A big acquisition and a confident outlook just pushed this data center helper back into the spotlight. The plan is to use strength to define your risk, open a hold position, and scale only if the next few quarters prove that custom chips and photonics are real revenue drivers.

Fast Growing Interest (Sponsored)

He remembers what it was like second-guessing every trade, missing the right moments.

That changed when he developed one indicator that simplified everything.

For 30 years, it helped him know exactly when to get in and when to step aside.

Now, he’s giving that same signal away for free, because he believes every investor deserves a fair shot at trading success.

This isn’t guesswork. It’s clarity.

[Unlock the free indicator today]

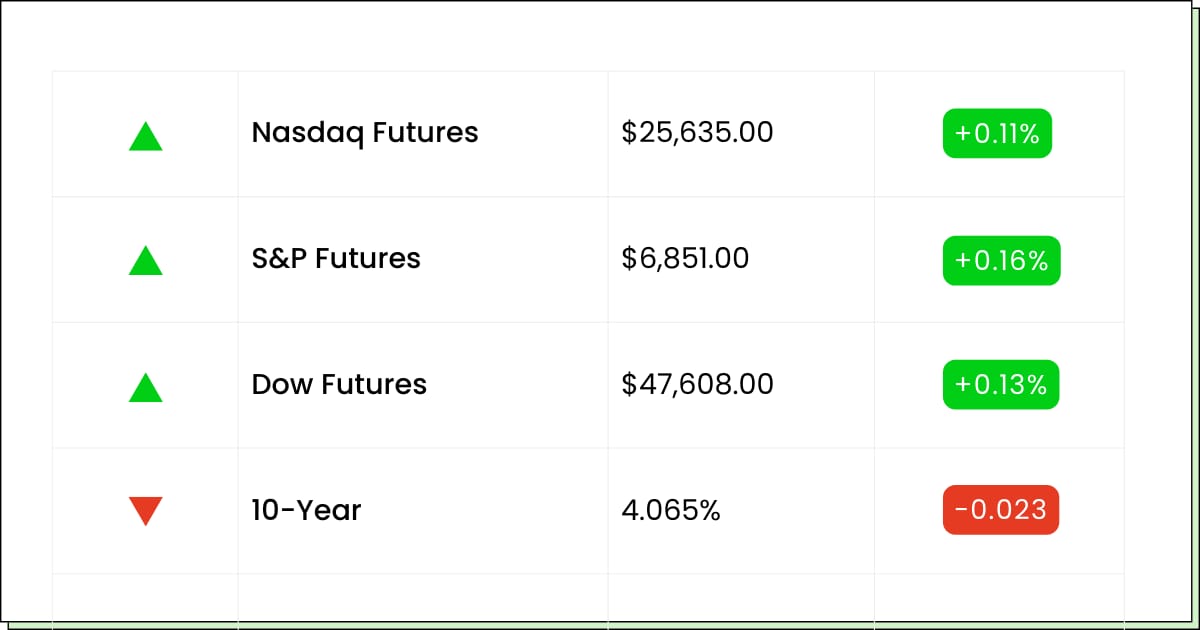

Futures at a Glance📈

Futures are inching higher as bitcoin shakes off yesterday’s nerves and climbs back above the big round numbers, giving risk appetite a little caffeine shot. AI chip and retail names are in focus after upbeat data center talk and holiday-shopping vibes, while traders line up the ADP jobs print and a highly expected Fed rate cut as fuel for a possible year-end rally.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Royal Bank of Canada [RY]

Dollar Tree [DLTR]

Aftermarket Earnings:

Salesforce [CRM]

Snowflake [SNOW]

Guidewire Software [GWRE]

Five Below [FIVE]

HealthEquity [HQY]

Economic Reports:

ADP employment (Nov): 8:15 am

Import price index (Sept, delayed): 8:30 am

Import price index ex-fuel (Sept, delayed): 8:30 am

Industrial production (Sept, delayed): 9:15 am

Capacity utilization (Sept, delayed): 9:15 am

S&P final U.S. services PMI (Nov): 9:45 am

ISM services (Nov): 10:00 am

Cybersecurity

CrowdStrike Tries To Hack Back Into Your Good Graces

Crowdstrike Holdings Inc (NASDAQ: CRWD) just put out a very chipper forecast, pointing to customers happily paying up for its AI-flavored security tools after last year’s ugly outage drama.

The message is that more companies want one dashboard that hunts bad guys for them, and they are still picking this one even after it face-planted on Windows.

For the stock, that kind of growing and fixing it combo is why it has been on a big run this year, even if the chart still has the occasional nerves when people remember grounded planes and frozen hospital systems.

You are basically deciding whether the new AI upgrades and sticky customers matter more than the old scar tissue.

If you want in, this is one where chasing giant green moves is optional. The smarter move is to wait for a wobble, then ease in while watching that management keeps talking about reliability and not just cool new features.

My Take For You: Starter position only, added on pullbacks, and do not be shy about taking a little off on big spikes, so a headline does not wreck your week.

My Verdict: Quality name in a must-have sector, but treat it like a strong growth stock with a history. Great to own in moderation, not a place to bet the mortgage.

Retail

American Eagle Is Betting Your Hoodie Has A Favorite Celebrity

American Eagle Outfitters Inc (NYSE: AEO) is going into the holidays yelling “look at me” with Sydney Sweeney billboards, Travis Kelce collabs, and a big marketing push aimed at teens and slightly richer shoppers.

It is working for now as sales are picking up, the vibe is trending, and Wall Street finally remembered this is more than just another mall store.

The catch is that all that buzz costs money, and the teen closet is still a battlefield where trends flip faster than TikTok sounds. You are basically betting that these campaigns keep hitting and that the brand stays cool when every other retailer is also throwing stars and influencers at Gen Z.

For you, this is less about perfectly timing the quarter and more about whether you believe American Eagle can stay in the “my friends wear this” club for a few more seasons. As long as those collabs keep pulling in traffic, the story can keep working.

My Take For You: If you like the turnaround, a small or medium position you add to on red days makes more sense than chasing every premarket pop. If you already rode the move, skim some gains and let the rest ride into the holidays.

My Verdict: Solid brand with real momentum, but fashion is fickle. Worth owning with guardrails, not treating like a forever stock in your bottom drawer.

Rapid Strength Rising (Sponsored)

A comprehensive review just revealed the 5 Stocks Set to Double, highlighting companies showing unusual early strength.

These stocks carry characteristics that often precede powerful market advances.

Previous research highlighted stocks achieving +175 percent, +498 percent, and +673 percent.¹

The full list is available for free until midnight.

Claim the 5 Stocks Set to Double Report. Free Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Semiconductors

Marvell Tries To Catch The Next AI Wave With A Shiny New Toy

Marvell Technology Inc (NASDAQ: MRVL) just wrote a multibillion-dollar check for Celestial AI and basically told investors, the next leg of the AI party lives here.

The idea is to wire up data centers with fancy light-based connections so chips can talk faster and cooler, which sounds very sci-fi and has Wall Street perking up again after a rough year.

The good news is that this plugs Marvell deeper into the custom chip world for the biggest cloud players and gives it a story that is not just “we sell parts to whoever Nvidia does not grab first.”

The less fun part is that a lot of the payoff is years away, while you still live with the bill, competition, and the risk that AI hype takes a breather just when they finish building the new gear.

So this is a classic growth trade: big upside if the photonics dream and data center demand play out, but you need patience and a stomach for charts that look like rollercoasters. No one is forcing you to guess every tick between now and 2028.

My Take For You: If you want exposure here, think small position now, add only if execution stays on track and the AI buildout keeps showing up in actual orders, not just conference quotes. If you are already long, use this rally to tidy up position size rather than doubling down on excitement.

My Verdict: Interesting way to play the next phase of AI plumbing, but not a sleepy dividend name. Treat it as a higher-risk growth slot and be ready for both big pops and grumpy pullbacks along the way.

Poll: Which budget category is hardest to stick to?

Movers and Shakers

Astera Labs [ALAB]: Premarket Move: +8%

Astera took a 13% faceplant after Amazon talked up a deeper Nvidia link, and suddenly everyone decided the AI party might move without them.

Then the note from Stifel basically said relax, they still get invited, and the stock is trying to bounce off the mat this morning. This is peak AI-whisper-stock behavior: one keynote, ten hot takes, lots of whiplash.

My Take: If you play it, keep it tiny and treat the rebound like a trade, not a long-term play. Quick trims on green, hard stop if it rolls back over.

D-Wave Quantum [QBTS]: Premarket Move: +5%

Quantum hype is back in the group chat, and D-Wave’s riding the future of computing wave again after landing on a fresh list of names to watch.

The story is still very sci-fi: cool tech, real products, but a long road between demo videos and steady cash flows. This is the kind of stock that can double on vibes and then halve on the next reality check.

My Take: Fun for a tiny moonshot. Size it like a lottery ticket, take partial profits on big spikes, and be okay if it goes quiet for a long time.

Pure Storage [PSTG]: Premarket Move: −14%

Pure put up decent revenue but whiffed by a penny on earnings, and Wall Street reacted like someone dropped their favorite hard drive.

After a big run this year, expectations were sky-high, so even a small miss is getting punished while people rethink how much perfection they want to pay for.

My Take: If you have been waiting to start a position, you can slowly buy into this drop as long as the call does not reveal any nasty surprises. If you own it already, apologies but consider trimming only if it cannot stabilize after the first flush rather than panic-selling into the hole.

Exclusive Trend Alert (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list for free.

Access the “7 Best Stocks for the Next 30 Days” now.

Everything Else

Fresh tariff impact warnings are creeping into 2026 outlooks, with some execs hinting that higher import costs could eventually show up as lower headcount.

Europe’s satellite wars are heating up as Starlink rival Eutelsat/OneWeb battles investor nerves and a SoftBank stake shuffle.

European stocks churned through another cautious session, with traders juggling sticky inflation, ECB guesswork, and year-end performance anxiety.

Amazon’s cloud arm is cozying up to Nvidia’s AI chips to build bigger, faster servers, pitching “AI factories” that could make it easier for enterprises to train models.

AI darling Anthropic is quietly laying the legal groundwork for a 2026 IPO, giving investors another mega-cap AI listing to daydream about.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.