An AI-hungry database titan just flunked a tiny revenue test and wiped double digits off the chart. We’ll map out when this pullback may turn into a starter-buy setup versus when to treat it as a warning shot and wait for cleaner growth and debt signals.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

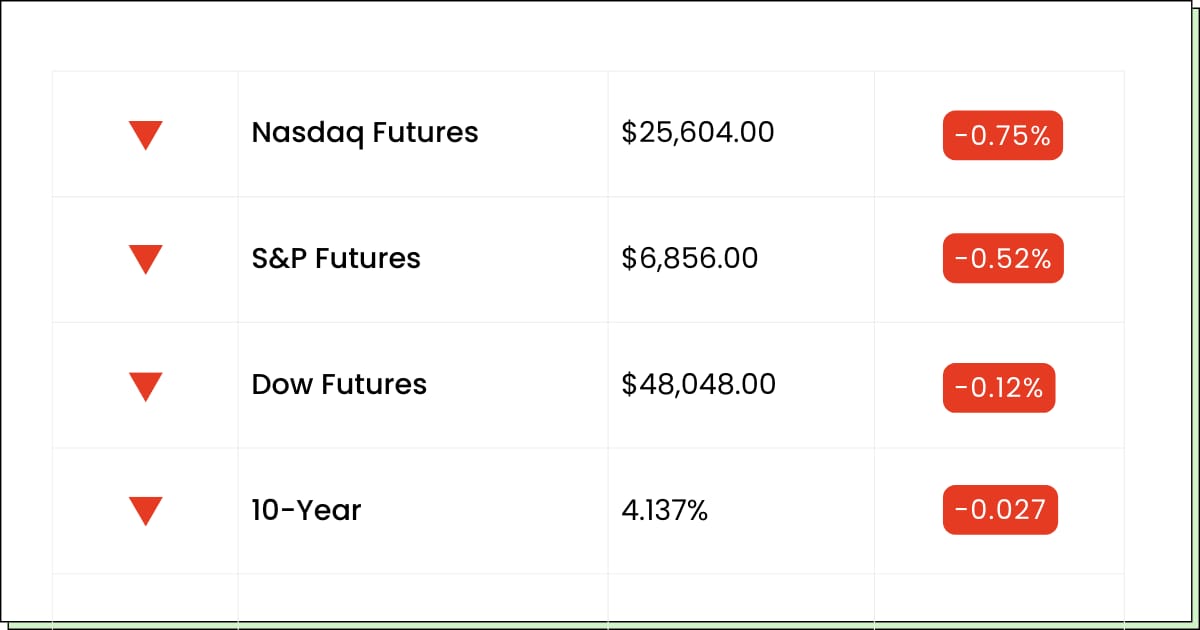

Futures at a Glance📈

Futures are wobbling as traders nurse an AI hangover after yesterday’s rate-cut sugar high. The big takeaway: small caps are still feeling the love from cheaper money, but the broader market is shifting into prove it mode while everyone waits to see whether lower rates can outrun sticky inflation and a choppier earnings tape.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Ciena Corporation [CIEN]

Manchester United [MANU]

Aftermarket Earnings:

Broadcom [AVGO]

Costco [COST]

Lululemon Athletica [LULU]

Netskope [NTSK]

RH [RH]

Economic Reports:

Initial jobless claims (Dec. 6): 8:30 am

U.S. trade deficit (Sept): 8:30 am

Tech / Space

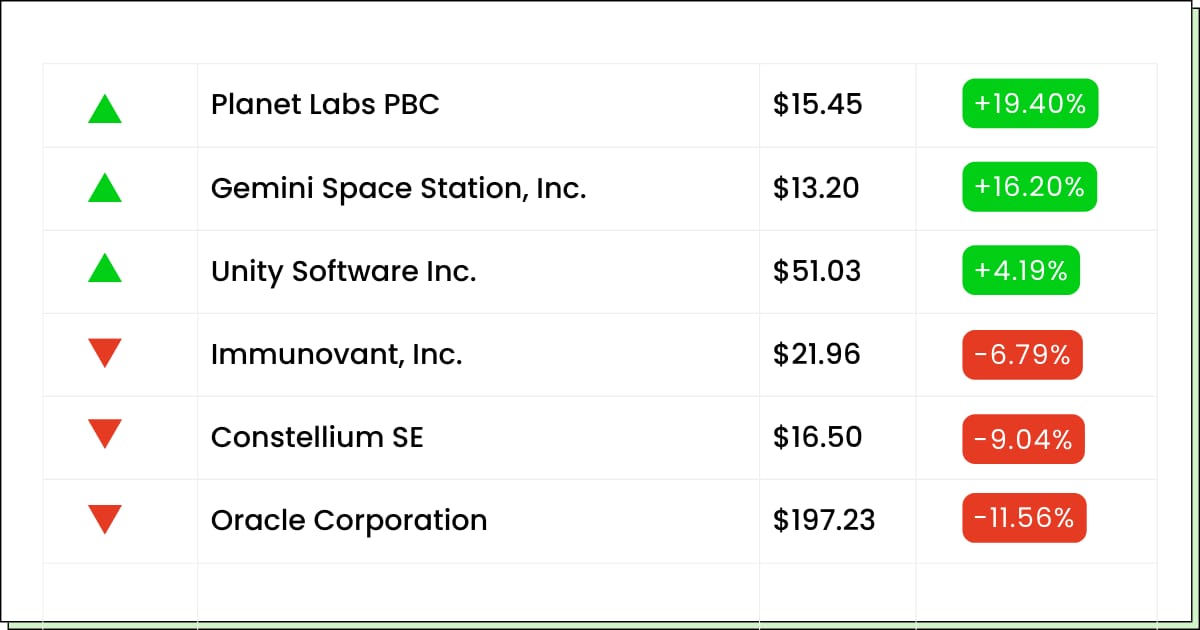

Planet Labs PBC Is Turning Satellite Pics Into Real Money

Planet Labs PBC (NYSE: PL) just posted one of those “oh wow, this might actually be a business” quarters, with revenue cruising past forecasts and the backlog looking like a packed airport runway. The story here is more governments and companies want eyes in the sky, and Planet keeps selling subscriptions to that bird’s-eye feed.

The stock has already had a huge year, and moves like this earnings beat are how you go from speculative space play to growth story. Just remember, it’s still tied to budgets, contracts, and the occasional launch delay, so it won’t trade like a sleepy blue chip anytime soon.

If you’re thinking in plain terms, this is a selling-data-from-space business that’s finally showing it can get paid steadily for it. That’s great, but big expectations can turn on a dime if guidance cools or deals slip.

My Take For You: If you’re new, look for a calmer entry after the excitement fades rather than chasing a big pop. If you’re already in, consider shaving a little on strength and riding the rest with a clear “I’m out if it breaks X” line in your head.

My Verdict: Solid growth story with real traction, but still a growth basket name, not a core holding. Fun for a small position if you’re okay with headline swings and launch-schedule drama.

Aerospace & Defense

Firefly Aerospace Is A Reminder That Not Every Rocket Goes Straight Up

Firefly Aerospace Inc (NASDAQ: FLY) came out of the IPO gate like a fireworks finale, then spent the rest of the year teaching investors what gravity feels like. The business isn’t dead by any stretch, but the stock chart looks like a launch, a stall, and then a long, slow drift back toward earth.

The good news is that if you didn’t chase that first-day hype, you’re now looking at the same company at a deep discount. The bad news is that the story still has plenty to prove: execution, contracts, and cash burn all matter a lot more once the confetti is swept up. Space is cool; steady returns are cooler.

So the real question here is whether you see a future rocket factory or just another space SPAC-adjacent cautionary tale. Until Firefly stacks a few boring, successful quarters in a row, the stock is going to trade more like a story than a spreadsheet.

My Take For You: If you’re curious, treat it like a speculative lottery ticket, not a retirement plan. Start tiny, only with money you’re okay watching wobble, and wait for actual business milestones before adding. If you bought early and are stuck, use bounces to lighten up.

My Verdict: High-risk, high-sci-fi. Keep it on the watchlist or as a very small side bet only if you genuinely enjoy volatility and cliffhanger earnings calls.

Emerging Strength Ahead (Sponsored)

A powerful shift in America’s AI landscape is underway and a new group of companies is positioned to benefit.

A free report reveals 9 AI-driven operations showing strong revenue trends and real domestic expansion.

These picks come from sectors seeing faster adoption, lighter regulatory pressure and growing infrastructure demand.

Investors watching early indicators may find the timing advantageous.

Get the Free Report

Technology

Oracle’s AI Party Just Got A Reality Check

Oracle Corp (NYSE: ORCL) spent the year telling everyone it was building an AI empire, but one soft revenue print and suddenly the market remembered this is still a business, not just a buzzword.

A tiny miss versus expectations was enough to knock the stock down hard and drag half the AI neighborhood with it. When you’re priced like a future king, even a small stumble looks like a face-plant.

Under the hood, demand for AI infrastructure still looks strong, but the bill for all those data centers and big-ticket projects is huge.

Investors are now asking the obvious question: are we getting paid fast enough for all this spending, or are we just funding a very expensive science fair? Until the answers feel clearer, every update is going to come with drama.

Think of it this way. The long-term AI story might still be intact, but the stock just got reminded that story and timing are not the same thing. That’s how you go from crowd favorite to “prove it to me” in one earnings call.

My Take For You: If you’re on the sidelines, this kind of flush is where you make a watchlist. Let it settle, listen for how management talks about returns on all that AI spend, and consider only a starter position if the next quarter shows progress, not just promises. If you’re already long, don’t panic-sell at the lows, but be honest about size.

My Verdict: Still a heavyweight in the AI arms race, but now firmly in show me territory. Reasonable as a measured position in a diversified tech mix, not something you overweight and forget about.

Poll: When prices rise, you’re most likely to…

Movers and Shakers

Unity Software [U]: Premarket Move: +4%

Unity’s comeback tour rolls on. After a year of layoffs and drama, it’s printing fresh 52-week highs and adding more green thanks to better cash flow and that Epic Games tie-up.

Just know it still trades like a boss fight on hard mode, fun until your P&L bar vanishes.

My Take: Starter size only and trim into big pops. New money should treat dips as maybe entries, not automatic buys.

Immunovant [IMVT]: Premarket Move: −7%

Biotech classic: big equity raise, big mood swing. The company’s loading up $550M to push its lead drug toward launch, but the market’s pouting over dilution.

Great runway, grumpy chart.

My Take: If you’re new, wait for the financing dust to settle. If you’re in, cut to a size you can forget about while the trial story plays out.

Coherent Corp [COHR]: Premarket Move: −4%

After nearly doubling this year on AI data-center hype, Coherent is finally exhaling. Analysts are still slapping on higher targets, but at these levels, even tiny jitters feel like turbulence.

My Take: Think slow nibble, not truck-backing. Lock in some gains if you’ve ridden the run, and use red days to rebalance, not to go all-in.

Watch Before Spike (Sponsored)

Imagine doubling your portfolio faster than expected.

This exclusive 5-stock report spotlights companies that experts believe could gain +100% or more in the coming months.

Each pick combines strong earnings trends, accelerating demand, and strategic positioning — the kind of mix that often precedes major price moves.

Previous lists from this same research team uncovered winners with gains up to +673%.¹

Access the latest report free until midnight before it’s taken down.

[Unlock the Free 5 Stocks Set to Double Report Now]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Everything Else

The U.S.–China AI talent race is turning into an arms race for brains, chips, and electricity, with both sides trying to corner the future of computing power.

Google’s DeepMind is setting up a UK automated research lab, betting that letting AI run more of the experiments will speed up breakthroughs (and maybe patents) far faster than human coffee breaks.

A new AI defense boom in Europe has startups in the U.K. and Germany pitching smarter drones, sensors, and software while regulators sprint to keep up.

A chorus of big names is split on whether we’re in an AI bubble already, but most still admit they’re staying in the trade until the music actually stops.

Telecom giant ZTE’s potential $1B+ U.S. payout over bribery allegations is a reminder that compliance budgets can look cheap compared with the cost of getting caught.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.