With South America sold off, this company finally looks more like a focused repair job than a global juggling act. That makes it a dip-only name, so hold if you’re already in, buy on pullbacks if you trust the 2026 growth story, and skip it entirely if you hate drama.

Fast Growing Interest (Sponsored)

He remembers what it was like second-guessing every trade, missing the right moments.

That changed when he developed one indicator that simplified everything.

For 30 years, it helped him know exactly when to get in and when to step aside.

Now, he’s giving that same signal away for free, because he believes every investor deserves a fair shot at trading success.

This isn’t guesswork. It’s clarity.

[Unlock the free indicator today]

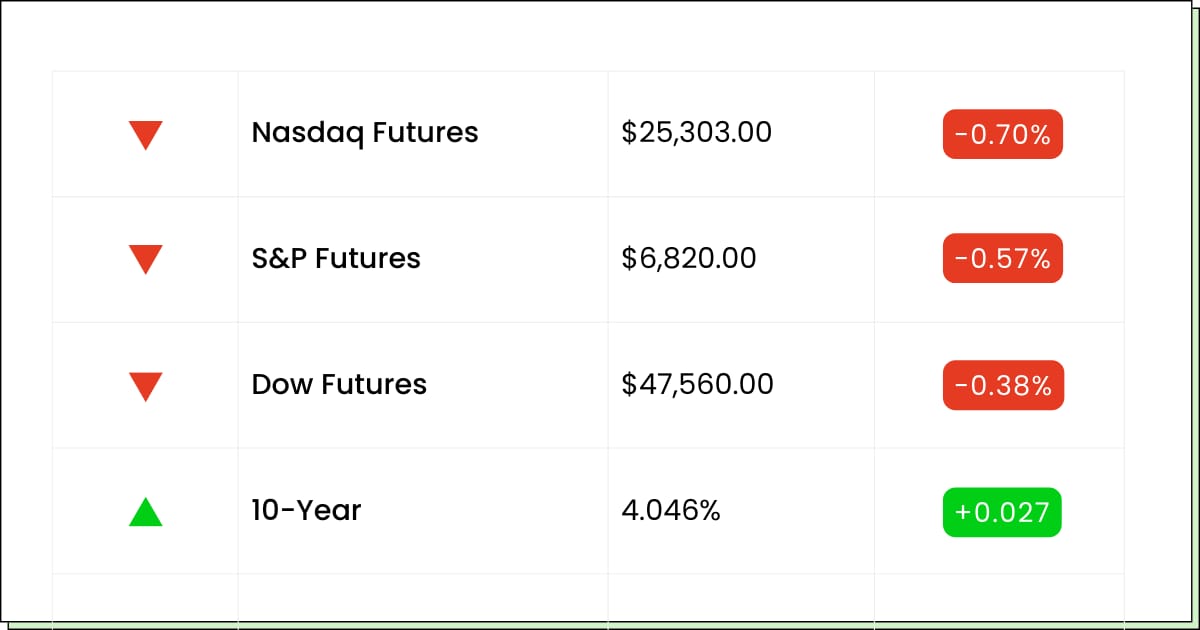

Futures at a Glance📈

Futures are slipping to start December as crypto stumbles and the big AI darlings take a breather together. Chip names and high-flyer tech are leaning red, but last week’s rip higher and December’s usual “Santa shows up eventually” seasonality still have dip-buyers lurking.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Hafnia [HAFN]

Aftermarket Earnings:

Credo Technology Group [CRDO]

MongoDB [MDB]

Vestis [VSTS]

Simulations Plus [SLP]

Economic Reports:

S&P final U.S. manufacturing PMI (Nov): 9:45 am

ISM manufacturing (Nov): 10:00 am

Fed Chair Powell speaks: 8:00 pm

Consumer & E-Commerce

Coupang’s Trust Fall Comes At The Worst Time

Coupang Inc (NYSE: CPNG) just managed the nightmare combo of a massive data leak and a mostly invisible founder, and shoppers in Korea are not thrilled. When 33-plus million customers see their info spill out, it stops feeling like a fun delivery app and starts feeling like a group chat you forgot to lock.

The governance twist — a boss with supercharged voting power and low face time — just adds extra spice to the frustration.

The real risk here is not just fines or hearings, it is trust. If people feel the company treats workers like widgets and data like confetti, they will happily tap into another app with next-day shipping and fewer headaches. That is the kind of slow burn that does not show up in one quarter, but can drag on a stock for years.

For us, this is one of those moments where the story matters as much as the numbers. You want to see clear fixes, a real apology from the actual decision-maker, and visible spending on security and culture, not just more lobbyists and PR.

My Take For You: If you are already in, keep your position small and wait to see how customers and regulators react before adding. If you are on the sidelines, treat every bounce as a chance to watch the fallout, not rush in.

My Verdict: Governance soap opera on top of a good business. Watch-list only until you see real accountability, not just faster deliveries.

Mining

Hecla The Silver Company Is Shining Like It Just Found Gold

Hecla Mining Co (NYSE: HL) has been acting like it found a cheat code, with growth scores, price targets, and silver hype all lining up at once. The stock has ripped this year, and now every screener that looks for fast growth and shiny momentum is circling it like moths around a campfire.

That is fun while it lasts, but you do not need a PhD in mining to know parabolic charts do not climb forever.

Under the hood, the story is simple: rising metals prices, better use of assets, and analysts suddenly remembering the company exists. Add in talk of big jumps in earnings and sales, and you get the classic cocktail of FOMO plus a very crowded trade. Great while the music is playing, brutal if silver cools, or the next report is just okay instead of amazing.

This is more roller coaster than savings bond. If you play it, you are signing up for days where the stock moves more than your entire portfolio used to. That can work in your favor, but only if you are disciplined about when to hop on and off.

My Take For You: If you want a taste, think tiny starter position and a clear line where you step out if the glow fades. If you are already up big, skimming some gains into strength is the move.

My Verdict: Momentum miner, not a forever hold. Fun as a side trade if you can handle swings, but do not let it become your main character.

Rapid Strength Rising (Sponsored)

Analysts just revealed their top 5 stock recommendations for 2026.

Each company is backed by solid growth trends, market resilience, and high upside potential.

If you missed the last market run, this could be your next opportunity.

The full report is free for a limited time, claim yours before midnight.

[Get the 5 Outperforming Stocks Report – Free Download]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Health Care

UnitedHealth Is Finally Packing Its Bags Abroad

UnitedHealth Group Inc (NYSE: UNH) has had a year straight out of a stress dream, and now it is selling its last South American business to private equity for a cool billion. That exit from Banmedica closes the book on a long, messy chapter overseas so management can stop juggling hospital networks in Chile and Colombia and refocus on cleaning up the core U.S. story.

When a company is fighting higher medical costs, bad headlines, and a federal probe, fewer side quests is not a bad idea.

The sale does not magically fix everything, but it does remove one more distraction and some risk from the map. Investors have been begging for a simpler, more boring version of this company after earnings misses, leadership shake-ups, and one too many plot twists.

A focused turnaround with a veteran CEO back in the chair is a much easier pitch than a sprawling global empire that keeps surprising you in the wrong ways.

Still, this remains a bruised heavyweight, not a comeback fairy tale… yet. The real tell will be whether 2026 and 2027 growth targets start to look achievable and whether cost surprises finally stop jumping out from behind the curtain.

My Take For You: If you already own it, holding or slowly averaging in on weak days can make sense as long as you are thinking multi-year, not multi-week.

My Verdict: Quality franchise going through rehab. Worth a patient watch and possibly a gradual build, but only if you are comfortable with headline risk and a slow recovery arc.

Which financial era would you most like to time-travel to invest in?

Movers and Shakers

Canadian Solar Inc [CSIQ]: Premarket Move: +15%

China Solar finally got a little sunshine, and this name is catching rays after peers dropped better-than-feared results and sentiment stopped crying in the corner. Toss in its big Aussie battery project going live, and you’ve got a sector darling on a good-hair day.

Just remember, solar can turn from save the planet to save my portfolio real fast when subsidies, pricing, or politics wobble.

My Take: Treat it like a hot rooftop in July: fine to step on briefly, not where you camp out. Starter trade only, take partial profits on pops, and don’t chase if the mood fades.

MARA Holdings Inc [MARA]: Premarket Move: −5%

This one tried to sneak an $850M convertible note offering past the market, and investors immediately did the dilution math and hit the eject button. When your business already lives and dies with bitcoin and energy prices, adding a fat IOU on top doesn’t exactly calm nerves.

It’s still a leveraged chip on crypto and power costs, which is fun when both line up and brutal when they don’t.

My Take: Pure adrenaline name. If you play it, think lotto ticket sizing, use tight stops, and let any sharp bounce pay you fast instead of hanging around for Act II.

Equinox Gold Corp [EQX]: Premarket Move: +3%

Gold bugs are humming again, and analysts keep ratcheting up their earnings estimates, so this miner is getting the “maybe they really figured it out” treatment. The stock’s already had a monster year, and fresh upgrades are basically throwing more logs on the campfire.

But it’s still a miner, which means it moves with metal prices, sentiment, and the occasional oops at the mine site.

My Take: If you want gold exposure with a little turbo, this works, but size it like a side dish, not the main course. Add on dips while gold stays firm, and be ready to trim if the shiny stuff cools off.

Exclusive Trend Alert (Sponsored)

Investors are watching closely as 7 select stocks begin to show signs of short-term strength.

Each one met strict criteria for growth, valuation, and momentum — indicators that have historically pointed to potential breakouts.

The opportunity may be short-lived, so timing is everything.

Review the report now and see which stocks could be poised for strong performance this month.

Click Here for the Free 7 Best Stocks Report

Everything Else

The latest crypto sell-off has bitcoin and ether sliding again, reminding everyone that “number go up” can quickly turn into “where did my gains go.”

A private survey showed China’s factories shrinking in November, keeping the global growth mood a little nervy heading into year-end.

Amazon and Google teamed up on a multicloud link that promises faster data pipes between their platforms, giving big customers one less excuse to postpone cloud experiments.

HSBC is leaning on French AI start-up Mistral to supercharge its generative-AI rollout, turning banking workflows into a fresh test case for homegrown European models.

U.S. shoppers rang up about $11.8 billion in online Black Friday spending, proving that higher rates and tariff chatter haven’t totally killed the urge to tap “add to cart.”

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.