Energy jumped on hard-power headlines, drilling optimism crept higher, and a media carve-out rattled holders. The smart move is fading the first pop in oil, stalking the service names, and avoiding forced spin-off selling.

Money Moves Now (Sponsored)

It's already creating millionaires and billionaires at the fastest pace in history.

CNBC calls it "the largest wealth creation spree in history."

Yet 1 in 3 Americans now fear their financial situation is deteriorating.

There's only one way to survive, says the man who predicted 2008 and 2020, but sadly it's already too late for many.

Everything you need to know is here.

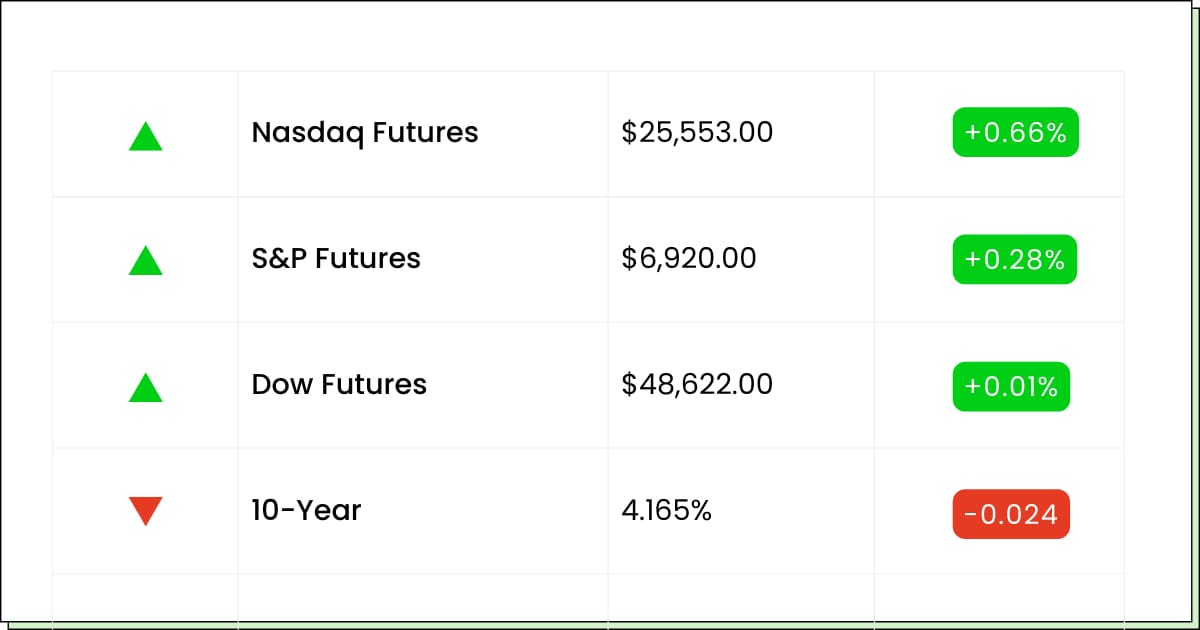

Futures at a Glance📈

Futures are ticking higher as markets digest the U.S. move in Venezuela. Energy names are doing the heavy lifting premarket, while tech is tagging along for the ride. Traders seem calm so far, treating it as a geopolitical headline rather than a market breaker, with attention already drifting toward the jobs report later this week.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Barnes & Noble Education, Inc. [BNED]

VisionWave Holdings, Inc. [VWAV]

Baosheng Media Group Holdings Limited [BAOS]

Economic Reports:

ISM manufacturing index (Dec): 10:00 am

Auto sales (Dec): tbd

Energy

Chevron Strikes Oil While Washington Strikes First

Chevron Corp (NYSE: CVX) woke up to a very loud headline and an even louder stock move. A surprise U.S. intervention in Venezuela sent energy traders scrambling for calculators, and Chevron shares jumped like someone found an extra zero in the reserves column.

The logic is simple enough. Venezuela has oil. Lots of it. And when geopolitics start rearranging the furniture, investors immediately picture big U.S. names showing up with hard hats and checkbooks. That doesn’t mean barrels start flowing tomorrow, but it does mean optimism gets priced in fast. Maybe too fast.

Here’s the grounding wire. Rebuilding Venezuela’s oil machine is a marathon, not a victory lap. Infrastructure is rough, politics are messy, and timelines stretch. The stock pop is about the possibility, not the payoff. Big difference.

My Take For You: If you’re not in, don’t chase the opening fireworks. Let the excitement cool and see where it settles. If you’re already holding, trimming into strength is just good manners.

My Verdict: Long-term story, short-term sugar rush. Respect the pop, but don’t confuse headlines with finished pipelines.

Media & Telecom

Comcast Spins The Wheel And Investors Feel A Little Dizzy

Comcast Corp (NASDAQ: CMCSA) is splitting personalities, carving off its slower cable networks into a shiny new spin while trying to remind everyone it’s still a broadband and theme-park cash machine. On paper, it’s a cleanup job. In practice, spins make stocks wobble.

The idea is to park the tired TV channels somewhere else and let the core business look faster, cleaner, and more modern. Wall Street usually likes that… eventually. Day one is more about confusion, recalculations, and “wait, how many shares do I own now?”

For regular investors, this is less about flipping and more about patience. Spins tend to slosh around before they find their footing.

My Take For You: If you’re new, wait until the dust settles and prices calm down. If you own it, don’t overreact to early chop.

My Verdict: Sensible move, messy execution window. Worth watching after the spin hangover fades.

Savings At Stake (Sponsored)

Economic confidence weakens when debt rises, wars expand, and currencies lose trust.

Many investors stay frozen while purchasing power quietly slips away.

History favors those who move early when political shifts change the landscape.

This Patriot’s Tax Shield outlines how tangible gold can serve as a defensive asset in uncertain times.

A free Wealth Protection Guide explains why Trump’s return could reshape demand for gold.

Click here to download the FREE Wealth Protection Guide now.

Energy Services

SLB Rides The Oil Mood Swing Like A Seasoned Surfer

Slb NV (NYSE: SLB) is doing that classic energy-services dance where oil prices twitch, headlines fly, and the stock tries not to spill its coffee. Venezuela drama gave the sector a jolt, but crude itself didn’t exactly throw a party.

That matters because SLB doesn’t sell oil, it sells the things oil producers needs. When producers feel rich, they drill. When prices wobble, budgets get “revisited,” which is corporate-speak for maybe later. With earnings coming up, traders are already leaning forward in their chairs.

The recent bounce says the market still believes in global projects and long-cycle work, but nobody’s ready to high-five just yet. This is more wait-and-see than full send.

My Take For You: If you’re not in, wait for clarity from earnings instead of guessing. If you’re holding, keep it steady and don’t panic over daily oil mood swings.

My Verdict: Solid operator, headline-sensitive stock. Better as a patient hold than a headline chase.

Poll: Which purchase feels the most “worth it”?

Movers and Shakers

Exxon Mobil Corp [XOM]: Premarket Move: +4%

Venezuela headlines hit, and Big Oil got its risk-on coffee. Exxon’s popping because when geopolitics get spicy, the mega-caps usually get the first invite.

Just remember today is a headline trade, not a finished story. Rebuilding an oil patch takes time, not vibes.

My Take: Don’t chase. If you’re in, skim some profit on strength. If you’re out, wait for the pop to cool.

eToro Group Ltd [ETOR]: Premarket Move: −2%

Goldman downgraded it and the stock sighed like it just got homework. Competition’s getting louder, and the market’s not paying up for “growth someday” right now.

It’s already been beat up, so this could be more drift than disaster. Still, knives are sharp.

My Take: Let it base first. If it steadies for a few sessions, then consider a starter position.

QXO Inc [QXO]: Premarket Move: +7%

Apollo reportedly threw a big check at the deal machine, and the stock jumped like it heard acquisition season. More ammo is great, but it also means expectations just got heavier.

This is the kind of pop that can fade if the next deal isn’t a home run.

My Take: Trade it. Ride momentum if you must, but wait for the actual deal before sizing up.

Winners Were Born (Sponsored)

Just months before the Great Depression, a little-known market indicator quietly appeared.

That same indicator later pinpointed Apple at pennies, Nvidia before its breakout, and Netflix before its explosive run.

Most investors never learned about it — until now.

As uncertainty clouds 2026 and heavily owned stocks face growing pressure, this signal is lighting up once more.

Three under-the-radar opportunities have emerged that could outperform while others struggle to recover.

Click here now to Find Out Why

Everything Else

Energy names are back in the spotlight as traders game out what a Venezuela flare-up could mean for supply and pricing, with oil majors catching the early attention.

Defense stocks are doing that “bad headlines, good stock” thing again after the hard-power era narrative got another jolt.

Elon Musk is once again trying to solve geopolitics with Wi-Fi, floating free internet via Starlink as Venezuela tensions heat up.

Foxconn just posted a monster Q4 revenue jump to a record high as AI demand keeps the hardware supply chain humming.

Samsung says it’s planning to double the number of devices with Galaxy AI features to 800 million in 2026, basically turning AI phones into the default setting.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.