has been a rough ride, and one good week does not rewrite the last year. The market will want steady proof that these wins keep coming and that the company can execute without slipping on timelines or expectations.

If the news flow stays positive, the stock can keep rebuilding confidence. If the updates go quiet, the excitement can cool off fast.

My Take For You: If you are new, let the move settle and see if it can hold gains. If you already own it, trimming a bit can reduce headline whiplash.

My Verdict: Improving setup, but still a prove-it name. Keep size modest.

Poll: When you hear “financial freedom,” what do you think of first?

Movers and Shakers

Vistra Corp [VST]: Premarket Move: +4.7%

Vistra is up after agreeing to buy Cogentrix Energy for about $4.7B, adding a bunch of natural gas power plants. Investors heard more supply and started clapping like the grid just stopped flickering.

This is a grown-up catalyst, but it is still a deal, which means approvals, timelines, and the occasional headline that makes the stock grumpy.

My Take: Do not chase the first pop. If you want it, wait for a calmer entry. If you already own it, trimming a little on strength is fine.

Core Scientific Inc [CORZ]: Premarket Move: +4.5%

Core Scientific is bouncing after BTIG upgraded it to Buy and tossed out a $23 target. The market loves an upgrade because it feels like permission to get excited again.

Just remember, this one can still move like a shopping cart with one bad wheel. It pops on headlines, then wobbles the second the crowd gets bored.

My Take: Treat it like a trade. Small bite, quick profit-taking on strong green, and step off if it starts fading.

Graphic Packaging Holding Co [GPK]: Premarket Move: −4.9%

GPK is sliding and the main headline is basically a calendar reminder. The company announced it will report Q4 and full-year results on February 3, with a morning call.

When a stock is already beat up, even quiet news can turn into nervous selling. Traders start positioning early, and sometimes the stock drifts lower just because nobody wants to be the last one holding the bag into earnings.

My Take: Let it settle. If it steadies after the open, you can start small and use February 3 as your checkpoint. If it keeps slipping, wait for a cleaner setup.

Secure Your Spot (Sponsored)

Just months before the Great Depression, a little-known market indicator quietly appeared.

That same indicator later pinpointed Apple at pennies, Nvidia before its breakout, and Netflix before its explosive run.

Most investors never learned about it — until now.

As uncertainty clouds 2026 and heavily owned stocks face growing pressure, this signal is lighting up once more.

Three under-the-radar opportunities have emerged that could outperform while others struggle to recover.

Click here now to Find Out Why

Everything Else

Wall Street’s already eyeing an IPO parade for names like SpaceX, OpenAI, and Anthropic, but the real question is who’s still willing to pay “peak hype” prices.

Nvidia wants to test robotaxis in 2027, which is basically it saying, “Yes, we make chips… and yes, we also want the keys.”

European stocks are wobbling as traders digest the Maduro fallout and decide whether this is a real risk-off moment or just another headline speed bump.

AMD rolled into CES with new chips and the usual message: “We’re not letting anyone have a quiet year.”

Intel is expected to show off its next-gen PC chip at CES, trying to turn “catch-up” into “comeback.”

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.