A government-linked rare earth headline just lit a match under the whole supply-chain corner of the market, pulling a uranium name into the action and giving copper bulls fresh confidence. We’ll break down what to watch in the fine print, where a safer entry could show up after the first adrenaline spike, and the one red flag that would make this rally evaporate.

Power Alignment (Sponsored)

On Behalf of Optimi Health Corp.

Psychedelics are no longer a debate. Australia already allows regulated prescribing. Clinics are operating. Programs are funded. That creates real ordering.

One small Canadian company sits on the licensed manufacturing side of this system, still trading like the story is theoretical.

Unlock the full story now

Futures at a Glance📈

Futures are leaning lower as traders brace for a packed week of mega-cap earnings and the Fed’s first policy decision of the year. There’s solid earnings so far, but everyone’s waiting on Apple, Microsoft, Meta, and any hint from Powell on when rate cuts might actually show up.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

Ryanair Holdings plc [RYAAY]

Steel Dynamics, Inc. [STLD]

Earnings (Aftermarket):

Nucor Corporation [NUE]

Brown & Brown, Inc. [BRO]

W.R. Berkley Corporation [WRB]

Graco Inc. [GGG]

AGNC Investment Corp. [AGNC]

Economic Reports:

Durable-goods orders (Nov, delayed): 8:30 am

Durable-goods minus transportation (Nov, delayed): 8:30 am

Materials

Southern Copper Is Getting Price Target Love And Acting Like It Just Got A Compliment In The Mirror

Southern Copper (NYSE: SCCO) moved higher as analysts nudged price targets up, riding the simple story that copper is hot and supply is not showing up fast enough. When the market thinks a metal stays tight, miners start getting treated like the last umbrella on a rainy day.

The push and pull here is pretty relatable. On one hand, higher targets and a strong copper backdrop make the stock look like it still has gas in the tank. On the other hand, some big shops are still basically saying nice company, but that price is spicy.

For you, this is less about charts and more about temperament. If copper stays firm, this can keep working. If copper cools or the market decides valuation matters again, this one can go from hero to who invited him quickly.

My Take For You: If you are already in, consider taking a little profit when it spikes and keep the rest as a ride-along. If you are not in, wait for a pullback or a quieter week instead of buying after a target-hike headline.

My Verdict: Quality name in a strong theme, but not a bargain. More of a hold-and-manage than a chase-and-pray.

Materials

USA Rare Earth Just Got A Government Co-Signer And Traders Are Throwing A Party

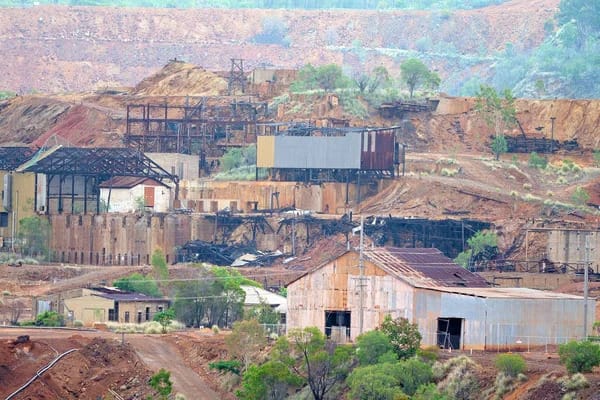

USA Rare Earth (NASDAQ: USAR) ripped higher in premarket after a report that Washington may take a stake as part of a big funding package to back a U.S. mine and magnet plant. Nothing gets traders moving like the words domestic supply chain and checkbook in the same sentence.

This is the part where the stock acts like it just found caffeine. Government support can change the whole vibe for a small miner trying to build real stuff on home turf. It can also change the share count, which is basically the investing version of someone slicing your pizza into more pieces and claiming you still have the same amount.

So keep your eyes on the boring details, because boring is where the truth lives. What does the financing cost, how much dilution is baked in, and how fast do new shares hit the market. If the terms disappoint or timing slips, this kind of premarket sugar rush can wear off fast.

My Take For You: If you are new, do not chase the pop. Let the details drop, then decide. If you already own it, consider trimming into strength and keep the rest small enough that dilution headlines do not ruin your day.

My Verdict: High-voltage speculative. Fun story, but read the fine print before you treat it like a long-term keeper.

Market Watching This (Sponsored)

It just signed a deal to get its tech in Apple's iPhone until 2040!

Online commenters are debating if this brand-new company will be the 7th trillion dollar stock.

Details on the controversy here.

Energy

Energy Fuels Is Catching Rare Earth FOMO

Energy Fuels (NYSEAMERICAN: UUUU) caught a premarket lift as traders stampeded back into anything tied to USA rare earth momentum. Policy headlines are basically the starter pistol for this corner of the market.

The funny part is UUUU still feels like a uranium name to a lot of people, but it has been working to be more than that. Between the broader push for domestic processing and its deal to buy Australia’s Australian Strategic Materials, the market is starting to connect the dots and price it like a company with more than one lane on the highway.

Just remember this sector has the emotional stability of a group chat at 2 a.m. Big plans take time, approvals take longer, and investors can go from excited to bored in a single news cycle. The setup can be real and the stock can still whip around like it is on a pogo stick.

My Take For You: If you are not in, wait for a calmer entry after the headline adrenaline fades. If you are in, keep it reasonable sized and be ready to take some off the table when the crowd gets loud.

My Verdict: Interesting momentum story with real strategy behind it, but expect mood swings. Good for a watchlist or a modest position if you can handle volatility.digitally, Bank of America expects its tech-driven strategy to fuel future growth.

Poll: If prices fluctuated hourly like stocks, what would you do differently?

Movers and Shakers

United States Antimony Corp [UAMY]: Premarket Move: +10%

Antimony prices firmed up, China supply data hit the tape, and the critical-minerals crowd stampeded in.

When a niche metal starts trending, everyone suddenly becomes a commodities expert.

My Take: Don’t chase the pop. Let it open, see if it holds, and only nibble if it stays strong. If you’re in, trim into green.

Revolution Medicines [RVMD]: Premarket Move: −22%

Buyout talks reportedly cooled over price, and the takeover premium just fell out of the stock like a loose tooth.

The pipeline’s still there, but the fairytale bid is not.

My Take: Wait for a floor. If you own it, don’t panic at the lows. If you want in, start small only after it stabilizes.

Erasca [ERAS]: Premarket Move: −10%

They closed a big stock offering, which means more cash for the mission and more shares for everyone to split.

The market’s doing the usual dilution grump.

My Take: VLet it settle. If it steadies later, you can starter-buy. If it keeps sliding, stand down and wait.

Crisis Hedge (Sponsored)

Economic confidence weakens when debt rises, wars expand, and currencies lose trust.

Many investors stay frozen while purchasing power quietly slips away.

History favors those who move early when political shifts change the landscape.

This Patriot’s Tax Shield outlines how tangible gold can serve as a defensive asset in uncertain times.

A free Wealth Protection Guide explains why Trump’s return could reshape demand for gold.

Click here to download the FREE Wealth Protection Guide now.

Everything Else

Canada and China are pushing toward a trade deal, but tariffs are still the sticking point in Trump-era talks.

U.S. natural gas prices jumped as Winter Storm Fern brought snow and ice that tightened near-term supply and demand.

A U.S. rare earths miner is gaining attention as Washington looks to secure critical minerals and reduce reliance on foreign supply chains.

Meta, TikTok, and YouTube will stand trial over youth addiction claims as lawsuits around social media harms move forward.

The EU has opened an X investigation tied to Grok’s sexualised imagery after concerns were raised by a lawmaker.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.