A fresh “we might mine rare earths” tease just put real spark in a very heavy stock. Fun headline, but rocks-to-revenue takes permits, plants, and patience. If you’re tempted, trim into strength or wait for a pullback and actual contracts.

Banks Enter Crypto (Sponsored)

In July, crypto history was made.

Congress passed the first federal framework for digital assets—and almost overnight, the market surged past $4 trillion.

Here’s why:

✓ Banks now have the green light to offer crypto services.

✓ Wall Street institutions can finally scale in.

✓ The uncertainty holding crypto back is gone.

This is the moment early movers have been waiting for.

Our Crypto Revolution report shows you exactly how to prepare—and it’s 100% free.

You’ll also get $788 in bonus resources when you claim your copy.

The floodgates are open.

Don’t wait until the crowd catches on.

[Claim Your Free Copy Today]

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

*The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

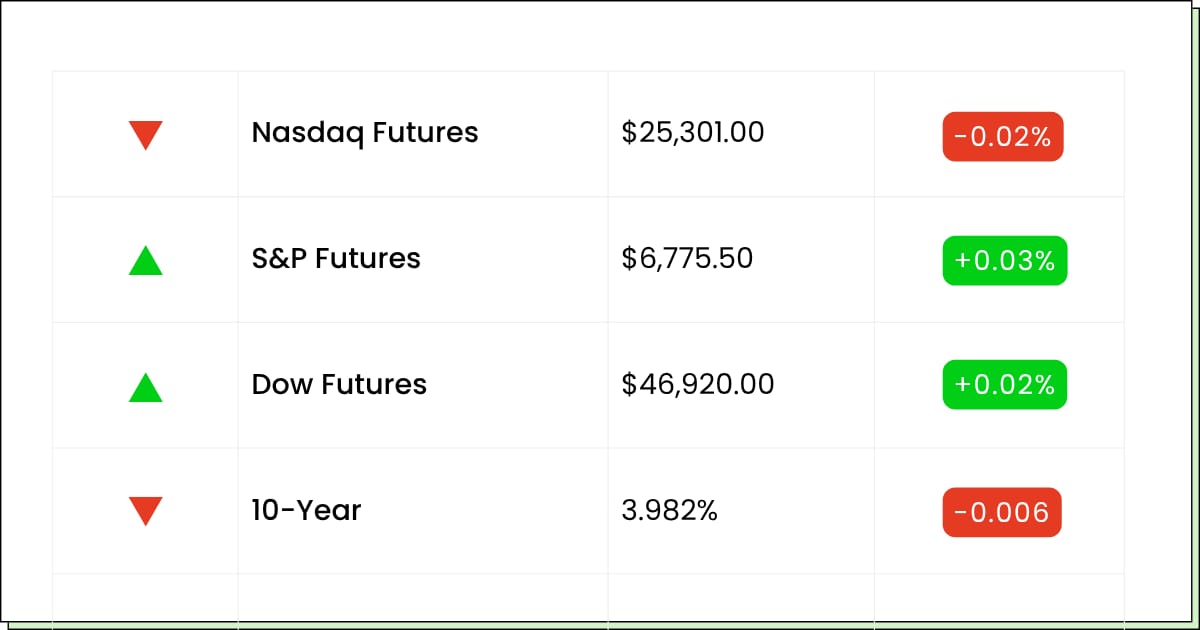

Futures at a Glance📈

Wall Street’s catching its breath after yesterday’s run, with futures basically doing a light stretch. Old-school winners are carrying the water, as cars, cans, and Post-its got applause, while regional banks look a shade less spooky. The “shutdown might end soon” chatter helps, too.

Now we cue Big Tech week. Netflix tonight, Tesla tomorrow, and the AI crowd waiting to see if the Magnificent Seven still wear capes. Sprinkle in CPI on Friday and rate-cut whispering, plus trade headlines that can’t decide between fight or make-nice, and you’ve got a market that wants higher, but is triple-checking its shoelaces first.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

GE Aerospace [GE]

Coca-Cola [KO]

Philip Morris International [PM]

RTX [RTX]

Danaher [DHR]

Lockheed Martin [LMT]

Northrop Grumman [NOC]

3M [MMM]

Elevance Health [ELV]

General Motors [GM]

Nasdaq [NDAQ]

Aftermarket Earnings:

Netflix [NFLX]

Texas Instruments [TXN]

Capital One [COF]

Chubb [CB]

Waste Connections [WCN]

Economic Reports:

Fed Governor Christopher Waller opening remarks: 9:00 am

Autos

Guidance in the Fast Lane For GM

General Motors (NYSE: GM) just reminded everyone it knows how to make money. The quarter cleared Wall Street on revenue and profit, guidance marched higher, and management says the tariff hit looks smaller than feared. They mean that trucks and SUVs are paying the bills while the company takes a more patient path on electric bets.

The good: pricing is holding, cash generation looks stout, and the balance sheet isn’t wheezing. The less good: charges from earlier electric plans still haunt results, and margins aren’t bulletproof if incentives creep or credit tightens.

Management’s job now is to keep the showroom humming, protect mix, and squeeze costs while proving profitable electrification has receipts, not slides.

For traders, the setup is post-beat momentum versus already in the price. For investors, the longer arc is steady cash, disciplined returns, and fewer own goals on product timing.

My Take For You: If you’re long, staircase your stop and let strength work. Thinking of a starter, I’d say you should prefer red days, not victory laps, and watch commentary on incentives and inventory. If supply chain or tariffs flare again, expect mood swings.

My Verdict: Accumulate on pullbacks. Not a rocket ship, but the cash machine runs, and a calmer strategy lowers unforced errors.

Industrials

Jets, Wrenches, and Backlog: The GE Aerospace Engine Is Humming

General Electric (NYSE: GE) flew past expectations with stronger revenue and a clean earnings beat, then nudged full-year guidance higher to ensure you noticed. The mix leans on its jet engines, aftermarket services, and defense exposure, a nice trio when airlines need parts, fleets age, and budgets stay sturdy.

The bull script writes itself: backlog is deep, pricing power has teeth, and the portfolio is tighter after years of cleanup. The bear script is quieter but relevant: anything that slows global traffic, snarls supply chains, or crimps defense orders can sand margins.

Add capital spending for next-gen engines and you’ve got a business that must execute, quarter after quarter, to defend today’s multiple.

For traders, the tape has momentum, but gap-up mornings can turn into profit-taking brunches. For long-term holders, the question is simple: can execution plus a solid backlog keep compounding without heroic assumptions?

My Take For You: If you’re already long, trail stops under rising support and let the trend work. For those looking to get in, prefer pullbacks toward the 20–50 day zone or post-earnings digestion rather than chasing a spike. Track book-to-bill, services growth, and supply cadence.

My Verdict: Buy on dips. Quality industrial with secular tailwinds; respect altitude and demand proof each quarter.

Early Entry Advantage (Sponsored)

The market rewards those who act early.

That’s why our team has just released an all-new report—5 Stocks Set to Double.

These picks were chosen because they stand out with:

Rock-solid fundamentals for confidence

Technical strength pointing to breakout potential

In the past, this exact type of report has uncovered stocks that posted triple digit runs of +175%, +498%, even +673%.

The new report is free—but only until midnight tonight.

Download your free copy here before time runs out

Don’t just settle for growth. Aim for massive.

Materials

Cliffs Flirts With Magnets, and the Market Loves a Makeover

Cleveland-Cliffs (NYSE: CLF) just tried on a new outfit: rare earths. Management says it’s scoping deposits in Michigan and Minnesota, which is the market’s way of hearing maybe magnets, maybe government friends, maybe higher multiples.

When Washington and Beijing arm-wrestle over critical minerals, any domestic supply story gets a megaphone.

Zoom out, though, as exploring is not producing. Turning rocks into revenue takes permits, plants, partners, and years. Expect capital needs and a learning curve outside of iron ore. If the geology underwhelms or financing turns pricey, today’s pep rally can become tomorrow’s nap.

You can always watch for third-party studies on those sites, any federal support or offtake chatter, and proof they can process, not just dig.

My Take For You: If you rode the pop, peel a little, and keep a runner in case Project Magnet gets real. If you’re flat, stalk red days or a pullback toward recent support rather than buying at peak excitement.

My Verdict: Speculative buy on dips only. Fun to rent on policy headlines; own it only if you’re cool with long timelines and shovels before cash flow.

Poll: What’s your biggest edge as an investor?

Movers and Shakers

Coca-Cola [KO]: Premarket Move: +2%

Soda’s still fizzing. A clean beat on revenue and profit, plus a steady thirst for Zero Sugar, has investors cracking a cold one. Price hikes on the fancy stuff (Topo Chico, Fairlife) did some heavy lifting, and guidance stayed steady, no surprises, just execution.

Still, this is a premium multiple for a slow grower, and snack aisles aren’t exactly empty. If the consumer wobbles or promo wars heat up, the mix can get sticky. But for now, Coke’s doing what Coke does. Selling bubbles at scale and kicking off cash.

My Take: If you own it, sip, don’t chug. Reinvest the dividend and add only on red days or near the 50-day. New money can make a starter size position, then build on dips rather than chasing a green open.

Crown Holdings [CCK]: Premarket Move: +9%

Can-maker pops the top with an earnings beat and better-than-expected revenue, reminding everyone that aluminum is the stealth growth aisle of the grocery store. Volumes held up, pricing helped, and the Street’s nudging targets because cans don’t do fashion cycles; they do shelf space and contracts.

Risks are still packaging, so input costs, customer concentration, and any softening in beverages can dent margins fast. But execution is tightening, and the setup into holiday sips looks better than the chart did a month ago.

My Take: Let the gap breathe, then look for a higher-low entry if it holds the first pullback. If you already own it, trail a stop under yesterday’s breakout and let it work toward that consensus target zone.

Newmont [NEM]: Premarket Move: −4%

Gold cooled a couple of percent, and the miner caught the draft lower, because miners are gold with extra feelings. After a monster run on record prices, buybacks, and post-deal cleanup, today is a great story, on the wrong morning. Nothing company-specific broke; this is mostly metal math and a little altitude sickness.

If bullion keeps backing off, miners usually move twice as much in the same direction. On the flip side, central-bank buying and tariff drama haven’t vanished. You’re basically renting volatility on top of commodity volatility.

My Take: Don’t knife-catch the first dip. If you’re long from lower, trim a slice and tighten stops; if you’re shopping, wait for gold to stabilize and use staggered buys near rising support instead of guessing the bottom.

Fast Movers (Sponsored)

The market’s strongest trades often begin quietly — before they hit the headlines.

Our team just identified 7 stocks flashing breakout potential for the next 30 days, using a proven short-term screening method that tracks earnings strength, price momentum, and analyst upgrades.

Each company in this list shows accelerating fundamentals and rising volume, key signs that institutions are beginning to take notice.

These setups don’t stay hidden for long — and once the move starts, it can happen fast.

Don’t wait until they’re up double digits.

Get your free copy of “7 Stocks Set to Surge in the Next 30 Days.”

Everything Else

Core server drama meets crypto server drama as CoreWeave–Core Scientific draws heat from investors, and the CEO’s basically saying relax.

A big, messy AWS outage reminded everyone that the cloud is just someone else’s computer, and sometimes it needs a reset, too.

Early lines for Cupertino are back. Stronger iPhone demand has traders treating Apple like it found a new charger for growth.

Goldman just waved a yellow flag on rare earths supply, which translates to more stockpiles, more geopolitics, and more whiplash in anything with magnets.

Coke is fizzing up its Africa play, with Coca-Cola HBC grabbing a majority stake in a key bottler to turbocharge distribution and pricing power.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.