One giant just borrowed for the next 100 years, a web gatekeeper just proved demand is real, and a chip name ripped after hours. The setups are there, but only if you play them right.

Software Compromised Silently (Sponsored)

On Behalf of Integrated Quantum Technologies Inc.

Chinese state hackers sat inside a trusted developer tool’s update system, pushing backdoors to high value targets undetected.

If supply chains are compromised this easily, unprotected AI data flows are a ticking bomb.

A tiny publicly traded company is building the fix, quantum resilient data protection that starts at the source.

Futures at a Glance📈

Futures are edging higher as traders line up for the delayed January jobs report on Wednesday. After a choppy session where tech sagged and the Dow still tagged a fresh record, the next mood swing likely comes from payrolls, revisions, and anything that changes the rate narrative. CPI on Friday is the next big speed bump.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings (Premarket):

• McDonald's Corporation [MCD]

• T-Mobile US, Inc. [TMUS]

• TotalEnergies SE [TTE]

• Shopify Inc. [SHOP]

• NetEase, Inc. [NTES]

• Vertiv Holdings, LLC [VRT]

Earnings (Aftermarket):

• Cisco Systems, Inc. [CSCO]

• AppLovin Corporation [APP]

• Equinix, Inc. [EQIX]

• Williams Companies, Inc. (The) [WMB]

Economic Reports:

• U.S. employment report (Jan): 8:30 am

• U.S. unemployment rate (Jan): 8:30 am

• U.S. hourly wages (Jan): 8:30 am

• Hourly wages year over year: 8:30 am

• Kansas City Fed President Jeff Schmid speaks: 10:10 am

• Monthly U.S. federal budget: 2:00 pm

Communication Services

Alphabet Sells a 100 Year IOU and Wall Street Checks the Fine Print

Alphabet Inc. (NASDAQ: GOOGL) just did something very un-tech: it went old-school and sold a 100-year bond to help fund its AI spending spree. Yes, a century. That is not a loan, that is a family heirloom with interest.

The vibe here is simple. The AI buildout is getting so big that even the cash kings are tapping the bond market, and investors are happy to lend as long as the story stays solid. The catch is this kind of super-long debt screams confidence, but it also puts a spotlight on one question: show me the returns.

For you, the move is not to overthink the bond mechanics. Treat this as a sentiment tell. If the market stays cool with Big Tech spending, you can stay in the trend. If the tape starts punishing capex again, you want a plan before the next headline hits.

My Take For You: If you own it, hold but trim a little on strong pops. If you do not, start small on dips instead of chasing green candles.

My Verdict: Still a core-quality name, but respect the spending cycle and keep your sizing sane.

Technology

Cloudflare Just Beat the Bouncer and Walked Into the After Hours Party

Cloudflare Inc. (NYSE: NET) dropped a better-than-feared quarter, and the stock promptly did what it loves to do: sprint in after-hours like it heard there are free appetizers. Earnings and revenue beat, guidance leaned confident, and the market rewarded it with a big smile.

The fun part is Cloudflare sells a story investors want to believe: more internet traffic, more security needs, more AI stuff running through the pipes. The not-fun part is the stock is still priced like it drinks espresso for breakfast. When expectations are high, the smallest hiccup can turn applause into tomatoes.

Your play is to avoid getting emotionally attached to the first pop. Let the reaction settle, then decide if this move is holding because buyers are real, not just hyped. If it can stay firm after the confetti falls, that is when it becomes interesting.

My Take For You: If you are not in, wait for a pullback and start small. If you are in, consider taking some off into strength and ride the rest with a stop line.

My Verdict: High-quality growth story, but trade the entry. Great company, spicy stock.

Rare Strategy (Sponsored)

It wasn't stocks. It wasn't real estate.

It was a little-known investment vehicle that turned Mitt Romney's $450,000 into as much as $100 million and Peter Thiel used to turn $2,000 into $5 billion within two decades.

Now, thanks to a new executive order, regular Americans can access the same type of investment.

Get more details here

Technology

Lattice Semiconductor Just Hit The Beat and Hit The Gas

Lattice Semiconductor Corp. (NASDAQ: LSCC) dropped results that were good enough to wake the stock up, and after-hours it bolted higher like someone yelled free guac. That kind of move usually means the report did what traders wanted: reduce worry and give the bulls something to point at.

The bigger takeaway is not the single quarter, it is the mood shift. When a stock jumps double digits after-hours, the market is basically saying, fine, we believe you again, at least for tonight. But these moves can be like a sugar rush. The real test is whether it holds up once the regular session opens and the grown-ups start pricing it.

For you, the plan is not to chase the first fireworks. If it holds most of the gain into the open and trades steady, you can start a small position. If it fades fast, let it cool and look for a better entry later in the week.

My Take For You: Starter buy only if it holds the pop. No chase.

My Verdict: Momentum-friendly setup, but you want confirmation in regular hours.

Poll: Which is harder to mentally recover from?

Movers and Shakers

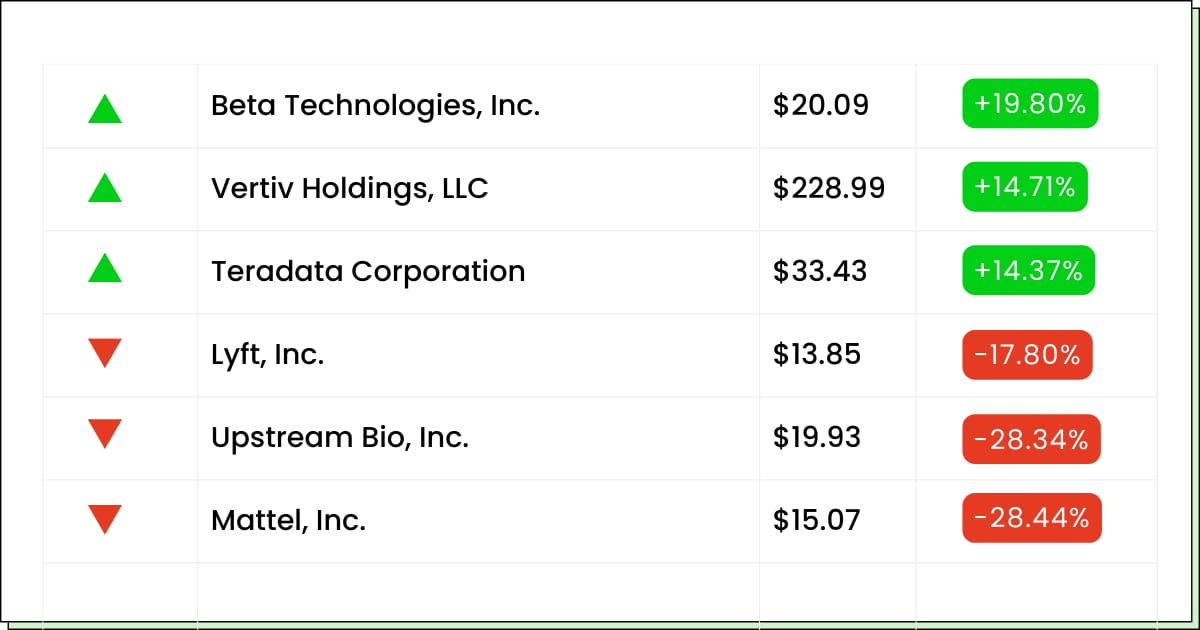

Vertiv Holdings Co [VRT]: Premarket Move: +14%

Data centers are still spending, and Vertiv basically just said the party isn’t over. The quarter was a little messy, but the outlook showed up looking sharp, and that’s what the market is buying.

Big gap days can get slippery fast, though. It can rip, dip, then decide who gets lunch money.

My Take: Don’t chase the open. If you’re not in, wait for a pullback. If you are, skim some gains and keep a tight leash.

Teradata Corp [TDC]: Premarket Move: +14%

Teradata pulled the beat-and-raise move and the stock’s acting like it found a bonus paycheck. Better numbers, better guide, and suddenly everyone remembers this thing exists.

Still, one good quarter doesn’t erase the longer funk. This is more improving than invincible.

My Take: Buy small only if it holds the gap after the open. If it fades hard, step aside and wait.

Mattel Inc [MAT]: Premarket Move: −28%

Mattel dropped ugly 2026 guidance and the market hit the eject button. This isn’t a normal dip, it’s investors re-pricing the whole story and the margins.

After a dump like this, bounces can be traps. Catching it early is like grabbing a falling Lego barefoot.

My Take: Don’t touch the open. Wait for it to stabilize near $15-ish. If it can’t hold, stay out. If it bases, nibble small and keep it tactical.

Next Opportunity (Sponsored)

$1,000 in just seven stocks in 2004 could have turned into a million-dollar portfolio today…

Back then… one financial expert begged people to look at Nvidia -- when it was trading at just $1.10!

Now… he’s urging you to look at a new group of seven stocks…

Check this Out (The NEXT Magnificent Seven)

Everything Else

After software got body-slammed by the AI panic, broker stocks are getting side-eyed too, with LPL Financial [LPLA] taking the early punch in this next on deck.

Salesforce employees are urging Marc Benioff to scrap certain ICE-related sales efforts, and the heat is landing right on CRM’s doorstep.

Elon Musk’s xAI just lost another co-founder, and leadership churn like that is rarely the vibe you want in a momentum name as Jimmy Ba departs.

ByteDance is reportedly exploring AI chip talks with Samsung, which is a reminder that big platforms want their own silicon, not just more cloud credits.

Telegram is staring at more fines in Russia, adding another layer of geopolitical lag to your group chats as regulators circle.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.