Good Afternoon!

Hey, everyone. It's Adam from Elite Trade Club.

Happy Friday! It’s November 17th. I hope you have an excellent weekend.

Before we get started, here’s a quick message from today’s sponsor:

Today’s Sponsor

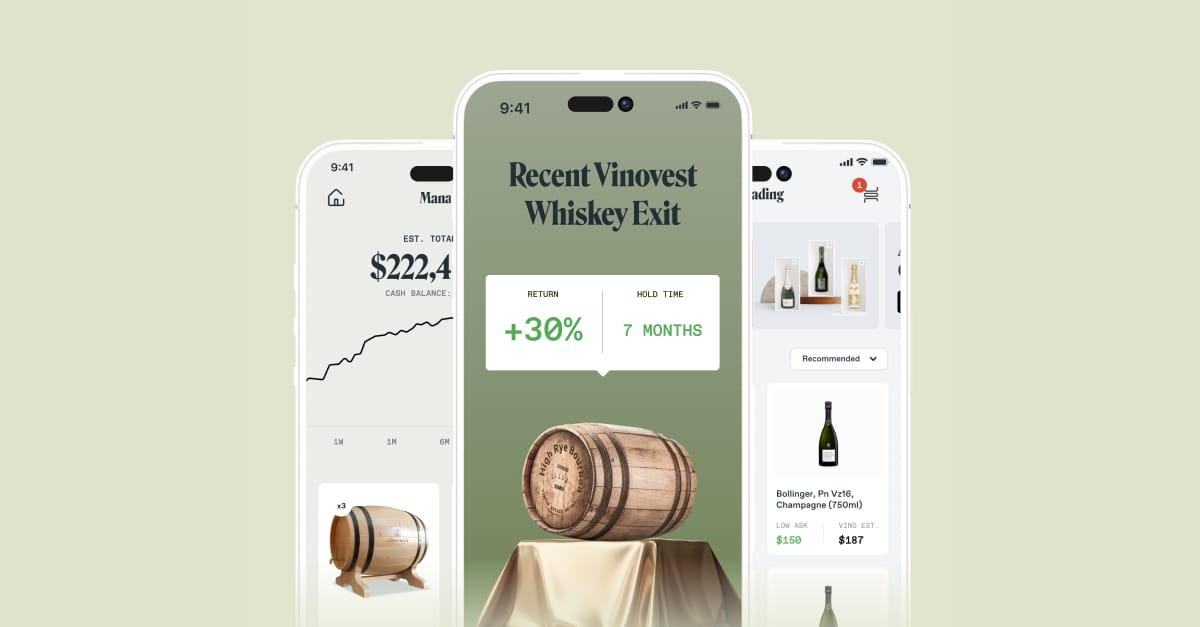

Pouring Profits: Why whiskey as an asset class.

Invest Like the Greats — What do Thomas Jefferson, LeBron James, and the British royal family have in common? They all invested in wine and whiskey. And with good reason. According to Knight Frank, wine and whiskey have been two of the best-performing alternative assets of the last decade. See how Vinovest makes it easy to invest like the ultra wealthy today!

Markets 📈

Stocks notched ended the day close to flat for the second day in a row. The S&P 500 [+0.1%], Nasdaq [<0.1%] and Dow [<0.1%] closed the day withing 0.1% of where they started, while the Russell 2K [+1.3%] managed a small rally.

Market-Moving News 🔎

🚀 S&P 500: Earnings Exceeding Expectations

It's a banner time for S&P 500 companies! Over 80% of the 469 that have reported earnings have not just met, but exceeded analyst expectations.

That's the highest rate of surpassing forecasts since Q2 of 2021, a stat courtesy of LSEG.

📈 Earnings Surplus:

These companies aren't just edging past predictions; they're leaping over them. We're talking earnings 7.1% above expectations, comfortably outdoing the long-term average of 4.1%.

📊 Market Response:

What does this mean for the broader market? Well, the S&P 500 index has responded with a robust 7.5% rise this month.

This uptick isn't just about those cooler inflation numbers; it's also a big thumbs-up to these stronger-than-anticipated corporate earnings.

🔍 The Takeaway:

In a financial landscape often clouded with uncertainty, this earnings season is bringing some much-needed sunshine.

It's a reminder that despite various economic headwinds, many companies are not just weathering the storm – they're thriving.

Top Winners and Losers 🔥

La Rosa Holdings [LRHX] $1.63 (+50.9%) announced the launch of its first office in Houston, TX.

Syntec Optics [OPTX] $8.96 (+73.9%) has been steadily gaining since completing its Nasdaq IPO earlier this month.

Fortress Bio [FBIO] $2.09 (+46.1%) president & CEO Lindsay Rosenwald made an insider buy worth $2.66 million on Nov. 14th.

Vigil Neuroscience [VIGL] $4.00 (40.0%) announced new interim data from a Phase 2 IGNIE trial of iluzanebart (formerly VGL101).

HNR Acquisitions [HNRA] $1.92 (36.0%) has been in free fall since completing its business combination with Pogo Resources.

ChargePoint [CHPT] $2.02 (35.4%) replaced its CEO and warned investors that it expects to miss its Q3 revenue guidance.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback from our members!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Text ELITESTOCKS to 47121 or click here to get our alerts on your mobile device, and never miss another fast-moving stock!

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.