A chipmaker just shocked Wall Street with explosive revenue growth despite an earnings miss. A logistics software provider is climbing after hiking its full-year outlook. Meanwhile, a power company is betting big on the AI boom with a multibillion-dollar plant deal. Here's what traders are watching today.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

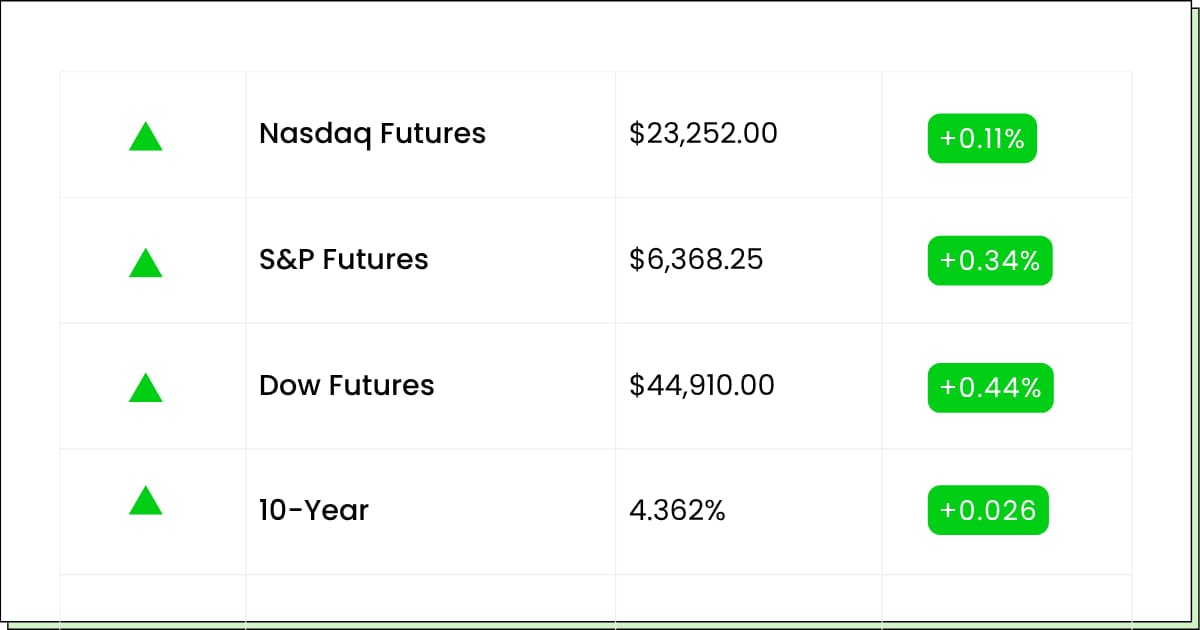

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Premarket:

AT&T Inc. [T]: Premarket

NextEra Energy Inc. [NEE]: Premarket

GE Vernova Inc. [GEV]: Premarket

Boston Scientific Corp. [BSX]: Premarket

Thermo Fisher Scientific Inc. [TMO]: Premarket

Amphenol Corp. [APH]: Premarket

CME Group Inc. [CME]: Premarket

Fiserv Inc. [FI]: Premarket

Moody’s Corp. [MCO]: Premarket

General Dynamics Corp. [GD]: Premarket

Infosys Ltd. [INFY]: Premarket

Equinor ASA [EQNR]: Premarket

Freeport-McMoRan Inc. [FCX]: Premarket

Hilton Worldwide Holdings Inc. [HLT]: Premarket

Aftermarket:

Alphabet Inc. [GOOG]: Aftermarket

Alphabet Inc. [GOOGL]: Aftermarket

Tesla Inc. [TSLA]: Aftermarket

International Business Machines Corp. [IBM]: Aftermarket

T-Mobile US Inc. [TMUS]: Aftermarket

ServiceNow Inc. [NOW]: Aftermarket

O'Reilly Automotive Inc. [ORLY]: Aftermarket

United Rentals Inc. [URI]: Aftermarket

Waste Connections Inc. [WCN]: Aftermarket

Crown Castle Inc. [CCI]: Aftermarket

Chipotle Mexican Grill Inc. [CMG]: Aftermarket

Las Vegas Sands Corp. [LVS]: Aftermarket

Raymond James Financial Inc. [RJF]: Aftermarket

Rollins Inc. [ROL]: Aftermarket

Packaging Corporation of America [PKG]: Aftermarket

Economic Reports:

Existing Home Sales [June]: 10:00 am

Timing Advantage (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

Energy Infrastructure

Talen Energy Jumps After Announcing $3.5 Billion Power Plant Deal

Talen Energy (NASDAQ: TLN) climbed over 9% in premarket trading following the announcement of a major acquisition aimed at boosting its energy capacity for data centers and commercial customers.

The utility provider signed definitive agreements to purchase two combined-cycle natural gas plants for a total of $3.5 billion. The assets include the Moxie Freedom Energy Center in Pennsylvania and the Guernsey Power Station in Ohio, both of which were previously operated by Caithness Energy.

Talen expects to close the deal in the fourth quarter of 2025 and plans to issue $3.8 billion in new debt to fund the transaction. The company emphasized that the additions will enhance its ability to provide scalable, grid-supported energy to hyperscale data centers and large energy users.

Analysts responded positively. UBS raised its price target to $399, Jefferies to $380, and Evercore to $372. The average one-year target price among 14 covering analysts now stands near $290, with a consensus rating of “Buy.”

The stock has climbed 48% year-to-date and recently broke past its previous 52-week high of $330.99. With a market cap of $14.3 billion, Talen is drawing attention as a key utility player in the AI infrastructure boom.

The acquisitions align with broader trends, including increased government and private investment in AI-related energy infrastructure. As demand accelerates, Talen’s enhanced capacity could improve earnings stability and growth prospects in a fast-evolving market.

Investors looking for utility exposure with tech-linked upside may find TLN compelling.

Supply Chain Software

Manhattan Associates Beats Q2 Estimates and Raises Full-Year Guidance

Manhattan Associates (NASDAQ: MANH) jumped over 15% in premarket trading after the software company beat second-quarter estimates and raised guidance for the full year.

The supply chain and warehouse management firm reported Q2 earnings of $1.31 per share, well above the $1.13 consensus forecast. Revenue came in at $272.4 million, exceeding expectations of $263.6 million.

Manhattan Associates also raised its full-year outlook. The company now expects FY 2025 earnings between $4.76 and $4.84 per share, compared to the previous consensus of $4.60. Revenue guidance was lifted to a range of $1.07 billion to $1.08 billion, also ahead of analyst projections.

Shares had declined by over 24% year-to-date prior to the report, following a period of valuation compression and mixed sentiment. Despite recent underperformance, Manhattan’s financial metrics remain strong, and the company continues to expand its cloud-based offerings.

Seven analysts lowered earnings estimates in the past 90 days, but no positive revisions were recorded ahead of the earnings beat.

Manhattan’s software is widely used across retail, logistics, and manufacturing, giving it strong long-term demand drivers. The company also reported improving sales pipelines and continued investment in innovation.

With the stock still well below its 52-week high of $312.60, and a market cap of $12.3 billion, the post-earnings move could mark a shift in momentum.

The raised outlook and solid execution may position Manhattan Associates as a rebound candidate in the second half of the year as investor confidence returns.

Undervalued Sector (Sponsored)

A well-known strategist just teased what could be one of the boldest calls of his 20+ year career.

He’s already helped everyday investors get in early on major winners — and now he’s set to reveal his next pick 100% free.

The opportunity? A perfect storm of market forces that could trigger massive upside in a single overlooked corner of the market.

The full breakdown drops July 24 at 2 p.m. ET — and it’s completely free to attend.

(By signing up, you agree to receive emails from OxFord Club. You can unsubscribe anytime. See our Privacy Policy.)

Power Modules

Vicor Corp Surges After Massive Revenue Beat Despite Earnings Miss

Vicor Corp (NASDAQ: VICR) jumped over 45% in premarket trading after posting second-quarter results that blew past revenue expectations, signaling renewed investor interest in the power module manufacturer.

Revenue reached $141.1 million, up 64% from a year ago and well ahead of the $96.4 million consensus estimate. However, the company reported an adjusted loss of $0.08 per share, falling short of analyst expectations for a $0.14 profit.

GAAP earnings were significantly higher at $0.91 per share, driven by one-time benefits. Net income totaled $41.2 million, compared to a loss in the prior-year period.

Despite the earnings miss, investors appear to be focused on Vicor’s rapid top-line growth, which reflects increased demand for its high-efficiency power solutions. The company’s product portfolio supports advanced computing and AI applications, giving it potential exposure to long-term technology tailwinds.

Analyst sentiment had cooled in recent months, with earnings estimates cut by more than 60% over the past quarter. There were no revisions in the past 30 days, but today's results may spark renewed coverage.

Vicor shares are now trading close to their 52-week high of $65.70. The stock had been down more than 6% year-to-date before this morning’s rally.

With a market cap of just over $2 billion and increased momentum in revenue growth, Vicor could see multiple expansion if the company returns to consistent profitability.

Investors seeking a turnaround story in tech hardware may want to track VICR in the weeks ahead closely.

Movers and Shakers

Penguin Solutions [PENG] – Last Close: $24.45

Penguin Solutions is an enterprise AI infrastructure company transforming from a holding firm to a specialized computing player. The company delivers integrated memory and advanced computing products, and it just completed a $38 million share buyback while raising full-year guidance.

Shares are up over 7% in premarket trading after Needham increased its price target to $30, citing confidence in AI demand and new clarity from recent investor meetings. Loop Capital and Citizens JMP also reiterated bullish ratings following upbeat earnings and five new customer wins, including SK Group.

My Take: Penguin is becoming a credible AI infrastructure supplier with fast-growing enterprise relationships. While revenue lumpiness is a risk, the raised guidance and analyst upgrades suggest it may be undervalued heading into a stronger second half.

Phibro Animal Health [PAHC] – Last Close: $29.23

Phibro Animal Health is a global provider of animal nutrition, vaccines, and health solutions across more than 80 countries. Its diversified product portfolio serves poultry, swine, cattle, aquaculture, and select industrial markets.

Shares are up over 7.5% in premarket trading following a wave of recognition from value investors. The company trades at a significant discount to peers, with recent earnings revisions and consistent outperformance suggesting the stock may still be under the radar.

My Take: PAHC stands out as a high-quality value pick in the healthcare space. If margins hold steady and global ag demand remains firm, the stock could re-rate toward its historical P/E range.

Range Resources [RRC] – Last Close: $35.65

Range Resources is a natural gas and energy exploration company operating in the Marcellus Shale region. The company focuses on low-cost production and shareholder returns, recently cutting net debt by $1.2 billion while ramping up buybacks.

Shares are trading almost 7% higher in premarket after the company posted Q2 earnings of $0.66 per share and raised production guidance. Net income soared 728% year over year to $237.6 million, and management reaffirmed its $3.15 billion revenue forecast amid stronger demand for natural gas.

My Take: Despite energy sector volatility, Range is executing well with rising free cash flow and disciplined capital use. This move looks sustainable if gas prices stay firm and production continues to scale.

Unseen Trends (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Everything Else

Trump signs Japan trade deal but keeps 15% tariffs in place.

Delta's AI fare strategy draws heat from lawmakers.

Krispy Kreme and GoPro jump as meme traders return, with more craziness likely to come.

Texas Instruments warns on demand, and the shares are falling 6%.

AT&T beats on subscribers and reveals tax savings plan, showing some resilience in this market.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.