Three headlines, three very different traps for retail investors. One looks calm but changes the whole playbook, one just scared everyone out at once, and one is screaming “chase me” in after-hours. We’ll show the clean, low-drama way to trade each one.

Strategic Priority (Sponsored)

On Behalf of Integrated Quantum Technologies Inc.

Most AI projects stall when real data enters the pipeline.

A new zero exposure approach aims to protect data before it moves, easing compliance and cross border deployment.

If enterprises want AI at scale, this layer can become a must have.

Get the name and symbols here

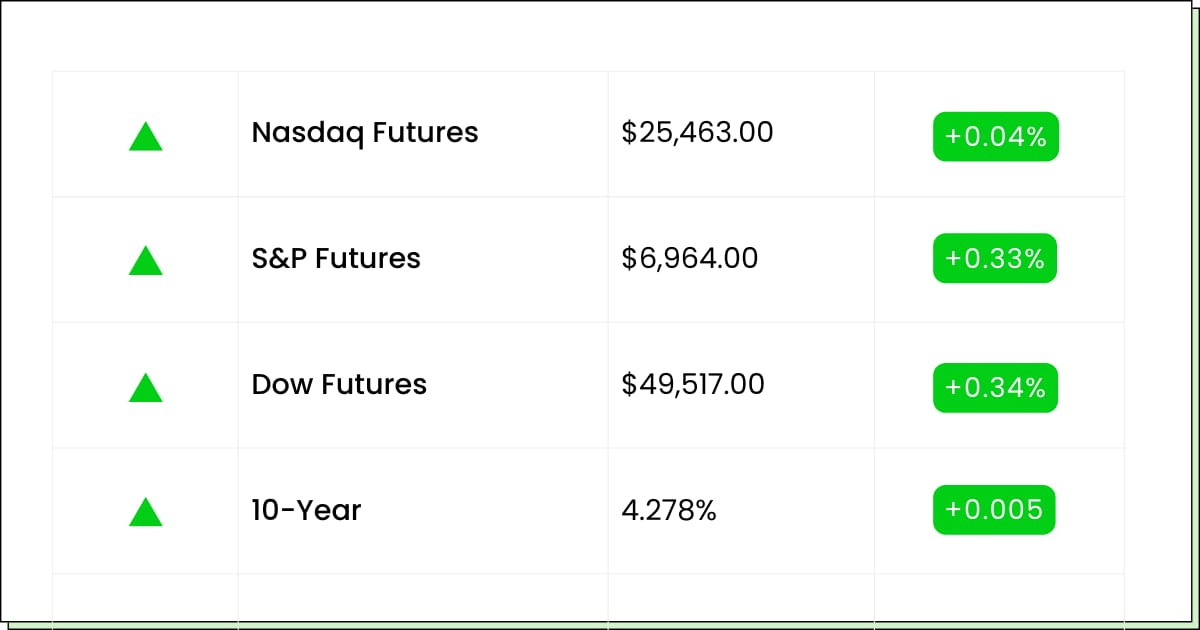

Futures at a Glance 📈

Futures are edging higher after yesterday’s tech-led slide, with traders rotating out of pricey growth and into more real economy names. AI disruption jitters smacked software, a big chipmaker’s outlook didn’t help, and now the market’s looking to payroll data and a heavyweight earnings slate to see if this was just a wobble or the start of a mood change.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

Eli Lilly and Company [LLY]

AbbVie Inc. [ABBV]

Novartis AG [NVS]

Novo Nordisk A/S [NVO]

Banco Santander, S.A. [SAN]

Uber Technologies, Inc. [UBER]

Toyota Motor Corp Ltd Ord [TM]

Earnings (Aftermarket):

Alphabet Inc. [GOOGL]

QUALCOMM Incorporated [QCOM]

Economic Reports:

ADP employment (Jan): 8:15 am

S&P final U.S. services PMI (Jan): 9:45 am

ISM services (Jan): 10:00 am

Fed Speakers:

Fed Governor Lisa Cook speaks: 6:30 pm

Media & Entertainment

Disney Finally Names A Successor, And The Market Exhales

Walt Disney Co (NYSE: DIS) just wrapped up its longest-running side plot by naming parks chief Josh D’Amaro as the next CEO. After years of succession suspense, investors finally get a real timeline, with Bob Iger handing over the keys at the March 18 shareholder meeting and sticking around as an adviser through year-end. That is a clean baton pass, at least on paper.

The market also likes where D’Amaro comes from. The parks and experiences business has been Disney’s most dependable profit engine, and it is not subtle about it. When the box office is lumpy and streaming debates get loud, the parks keep selling tickets, snacks, and overpriced ears like it is their love language.

The risk is that Hollywood is a different sport than ride ops. Managing talent, hits, and headlines is its own roller coaster. If Disney keeps its strategy consistent and avoids another leadership whiplash cycle, the stock can look less like a soap opera and more like a steady compounder again.

My Take For You: Give it a few weeks for the messaging to settle. You want early signs of unity, not internal tug-of-war leaks.

My Verdict: Watch-list buy on dips. Better when the transition looks boring, not when it looks dramatic.

Healthcare

Novo Nordisk Slips Hard As Guidance Turns Into A Cold Shower

Novo Nordisk A/S (NYSE: NVO) got smacked after it surprised the market with a rough 2026 outlook, and the CEO basically told investors to expect more pain before the bounce. That is not the kind of pep talk that sparks a rally, and the stock reacted like it stepped on a rake in public.

The why is pretty straightforward: U.S. pricing pressure is hitting the core business, and even a strong launch for the Wegovy pill cannot fully offset the near-term math. Novo is trying to expand access and affordability, which is great for patient growth, but the market cares about margins today, not applause tomorrow.

This is a classic reset moment. Big drops on guidance can turn into opportunity, but only after the stock finishes the emotional tantrum phase. Let analysts update numbers, let sentiment cool, and watch how management frames demand, pricing, and competition over the next few updates.

My Take For You: If you are not in, wait for the stock to stabilize and for follow-up details on pricing. If you are in, consider trimming and keeping your position size humble.

My Verdict: High-quality name, messy setup. Patience beats bravery here.

Act Without Dela (Sponsored)

A new research report highlights 5 stocks with the strongest potential to double in the year ahead.

Each was selected from thousands of companies and shows a rare mix of:

Strong fundamentals

Bullish technical setups

Past versions of this report delivered gains of +175%, +498%, and even +673%¹ — and the latest edition is free for a short time.

Available only until MIDNIGHT TONIGHT.

Download the free report

Semiconductors

Silicon Laboratories Bounces On Texas Instruments Chatter

Silicon Laboratories Inc (NASDAQ: SLAB) went full trampoline after reports that Texas Instruments is in advanced talks to buy the company for roughly $7 billion. That is the kind of headline that turns a normal Tuesday into a confetti cannon, and the stock responded exactly how you would expect when the word acquire hits the tape.

This move changes the game because you are no longer trading fundamentals; you are trading deal odds. If the market believes the talks are real, SLAB can float on hope. If anything cools off, the stock can give back gains fast because rumor fuel burns hot and runs out quickly.

The clean way to think about it is simple. A takeover pop creates a new question: what is the spread between where the stock trades and where a deal might land, and what are the chances it actually closes? That is a trader’s puzzle, not a long-term investing thesis. And it can flip in one headline.

My Take For You: If you are not in, do not chase after-hours fireworks. If you are in, taking some profit is not boring; it is smart.

My Verdict: Trade territory. Great for disciplined risk management, not for buy-and-forget comfort.

Poll: You’re at dinner. Someone suggests splitting evenly. What do you do?

Movers and Shakers

Super Micro Computer Inc. [SMCI]: Premarket Move: +11%

SMCI just got a fresh Buy repeat, and traders hit the caffeine button. When Wall Street starts talking upside again, this thing can bounce hard.

Still, it moves like a shopping cart with one bad wheel. Fun on the way up, chaos on the way down.

My Take: Ride the momentum, keep it small, and skim wins on strength. If it gives back the pop fast, step aside.

Enphase Energy Inc. [ENPH]: Premarket Move: +24%

ENPH is ripping after guidance improved, and the price target moved higher. Solar names love a whiff of good news, especially after getting kicked around.

The catch is that this can cool off just as fast once the opening hype fades.

My Take: Do not chase the first spike. If it holds above the morning low, start a small position. If it fades, wait for a calmer entry.

Advanced Micro Devices Inc. [AMD]: Premarket Move: -9%

AMD slipped on softer forward vibes, and the market is doing the classic punish-first-ask-questions-later routine.

This is the kind of drop that can turn into a clean dip buy or a longer sulk, depending on how it trades after the open.

My Take: Let it settle for 30 to 60 minutes. If it finds a floor and starts reclaiming levels, nibble small. If it keeps sliding, save your ammo.

Timing Is Critical (Sponsored)

Foreign powers are challenging the dollar while global tensions continue to rise.

Markets reward preparation, not hesitation, during moments of political and economic stress.

Savings left unprotected often take the hardest hit when volatility accelerates.

This Patriot’s Tax Shield shows how physical gold has historically helped investors protect purchasing power.

A free Wealth Protection Guide breaks down how Trump’s vision could create renewed momentum for gold.

Get the FREE guide and see how to protect savings today.

Everything Else

Pinterest’s CEO reportedly called out staffers after an internal layoff tracker started making the rounds.

A burst of hype sent Chinese solar names ripping higher, as investors piled into panel makers tied to the latest Musk-adjacent narrative.

Nintendo shares took a sharp hit on worries a memory shortage could crimp hardware momentum.

European software and data names got smacked as investors fretted that new AI tools could eat workflows faster than incumbents can defend them.

Nvidia is reportedly closing in on a massive OpenAI investment that would raise the stakes in the AI arms race even more.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.