Good Afternoon!

Hey, everyone. It's Adam from Elite Trade Club.

Here’s what moved the market today.

Technology

This Nasdaq-listed company is redefining AI in the $124 billion smart glass market.

From cockpit shading systems to energy-efficient building glass, their technology powers global leaders like Boeing, Mercedes-Benz, and National Geographic.

Their projected $240M revenue from aerospace positions them as an AI-driven market disruptor you can’t ignore.

Markets 📈

The market started off the week on a strong note, elevating several U.S. indexes. The Russell 2K small-cap index performed the best, earning 1.8% on the day.

DJIA [+1.24%]

S&P 500 [+0.88%]

Nasdaq [+0.63%]

Russell 2K [+1.80%]

Market-Moving News 📈

Software

MicroStrategy Expands Bitcoin Holdings With Aggressive Growth Strategy

Bitcoin acquisition. The company, known for its shift from enterprise software to a cryptocurrency-focused approach, continues to build its Bitcoin holdings as part of its long-term strategy.

The latest purchase extends MicroStrategy’s streak of weekly Bitcoin acquisitions, solidifying its position as one of the largest corporate holders of the digital asset. With these consistent additions, the company now owns a significant portion of the total Bitcoin supply, further emphasizing its commitment to cryptocurrency as a core asset.

To fund these acquisitions, MicroStrategy has utilized a combination of stock sales and convertible debt offerings. This strategy aligns with its broader capital-raising goals, which are designed to support its ambitious Bitcoin accumulation plan through the coming years.

The company is also preparing for a key shareholder vote on a substantial increase in its authorized share count, a move that could pave the way for even greater flexibility in financing its crypto initiatives.

As the regulatory and market landscape for cryptocurrency evolves, MicroStrategy remains at the forefront of corporate Bitcoin adoption, leveraging its resources to navigate this dynamic space.

Electric Vehicles

Tesla Shares Fall After EV Policy Changes Under New Administration

Tesla shares took a hit on Tuesday, reversing earlier gains as policy changes under the new administration raised concerns for the electric vehicle sector. On his first day in office, the president repealed several measures enacted by the previous administration, including a policy aiming for half of new U.S. cars to be electric by 2030.

The move sent ripples through the EV industry, with Tesla's stock dropping alongside declines in other prominent electric vehicle makers. In contrast, traditional automakers saw gains, reflecting shifting market sentiment following the announcement.

The administration also called for a review of government support for EVs, including tax credits and subsidies designed to promote clean energy adoption. This development could challenge the growth trajectory of the sector, which has benefited from years of supportive policies. While some industry leaders remain optimistic about their ability to adapt, others are expressing concerns about how these changes could impact consumer demand.

Despite the recent drop, Tesla’s stock has seen significant growth since the election, buoyed by broader market trends. Investors will now watch closely to see how the company and the broader EV industry navigate the evolving regulatory landscape.

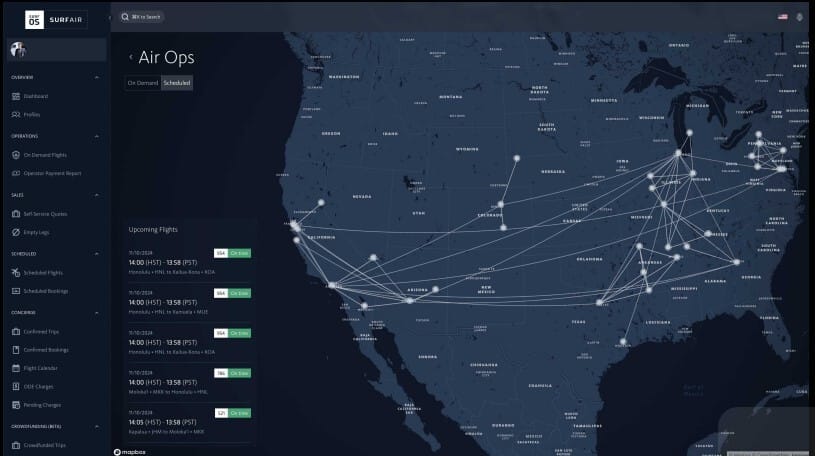

Aviation

Looking for the next big EV opportunity?

The market is expanding rapidly, and one stock is standing out with its innovative approach and strong industry partnerships.

Find out more about this potential game-changer.

Get a full report here.

Construction

D.R. Horton Sees Earnings Boost as Housing Demand Strategies Pay Off

D.R. Horton, the nation’s largest homebuilder, has seen a positive response from the market following the release of its first-quarter fiscal 2025 results. The company surpassed expectations for both earnings and revenue, driven by strategies aimed at addressing affordability concerns in the housing market.

While revenue experienced a slight year-over-year decline, the results highlighted the impact of incentives like mortgage rate adjustments, which have helped improve accessibility for buyers. To further meet shifting market demands, the company has focused on offering homes with smaller floor plans, providing more affordable options for potential homeowners.

D.R. Horton also revealed plans to increase its stock repurchase program, reflecting confidence in its financial position and long-term strategy. The updated buyback outlook underscores the company's efforts to return value to shareholders while navigating a challenging housing environment.

Despite the positive momentum from the latest earnings announcement, the company’s shares remain slightly down over the past year. However, with favorable demographics supporting housing demand, D.R. Horton continues to adapt its approach to meet market conditions effectively.

Top Winners and Losers 🔥

Redwire Corporation [RDW] $22.33 (+51.39%)

Redwire announced its acquisition of Edge Autonomy, a leading provider in uncrewed airborne systems.

Rigetti Computing Inc [RGTI] $13.98 (+42.22%)

Rigetti Computing is still in the spotlight as the Trump administration’s first moves highlight AI.

Tempus AI Inc [TEM] $47.64 (+35.53%)

Tempus AI jumped today after the launch of its personal health app.

FTAI Aviation Ltd [FTAI] $83.79 (-25.44%)

FTAI Aviation fell further after the company shared additional information surrounding concerns in Muddy Waters’s short report.

New Oriental Education & Technology Group [EDU] $46.71 (-23.25%)

New Oriental lost ground despite a positive Q2 earnings report, indicating investors aren’t happy with the company’s direction.

Walgreens Boots Alliance Inc [WBA] $11.37 (-9.19%)

Walgreens is in hot water with the DOJ’s lawsuit alleging millions of illegal prescriptions.

iGaming

The iGaming market is rewriting the rules, with New Jersey hitting $2.4B in revenue last year.

One company stands out, delivering $2.13 for every $1 spent and expanding into lucrative markets.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.