A chip name is getting the pre-earnings cheer squad, an LNG exporter just got a courtroom plot twist, and biotech is back in the spotlight with fresh vaccine data. The moves look obvious at first glance. The smarter trade is usually the second glance. We’ll show you what to watch next and where the easy mistake lives.

Next Opportunity (Sponsored)

$1,000 in just seven stocks in 2004 could have turned into a million-dollar portfolio today…

Back then… one financial expert begged people to look at Nvidia -- when it was trading at just $1.10!

Now… he’s urging you to look at a new group of seven stocks…

Check this Out (The NEXT Magnificent Seven)

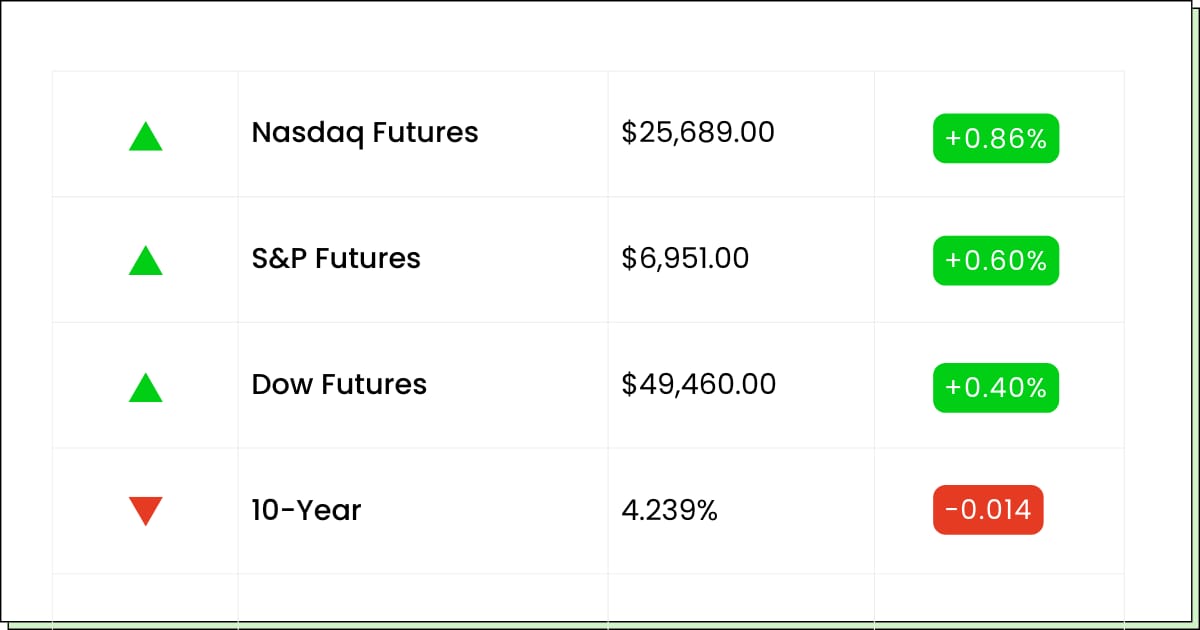

Futures at a Glance📈

Futures are inching higher after markets ripped on a relief rally, with Trump backing off the Feb. 1 Europe tariff plan and teasing a Greenland deal framework instead of a showdown. Now the vibe shifts from geopolitics to data, with PCE inflation and jobless claims up first. Earnings stay in the spotlight too, with big prints on deck from names like P&G, Intel, and GE Aerospace.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

Procter & Gamble Company (The) [PG]

GE Aerospace [GE]

Abbott Laboratories [ABT]

Freeport-McMoran, Inc. [FCX]

Earnings (Aftermarket):

Intel Corporation [INTC]

Intuitive Surgical, Inc. [ISRG]

Capital One Financial Corporation [COF]

CSX Corporation [CSX]

Economic Reports:

Initial jobless claims (Jan. 17): 8:30 am

GDP, first revision (Q3): 8:30 am

Personal income, delayed (Nov): 10:00 am

Personal spending, delayed (Nov): 10:00 am

PCE index, delayed (Nov): 10:00 am

PCE year over year (delayed): 10:00 am

Core PCE index (Nov): 10:00 am

Core PCE year over year (delayed): 10:00 am

Tech

Intel Just Got A Standing Ovation Before The Show Even Starts

Everybody’s suddenly acting like Intel Corp (NASDAQ: INTC) is back in its prime, and the stock is partying like it found the good playlist again ahead of earnings. When a beaten-up name starts making new highs, it usually means the crowd has decided the comeback story is real enough to buy first and ask questions later.

The vibe is simple: data center demand is hot, AI spending is loud, and Intel is trying to convince the market it can be both a chip seller and a chip maker for others. That is a great pitch when it works, and a messy group project when it does not.

Your move is not to chase the confetti. Let earnings do the talking. If the stock pops, wait for the morning-after pullback and see if buyers show up again. If it dumps, you get a cleaner entry and a clearer line in the sand.

My Take For You: Starter position only after earnings. Add if guidance supports the hype and the stock holds the post-report level.

My Verdict: Fun momentum with real catalyst risk. Treat it like a trade until the report confirms the glow-up.

Energy

The LNG Referee Venture Global Just Raised The Hand, And The Crowd Went Wild

Venture Global Inc (NYSE: VG) finally got a win on the legal scoreboard, and the stock is acting like it just dodged a speeding ticket. Arbitration rulings can do that. One headline and suddenly the market pretends last year’s stress never happened.

The basic story is contract drama. Buyers were mad about cargo deliveries versus selling LNG on the spot market, and Venture Global has been stuck in the middle of a long, expensive argument. This ruling is one less weight on the ankle, even if there are still other shoes hovering overhead.

For you, the plan is to treat the pop like a gift, not a marriage proposal. If it keeps running, do not chase. If it cools off and holds a higher low, that is your calmer setup.

My Take For You: If you are in, trim into strength and keep a tight risk line. If you are not, wait for a pullback and only nibble if the chart stops acting manic.

My Verdict: Headlines can move it fast, but the legal saga is not fully over. Trade it, do not cuddle it.

Funds Are Watching (Sponsored)

This AI-powered cybersecurity provider serves Fortune-level enterprises and federal agencies nationwide.

Recent contract wins have pushed backlog beyond $70M, extending revenue visibility for years.

Run-rate revenue is climbing rapidly as new government and enterprise deployments go live.

With institutional capital now involved and supply extremely limited, timing may matter.

Explore the setup before it’s widely notice

Biotech

Moderna Found A New Plotline, And It Is Not Another Booster Season

Moderna Inc (NASDAQ: MRNA) jumped after longer-term melanoma vaccine data with Merck’s Keytruda kept looking strong, and traders did what traders do. They sprinted toward the word durable like it was a free upgrade.

This is the kind of headline that can keep the stock buoyant because it supports the big rebrand: Moderna as a real pipeline company, not a one-hit pandemic wonder. The catch is biotech momentum can flip fast if the next update is anything less than exciting.

So keep it simple. Do not buy the first candle. Let the move settle, then look for a boring day where it refuses to give back the gains. That is usually where the better entries show up.

My Take For You: Wait for consolidation, then start small. Add only if follow-up trial progress stays clean and the stock holds support.

My Verdict: Strong story fuel, but still a mood-swing sector. Good watchlist name with a disciplined entry plan.

Poll: Which money moment gives you the biggest dopamine hit?

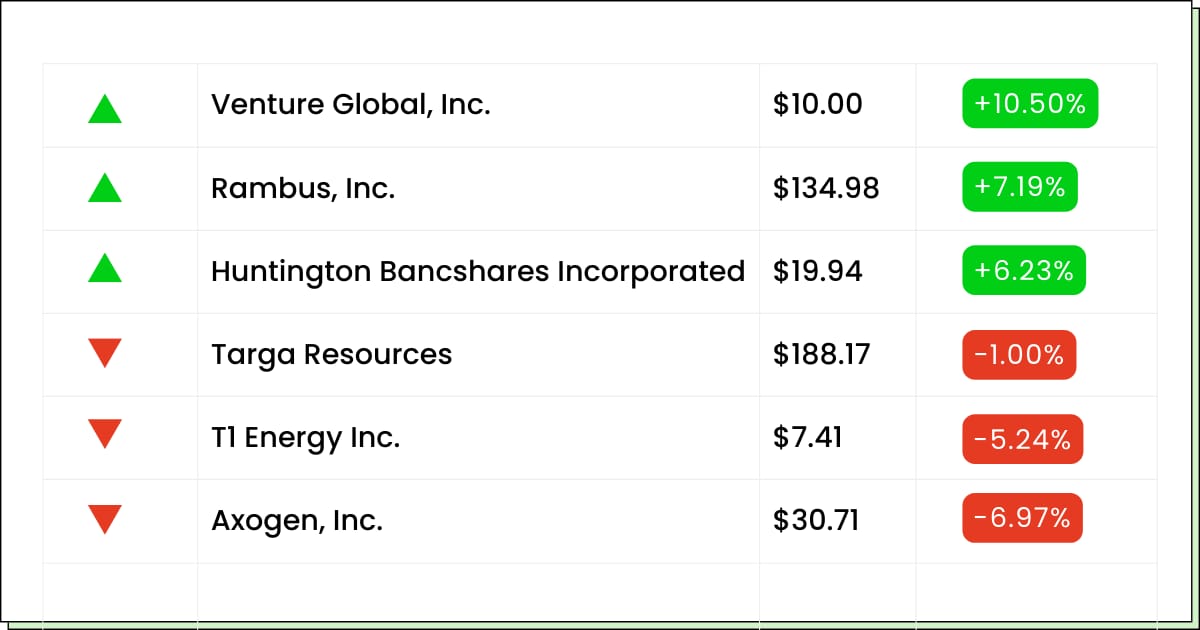

Movers and Shakers

Rambus Inc [RMBS]: Premarket Move: +6%

The chip party is back, and this smaller name just walked in wearing a shiny new 52-week-high hat. When semis catch a wave, the higher-beta surfers usually get launched the farthest.

The catch is the calendar. Earnings are coming up soon, and nothing ruins a rally like guidance that shows up underdressed.

My Take: If you missed the rip, do not sprint after it. Let it cool, then nibble on a dip if the sector stays hot and the stock holds its new “comfort zone.”

Huntington Bancshares Inc [HBAN]: Premarket Move: +6%

Regional banks are doing that thing where they quietly grind higher while nobody’s looking, then suddenly you notice it’s sitting at a fresh 52-week high like it pays rent there.

This move feels less like hype and more like steady confidence, plus the dividend crowd loves a dependable check.

My Take: Not a chase. If it pulls back a bit after the open, it can be a starter position. If it keeps ripping, wait for a calmer entry and let the trend prove it.

T1 Energy Inc [TE]: Premarket Move: −5%

Nothing hits like a short report before breakfast. This one is getting thumped after a bearish write-up tossed out some nasty claims and traders did what they do best: panic first, read later.

These situations can bounce hard, but they can also keep bleeding if more headlines drop or the company fumbles its response.

My Take: Treat it like a slippery floor sign. No hero buys. If you already own it, tighten your risk line. If you do not, wait for clarity and a real rebuttal before you even think about stepping in.

Strategic Shift (Sponsored)

The world is rapidly shifting to cashless systems, with countries like China leading the way.

As the U.S. rolls out FEDNOW, it’s clear that convenience could come at a steep price—your freedom.

With digital currencies, those who control the ledger control your ability to speak, transact, and live freely.

Stay informed and safeguard your future. Download our guide on CBDCs and protect your wealth.

Everything Else

OpenAI is courting Middle East money for a mega funding round that could reshape the AI arms race.

Asia woke up to tariff jitters as traders digested more Greenland drama and the latest cross-border trade noise.

Hyundai’s union is waving a red flag over a humanoid robot push, warning the shiny new helpers could start coming for real jobs.

Telenor is officially cashing out of its stake in Thailand’s True, a big move in the telecom chessboard.

A Canadian court just said TikTok can keep operating for now, keeping creators, marketers, and regulators in the same group chat a bit longer.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.