Presented By

A defense and IT contracting firm is surging after beating Q4 estimates, a quantum computing stock is soaring 23% ahead of a major AI conference, and a medical robotics company is rising on a breakthrough FDA clearance. Read on to find out more.

📲 Want our updates via text message? Get Elite Trade Club's pre-market insights and hottest stocks straight to your cell for 100% free. Click here to sign up.

Early Opportunity (Sponsored)

Remember when NASDAQ: OLED launched its IPO at $6 and later soared to a peak of $252.69, achieving a remarkable 4,090% gain?

Now a new MicroLED innovator with a patented groundbreaking technology and a co-development partnership with a major display manufacturer could enable the mass commercialization of MicroLED displays.

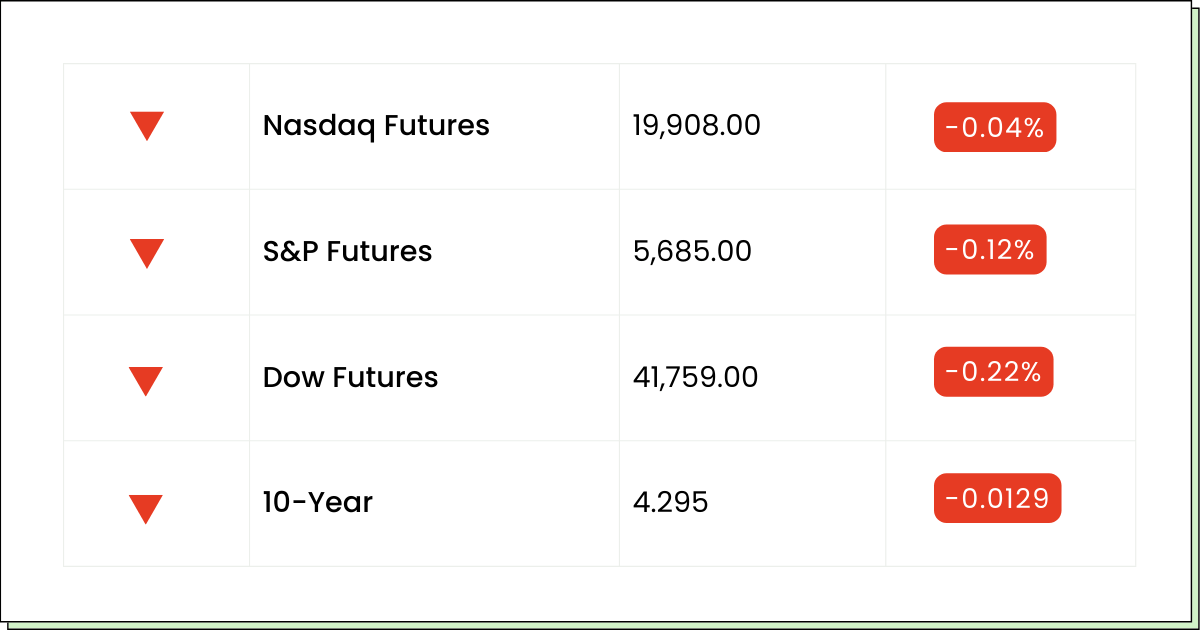

Futures 📈

What to Watch

Earnings:

FinVolution Group (FINV): Aftermarket

Getty Images Holdings, Inc. (GETY): Aftermarket

Harrow, Inc. (HROW): Aftermarket

Altus Power, Inc. (AMPS): Aftermarket

Open Lending Corporation (LPRO): Aftermarket

Consolidated Water Co. Ltd. (CWCO): Aftermarket

Lithium Argentina AG (LAR): Aftermarket

Natural Gas Services Group, Inc. (NGS): Aftermarket

Economic Reports:

U.S. retail sales [Feb]: 8:30 a.m.

Retail sales minus autos [Feb]: 8:30 a.m.

Empire State manufacturing survey [Mar]: 8:30 a.m.

Business inventories [Jan]: 10:00 a.m.

Home builder confidence index [Mar]: 10:00 a.m.

Technology

SAIC Beats Q4 Expectations, Announces Higher-Than-Expected 2026 Guidance

Science Applications International Corporation (NASDAQ: SAIC) reported stronger-than-expected fourth-quarter results, driving its stock up 4% in premarket trading.

The technology integrator also provided an upbeat outlook for fiscal 2026, signaling continued momentum across its government-focused markets.

For the quarter ending January 31, SAIC posted adjusted earnings per share of $2.57, well above the analyst consensus of $2.08.

Revenue reached $1.84 billion, surpassing expectations of $1.81 billion and reflecting 5.8% organic growth year-over-year.

For the full fiscal year 2025, SAIC reported revenue of $7.48 billion, a 3.1% organic increase from the prior year. Adjusted EBITDA stood at $710 million, representing 9.5% of total revenue.

Looking ahead, SAIC expects fiscal 2026 revenue to range between $7.60 billion and $7.75 billion, exceeding the analyst consensus of $7.63 billion.

The company also projects adjusted earnings per share between $9.10 and $9.30, topping expectations of $8.85.

CEO Toni Townes-Whitley highlighted the company’s strong financial execution, noting that revenue, EBITDA, earnings per share, and free cash flow all exceeded forecasts.

Additionally, SAIC secured a $1.8 billion recompete contract, further strengthening its position in defense, space, civilian, and intelligence markets.

With a $20 billion backlog of submitted bids, SAIC is confident in its growth trajectory as it advances digital transformation initiatives for government clients.

AI

DeepSeek’s Impact Prompts Tech Firms to Ramp Up AI Spending by $500 Billion

Major technology companies are ramping up their artificial intelligence (AI) investments, with spending projected to exceed $500 billion by early next decade, according to a Bloomberg Intelligence report released today.

The shift is driven by advances in AI inference models, particularly from OpenAI and China’s DeepSeek.

Tech giants, including Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Meta (NASDAQ: META), are expected to allocate $371 billion toward AI-related data centers and computing resources in 2025, marking a 44% increase from the previous year.

By 2032, that figure is set to rise to $525 billion, a faster growth rate than initially forecasted.

Until now, AI investments have primarily focused on training large-scale models. However, companies are now pivoting toward inference—the process of running AI systems after they have been trained.

This transition has been accelerated by the emergence of new reasoning models from DeepSeek and OpenAI, which simulate human-like thought processes and require increased computational power.

DeepSeek’s ability to develop competitive AI models at a fraction of the cost of leading U.S. firms has sparked discussions about optimizing AI development spending.

While AI training investments may slow, the growing emphasis on inference computing is expected to fuel the next phase of AI expansion.

Bloomberg Intelligence analysts expect DeepSeek’s influence to push tech firms to accelerate their investments in inference, making it the fastest-growing segment in the generative AI market.

The Next Nuclear Boom (Sponsored)

On Behalf of Azincourt Energy Corp

The world’s richest investors—Gates, Bezos, Altman—are pouring billions into nuclear energy. With uranium demand surging, one tiny uranium junior could potentially be the next big winner.

Credit Technology

Qifu Technology’s Q4 Net Income Jumps, Shares Surge

Qifu Technology (NASDAQ: QFIN) reported strong fourth-quarter earnings, with non-GAAP net income rising significantly despite a slight dip in revenue.

The company’s stock is up 6% in premarket trade today.

For the quarter ending December 31, Qifu posted a non-GAAP net income of 13.66 Chinese renminbi ($1.87) per diluted American depositary share, a sharp increase from 7.14 renminbi ($0.99) a year earlier.

Earnings per share of the firm are 6.62 renminbi ($0.91), compared to 3.44 renminbi ($0.48) from the prior year period.

However, total revenue for the quarter is down slightly to 4.48 billion renminbi ($620 million) from 4.50 billion renminbi in the same period last year.

The result is still above the estimate of 4.25 billion renminbi, according to FactSet.

Looking ahead, Qifu Technology has provided guidance for the first quarter of 2025, projecting non-GAAP net income between 1.80 billion and 1.90 billion renminbi.

The Quify Technology board has approved a dividend of $0.35 per share.

Movers and Shakers

Quantum Computing Inc. [QUBT] - Last Close: $7.09

Quantum Computing Inc. is a technology company focused on developing quantum-based solutions for real-world optimization and machine learning applications.

Its shares are surging 23% in premarket trading as investors anticipate increased attention on quantum computing ahead of Nvidia's GTC AI conference next week.

Nvidia CEO Jensen Huang is set to discuss the future of quantum computing alongside industry leaders, fueling optimism about the sector's growth potential.

My Take: Quantum stocks may see further rallying during the conference if Nvidia makes any major announcements, so keep a close eye on this stock.

Monogram Technologies Inc. [MGRM] - Last Close: $2.33

Monogram Technologies Inc. is an AI-driven robotics company that uses precision robotic-assisted technology in the field of orthopedic surgery.

Its shares are up 12% in premarket trading today after the company received FDA 510(k) clearance for its Monogram mBôs™ TKA System, a robotic-assisted knee replacement platform.

My Take: This could be a game changing moment for MGRM, so keep a close watch on how the stock performs during the day.

KULR Technology Group, Inc. [KULR] - Last Close: $1.45

KULR Technology Group, Inc., specializes in advanced thermal management and battery safety solutions for aerospace, defense, and electric vehicle industries.

Its shares are surging in early trade after announcing that a private U.S. space company has selected its M35A battery cells for spaceflight programs.

My Take: KULR is carving out a solid niche in high-performance battery safety and space applications. Its stock is up more than 600% in the last year. Keep this stock on your radar.

Technology (Sponsored)

It just signed a deal to get its tech in Apple's iPhone until 2040!

Online commenters are debating if this brand-new company will be the 7th trillion dollar stock.

Everything Else

Thailand attracts $2.7 billion in tech investments as its data centers expand.

China's AI race heats up as Baidu unveils ERNIE X1 to rival DeepSeek.

AstraZeneca expands its oncology portfolio with the purchase of Belgian biotech firm EsoBiotec.

China ramps up its domestic demand strategy as policymakers focus on long-term growth.

Transatlantic trade tensions could disrupt $9.5 trillion in business, a report says.

Tesla brings an assisted driving trial to China amid regulatory challenges.

Forever 21's U.S. stores face closure as the firm files for bankruptcy.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.

*Standard message/carrier rates may apply.

Legal Stuff: Stocks featured in this newsletter are for entertainment purposes only. You should not base any investment decisions on information contained in my newsletter. Stocks featured in this newsletter may be owned by owners/operators of this website, which could impact our ability to remain unbiased. Please consult a financial advisor before making any trading decisions. I may earn a small commission from links placed inside these emails.