Good morning. It's January 13th, and today, we’ll look at two large acquisition deals announced by Johnson & Johnson and Clearwater Analytics.

High-Stakes Growth

As the iGaming industry heats up, one company is quietly outpacing its rivals with a winning formula that’s hard to ignore.

This isn’t just about online gaming—it’s about redefining the market. With an average bet size 5x the industry standard, a retention rate nearly double that of its competitors, and a proprietary AI platform driving personalized player experiences, this stock is poised for massive growth.

Their recent expansion into the lucrative Latin American market signals the start of a global push that could send this company soaring in 2025.

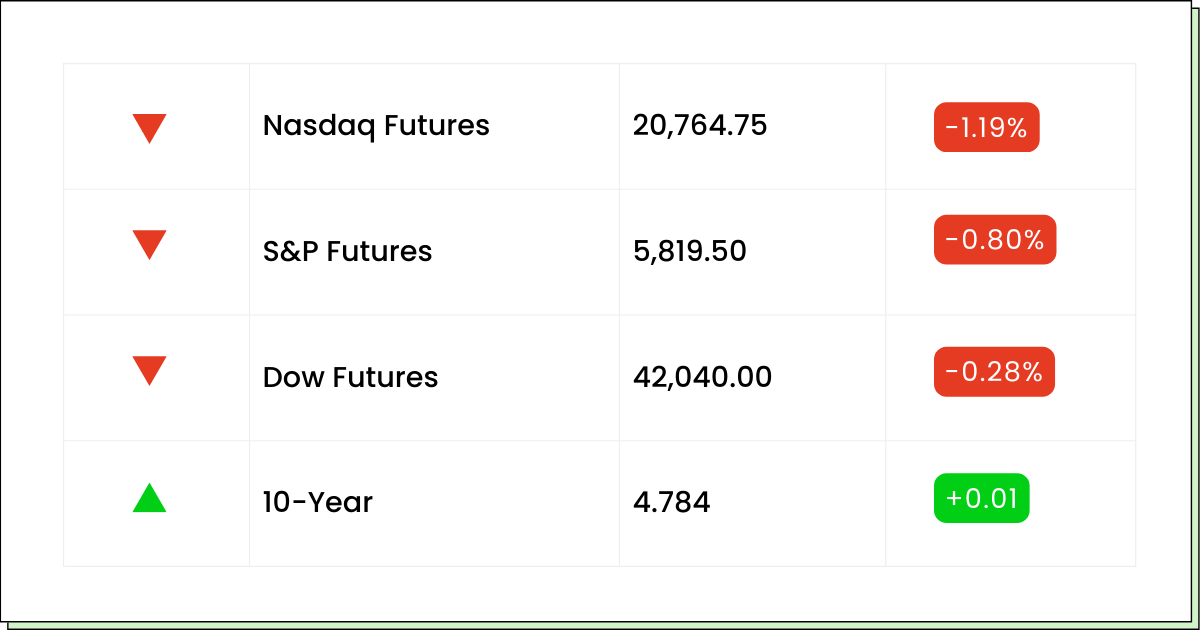

Futures 📈

What to Watch

Earnings Reports:

Comtech Telecommunications [CMTL]: Premarket

ServiceTitan [TTAN]: Aftermarket

KB Home [KBH]: Aftermarket

Aehr Test Systems [AEHR]: Aftermarket

Educational DeveloAftermarketent [EDUC]: Aftermarket

Economic Reports:

Monthly U.S. federal budget [Dec]: 2:00 p.m.

Biotechnology

J&J Boosts Neurological Drug Offerings with $14.6B Acquisition

Johnson & Johnson (J&J) will acquire Intra-Cellular Therapies for $14.6 billion, marking a significant expansion into the neurological treatment market. The deal values Intra-Cellular's shares at $132 each, a 39% premium over their Friday close, and has sent the company's stock soaring 35% in premarket trading.

This acquisition will provide J&J with access to Intra-Cellular's flagship drug, Caplyta, which is approved for treating schizophrenia and bipolar-related depressive episodes. The drug generated $481.3 million in sales in the first nine months of 2024, and the company is pursuing additional U.S. regulatory approvals for its use in major depressive disorder.

J&J continues to expand its pharmaceutical and medical device portfolios. Recent acquisitions include Shockwave Medical for $13.1 billion and Proteologix for $850 million. The company views this latest move as essential for growth beyond 2025, especially as its psoriasis drug Stelara faces biosimilar competition.

The transaction, expected to close later this year, will be funded through a mix of cash and debt. J&J's aggressive strategy underscores its commitment to solidifying leadership in innovative treatment solutions for complex disorders.

Investment Management

Clearwater Expands Global Reach with Enfusion Acquisition

Clearwater Analytics (NYSE: CWAN) is acquiring Enfusion (NYSE: ENFN) in a $1.5 billion deal aimed at creating the first fully cloud-native platform for the investment management industry. The mixed cash-and-stock transaction includes a $30 million payment to end Enfusion's tax receivable agreement.

This merger will integrate Enfusion's front-office solutions with Clearwater’s middle- and back-office capabilities, enabling a seamless end-to-end platform for investment professionals.

The strategic combination is expected to increase Clearwater's total addressable market by $1.9 billion and bolster its expansion in key regions like Europe and Asia, which contribute 38% of Enfusion’s revenue.

Enfusion’s projected full-year 2024 revenue stands at $201–202 million, reflecting 15–16% year-over-year growth, with an annual recurring revenue (ARR) estimate of $210–211 million. Clearwater anticipates $20 million in cost synergies post-acquisition and plans to improve Enfusion’s adjusted EBITDA margin by 400 basis points in the first year, with another 400 basis points projected in the second year.

Shares of Clearwater Analytics are up 1.70% in premarket trade, while Enfusion shares have surged by more than 12%.

The transaction, which is subject to regulatory approvals, is expected to close in the second quarter of 2025, marking a significant milestone in Clearwater's global growth strategy.

Crypto

Back in 2017, President Trump’s inauguration marked the start of a historic crypto surge, turning modest investments into extraordinary gains. Coins like Monero, Stellar, and ReddCoin delivered life-changing returns for those who acted early.

Now, as America prepares for its first pro-crypto president, the stage is set for another potential breakthrough. Tech expert Jeff Brown believes this moment could redefine the crypto market and create unprecedented opportunities for investors.

Jeff has identified specific “Trump coins” he believes are poised to soar under the new administration, with one in particular that could deliver exponential returns.

Sportswear

Lululemon Raises Quarterly Guidance as Holiday Sales Surge

Lululemon Athletica (NASDAQ: LULU) raised its sales and profit projections for the holiday quarter, citing strong consumer demand for its athleisure products. The updated guidance reflects the sportswear company’s robust performance during the busy shopping season, driven by its popular apparel offerings.

The company now anticipates net revenue for the quarter to range between $3.56 billion and $3.58 billion, up from its prior forecast of $3.475 billion to $3.51 billion. Additionally, Lululemon expects profit per share to land between $5.81 and $5.85, an increase from its earlier estimate of $5.56 to $5.64.

Shares of Lululemon are up nearly 5% in premarket trading, signaling investor confidence in the company’s outlook.

The updated forecast comes as other retailers, such as Nordstrom, also report stronger-than-expected holiday sales. Nordstrom recently revised its annual guidance upward, citing increased traffic and successful discount strategies during the season.

Lululemon’s upgraded projections underscore its position as a leader in the athleisure market, a sector that continues to thrive on high consumer interest and resilient spending patterns.

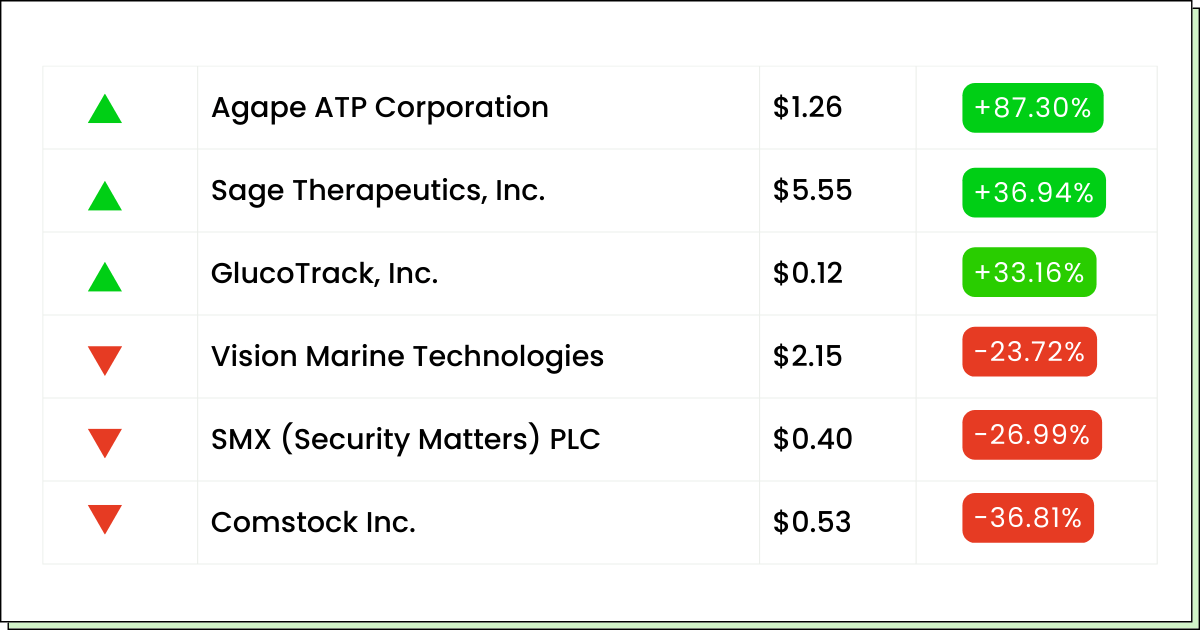

Movers and Shakers

22nd Century Group, Inc [XXII] - Last Close: $4.89

22nd Century Group, Inc. (XXII) is a biotech firm focused on developing reduced nicotine content tobacco products to support harm reduction in smoking.

The company announced today that it is ready to support the FDA's proposed tobacco product standard to mandate reduced nicotine content in cigarettes through its VLN® reduced-nicotine cigarettes. This has caused its shares to surge by nearly 50% in premarket trade today.

My Take: 22nd Century Group has faced consistent net losses over the last five years. It might be best to wait and watch before investing here.

Sage Therapeutics, Inc. [SAGE] - Last Close: $5.55

Sage Therapeutics (SAGE) is a biopharma company specializing in treatments for central nervous system disorders.

Biogen Inc. (BIIB) proposed acquiring all outstanding shares of Sage Therapeutics that it does not own for $7.22 per share yesterday. This valuation of Sage's equity at approximately $442 million represents a 30% premium over its closing price, leading to a 37% rise in its stock price in premarket trading.

My Take: Sage’s stock has dropped 78% in the last one year, in part due to multiple trial failures in its therapy for cognitive impairment in Huntington's disease. It might be wise to adopt a cautious approach here for now.

Option Care Health, Inc. [OPCH] - Last Close: $23.99

Option Care Health (OPCH) provides home and alternate site infusion services, delivering comprehensive care to patients nationwide.

OPCH shares have risen by over 14% in premarket trading today after its preliminary Q4 adjusted earnings per diluted share came in between $0.42 and $0.45, surpassing analysts' expectations of $0.35.

Moreover, net revenue for the quarter is anticipated to be around $1.34 billion to $1.35 billion, indicating up to a 20% year-over-year increase. For the full year 2024, adjusted EPS is expected to range from $1.55 to $1.59, also exceeding the consensus estimate of $1.30.

My Take: OPCH has seen consistent revenue and net income growth in recent quarters. Keep this ticker on your radar for future growth.

Online Gaming

While others battle for attention in a crowded space, one iGaming company is rewriting the rules of premium online gaming—and winning big.

With an average bet size 5x higher than competitors, cutting-edge AI technology delivering personalized experiences, and a proven ability to turn $1 of marketing into $2.13 in revenue, it’s no wonder this company is leading the charge.

Its recent expansion into the booming Latin American market is just the beginning. With new territories on the horizon, the stage is set for a breakout year.

Everything Else

OpenAI pushes for AI policy reforms to maintain US’s edge over China.

iPhone users accuse Apple of unfair 30% App Store commissions in a landmark UK case.

Eskom's first profit in a decade was overshadowed by the unpaid municipal debt crisis.

China's trade growth defies expectations as stimulus measures support industrial demand.

BMW faces a sales dip amid its braking system recall and growing competition in China.

Slowing inflation in India sparks hopes for monetary policy easing in February.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.