A streaming giant is rising on a bullish revenue outlook and traction in ad-supported tiers, a $5.8B steel mill deal might reshape U.S. EV supply chains, and a cannabis-focused fintech’s shares are doubling after striking a major deal. Read on to find out more.

Uranium Bull Market (Sponsored)

On Behalf of Azincourt Energy Corp

In 2018, UEC was a forgotten uranium stock trading for just $0.60.

Five years later? It had exploded into a $3.11 billion juggernaut.

That’s the power of timing the uranium cycle.

But this time, the fuel behind it is different:

30+ countries committing to triple nuclear capacity

Domestic enrichment startups like General Matter raising tens of millions

And right now, a tiny uranium explorer in Canada’s Athabasca Basin is sitting on drill-ready projects… just like UEC once was.

The opportunity is hiding in plain sight.

History doesn’t repeat, but in uranium… it often rhymes.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

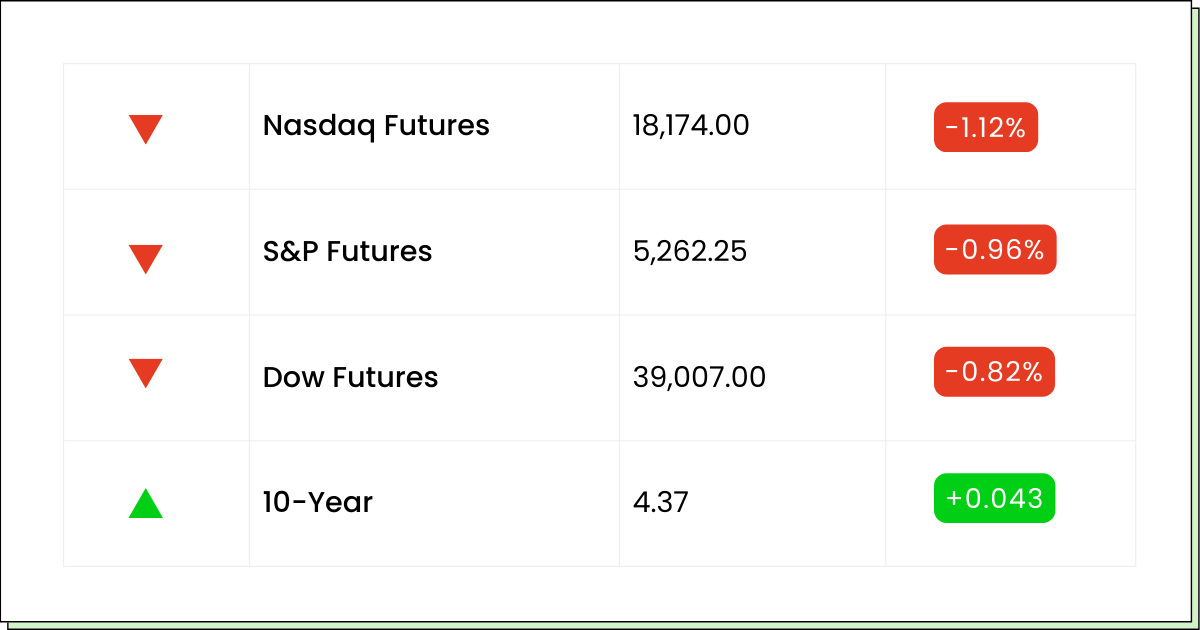

Futures 📈

What to Watch

Earnings:

W.R. Berkley Corporation [WRB]: Afterhours

Equity Lifestyle Properties, Inc. [ELS]: Afterhours

Medpace Holdings, Inc. [MEDP]: Afterhours

AGNC Investment Corp. [AGNC]: Afterhours

Western Alliance Bancorporation [WAL]: Afterhours

Economic Reports:

U.S. leading economic indicators [March]: 10:00 am

Air Travel (Sponsored)

Electric aviation is no longer just a vision—it’s rapidly becoming reality.

Major players are jumping in.

Toyota has invested $500 million to support electric air taxis.

United Airlines has already ordered hundreds of electric aircraft for future regional air travel.

And even the US Air Force is testing electric air taxis.

This NYSE-listed stock just secured a $50 million financing, strengthening its balance sheet and adding fuel to its transformation plan.

With over $119 million in revenue in 2024, they’re not just joining the boom; they’re helping set the pace.

While others are gearing up, this company is already generating real results, flying passengers today on its network of regional flights across the U.S. using aircraft that could one day upgrade to electrified technology.

Trading for under $3, it’s well positioned in a potential growth industry that’s still in its early days.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Media

Netflix Shares Rise On Strong Outlook Despite Economic Uncertainty and Trade Concerns

Netflix (NASDAQ: NFLX) shares are climbing 2.2% in premarket trading today, as investors respond positively to the company’s robust annual revenue guidance despite broader economic concerns.

The streaming platform reaffirmed its 2025 revenue projection of $43.5 billion to $44.5 billion, easing market worries that potential tariff-driven slowdowns could impact consumer discretionary spending.

Co-CEO Greg Peters stated that Netflix remains stable even in challenging macroeconomic conditions, citing the platform’s consistent performance during past downturns.

He added that there have been no meaningful changes in user engagement or churn.

The company's ad-supported subscription tier continues gaining traction, now representing 55% of new memberships in available regions.

Analysts see this as a promising revenue stream, with some highlighting the long-term potential of ad-tech investments.

Netflix recently stopped reporting subscriber counts, shifting focus to top-line performance and advertising growth.

Earlier this month, reports suggested the company aims to nearly double revenue to $78 billion by 2030, driven in part by a $9 billion global ad business.

Automobiles

Korean Giants Posco and Hyundai Team Up for Massive U.S. Mill as Tariff Talks Resume

Posco Holdings Inc. (NYSE: PKX) is partnering with Hyundai Motor Group (OTCPK: HYMTF) on a $5.8 billion steel mill project in Louisiana, the companies confirmed this morning.

This marks a major expansion of South Korean industrial investment in the U.S.

The two corporations signed a memorandum of understanding to collaborate on the venture, which will support the production of next-generation automotive-grade steel sheets.

The facility, slated to begin operations by 2029, will be capable of producing 2.7 million tons annually.

While Posco’s financial stake in the project remains undisclosed, the deal aligns with Hyundai’s broader $21 billion commitment to U.S. expansion.

This project has drawn political attention, with former President Donald Trump touting it as evidence that tariff policies have incentivized domestic manufacturing.

Hyundai first announced the mill in March, following earlier steel duties imposed by the Trump administration.

Beyond steel, the two firms will also explore joint initiatives in the battery supply chain to help source critical materials that comply with U.S. and European regulations.

Hyundai expects the collaboration to enhance long-term resilience in electric vehicle production.

Meanwhile, South Korean trade officials are en route to Washington this week to request tariff relief, including a reduction in the still-active 25% duties on steel, aluminum, and automobiles exported to the U.S.

Junior Mining Spotlight (Sponsored)

On Behalf of Azincourt Energy Corp

Right now, the US has 94 nuclear reactors.

And 90% of the fuel they run on? It’s imported.

Tariffs are coming. Tensions are rising. And the government knows it needs more domestic-friendly supply.

Why Peter Thiel just joined the board of a uranium enrichment startup. Why Canada’s uranium is now more strategic than ever.

And why one tiny explorer in Saskatchewan’s Athabasca Basin could be positioned perfectly.

The company has two active projects.

It’s drilling in the richest uranium district on Earth.

And as the US tries to secure its nuclear future, Canadian explorers like this one may be the first call utilities make.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Technology

Verb Technology Finalizes Lyvecom Acquisition in $5.2M Deal

Verb Technology (NASDAQ: VERB) officially completed its acquisition of AI-driven video commerce platform Lyvecom on Thursday.

The deal, finalized on April 11, involves a mix of cash, debt repayment, and equity compensation.

Verb paid $3 million in cash for Lyvecom’s outstanding capital stock, repaid $1.125 million in investor SAFEs (Simple Agreements for Future Equity), and covered a $100,000 loan owed by Lyvecom to a related party.

Additionally, Verb issued 184,812 restricted shares—valued at $1 million based on a 30-day volume-weighted average of $5.41 per share—to complete the acquisition.

These restricted shares are bound by lock-up and leak-out agreements, limiting immediate resale.

The agreement also includes an earn-out clause allowing Lyvecom shareholders to receive up to $3 million more over the next two years, contingent on the company meeting specific performance targets.

With the acquisition now closed, Verb is looking to strengthen its position in the AI-powered video commerce space.

Lyvecom’s platform, which integrates live video and e-commerce capabilities, is expected to enhance Verb’s product offerings and expand its reach in the interactive commerce market.

Verb’s stock is up 7.1% in premarket trade this morning.

Movers and Shakers

SHF Holdings, Inc. [SFHS] - Last Close: $2.23

Safe Harbor Financial is a fintech pioneer offering compliant banking and credit services to the cannabis industry.

Its stock is rising more than 100% in premarket trading today after Safe Harbor announced a strategic partnership with FundCanna, a top provider of cannabis lending solutions, which will allow both companies to cross-refer clients.

My Take: Safe Harbor’s integration with FundCanna positions it as a one-stop shop for cannabis financial services. However this stock is struggling with profitability and has lost 75% of its worth YTD, so be careful if you wish to invest here.

Evogene Ltd. [EVGN] - Last Close: $0.97

Evogene is a computational biology company which employs AI-driven tech engines in agriculture, therapeutics, and chemicals.

The stock is surging nearly 50% in premarket trading today after Evogene announced the sale of the majority of its ag-biologicals subsidiary Lavie Bio to ICL.

My Take: This is a smart strategic move. Evogene monetizes its IP while offloading operational costs—plus it keeps a foot in the door for future upsides from Lavie Bio’s partner deals. It could be a potential turning point for long-term value creation.

American Resources Corporation [AREC] - Last Close: $1.29

American Resources Corporation is a raw materials provider in sustainable mining and critical mineral refining. Its subsidiary ReElement Technologies is a major domestic rare earth producer.

Shares of AREC are surging 14% in premarket trading after the company announced a major Phase 2 expansion of its Noblesville rare earth refining facility, doubling production capacity of high-purity neodymium, praseodymium, dysprosium, and terbium.

My Take: Given the current scenario surrounding rare earth minerals, AREC’s expansion is a major move for building a U.S.-based supply chain which is a major geopolitical priority. AREC is a good stock to keep your eye on for the future.

AI-Powered Aviation (Sponsored)

If you're searching for the next opportunity, this aviation player is quietly making moves in the industry.

No guarantees, but when the right elements come together, we’ve seen how momentum can take off for other companies before.

The Timing is Everything.

One of the biggest game-changers? A strategic agreement with Palantir Technologies(1) to develop an AI-driven operating system designed to revolutionize the advanced air mobility industry.

Aviation has been slow to embrace AI, but this company is working on real, data-driven software that could revolutionize regional air travel.

Aviation is next, and this company is positioning itself ahead of the curve.

Insiders Are Betting on It.

Board members have increased their holdings.

Analysts across multiple platforms are calling this a company to watch

Appreciate you tuning in—potential disruptors like this don’t come around often.

Stay sharp, stay informed, and take the next step to uncover the full details.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

Everything Else

As Kazakhstan eyes the rare earth boom, an American financier moves to acquire a key mining player.

A Chinese tech firms turn to Huawei’s 910C chip amid the crackdown on Nvidia exports.

Malaysia’s flagship carrier explores fast-tracking aircraft purchases amid shifting skies.

Hesai will introduce advanced lidar with double the range for self-driving cars by 2026.

China strikes back at U.S.-backed isolation efforts, threatening global trade impact.

Korean customs uncover millions in fake origin labels aimed at sidestepping trade rules.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.

*Standard message/carrier rates may apply.

Legal Stuff: Stocks featured in this newsletter are for entertainment purposes only. You should not base any investment decisions on information contained in my newsletter. Stocks featured in this newsletter may be owned by owners/operators of this website, which could impact our ability to remain unbiased. Please consult a financial advisor before making any trading decisions. I may earn a small commission from links placed inside these emails.