One company just floated a raise so big it made investors flinch, another got rocked by an AI curveball that could change the rules, and a beauty name quietly got a heavyweight vote of confidence. The moves look obvious from the headlines. The smart entries are not. We’ll lay out the one thing to watch on each before you touch the buy button.

Structural Edge (Sponsored)

For decades, one type of investment was reserved for the ultra-wealthy.

Then Trump signed Executive Order 14330 - and opened it to everyone.

Now you can get into this boom for less than $20.

See what changed

Futures at a Glance📈

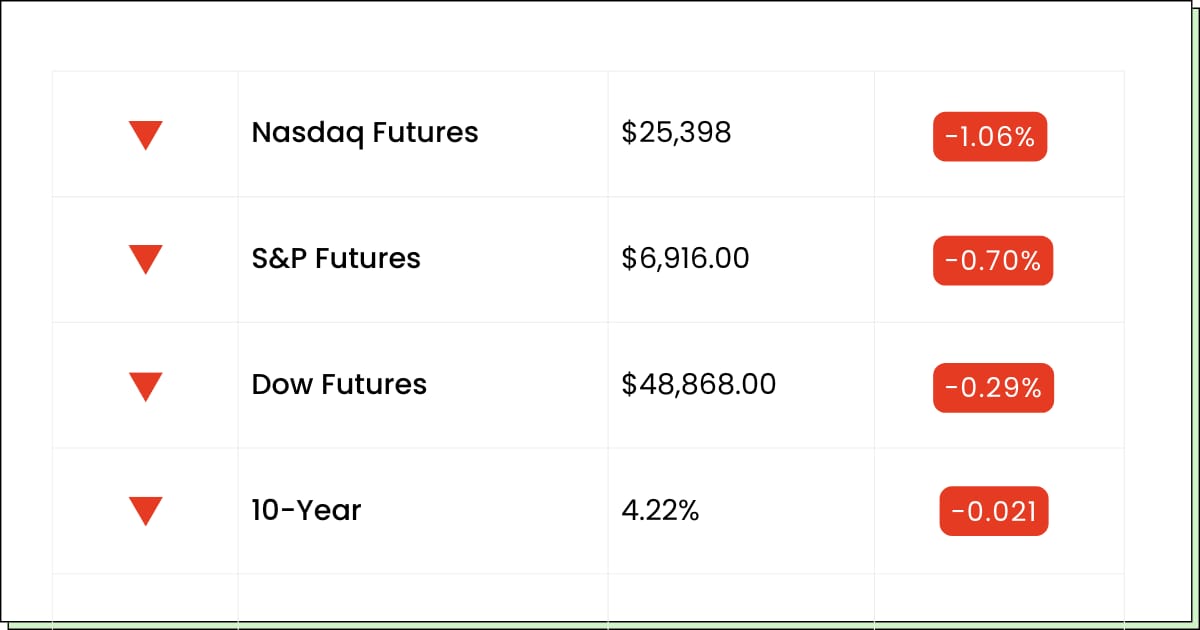

Futures are leaning lower to start the week as risk appetite cools after a rough metals-and-crypto unwind. Traders are also side-eyeing the AI boom after chatter that a major chip player’s mega-investment plans may be wobbling, while a heavy earnings week and Friday’s jobs report set up the next big mood swing.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

The Walt Disney Company [DIS]

Mizuho Financial Group [MFG]

IDEXX Laboratories [IDXX]

Tyson Foods [TSN]

Earnings (Aftermarket):

Palantir Technologies [PLTR]

Simon Property Group [SPG]

NXP Semiconductors [NXPI]

Teradyne [TER]

Woodward [WWD]

Fabrinet [FN]

Economic Reports:

S&P flash U.S. manufacturing PMI (Jan): 9:45 am

ISM manufacturing (Jan): 10:00 am

Auto sales (Jan): TBA

Tech

Oracle Tries To Fundraise Like It’s Hosting The AI Olympics

Oracle Corp (NYSE: ORCL) just announced plans to raise a truly cartoonish amount of money ($50 Billion), and the market’s immediate reaction was basically, cool story, why does it feel like my bill is coming too. The dip makes sense. Big fundraising headlines can sound like growth, but they also sound like dilution, debt, and a lot of new pressure to deliver.

Then came the extra spice: chatter about possible layoffs to free up cash. Whether that happens or not, it tells you what investors are worried about right now. This is an arms race, and everyone’s asking who’s building a moat versus who’s building a mortgage.

Simple playbook here: don’t chase the drama on day one. Let the stock prove it can stabilize after the fundraising headline. If it holds its footing and management starts sounding more like a plan and less like a fundraiser, you can start small.

My Take For You: If you’re not in, wait for a calmer entry after the initial headlines cool off. If you’re in, keep it modest and consider trimming on bounces until the funding plan looks cleaner.

My Verdict: Watch-list for now. Interesting story, but it needs to earn trust before it earns a bigger position.

Tech

Unity Software Gets Jump-Scared By A New AI Toy

Unity Software Inc (NYSE: U) is trying to bounce after getting rattled by Google DeepMind showing off a world-building demo that made traders do the classic sell first, ask questions later routine. Nobody likes hearing there’s a new shortcut in their business, even if it’s still early and clunky.

Here’s the real vibe: this stock is going to react to vibes, demos, and headlines until the next real checkpoint. And that checkpoint is the next earnings update, where investors want to hear a calm, confident explanation of how Unity stays useful even as AI tools get louder.

Your move is to treat this like a wobbly table at a café. Let it stop shaking before you put your coffee down. If it firms up ahead of the report, fine, start tiny. If it swings around, wait for the numbers and the narrative to land.

My Take For You: If you’re new, don’t buy the rebound just because it exists. Wait for the next update and then decide. If you’re already in, keep it small and avoid averaging down until the story steadies.

My Verdict: Speculative watch-list. Plenty of upside if sentiment flips, but it can whipsaw hard on the next shiny demo.

Breakout Tension Rising (Sponsored)

From thousands of stocks, only five stood out as having the best chance to gain +100% or more in the months ahead.

A newly released 5 Stocks Set to Double special report reveals all five tickers — free for a limited time.

While future results can’t be guaranteed, previous editions of this report delivered gains of +175%, +498%, and even +673%¹.

The newest picks could follow a similar path.

This free opportunity expires at MIDNIGHT TONIGHT.

Get the free report here

Consumer

The Estée Lauder Companies Gets A Big Buyer And A Mixed Mirror Check

Estée Lauder Companies Inc (NYSE: EL) is getting a confidence boost after Bank of New York Mellon loaded up on shares, which is the institutional version of saying, I’ll have what they’re having. The stock has been acting stronger lately, too, so the timing feels like the market is warming back up to the glow-up story.

The catch is that the Wall Street mood is still mixed. Some folks see a comeback, others see a stock that’s already sprinted close to the top of its range and needs a breather. That’s why this feels less like a chase and more like a wait-for-your-price situation.

So keep it simple: don’t buy the shiny window display. Wait for a pullback, or wait for the next update that confirms the momentum is real and not just a good lighting angle.

My Take For You: If you want in, start small only on weakness, not after a pop. If you’re already holding, let it ride, but consider trimming a little if it runs into resistance fast.

My Verdict: Buy-on-dips candidate. Not a must-chase, but a solid watch if you’re building a calmer, consumer-style position.

Poll: You get $500 but it has to be spent in 24 hours. What are you doing?

Movers and Shakers

SharpLink Gaming [SBET]: Premarket Move: −10%

Wall Street likes the crypto stash story until it looks at the chart and remembers crypto can bite. This one’s basically a sports betting marketer wearing an Ethereum hoodie, and when ETH sneezes, the stock catches it.

Today feels like the market saying cool story, but we’re not paying full price for the vibe. If you trade it, treat it like a hype cycle, not a savings account.

My Take: Small bite only, and only if it stops sliding and starts behaving. If it keeps leaking, step aside and let gravity finish the job.

Celcuity [CELC]: Premarket Move: −10%

They hit a real milestone with the FDA priority review, which is usually the kind of headline that makes biotech Twitter do backflips. But after a monster run, the stock is acting like it just realized the next step still takes time.

This is the classic biotech vibe shift: good news, then a reality check, then everyone argues about whether the win is already priced in.

My Take: Don’t chase the adrenaline. If you want exposure, wait for a calmer base and use a tight leash. Great story, but it can still whip around on one sentence of update.

IDEXX Laboratories [IDXX]: Premarket Move: +3%

Pet health is still one of the most recession proof businesses on earth because people will skip their own dentist but never the dog’s. The AI imaging and cancer testing updates are the kind of upgrades that keep clinics locked in and competitors annoyed.

This is not a meme rocket. It’s more like a steady treadmill that occasionally gets a speed boost when product news hits right.

My Take: If you’ve wanted it, consider a starter position and add only if it holds the pop. If it fades by mid-morning, let it come to you instead of paying the first price.

Safe Haven (Sponsored)

Political transitions historically increase uncertainty—and this cycle is no exception.

Tariff expansion is reviving crash-risk conversations across Wall Street.

Asset protection strategies are gaining attention as volatility accelerates.

Ignoring structural risk has consequences during regime shifts.

Awareness precedes action.

No guarantees are implied.

This content is not a recommendation to buy or sell.

Download the FREE Presidential Transition Guide now.

Everything Else

Gold and silver just did a trapdoor impression in a historic plunge, reminding everyone that even safe havens can slip on a banana peel.

India is dangling juicy tax breaks to lure hyperscalers and turn the country into a bigger AI data-center magnet.

Oil is easing off after Donald Trump signaled possible Iran talks in this supply-shock unwind.

Elon Musk may find it easier to mash SpaceX and xAI together than to do anything similar with Tesla in this corporate Rubik’s cube.

Alibaba is dropping serious cash on a Lunar New Year AI spending blitz as the chatbot arms race gets louder.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.