This company’s latest update showed steady demand and better cash flow, and management laid out a 2026 growth plan while kicking off a review to boost the share price. If you want the simple way to trade that mix of stability and potential upside, keep reading.

Be Prepared Now (Sponsored)

A veteran trader just revealed the indicator he’s used for more than 30 years to spot major market moves early.

Most traders have never heard of it, yet it continues to flash before big momentum hits.

He says it’s triggering again, and the timing may be critical.

See the free indicator on the next page before the window closes.

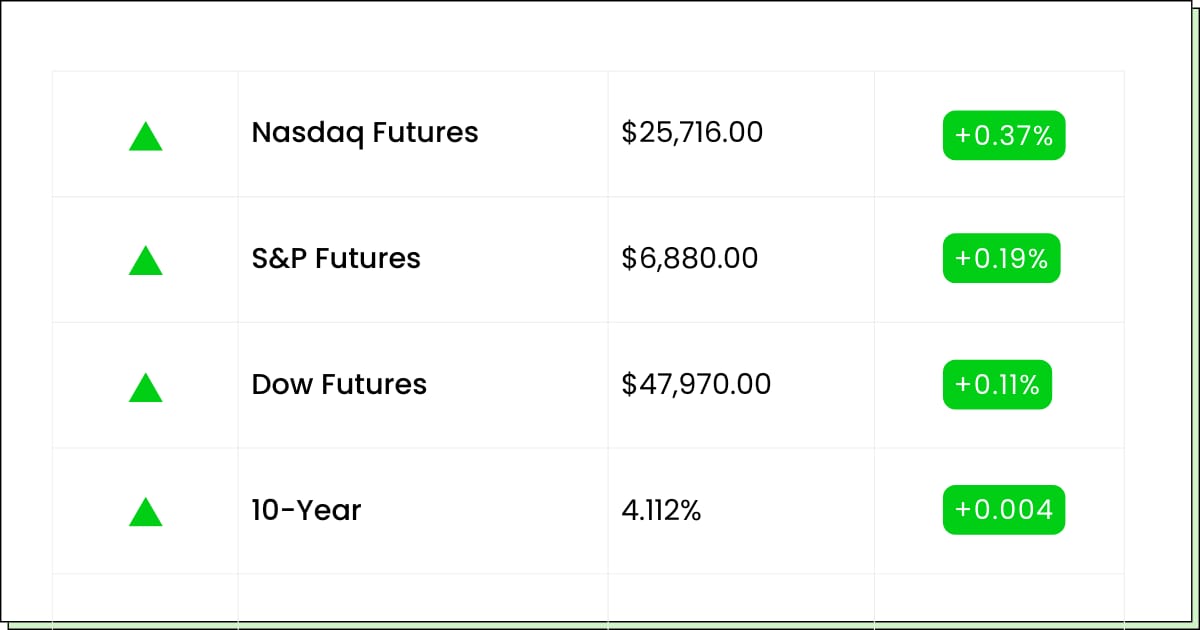

Futures at a Glance📈

Futures are inching higher as traders line up for a fresh read on the Fed’s favorite inflation gauge. A delayed PCE print and a new consumer sentiment check hit before the open, and the bet is that softer hiring plus still-sticky prices keep a December rate cut on the table.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Victoria’s Secret & Co [VSCO]

KNOT Offshore Partners [KNOP]

Tuniu Corporation [TOUR]

MoneyHero Limited [MNY]

Economic Reports:

Personal income (Sept, delayed): 8:30 am

Personal spending (Sept, delayed): 8:30 am

PCE index (Sept, delayed): 8:30 am

PCE index year over year (Sept): 8:30 am

Core PCE index (Sept, delayed): 8:30 am

Core PCE year over year (Sept): 8:30 am

Consumer sentiment, prelim (Dec): 10:00 am

Consumer credit (Oct): 3:00 pm

Technology

Meta Puts The Metaverse On A Diet, and Wall Street Approves

Meta Platforms Inc (NASDAQ: META) (AKA Facebook) popped after word got out that Zuckerberg is eyeing big cuts to the metaverse budget, including potential layoffs. After years of pouring billions into VR headsets and digital legs, the company seems ready to admit that maybe the money printer lives in ads and AI, not cartoon conference rooms.

The market’s basic reaction: “Finally.”

The twist is kind of funny. Meta literally renamed itself for this idea, and now the metaverse unit might be the part that gets sent to the budgeting timeout corner. That signals a more grown-up Meta, focused on things that print cash today while still keeping the sci-fi dreams alive in the background instead of front and center on every slide deck.

For investors, this is less about headsets and more about discipline. Trimming a money-losing side quest frees up room for buybacks, core app investment, and AI tools that advertisers actually care about.

If the cuts stick and user time stays strong across Instagram, Facebook, and WhatsApp, Wall Street will happily pretend the metaverse era was just a phase.

My Take For You: If you’re not in, you can start a small position and add only if they follow through on cutting losses and growing AI ad tools. If you’re already in, use strength to trim a bit and recycle some gains into cheaper names if Big Tech keeps wobbling.

My Verdict: Still a core-quality name, but treat this bounce as a reset, not a victory lap. Green light for a starter or hold, as long as you’re okay riding the headline roller coaster.

Software & Security

Rubrik Finally Shows Up To The Profit Party

Rubrik Inc (NYSE: RBRK) just flipped the script from one day we’ll make money to actually posting a surprise profit, and the market did a double-take. Instead of the usual red ink, the company posted a real positive EPS number and solid growth in subscriptions. This is starting to look less like a science project and more like a grown business.

The story here is simple enough. Companies are drowning in data, ransomware, and AI buzzwords. Rubrik shows up offering to back everything up, secure it, and wrap it in cloud-first packaging. The quarter’s results say customers are buying that story, and cash flow is following, which matters a lot more than any fancy slide about platform journeys.

But this is still an early innings kind of win. One good quarter doesn’t magically turn a volatile, security-adjacent stock into a sleepy utility.

Expectations will creep up, competition isn’t going away, and the bar for AI security claims gets higher every earnings season. You want to see a few more clean quarters before calling it a forever hold.

My Take For You: If you’re new, consider a small starter and only add if they string together more profitable quarters and keep subscription growth humming. If you’re already long, it’s a nice spot to take a little profit.

My Verdict: Interesting up-and-comer, best treated as a focused position rather than a core holding. Fun if you like the security theme, but keep size reasonable and your expectations flexible.

Early Activity Spike (Sponsored)

Five stocks are entering a technical phase that could lead to strong performance if current trends continue.

Key indicators are turning positive, and the market’s early reaction is already showing signs of growing interest.

These developments rarely remain under the radar for long.

See the full analysis before the next move unfolds.

View the Five Picks.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Healthcare

Contact Lens Giant Cooper Is Finally Back In Focus

Cooper Companies Inc (NASDAQ: COO) just delivered the kind of quarter that says steady, not sexy, and the stock is finally getting a little love. Revenue nudged higher, contact lenses and women’s health kept the lights bright, and free cash flow looked solid – even if official earnings per share took a hit from restructuring costs. It’s not fireworks, but it is progress.

The more interesting part is what management is hinting at next. They’re guiding to mid-single-digit sales growth and better earnings in 2026, while also teeing up a strategic review and naming a new board chair.

That combo usually means someone is looking under the hood for ways to slim down, sell pieces, or sharpen focus, all things long-suffering shareholders tend to like.

This isn’t a hype machine stock. It’s the kind of name that quietly benefits from people needing clearer vision and fertility/health services year after year. If the review leads to cleaner margins, tighter operations, or even a break-up story, patient investors may finally get rewarded for sitting through the choppy patches.

My Take For You: If you want something calmer than AI chips, this is a decent candidate for a gradual build, so slip in on weak days, not on big pops. If you already own it, consider holding through the strategic review with a plan to trim if the stock rips.

My Verdict: Boring in a good way. Suitable as a small to midsize core holding for long-term, quality-tilted portfolios, especially if you can ignore the day-to-day noise and wait for the strategy cleanup to play out.

Movers and Shakers

ServiceTitan [TTAN]: Premarket Move: +8%

Home-services software is getting some love again after another strong quarter and a fresh thumbs-up from the analyst crowd. Revenue, usage, and subscriptions are all climbing, which is Wall Street’s way of saying plumbers and HVAC crews are still swiping cards and booking jobs.

Bears who bet on a housing or HVAC slowdown here just got a reminder that leaky pipes don’t care about the macro.

My Take: If you like steady SaaS tied to real-world fixes, a small starter buy on any fade today makes sense, then only add if the uptrend and growth both keep holding.

Ulta Beauty [ULTA]: Premarket Move: +6%

Beauty retail is still main-character energy, and this chain keeps beating the script with better comps, higher earnings, and another raised outlook. New categories like wellness and international give it fresh shelves to fill, even as one big retail partnership fades into the background.

The stock isn’t cheap, but the combo of loyal shoppers and fat margins explains why analysts keep bumping their targets instead of their mascara.

My Take: Treat this as a quality leader you scale into slowly, buy partial on red days, trim on big rips, and avoid chasing if it turns into a full glam squeeze.

Hewlett Packard Enterprise [HPE]: Premarket Move: −9%

Old-school tech is catching a reality check after revenue came in light and AI server sales slipped, even as profits and guidance looked surprisingly decent.

The story now is delayed with Juniper synergies. A better cash flow outlook and a steady dividend both help, but they don’t erase investor impatience with “AI later” promises.

My Take: If you’re curious, let the drop play out and look for a calmer base to start a value-ish position; if you already own it, keep it small and lean on that dividend while you wait for the AI backlog to ship.

Extremely Rare Pattern (Sponsored)

This month’s top-ranked stocks share a powerful combination of performance indicators.

Each one appears on a short list that has a track record of highlighting fast movers.

When these signals align, opportunities can unfold quickly.

View the 7 Best Stocks before momentum builds further.

Access the Free Report Today

Everything Else

• Apple is shuffling the deck again as long-time execs Lisa Jackson and Kate Adams exit, underlining how leadership changes can reshape everything from policy clout to product priorities.

Online lender SoFi reminded investors that growth costs money, with shares slipping after a fresh $1.5 billion offering that juices its balance sheet but also dilutes the pie.

Nvidia’s “problem” right now is the kind most CEOs would frame and hang on the wall, as its overflowing cash hoard sparks questions about how much goes to chips, deals, or buybacks.

Microsoft is quietly hiking prices on its Microsoft 365 suites for businesses and governments, betting that AI bells and whistles will keep companies paying up rather than shopping around.

AMD’s boss says the company is ready to swallow a 15% China tax on AI chips, signaling that access to the world’s second-largest economy is still worth a steeper toll.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.