A beaten-down healthcare name is finally showing signs of stabilization, silver’s surge is putting miners back in the driver’s seat, and a battered consumer brand just attracted serious insider confidence. Read below to see how we’re playing it.

Interest Building Fast (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

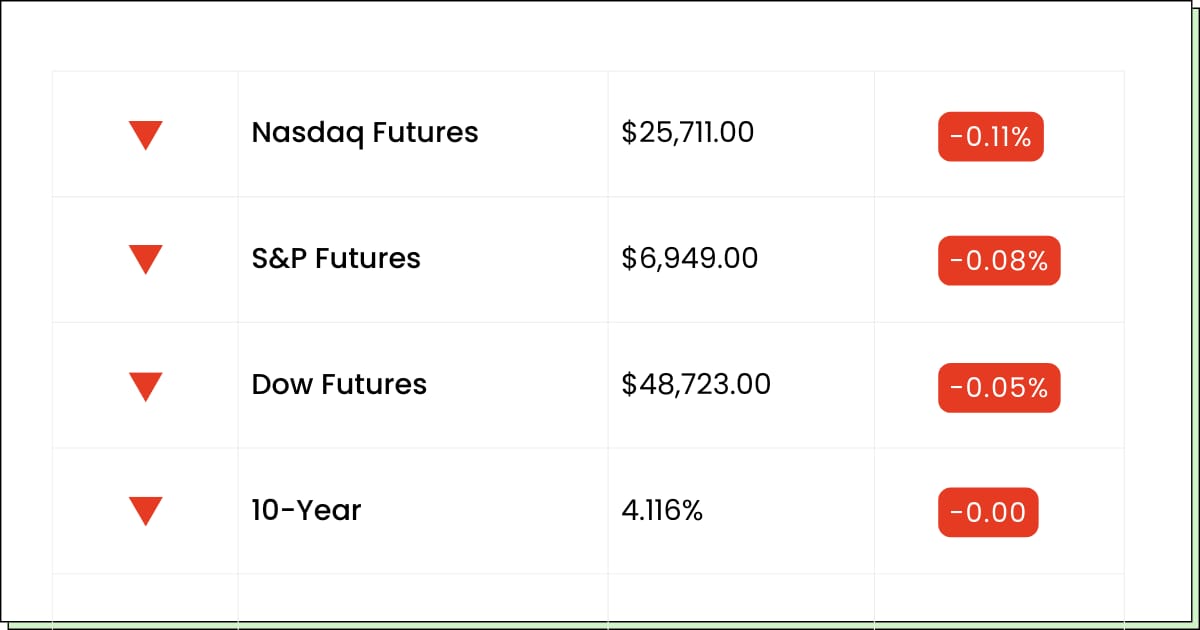

Futures at a Glance📈

Futures are basically flat after Monday’s pullback, with Big Tech and AI names taking a breather and materials still feeling the hangover from silver’s rough day. Today’s mood hinges on two catalysts: home price data this morning and the Fed minutes this afternoon. Also, with markets closed Thursday for New Year’s, expect a little extra positioning noise.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

BHP Group Limited [BHP]

Hyperliquid Strategies Inc [PURR]

VisionWave Holdings, Inc. [VWAV]

Cheche Group Inc. [CCG]

Broadway Financial Corporation [BYFC]

North European Oil Royalty Trust [NRT]

Huize Holding Limited [HUIZ]

Tao Synergies Inc. [TAOX]

Economic Reports:

S&P Case-Shiller home price index (20 cities) (Oct): 9:00 am

Chicago Business Barometer (PMI) (Dec): 9:45 am

Minutes of Fed's December FOMC meeting: 2:00 pm

Healthcare

Molina’s Bounce Feels Nice, But The Road Still Has Potholes

After getting knocked down most of the year, Molina Healthcare Inc (NYSE: MOH) finally caught its footing, and the stock has been stringing together some green days. A new care partnership helped sentiment, and traders are clearly warming up to the idea that the worst might be behind it. After a drop this steep, even modest good news can feel like relief.

But context matters. This bounce is happening after a major earnings reset tied to higher medical costs and policy uncertainty.

The company has already said it plans to dial back some exposure heading into next year, which is a sensible move but also an admission that the last setup didn’t work as planned. Stabilization is the goal right now, not aggressive growth.

This is one of those situations where hope is returning faster than certainty. Molina doesn’t need a miracle, but it does need costs to behave and next year to come in without fresh surprises. Until then, the stock is likely to trade on sentiment swings rather than clean fundamentals.

My Take For You: If you’re new, wait for pullbacks instead of buying strength. If you already own it, rallies are opportunities to trim and reduce stress.

My Verdict: Recovery story in progress. Worth watching closely, but patience still does most of the work here.

Materials

Silver’s On Fire And Hecla Is Riding Shotgun

When silver takes off, miners tend to overreact in both directions, and that’s exactly what’s happening here with Hecla Mining Co (NYSE: HL). With metal prices pushing to fresh highs, this stock has surged alongside them, pulling in momentum traders and year-end positioning flows. In a quiet tape, shiny things get all the attention.

The upside case is simple and tempting. Strong silver prices mean better margins, stronger cash flow, and more enthusiasm from traders looking for leverage to the metal. Add thin holiday liquidity, and moves can stretch further than anyone expects. That’s how you get sharp rallies in a short time.

The risk is just as straightforward. If silver cools off, miners usually cool off faster. Profit-taking tends to show up suddenly, and stocks like this can give back gains in a hurry once the crowd thins out. This is not a set-it-and-forget-it situation.

My Take For You: If you’re already in, protect gains and respect the trend. If you’re not, wait for a dip instead of chasing a breakout.

My Verdict: Momentum-fueled metals play. Exciting while it lasts, but sizing and discipline matter more than conviction.

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

Consumer / Apparel

A Quiet Insider Buy For Under Armour Is Doing More Talking Than Ads

Under Armour Inc (NYSE: UA) hasn’t been stylish for a while, which is exactly why recent insider buying caught attention. After months of sliding prices and bad headlines, a deep-pocketed buyer stepping in sends a message that someone thinks the pain may be overdone. That doesn’t guarantee a turnaround, but it does change the conversation.

The brand still faces real challenges. Growth has been uneven, competition is fierce, and rebuilding relevance takes longer than rebuilding inventory. This isn’t a quick-fix story, and it won’t suddenly become fashionable just because someone bought shares.

What makes this interesting is timing. Insider buying after a long decline often signals belief that the next year looks better than the last one. It suggests downside may be limited from here, even if upside takes time to materialize. That’s not exciting, but it can be valuable for patient investors.

My Take For You: Treat this as a small, speculative starter position if you’re curious. Avoid going big until the story proves itself.

My Verdict: Early-stage turnaround watch. Encouraging signal, but results need to follow before confidence does.

Poll: Which feels worse emotionally?

Movers and Shakers

IonQ Inc. [IONQ]: Premarket Move: +3%

IonQ dropped a 100-qubit South Korea deal, and the stock did the classic quantum move: wobble first, think later.

Big headline, fuzzy money details, and traders are still deciding if this is revenue or just sci-fi marketing.

My Take: Trade it small. If it pops early, skim. If it fades, don’t fight it.

Applied Digital Corp [APLD]: Premarket Move: +2%

APLD wants to spin out its cloud business into a standalone AI compute play. Wall Street loves a good separate the parts story, especially when it smells like GPUs and optionality.

Just remember, spinouts are slow, and hype is fast.

My Take: Don’t chase. Buy dips only, and keep a tight leash if it gets sloppy.

Northern Oil and Gas Inc [NOG]: Premarket Move: −2%

Analysts are mostly shrugging with Hold ratings, while insiders have been buying like they found a coupon.

The yield looks tasty, but the stock has been acting like it needs a nap. This one moves when oil mood swings.

My Take: Income folks can nibble. Traders should wait for a cleaner bounce setup.

Conditions Just Changed (Sponsored)

We’re sharing a free copy of our brand-new report: 7 Best Stocks for the Next 30 Days.

For decades, our objective, mathematical stock prediction system has delivered market-beating results, identifying trades with exceptional potential.

This report uncovers the 7 highest-potential stocks from our top-rated selections — fewer than 5% of all stocks qualify.

These could be the most exciting short-term trades in your portfolio.

Act now — download your free copy and be ready for the next move.

[Get the Free Report]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Everything Else

Meta just went shopping again, snapping up a Singapore AI agent firm to bulk up its AI agent ambitions.

Silver decided it’s the main character, surging again to cap a stellar year for precious metals.

Investors are side-eyeing Novo’s next act beyond weight loss, while researchers are cautiously excited about the science pipeline.

Nvidia quietly took a massive Intel stake under a prior agreement, basically saying “we’ll help, but we’re also keeping a receipt.”

SoftBank is reportedly closing in on DigitalBridge, adding another brick to its “own the picks-and-shovels” data center shopping spree.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.