One name is ripping on Greenland headlines ahead of a key update, one is quietly playing defense while gas prices sulk, and one just got slapped by a report that can turn confidence into chaos. The move is to wait for the update, size small, and only add when the noise turns into facts, but more on that below.

Confident Choices (Sponsored)

Once exposure moves into a listed ETF, participation tends to broaden.

Advisors, institutions, and individual investors can all access a digital network through familiar market infrastructure.

Get the full report and reveal the ETF details

*For standardized returns of the Canary HBR ETF, please visit [HBR ETF - Canary Capital]. Past performance does not guarantee future results.

*The Fund’s investment objectives, risks, charges and expenses should be considered before investing. The prospectus contains this and other important information, and it may be obtained at https://canaryetfs.com/HBR/prospectus/. Read it carefully before investing.

*The Fund is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and therefore is not subject to the same regulatory requirements as mutual funds or traditional ETFs registered under the 1940 Act.

*Investing Involves Significant Risk. The loss of principal is possible. Canary HBR ETF (the "Fund") may not be suitable for all investors. This document does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions.

*The fund is new with a limited operating history. Digital assets, such as HBR, are a relatively new asset class, and the market for digital assets is subject to rapid changes and uncertainty. Digital assets are largely unregulated and digital asset investments may be more susceptible to fraud and manipulation than more regulated investments.

*HBR is subject to unique and substantial risks, including significant price volatility and lack of liquidity, and theft. The value of an investment in the Fund could decline significantly and without warning, including to zero. HBR is subject to rapid price swings, including as a result of actions and statements by influencers and the media, changes in the supply of and demand for digital assets, and other factors. There is no assurance that HBR will maintain its value over the long-term. The Fund is not actively managed and will not take any actions to take advantage, or mitigate the impacts, of volatility in the price of HBR. An investment in the Fund is not a direct investment in HBR. Investors will not have any rights that HBR holders have and will not have the right to receive any redemption proceeds in HBR. Shares of the Fund are generally bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Only Authorized Participants may trade directly with the Fund and only large blocks of Shares called "creation units." Your brokerage commissions will reduce returns.

*Paralel Distributors LLC serves as the marketing agent. Paralel is unaffiliated with Canary Capital and Native Ads.

*Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

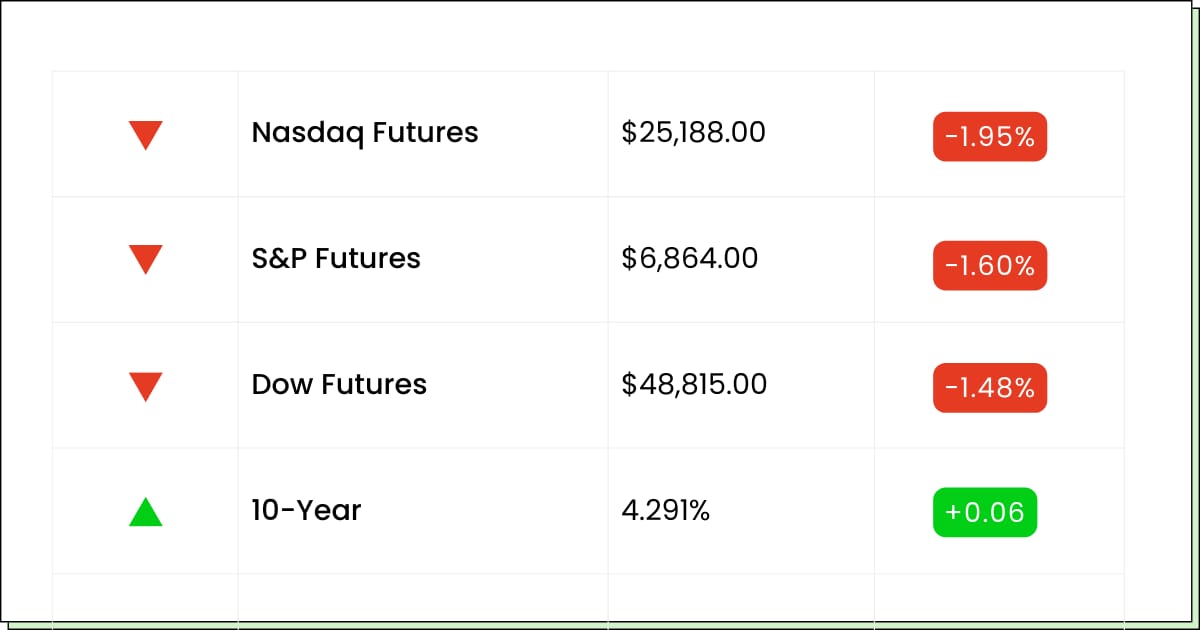

Futures at a Glance📈

Futures are sliding as Trump’s Greenland tariff threats crank up trade anxiety, with Europe floating counterpunches. After the long weekend, markets are finally pricing the headlines, while traders wait for earnings to steal the spotlight again.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

3M Company [MMM]

U.S. Bancorp [USB]

Fastenal Company [FAST]

D.R. Horton, Inc. [DHI]

Fifth Third Bancorp [FITB]

KeyCorp [KEY]

Earnings (Aftermarket):

Netflix, Inc. [NFLX]

United Airlines Holdings, Inc. [UAL]

Interactive Brokers Group, Inc. [IBKR]

Wintrust Financial Corporation [WTFC]

Economic Reports:

None scheduled

Materials

Critical Metals Jumps As Greenland Headlines Turn Into A Trading Machine

Critical Metals Corp (NASDAQ: CRML) popped in premarket because Greenland is back on the front page, and this stock loves a good geopolitical plot twist. When investors start talking about rare earths, tariffs, and strategic supply chains, CRML tends to move like it drank three coffees.

The company is pushing its Tanbreez project as a Western supply chain story, plus there’s fresh chatter around a potential Saudi processing partnership. That is exciting, but it is also the kind of thing that can be more PowerPoint than payday until dates and dollars show up.

The simple setup is this: a business update is coming, and traders want specifics. If management brings real timelines and financing clarity, the rally can stick. If it is vague, this can fade fast once the adrenaline wears off.

My Take For You: If you are new, don’t chase the first pop. Let the update hit, then buy only if the plan sounds funded and feasible.

My Verdict: Fun momentum trade with a real theme, but it needs receipts before it deserves a long-term seat.

Energy

Expand Energy Corp Gets Love From Analysts While Gas Prices Play Hard To Get

Expand Energy Corp (NASDAQ: EXE) is getting back-pats from Wall Street, with analysts basically saying this is their favorite kid for 2026. The pitch is simple: big natural gas producer, cleaner balance sheet habits, and a management team trying to act like an adult when prices are being moody.

The twist is they are not trying to grow like a teenager with a new credit card. With gas prices softer, the company is talking more about holding steady and keeping discipline, which is great for stability but less exciting for people who want fireworks by lunch.

So this becomes a patience stock, not a thrill ride. If energy prices cooperate, this can grind higher. If gas stays sleepy, you are mostly here for the steady story and the shareholder-friendly vibe.

My Take For You: Treat it like a slower build. Starter position only, add on dips if the outlook stays disciplined.

My Verdict: Solid, boring in a good way, but it needs a friendlier gas tape to really strut.

Inside Strategy (Sponsored)

Foreign powers are challenging the dollar while global tensions continue to rise.

Markets reward preparation, not hesitation, during moments of political and economic stress.

Savings left unprotected often take the hardest hit when volatility accelerates.

This Patriot’s Tax Shield shows how physical gold has historically helped investors protect purchasing power.

A free Wealth Protection Guide breaks down how Trump’s vision could create renewed momentum for gold.

Get the FREE guide and see how to protect savings today.

Tech

AppLovin Corp Gets Smacked By A Spicy Report And The Market Hits The Panic Button

AppLovin Corp (NASDAQ: APP) has been a market darling, but this week it caught a nasty headline and the stock reacted like it stepped on a Lego. A report tossed out serious allegations, and when that happens, traders do not wait around to see who is right, they hit sell and ask questions later.

That does not automatically mean the story is broken, but it does mean the stock is now wearing a volatility warning label. Even strong businesses can get temporarily priced like a rumor factory when the news cycle gets loud.

The play here is boring and smart: let facts catch up. Watch for company responses, any official scrutiny, and whether the stock can actually stabilize instead of bounce like a pinball.

My Take For You: If you are not in, wait for clarity and a calmer chart. If you are in, trim risk and keep it small until the fog clears.

My Verdict: High-quality name in a headline storm, tradable later, but right now it is a wait-for-real-information situation.

Poll: If a friend says “it’s not that expensive,” you assume…

Movers and Shakers

Twist Bioscience Corp [TWST]: Premarket Move: −7%

The COO just sold about $931K worth of stock, and the market is doing that thing where it sees insider selling and instantly assumes someone knows the ending. Sometimes it’s nothing. Sometimes it’s a vibe killer. Either way, it can spook weak hands before breakfast.

The funny part is the stock has been showing momentum lately, so this looks less like a broken story and more like a speed bump that traders are turning into a pothole.

My Take: Don’t panic-sell into deep red. Let the open breathe, then only nibble if it steadies and the selling dries up. If it keeps sliding, skip the hero act and wait for a cleaner base.

Hecla Mining Co [HL]: Premarket Move: +6%

Gold and silver are back in main-character mode, and HL is acting like it just found a fresh vein in the couch cushions. Add in the MidCap 400 inclusion glow-up and you’ve got a stock that can levitate on headlines longer than you think.

But this is still a metals trade at heart, and those can flip fast when the fear meter cools or the dollar flexes.

My Take: Ride it if you’re already in, but pay yourself on strong pops. If you’re not in, wait for a dip day or a calmer entry instead of buying the top of the excitement.

Newmont Corporation [NEM]: Premarket Move: +3%

Gold keeps ripping, and the big miners are getting invited to the party again. Newmont looks like the simple way to play it, but miners are basically running a giant, expensive kitchen while commodity prices decide the menu.

The chatter today is basically: sure, miners can move, but the cleaner way to play gold might be through streamers that get paid without doing the digging.

My Take: If you want exposure, start small and think in timeframes. If you’re chasing a quick pop, this can be a slow roller.

Scarcity Meets Growth (Sponsored)

This AI-powered cybersecurity provider serves Fortune-level enterprises and federal agencies nationwide.

Recent contract wins have pushed backlog beyond $70M, extending revenue visibility for years.

Run-rate revenue is climbing rapidly as new government and enterprise deployments go live.

With institutional capital now involved and supply extremely limited, timing may matter.

Explore the setup before it’s widely notice

Everything Else

Europe opened with tariff jitters as Davos buzz met trade angst, and stocks did the classic flinch.

Bonds tossed a quick yield tantrum with the 10-year in focus as traders re-priced the inflation and rate-cut path.

Stellantis hit a five-year check-in, and it’s less celebration, more strategy audit under EV pressure.

OpenAI’s CFO says the run-rate crossed $20B, basically confirming the AI boom is now a real cash machine.

Taylor Swift’s label just locked a China licensing deal with NetEase Cloud Music, so that catalog looks even more “official.”

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.