One software winner is finally charging for the heavy AI users, one marketplace just sold a side brand for cash, and one delivery name face-planted, then popped back up. We’ll map the cleaner entries so you can start small without chasing the first move.

Trusted By Readers (Sponsored)

Every day, the 1440 team of editors hand-selects and summarizes the most important stories from over 100 trusted sources.

The result?

A 5-minute newsletter that’s fast, factual, and refreshingly human. No bots. No bias.

Just clear, comprehensive news on politics, business, and culture trusted by over

4 million readers and always free.

Sign-up for 1440

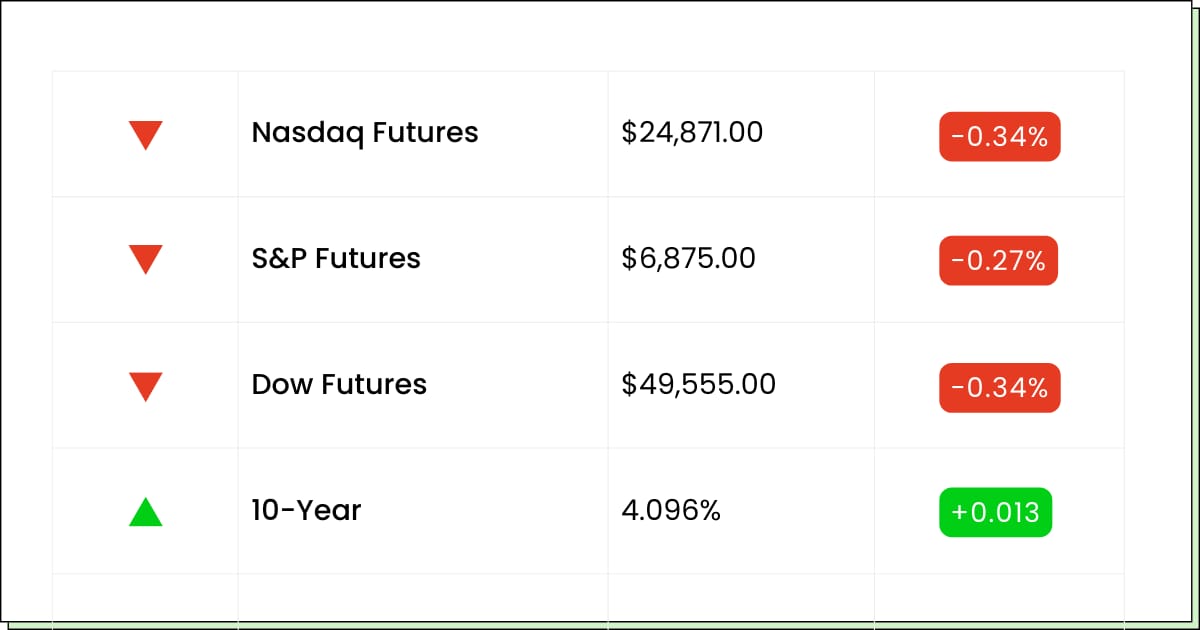

Futures at a Glance📈

Futures are slipping after a solid Wednesday bounce, with Big Tech taking a small breather while oil stays jumpy on fresh Iran chatter. Walmart reports this morning, and the market is treating it like a consumer mood ring. Jobless claims and housing data are on deck, with Friday’s PCE inflation print still looming as the real boss fight.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

• Walmart Inc. [WMT]

• Deere & Company [DE]

• Southern Company [SO]

• Quanta Services, Inc. [PWR]

• Targa Resources, Inc. [TRGP]

Earnings (Aftermarket):

• Newmont Corporation [NEM]

• Comfort Systems USA, Inc. [FIX]

• Alibaba Group Holding Limited [BABA]

Economic Reports:

• Initial jobless claims (Feb. 14): 8:30 am

• U.S. trade deficit (Dec.): 8:30 am

• Philadelphia Fed manufacturing survey (Feb.): 8:30 am

• Advanced U.S. trade balance in goods (Dec.): 8:30 am

• Advanced retail inventories (Dec.): 8:30 am

• Advanced wholesale inventories (Dec.): 8:30 am

• Leading economic index (Dec.): 10:00 am

Fed Speakers:

• Fed Vice Chair for Supervision Michelle Bowman: 8:30 am

• Minneapolis Fed President Neel Kashkari: 9:00 am

Software

Figma Just Found A New Way To Charge For Creativity

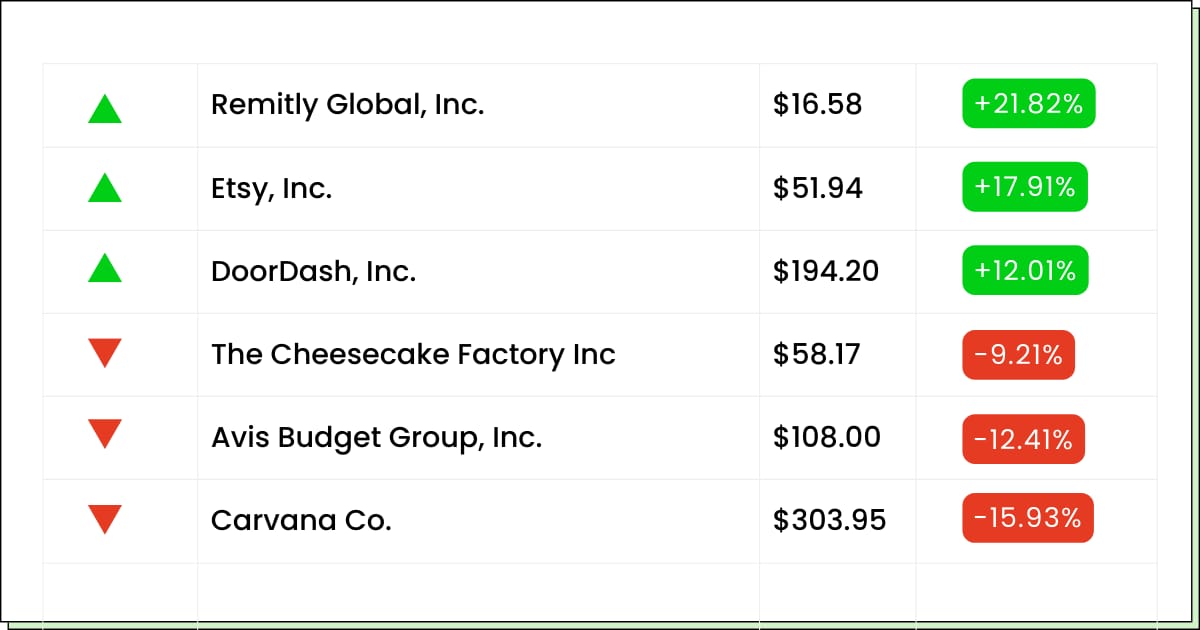

Figma Inc (NYSE: FIG) popped after telling the market two things it loves to hear: growth is still sprinting, and the AI add-ons are starting to pay rent. The company beat expectations, guided higher, and basically reminded everyone that design tools are not a nice-to-have when every app team is trying to ship faster.

The fun twist is the monetization part. Figma is leaning into AI features, but it is also tightening the meter. Starting in March, some heavy users will hit monthly limits unless they pay up. Translation: the free buffet is ending, and the kitchen is putting prices on the menu.

For investors, the main risk is the same as always, with a big after-hours jump: you can get excited and buy the top of the first candle. The smarter move is to watch how the stock behaves after the celebration fades and see if buyers still show up on normal days.

My Take For You: Let it cool for a session or two. Starter position only on a dip or a calm base.

My Verdict: Watch-list buy on weakness, not a chase-the-pop moment.

E-Commerce

Etsy Just Cleaned The Closet And Found Cash In The Pocket

Etsy Inc (NYSE: ETSY) ripped higher after agreeing to sell Depop to eBay for about $1.2B in cash. If Etsy has felt like a house with too many hobby rooms, this is management shutting a door, turning off the lights, and saying: We are focusing on the main living room now.

Depop was the cool resale cousin with a younger crowd, but it also came with distraction risk. Etsy has been battling softer shopping moods and intense competition, so simplifying the story is a nice change of pace. Less juggling, more execution.

The key for readers is not the deal headline; it is what comes next. Will Etsy use the cash to strengthen its core marketplace and keep buyers coming back, or will this be a one-time sugar rush? The stock jumping tells you investors like the cleanup, but the real test is whether trends improve after the confetti.

My Take For You: If you want in, wait for the post-pop pullback and start small.

My Verdict: Better story today, but it still needs proof in the next few updates.

Hidden Asset Boom (Sponsored)

While President Trump's official salary is $400,000 per year... his tax returns reveal he's been collecting up to $250,000 PER MONTH from one hidden source.

Until recently, most Americans couldn't touch the type of investment that makes up this investment.

But thanks to Executive Order 14330, that just changed.

If you love investing in disruptive new companies...

Discover how to invest in the fund Trump uses to collect this income

Consumer Tech

DoorDash Slipped On The Report Card And Then Remembered It Could Sprint

DoorDash Inc (NASDAQ: DASH) had a classic drama-queen session: it dipped after earnings and guidance disappointed, then reversed hard as traders realized the business is still growing fast. Revenue was up big, orders were up big, and the stock basically said sorry for the messy delivery, tip included.

What spooked people was the spending vibe. DoorDash is trying to build one global platform across its brands, and that is the kind of project that eats time, money, and patience. It is like renovating your kitchen while still trying to cook dinner every night.

For investors, the question is simple: are these investments building a stronger moat, or are they just an expensive hobby? When a stock is already down a lot this year, it does not take much to spark a rebound, but it also does not take much to restart the anxiety.

My Take For You: Don’t chase the after-hours bounce. Look for a calmer entry on a red day.

My Verdict: Tradeable rebound candidate, but only with tight position sizing and a quick leash.

Movers and Shakers

Lemonade [LMND]: Premarket Move: +16%

Lemonade is popping ahead of earnings because traders smell a smaller loss and a cleaner path to making money land. It’s basically the gym selfie of stocks: looking strong right before weigh-in.

The big watch item is whether claims stay tame and growth stays real, especially with auto insurance in the mix. Auto is where dreams go to get expensive fast.

My Take: This one loves drama around earnings. If you’re not in, wait for the call and buy the dip only if the reaction is calm. If you’re in, consider trimming a little into the pop.

eBay [EBAY]: Premarket Move: +9%

eBay’s waking up like it remembered it still prints money. Solid results have traders feeling good, even while the analyst crowd keeps the “meh” rating stapled on.

This is not a rocket ship story. It’s a steady, slightly boring cash machine that occasionally gets a nice glow-up when expectations are low and results are fine.

My Take: Don’t chase the premarket high-five. If you want it, start small on a red day or after the hype cools. If you already own it, this is the kind of strength you can trim into and rebuy lower without losing sleep.

Carvana [CVNA]: Premarket Move: −16%

Carvana just hit a pothole the size of a used SUV. Costs came in hotter than expected, and the stock is reacting like someone found a mystery stain in the back seat.

This name also has a history of swinging hard, so a big drop does not automatically mean it’s broken. But it does mean the easy-money vibe is gone for now.

My Take: Let it settle. If you’re not in, don’t try to catch the falling wrench. If you’re in, keep it smaller than you think you should and set a clear line where you step aside if the slide keeps going.

Rare Asset Play (Sponsored)

A tiny government task force working out of a strip mall just finished a 20-year mission.

And with almost no media coverage, they confirmed one of the largest U.S. territorial expansions in modern history...

A resource claim worth an estimated $500 trillion.

Thanks to sovereign U.S. law, this isn't just a national asset.

It's an American birthright.

That means every citizen now has the legal right to stake a claim...

But very few even know the opportunity exists.

If you want to see how you can get in line for your portion of this record-breaking windfall...

I've assembled everything you need to see inside a new, time-sensitive briefing:

Get all the details here - while the claim window remains open.

Everything Else

Sam Altman basically told India to buckle up, because the jump from helpful AI to scary-smart AI might happen faster than anyone wants to admit, per his comments at the India summit.

Airbus is posting solid numbers while quietly enjoying Boeing’s turbulence, but it still has to prove it can crank out more planes without turning the supply chain into a long-running delivery saga.

Elizabeth Warren is pushing regulators to treat crypto like a “no freebies” zone, warning against any backdoor bailout path if the big players blow up.

Microsoft says it does not believe ICE is using its tech for mass surveillance, but the whole thing is still a reminder that “who’s using what” is a messy trust question.

Live Nation just failed to kick out a federal antitrust lawsuit, which keeps the pressure on ticket pricing and the whole “fees surprise” problem people love to hate at checkout time.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.