A celebrity campaign just sent one retailer’s shares soaring in classic meme-stock fashion. A clinical research giant is gaining ground after a solid earnings beat and expanded buyback. And a pharma supplier raised its full-year outlook as demand for injectable therapies accelerates. Here’s what traders are watching today.

Fresh Watchlist (Sponsored)

Some stocks don’t just rise — they explode.

A new report reveals 5 stocks with the potential to gain 100%+ in the next 12 months, backed by strong fundamentals and bullish technical signals.

Past picks from this team have soared +175%, +498%, even +673%. ¹

This free report gives direct access to the names and tickers — no fluff, just high-upside plays.

Available free until midnight tonight.

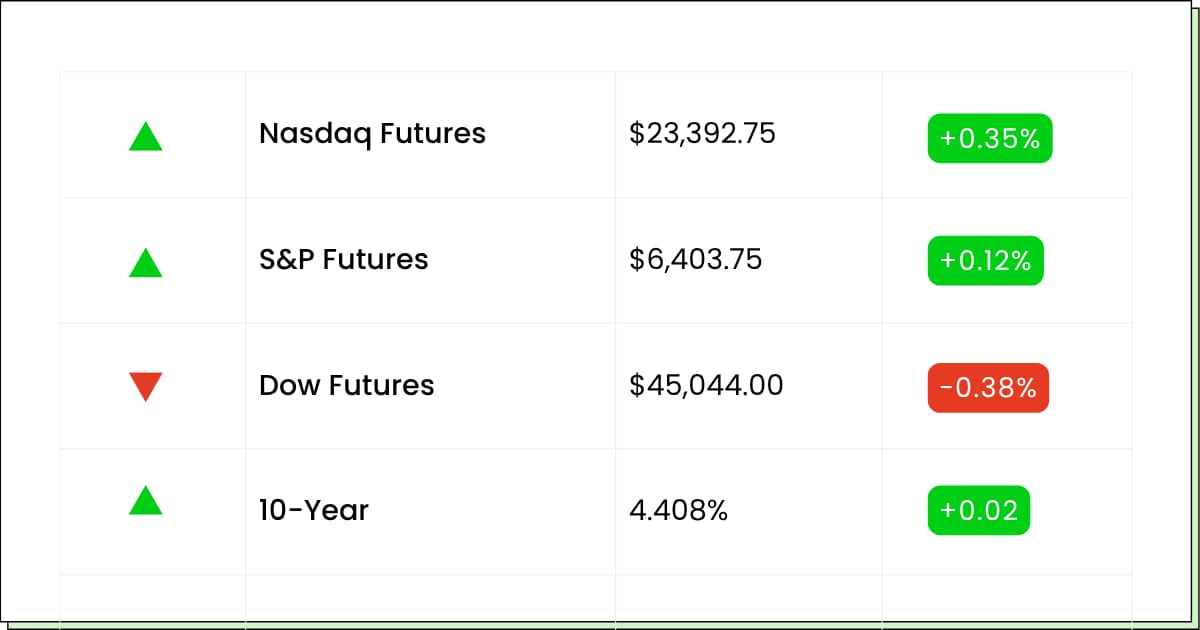

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Premarket:

Honeywell International Inc. [HON]: Premarket

TotalEnergies SE [TTE]: Premarket

Union Pacific Corporation [UNP]: Premarket

Blackstone Inc. [BX]: Premarket

Ameriprise Financial Services, LLC [AMP]: Premarket

Nasdaq, Inc. [NDAQ]: Premarket

L3Harris Technologies, Inc. [LHX]: Premarket

Keurig Dr Pepper Inc. [KDP]: Premarket

Valero Energy Corporation [VLO]: Premarket

Lloyds Banking Group Plc [LYG]: Premarket

Westinghouse Air Brake Technologies Corporation [WAB]: Premarket

Tractor Supply Company [TSCO]: Premarket

STMicroelectronics N.V. [STM]: Premarket

Dover Corporation [DOV]: Premarket

Nokia Corporation [NOK]: Premarket

CenterPoint Energy, Inc. [CNP]: Premarket

Labcorp Holdings Inc. [LH]: Premarket

Dow Inc. [DOW]: Premarket

Flex Ltd. [FLEX]: Premarket

Teck Resources Ltd [TECK]: Premarket

TransUnion [TRU]: Premarket

West Pharmaceutical Services, Inc. [WST]: Premarket

TechnipFMC plc [FTI]: Premarket

Allegion plc [ALLE]: Premarket

Pool Corporation [POOL]: Premarket

A.O. Smith Corporation [AOS]: Premarket

Aftermarket:

Intel Corporation [INTC]: Aftermarket

Newmont Corporation [NEM]: Aftermarket

Digital Realty Trust, Inc. [DLR]: Aftermarket

Deutsche Bank AG [DB]: Aftermarket

Edwards Lifesciences Corporation [EW]: Aftermarket

VeriSign, Inc. [VRSN]: Aftermarket

Weyerhaeuser Company [WY]: Aftermarket

Comfort Systems USA, Inc. [FIX]: Aftermarket

Deckers Outdoor Corporation [DECK]: Aftermarket

Healthpeak Properties, Inc. [DOC]: Aftermarket

Gaming and Leisure Properties, Inc. [GLPI]: Aftermarket

Kinsale Capital Group, Inc. [KNSL]: Aftermarket

Coca-Cola Consolidated, Inc. [COKE]: Aftermarket

Ovintiv Inc. [OVV]: Aftermarket

Economic Reports:

Initial Jobless Claims [July 19]: 8:30 am

S&P Flash U.S. Services PMI [July]: 9:45 am

S&P Flash U.S. Manufacturing PMI [July]: 9:45 am

New Home Sales [June]: 10:00 am

AI Trade Shakeup (Sponsored)

The escalating U.S.-China trade tensions are reshaping the AI landscape.

Companies like Nvidia are facing significant revenue hits with the U.S. imposing new export restrictions on advanced AI chips to China.

This shift opens doors for U.S.-based AI companies poised to fill the gap. I’ve identified 9 under-the-radar AI stocks with:

Deep AI integration across their core operations

Strong U.S. manufacturing capabilities

Infrastructure ready to capitalize on policy shifts

Access our FREE report, "Top 9 AI Stocks for This Month" to discover these opportunities before the broader market catches on.

Pharmaceuticals

West Pharmaceutical Lifts Full-Year Forecast After Q2 Earnings Beat

West Pharmaceutical Services [WST] is trading sharply higher by 22% premarket after the company reported strong Q2 results and raised its full-year 2025 outlook. Revenue rose 9.2% to $766.5 million, driven by demand for high-value packaging components used in GLP-1 injectable medications and other specialty biologics.

Earnings per share came in at $1.82, up from $1.51 last year, with adjusted EPS reaching $1.84. The company now expects full-year sales between $3.04 billion and $3.06 billion, up from its prior range of $2.945 billion to $2.975 billion.

It also lifted its adjusted EPS forecast to a range of $6.65 to $6.85, citing continued strength in its Westar and NovaChoice product lines.

West’s Proprietary Products segment accounted for 81% of total revenue and grew 10.7% in the quarter. Meanwhile, Contract-Manufactured Products rose 3%, supported by demand for self-injection devices for obesity and diabetes treatments. Analysts have responded positively, with three upward EPS revisions in the last month, and KeyBanc has reiterated an Overweight rating.

The company also declared a Q4 dividend of $0.22 per share and maintained capital spending guidance of $275 million. Following recent leadership changes, including the appointment of Robert McMahon as CFO, West appears to be executing well across both operations and investor relations.

Investors may look to this as a defensive healthcare name with exposure to structural demand trends in obesity treatment. If GLP-1 momentum holds, West could be one of the quieter winners in the pharmaceutical infrastructure sector.

Healthcare Services

ICON plc Tops Estimates, Boosts Outlook With Share Repurchase Plan

ICON plc [ICLR], a global clinical research organization, is climbing 16% in premarket trade after reporting strong Q2 results and raising its full-year guidance. The company posted earnings of $3.26 per share, beating the consensus estimate by $0.07. Revenue rose to $2.02 billion, above analyst expectations of $1.98 billion.

ICON’s net income surged 30.7% year over year to $183 million, despite a modest decline in revenue versus Q2 2024.

The firm attributed the performance to improved cost controls and strong demand for its clinical development services. ICON also announced a $500 million expansion to its share repurchase program, signaling confidence in long-term earnings power.

This follows a quarter of mixed sentiment, with one analyst upgrading estimates and 13 revising downward. However, ICON has now guided full-year revenue to be between $7.85 billion and $8.15 billion, and adjusted EPS to be between $13.00 and $14.00, both above previous forecasts.

The positive reaction reflects a broader shift in investor sentiment toward CROs as pharma and biotech pipelines rebound. ICON’s gross business wins totaled $2.97 billion this quarter, suggesting the company is still gaining share in a competitive market.

Analysts remain cautiously bullish, with a consensus Buy rating, and several firms reaffirm their price targets of $350–$380. Technical momentum is also improving, though some caution that shares may be entering overbought territory.

Investors should watch whether ICON maintains this trend through Q3. With short-term sentiment recovering and a strong repurchase plan in place, the stock may have more room to run, especially if biopharma spending continues to rebound.

Ranked for Growth (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

Retail

American Eagle Jumps on Sydney Sweeney Campaign and Meme Stock Buzz

American Eagle Outfitters [AEO] is surging in premarket trading after launching a high-profile campaign featuring actress Sydney Sweeney, reigniting interest among retail investors.

Shares are up over 18% premarket, with volume spiking as the campaign went viral on social media platforms like Reddit and Stocktwits.

The campaign, which features Sweeney modeling American Eagle denim, is being hailed as a bold pop culture moment that could help the struggling brand reconnect with its Gen Z base. The stock initially climbed 6% on Wednesday after the campaign was announced and continued its momentum through Thursday morning.

Investor enthusiasm mirrors earlier meme stock rallies, with 13% of the company’s float currently sold short. This raises the potential for a short squeeze if momentum persists.

While American Eagle’s fundamentals remain challenged, declining mall traffic and increasing digital competition have weighed on its margins; however, this media buzz could provide a short-term catalyst ahead of its next earnings report.

Management has yet to comment on how the campaign will impact sales or guidance, but traders will be closely watching to see if the company capitalizes on this attention. If AEO offers even modest improvements in revenue or margin guidance in its next earnings call, the stock could see sustained upside.

This rally highlights how narrative and virality now play a significantly larger role in retail stocks. Investors chasing momentum may find opportunity here, but they should also brace for volatility once the meme stock fever cools.

Movers and Shakers

MaxLinear, Inc. [MXL] – Last Close: $15.32

MaxLinear designs and manufactures high-performance semiconductors used in broadband, Wi-Fi, and data center interconnect applications. The California-based chipmaker has been working to diversify away from consumer exposure and toward infrastructure markets, such as 5G and cloud networking.

Shares are up over 24% in premarket trading after the company returned to non-GAAP profitability in Q2 and posted an 18% year-over-year revenue increase. Operating expenses dropped sharply, free cash flow turned positive, and forward guidance suggests further margin improvement. MaxLinear expects Q3 revenue between $115–$135 million, supported by a strengthening backlog in data center and Wi-Fi markets.

My Take: MXL has quietly stabilized after a rough patch in 2023 and now appears to be executing a turnaround. With improving financials and product traction in key growth areas, the stock may be underpriced for patient investors.

Tesla Inc. [TSLA] – Last Close: $332.56

Tesla is the world’s leading electric vehicle and autonomous mobility platform, but its stock has been hit hard by political drama and weakening near-term sales. Elon Musk warned of potentially “rough quarters ahead” due to the phaseout of U.S. EV tax credits and increasing Chinese competition.

Shares are down over 6% premarket after Tesla reported a 16% drop in auto revenue and a second straight quarter of declining sales. However, the long-term case remains: Tesla continues to lead in AI-driven robotics, energy storage, and autonomous driving, sectors that could define the next decade of growth.

My Take: Near-term sentiment may stay shaky, but Tesla’s long-range vision still gives it a unique edge. Investors who can stomach the political noise and quarterly volatility might find value building a position during periods of pessimism.

Krispy Kreme Inc. [DNUT] – Last Close: $4.32

Krispy Kreme is one of the most recognizable donut brands in the world, but its stock has cratered over 55% year to date. Despite mounting losses, retail traders have piled in this week, sending shares on a meme-fueled rebound tied to high short interest and brand nostalgia.

The company is up nearly 20% over the past few days, although it's down almost 3% premarket. Krispy Kreme checks several boxes for a classic meme stock: a well-known name, low float, high short interest, and the potential for a turnaround narrative shared on Reddit and Stocktwits. So far, it’s worked.

My Take: DNUT isn’t for the faint of heart, but it could have room to run if sentiment holds. For traders watching options flows and short interest, this remains a high-risk, high-reward play with explosive potential in the short term.

Market Shift Ahead (Sponsored)

A well-known strategist just teased what could be one of the boldest calls of his 20+ year career.

He’s already helped everyday investors get in early on major winners — and now he’s set to reveal his next pick 100% free.

The opportunity? A perfect storm of market forces that could trigger massive upside in a single overlooked corner of the market.

The full breakdown drops July 24 at 2 p.m. ET—and it’s completely free to attend.

(By signing up, you agree to receive emails from OxFord Club. You can unsubscribe anytime. See our Privacy Policy.)

Everything Else

Nestlé plans to raise prices as tariffs and commodities squeeze profit margins.

Private credit giants turn to Asia to close growing regional funding gaps.

Trump-era subsidy cuts cool U.S. clean energy as project costs rise.

Exxon and Chevron may be positioning for a massive oil merger.

JPMorgan and Schwab agree retail investors dominate this market cycle.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.