Good morning. It's September 3rd, and today we’ll take a look at the escalating Apple-Huawei rivalry, record profits for the two biggest U.S. market makers, and a tiny AI stock that has more than doubled in premarket trade.

Previous Close 📈

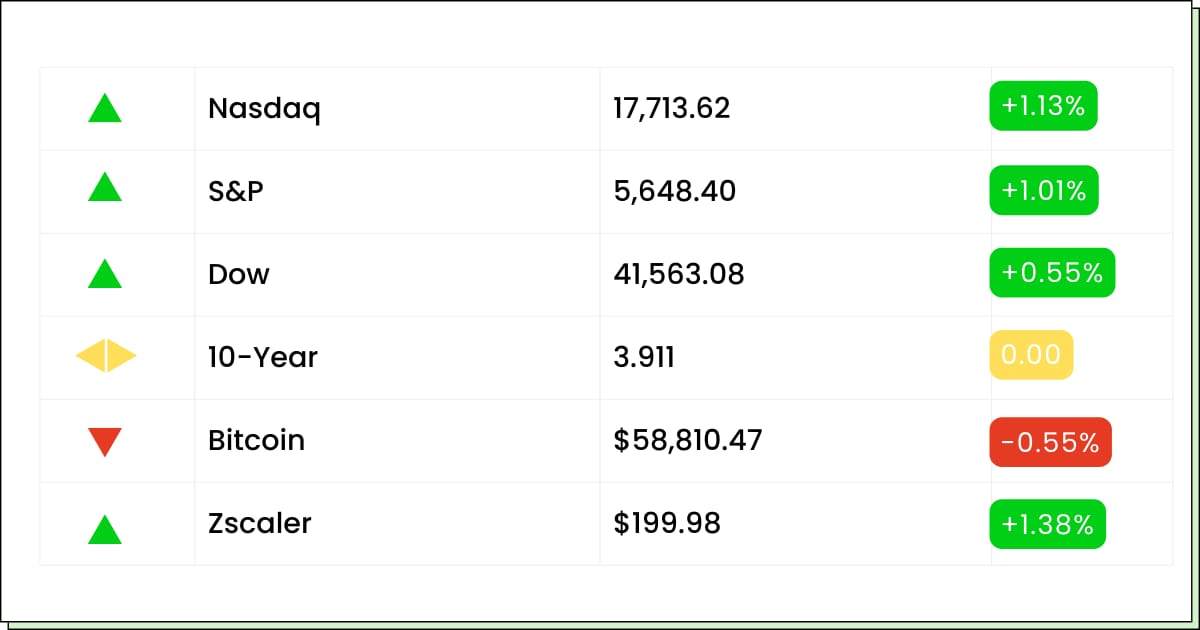

The major indices ended August with gains after a positive final session on Friday. The S&P 500 rose by 2.3% last month, achieving its fourth consecutive monthly increase, while the Dow and Nasdaq climbed 1.8% and 0.7%, respectively.

Futures

U.S. stock futures are down today as traders anticipate a challenging month following a robust yet turbulent August.

What to Watch

It’s going to be a hectic start to the month. Hello Group (NASDAQ: MOMO) and 36Kr Holdings (NASDAQ: KRKR) will announce their results before the day’s opening bell, followed by the S&P final U.S. manufacturing PMI for August release at 9:45 a.m.

Construction spending data for July and the ISM manufacturing data for August will become available at 10:00 a.m.

After the closure of the day’s trade, tech firms Zscaler (NASDAQ: ZS), GitLab (NASDAQ: GTLB), and PagerDuty (NYSE: PD) will release their earnings data.

Ever been frustrated by a missed opportunity because you weren’t at your monitor when a stock made a big move? It’s a common pain point for traders—no one can watch the market around the clock. But what if you didn’t have to?

Steven Brooks is launching TradeFusion, an AI trading bot that monitors the market 24/7, ensuring you never miss a profitable trade again.

Entertainment

Market-Making Giants Citadel and Jane Street Report Surge in Trading Revenues

Citadel Securities and Jane Street Group LLC, two major market-making firms in the United States, are set to achieve record-breaking revenues this year. They will also expand into trading areas traditionally dominated by large banks.

Citadel Securities saw its net trading revenue increase by 81% to $4.9 billion in the first half of this year, compared to last year's equivalent period. Meanwhile, Jane Street experienced a 78% rise to $8.4 billion, positioning the firms for an unprecedented annual revenue total.

Jane Street has maintained its leadership in the exchange-traded funds (ETF) sector while expanding into credit trading. Citadel Securities has ventured into corporate-bond trading, focusing initially on investment-grade bonds, and has begun electronic trading in euro and sterling interest-rate swaps.

Jane Street’s recent investor update revealed that its growth has been fueled by sustained high trading volumes in equities and options, as well as significant inflows into ETFs. Earlier this year, the firm raised $1.4 billion through a high-yield bond sale to boost its cash reserves, facilitating continued investment in its business.

Citadel Securities, led by Ken Griffin, reported adjusted earnings of $2.7 billion in the first half of this year, a significant jump from $1.1 billion in the same period last year.

The firm recorded $2.6 billion in net trading revenue and $1.4 billion in adjusted earnings in the second quarter alone. Jane Street's first-half adjusted earnings were about $6.1 billion, almost double the $3.1 billion recorded a year earlier, with $2.9 billion of this year’s earnings coming in the second quarter.

Technology

Airbnb Challenges NYC Law on Short-Term Rentals, Cites Increased Costs

Airbnb has called on New York City to reassess its stringent regulations on short-term rentals, arguing that the rules, in place since September 2023, have led to higher costs for travelers without alleviating the housing crisis.

The company, in a blog post today, criticized Local Law LL18, which requires hosts to be permanent residents of the property and to register with the city for short-term rentals.

According to a report from data analytics firm Airdna, short-term rental listings on Airbnb in New York City for stays under 30 nights plummeted by 83% following the law's implementation.

Airbnb contended that these regulations have not affected the city’s apartment vacancy rates, which remain steady at 3.4% as per Apartment List data.

Additionally, Airbnb highlighted the economic impact on travelers, noting that hotel rates in New York City increased by 7.4% year-over-year in July, compared to a 2.1% rise across the U.S., based on Co-Star data.

The company argued that relaxing parts of the law could boost the availability of accommodations, support local hosts, and stimulate businesses reliant on tourism.

Retail

Huawei Plans Major Product Reveal Hours After Apple's iPhone 16 Launch, Teases ‘Epoch-Making’ Innovation

Huawei Technologies is gearing up for a significant product launch just hours after Apple introduces its iPhone 16 lineup.

Richard Yu, head of Huawei's consumer group, confirmed a September 10 event on Weibo, hinting at an "epoch-making product" that has been in development for five years. The tech giant is set to reveal the first commercially available smartphone that folds twice, as per an insider.

The upcoming launch also includes plans for an Aito electric vehicle, though specifics about the final lineup remain flexible. This timing follows Apple’s scheduled September 9 event, where the company will debut its latest iPhone models and accessories, aiming to entice users to upgrade.

Earlier this year, Huawei reclaimed its position in the premium smartphone market in China, pushing Apple out of the top five device makers in the June quarter with the successful launch of the Mate 60 series, featuring an innovative chip.

The back-to-back scheduling of Huawei's event appears to be a strategic move to directly compete with Apple, positioning itself as a formidable rival.

Richard Yu has been seen using the new foldable device, nicknamed the "trifold," which promises a larger screen experience within the compact size of a standard smartphone.

We already know Trump has vowed to "drill, baby, drill," which would be beneficial for domestic oil companies. Cryptocurrencies could also do well, especially with Trump's pro-crypto running mate, Senator J.D. Vance. Plus, Trump is also bullish on cryptocurrencies, referring to himself as pro-crypto.

If you believe Vice President Kamala Harris will win the election, you may want to invest in all things green. That includes green energy and cannabis.

Movers and Shakers

UTime Limited [WTO] - Last Close: $0.08

UTime's stock is surging by 17% so far today.

The company signed an NDA to acquire Bowen Therapeutics, a maker of monkeypox vaccines. This acquisition includes taking over Bowen's laboratory at UMASS Medical School and supporting the FDA registration of its vaccines.

With monkeypox becoming a global concern, this move positions UTime to enter the vaccine market and accelerate its research and development in infectious diseases.

My Take: This is a very tiny stock, but it has good volume and the acquisition gives it a lot of potential. Keep your eyes on this one.

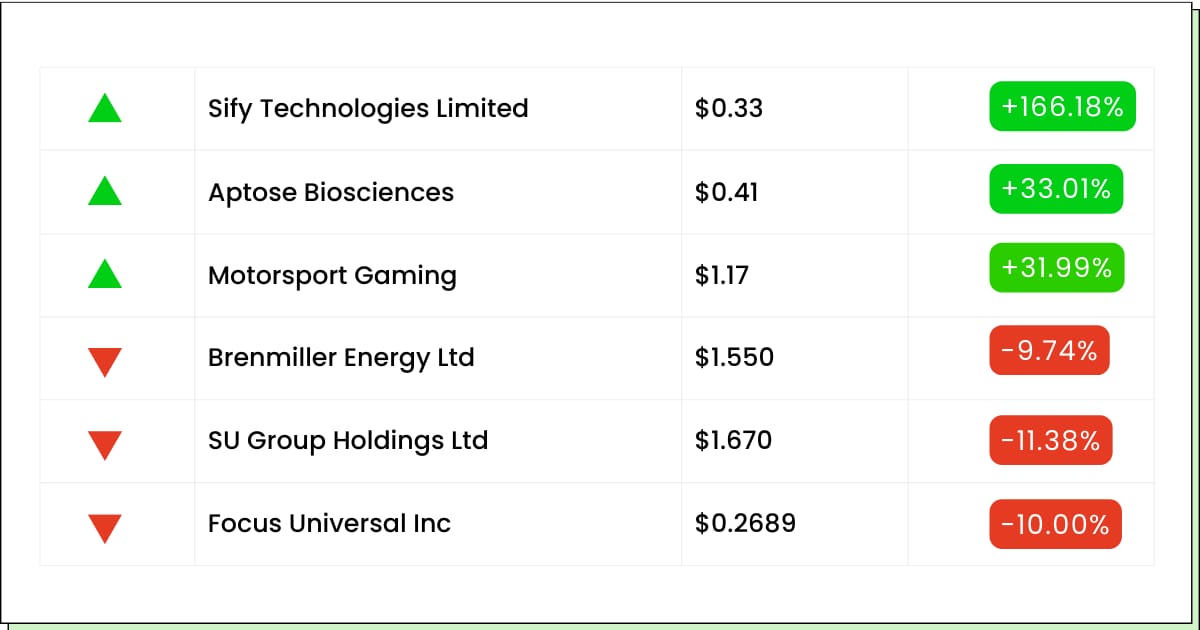

Aptose Biosciences Inc. [APTO] - Last Close: $0.41

Aptose Biosciences' stock is up 38% in premarket trading.

The company secured a $10 million loan from Hanmi Pharmaceutical, giving it a financial boost with flexible terms.

The loan, which carries a 6% annual interest rate and is repayable by January 2027, also comes with an interesting option: if Aptose and Hanmi amend their current agreement or form a new collaboration, the loan can be converted into a prepayment for future milestones.

This flexibility provides Aptose with both immediate funding and the potential to settle future obligations, which investors see as a positive move for the company’s growth prospects.

My Take: The stock has been consistently declining, and despite the new funding arrangement, it would be best to keep this one on the wait-and-watch list.

Sify Technologies Limited [SIFY] - Last Close: $0.33

Sify Technologies' stock is rising by 172% in premarket trading today.

The company has become the first in India to achieve NVIDIA's DGX-Ready Data Center certification for liquid cooling.

This means Sify's data centers are now certified to support powerful AI computing systems like NVIDIA's DGX platform, which is crucial for advanced AI tasks like analytics, training, and data processing.

The certification allows Sify to offer high-performance AI infrastructure to businesses, making it an attractive choice for companies looking to scale up their AI capabilities securely and efficiently.

My Take: This is a very tiny stock with moderate-to-high volatility, so expect substantial ups and downs if you decide to run this one down.

If you think you’ve missed out on the AI boom, think again. While NVIDIA’s story is well-known, a whole new wave of under-the-radar AI companies is still trading at incredibly low prices—offering you a chance to multiply your investment.

For example, Super Micro Computer (SMCI) delivered a staggering 426% gain in just 5 months. This is your chance to get in early on the next big AI winners, just like NVIDIA in 2014.

Everything Else

Brazil threatened Starlink’s operations following non-compliance with court orders.

Rolls-Royce stock gains 4% as Cathay Pacific downplays A350 engine concerns.

TikTok owner ByteDance is looking to secure a $9.5 billion corporate loan in Asia.

Intel is eyeing the sale of Altera as part of its restructuring strategy.

A study found an Ozempic and Wegovy drug component cut COVID-19 deaths.

Indonesian gold miner J Resources’ founder is considering a stake sale.

Volkswagen may shut down German plants as it battles competition and rising costs.

Tesla China sales rebounded in August but still trail local rivals like BYD.

Airbaltic’s IPO is set for late 2023, and the Latvian government will retain a minority stake.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.