Surprise upside and a higher outlook woke up the stock. We’ll point you to the proof points (margins, membership trends) and lay out an easy way to tiptoe in now and only add if the next checkup looks healthy.

Blockchain Breakthrough (Sponsored)

A new small-cap player is turning heads after becoming the first U.S. public company to tokenize a dividend-paying security on Ethereum.

With 50,000 ETH in reserve and a $200 million buyback plan underway, this firm isn’t speculating—it’s executing.

Led by a proven financial veteran who scaled a major brokerage to billions, the company is positioned at the intersection of blockchain and Wall Street.

[Tap to Discover the Company Behind This Blockchain Breakthrough]

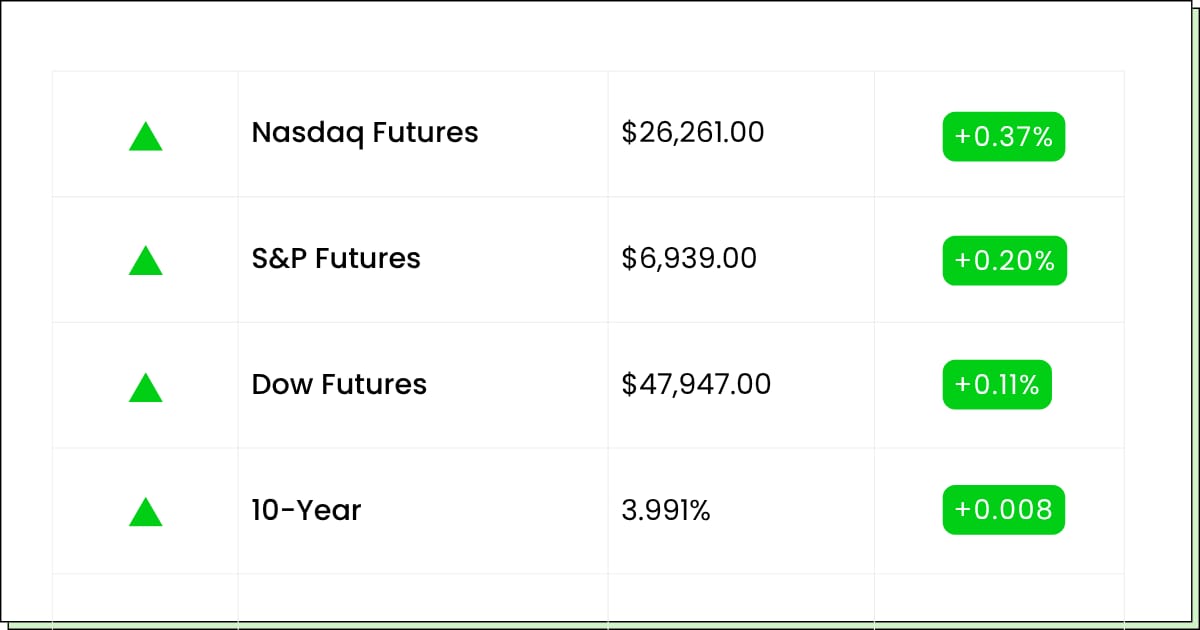

Futures at a Glance📈

Futures are mixed as traders wait on the Fed and Powell’s tone. Nvidia is jumping toward a new valuation milestone while mega-cap results kick off after the close and continue tomorrow. Trade tensions have cooled ahead of a Trump–Xi meetup, but rich valuations and the ongoing government shutdown are still the flies in the champagne.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Caterpillar [CAT]

Boeing [BA]

Verizon [VZ]

CVS Health [CVS]

Aftermarket Earnings:

Microsoft [MSFT]

Alphabet [GOOGL]

Meta Platforms [META]

MercadoLibre [MELI]

Starbucks [SBUX]

Carvana [CVNA]

Visa [V]

Economic Reports:

Advanced U.S. trade balance in goods (Sept): 8:30 am*

Advanced retail inventories (Sept): 8:30 am*

Advanced wholesale inventories (Sept): 8:30 am*

Pending home sales (Sept): 10:00 am

FOMC interest-rate decision: 2:00 pm

Fed Chair Powell press conference: 2:30 pm

*Data subject to delay if government shutdown continues.

Healthcare

CVS Finds Its Footing And Starts To Jog Again

CVS Health Corp (NYSE: CVS) showed up with results that actually impressed, and the market finally noticed. Insurance is behaving better, the pharmacy counters are busy, and the new boss sounds like he’s cleaning up the messy bits instead of just promising to. It’s the rare quarter where a giant can say beat and raise without everyone rolling their eyes.

There’s still baggage. Closing clinics and taking a big accounting hit isn’t fun, even if it’s the right reset. The drugstore aisles are a street fight, and customers are picky on price and convenience.

But if the insurer keeps improving and the pharmacy keeps humming, this turns from fixer-upper to livable house pretty quickly.

For most readers, the question is simple. Is this just a relief bounce or the start of a real turn? The answer lives in consistency. Two or three more quarters like this, and the story graduates from try-hard to dependable.

My Take For You: If you’ve been watching from the sidewalk, start with a small step and add only if the next few reports look this clean. If you’re already in, enjoy the strength and keep expectations reasonable.

My Verdict: Watch-to-own. Worth building on if execution stays steady and the spring cleaning continues.

Technology

Nvidia Keeps Adding Fuel To The AI Bonfire

Nvidia’s (NASDAQ: NVDA) premarket pop is the market’s way of saying the AI party is still going, and this company is still the DJ. New big-number talk, fresh projects, and another reach into future networks have investors imagining even more demand for the chips that power everything smart. When the whole market rallies on AI, this name usually grabs the spotlight.

Yes, there are murmurs about froth. When expectations get this high, the bar for good enough climbs with it.

Big ambitions need big execution, and even great companies take breathers. But as long as the orders keep stacking and the ecosystem keeps widening, the main act remains onstage.

If you’re hunting for a plan that doesn’t require a PhD in semiconductors, it’s this: respect momentum, respect gravity, and remember even heroes stumble on stairs.

My Take For You: New to it? Take a small position, don’t lunge, and be okay adding on calmer days. Already in? Let winners be winners, but don’t turn a victory lap into a marathon.

My Verdict: Core long for the AI trend with humility. Own it for the story, expect some drama, and avoid chasing every fireworks burst.

Ends Midnight Tonight (Sponsored)

If you’ve ever wished you caught the next big winner early—this could be your chance.

A new 5-stock report highlights companies with the strongest potential to deliver triple-digit returns in the next year.

Each pick is backed by strong fundamentals and major market catalysts—the same type of setups that have produced big wins in the past.

Previous reports from this team identified stocks that surged as high as +498% and +673%.

This new list could hold the next ones — but access is free only for a limited time.

[Download the 5 Stocks to Double Report – Free Today]

Healthcare

Centene Surprises The Class And Raises Its Hand For Extra Credit

Centene (NYSE: CNC) walked in with a better-than-expected report and a raised outlook, which is exactly what a lagging student needs to get back on the honor roll.

Growth in key lines helped, the cost work is underway, and management actually sounded confident about the road ahead. The stock’s early jump says investors were not ready for good news from this name.

There’s still a bruise on the report card from a big non-cash charge, and health plans don’t live in a calm world. Costs can flare up, politics can rewrite the rules midyear, and guidance has a way of wobbling. But when a perennial worrier posts a beat and talks improvement, you pay attention.

This is a rebuild, not a rocket launch. The opportunity is catching the turn before the crowd fully believes, while remembering this is health insurance, which is never a quiet neighborhood.

My Take For You: If you’re curious, take a small starter and let the next quarter confirm the momentum. If you’re holding from lower, peel a little into strength and keep the rest for the rerating.

My Verdict: Cautious buy on proof-of-progress. Let results keep doing the talking and add only as the story holds together.

Trivia: What company’s motto was once “Don’t leave home without it”?

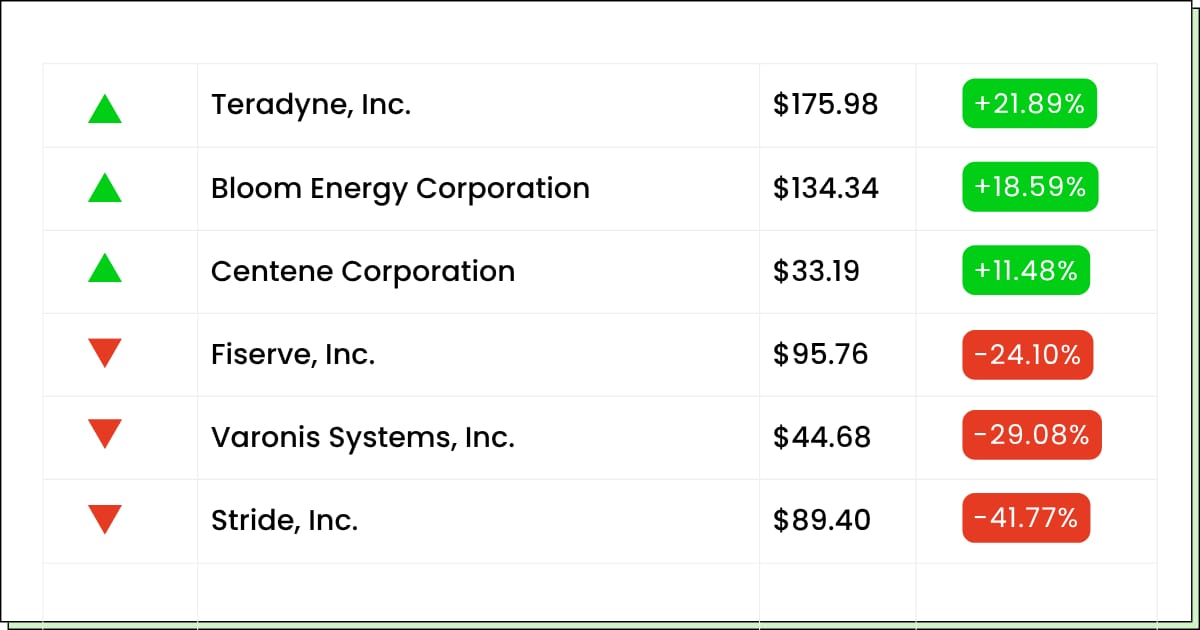

Movers and Shakers

Varonis Systems [VRNS]: Premarket Move: −29%

Ouch. A soft revenue print and a downbeat outlook sent this data-security name through the trapdoor.

Yes, the cloud side is growing, but investors heard slower renewals and goodbye to the old self-hosted product and headed for the exits. That’s what happens when the story shifts mid-stride.

My Take: Let it find a floor first. If you must touch it, think tiny and only after it stops falling for a day or two.

Teradyne [TER]: Premarket Move: +20%

The chip-tester just rang the bell with a better quarter and a loud outlook tied to the AI build-out.

There were more gadgets to test, so more work for the tester. A C-suite shuffle is in the mix, but the headline is simple, orders are hot, and the stock is moving higher.

My Take: Don’t chase a sprint. If you like it, wait for a breather and then scale in instead of buying at full tilt.

Caesars Entertainment [CZR]: Premarket Move: −9%

Earnings came up light while sales were fine, which is like hitting the buffet and skipping the main course.

The market hates mixed plates, so the stock’s getting comped with a discount at the open. The bigger picture is still about costs, demand, and how much the sportsbook carries its weight.

My Take: Not a great time to jump in. Let the opening wobbles pass and see if buyers show up before you ante up.

Blockchain History (Sponsored)

A quiet revolution is unfolding on Wall Street. A small U.S. firm just became the first to tokenize a dividend-paying security on Ethereum — marking a major step in financial innovation.

With $200 million earmarked for buybacks, 50,000 ETH in reserves, and a $10-per-share trust distribution, it’s showing execution over hype.

Industry insiders say this could be the most significant blockchain milestone of the year.

[Click Here To See the Company Making Blockchain History]

Everything Else

Lucid is leaning on Nvidia’s brainpower to push deeper into self-driving, a reminder that in car tech it pays to sit next to the smartest kid in class.

The hardware whisperer says the AI party is still early as the Celestica CEO sees demand building, not fading, while everyone wires up more racks.

Pharma meets pixels with Eli Lilly teaming up on an AI factory supercomputer to speed drug discovery, as molecules move faster when GPUs do the lifting.

Sunroofs are raining on the parade as Ford recalls nearly 175,000 vehicles over a moonroof defect, so service bays just got busier.

Earnings season for the oil crowd looks okay-ish, with Big Oil expected to edge up while analysts stare hard at 2026 guidance for clues to the next rally.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.