After its first clean profit and an upbeat outlook, the office-bot story finally matches the slide deck. The game plan is a starter buy on the post-earnings glow, then only average up if new deals and cash flow stay on script, with a clear exit line if guidance cools.

Avoid Painful Mistakes (Sponsored)

Before multiple market surges took off, one trader’s trusted indicator lit up and those who followed it had a chance to act early.

It’s a straightforward signal that shows clear buy and sell moments, without complicated software or guesswork.

After relying on it for decades, he’s finally making it available for free.

Most investors will hear about it long after it works.

Get the indicator now while the window is still open.

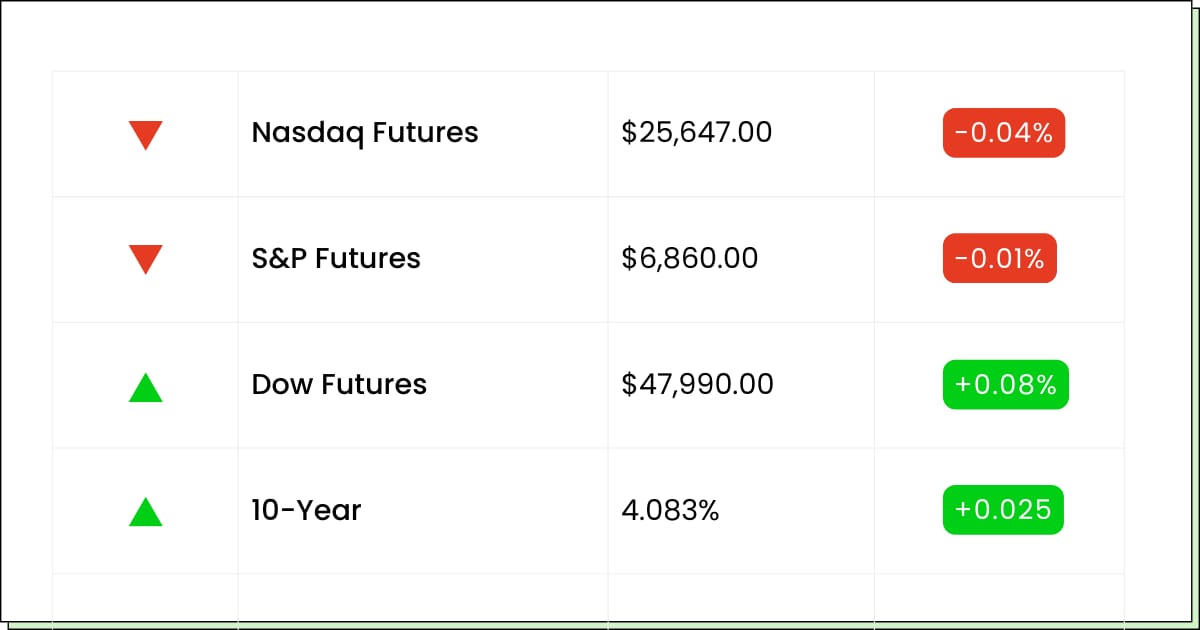

Futures at a Glance📈

Futures are basically treading water this morning, but the mood is tilting more dovish as traders latch onto weaker jobs data as fuel for a December rate cut. Big Tech is still wobbling while money tiptoes into more defensive corners of the market. Today’s jobless claims and layoff numbers are the next checkpoints, with tariff noise from D.C. humming in the background.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Toronto-Dominion Bank [TD]

Bank of Montreal [BMO]

Canadian Imperial Bank of Commerce [CM]

Kroger [KR]

Dollar General [DG]

Aftermarket Earnings:

Hewlett Packard Enterprise [HPE]

Ulta Beauty [ULTA]

Samsara [IOT]

The Cooper Companies [COO]

Economic Reports:

Initial jobless claims (week of Nov. 29): 8:30 am

Fed Vice Chair for Supervision Michelle Bowman speaks: 12:00 pm

Software & Cloud

Salesforce Tries To Sell Wall Street On Its Comeback Story

Salesforce Inc (NYSE: CRM) finally showed up with a tidy earnings beat and a better revenue guide, like the student who bombs a midterm then nails the group project. The AI helper suite is starting to actually pay rent, with Agentforce turning into a real line of business instead of just a slide on the conference deck.

The market gave it a polite nod, not a standing ovation, which tells you trust still needs rebuilding. Big picture, this is a show me phase. The company is telling a big story about automating sales emails, support tickets, and IT requests while layering in acquisitions to stay relevant.

That is great on paper, but the stock has been in the penalty box all year and investors are still side-eyeing anything that sounds like an AI buzzword. The turnaround is less about one quarter and more about proving that customers keep signing up and actually use the new tools.

If you strip out the noise, the setup is pretty simple: a former market darling, beaten up, now walking back toward the main stage with slightly better posture. You do not have to decide today if it will reclaim its old glory, you just have to decide how much of your portfolio you want tied to that rehab story.

My Take For You: If you are new, a small starter position on red days makes more sense than chasing green candles. If you are already in, this is a “tight leash” situation: trim into strength and demand a few more quarters of steady progress before you size up again.

My Verdict: Watch-list and nibble only. It can grow back into a leader, but it still has to prove that AI is a real engine, not just a shiny sticker on a mature software machine.

Biotech

Anbio Biotech Is Trading Like It Found Magic Beans

Anbio Biotechnology (NASDAQ: NNNN) has been trading like someone slipped fairy dust into the lab fridge, with the stock up several hundred percent this year and now every small-cap screen lighting up with its name.

Underneath the fireworks, you still have a real business, a decent profitability metric, and the rare sight of a biotech that is not drowning in debt. That is the part fundamentals people quietly like.

The other part is pure good feelings. Moves this big attract day traders, short sellers, and everyone in between, which means the price can swing like a door in a windstorm on even tiny bits of news.

Articles are suddenly dissecting return on equity and capital efficiency as if that alone explains why the chart goes almost straight up. Spoiler: it does not. At this speed, emotion and momentum are in the driver’s seat, not spreadsheets.

For you, the risk is confusing a hot streak with a safety net. High returns can keep you in a name long after the easy money is gone, just because it feels wrong to walk away. That is when one bad headline or a cold day for small caps can erase weeks of gains in a handful of ticks.

My Take For You: If you are just curious, this belongs in your fun money bucket only. Think tiny position, pre-defined exit, and zero expectation that the rocket goes on forever.

My Verdict: High-octane lotto ticket. Fine for a very small speculative slice if you can handle whiplash, but not a core holding unless you enjoy checking quotes way more than is healthy.

Rapid Strength Rising (Sponsored)

A comprehensive review just revealed the 5 Stocks Set to Double, highlighting companies showing unusual early strength.

These stocks carry characteristics that often precede powerful market advances.

Previous research highlighted stocks achieving +175 percent, +498 percent, and +673 percent.¹

The full list is available for free until midnight.

Claim the 5 Stocks Set to Double Report. Free Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Automation & AI

UiPath’s Robot Intern Just Got Its First Real Paycheck

UiPath Inc (NYSE: PATH) finally had the “I pay my own way now” moment, posting its first profitable quarter and reminding everyone that automation is not just a cool demo, it can actually show up in the income statement.

Revenue grew at a steady clip, guidance looked solid, and the stock gave a little victory lap as traders realized this robot intern might actually be promotion material.

On the ground, the story is simple: companies are tired of people doing copy-paste work, and UiPath is selling the software that does the clicking, filing, and follow-ups without asking for vacation days.

Layer in the buzz around agentic AI and digital coworkers and you get a narrative that is easy for executives to pitch and for investors to understand. The catch is that the whole automation crowd is getting more crowded, and expectations tend to run hot whenever AI is in the mix.

For you, the trick is not falling for straight-line thinking. One good quarter does not mean every report will look this clean, and management is already hinting that AI features will take time to really move the needle. The business looks healthier, but this is still a growth name that can wobble if the macro, budgets, or hype cycle cool off.

My Take For You: If you have been watching from the sidelines, this is a decent moment to consider a starter position and then add only if they string together a few more quarters of smooth execution. If you are already long, you can hold and use pullbacks to rebalance.

My Verdict: Promising automation player, good enough for a moderate allocation if you are comfortable with growth risk. Treat it like a long-term “robots doing the boring stuff” bet, not a guaranteed straight line up.

Poll: What’s your biggest financial pet peeve?

Movers and Shakers

Diginex Ltd [DGNX]: Premarket Move: +5%

This one’s riding the ESG wave after signing an MOU to buy an AI carbon-accounting platform used by big-name corporates. The pitch is to become a one-stop compliance-and-carbon dashboard for every nervous board.

It’s a cool story, but remember nonbinding and early stage live here too, and this thing has already gone from penny stock to double digits.

My Take: Treat it as spicy, not staple. Small buy only, take profits on big pops, and step aside if the deal drags or customer wins stop showing up.

Snowflake Inc [SNOW]: Premarket Move: −9%

Classic growth-stock move. Beat the quarter, underwhelm the dream. Numbers were fine, but guidance didn’t scream acceleration, so a richly priced favorite is getting its expectations trimmed.

The data and AI story is still there; this is more about resetting “too high” hopes than a broken business.

My Take: If you’ve been waiting, this kind of pullback can be your entry to scale in slowly. If you’re long, avoid panic-selling the first flush and decide in advance where you’d cut if the bounce never shows.

Symbotic Inc [SYM]: Premarket Move: −12%

Yesterday it was partying on a big stock offering to fuel more warehouse robots; today the market remembers offerings mean dilution and is handing out a reality check. The growth story is intact, the price just needs a breather.

High-flyer automation names do this: sprint on headlines, then drop a floor or two when the bill shows up.

My Take: New money should wait for the dust to settle and look for a base, not a free fall. Existing holders should keep positions modest and plan to trim into future strength instead of trying to surf every swing.

Exclusive Trend Alert (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list for free.

Access the “7 Best Stocks for the Next 30 Days” now.

Everything Else

Nvidia’s chief used his White House time to talk chip controls with Trump and warn that overdoing regulation could slow AI just as the U.S. is pulling ahead.

Airbus trimmed its 2025 handover plans as A320 fuselage checks bite, a reminder that supply chains still love throwing wrenches into the bull case for travel.

Macro investor Scott Bessent argued the U.S. could still mimic today’s tariff playbook even if a key Supreme Court ruling goes against it, keeping trade-policy risk firmly on the table for 2026.

Taiwan moved to ban China’s Xiaohongshu app for a year over fraud worries, another sign that national-security and consumer-protection fears are redrawing the social-media map.

Brussels is reportedly lining up an antitrust case into how Meta uses WhatsApp data to train its AI, adding fresh regulatory fog to Big Tech’s race for smarter models.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.