One forgotten real estate tech stock is suddenly back in the spotlight—and retail traders can’t get enough of it. Fueled by Reddit buzz and bold hedge fund chatter, it’s now being called the “last player standing” in its space. It has our attention - here’s why.

Fresh Insights (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

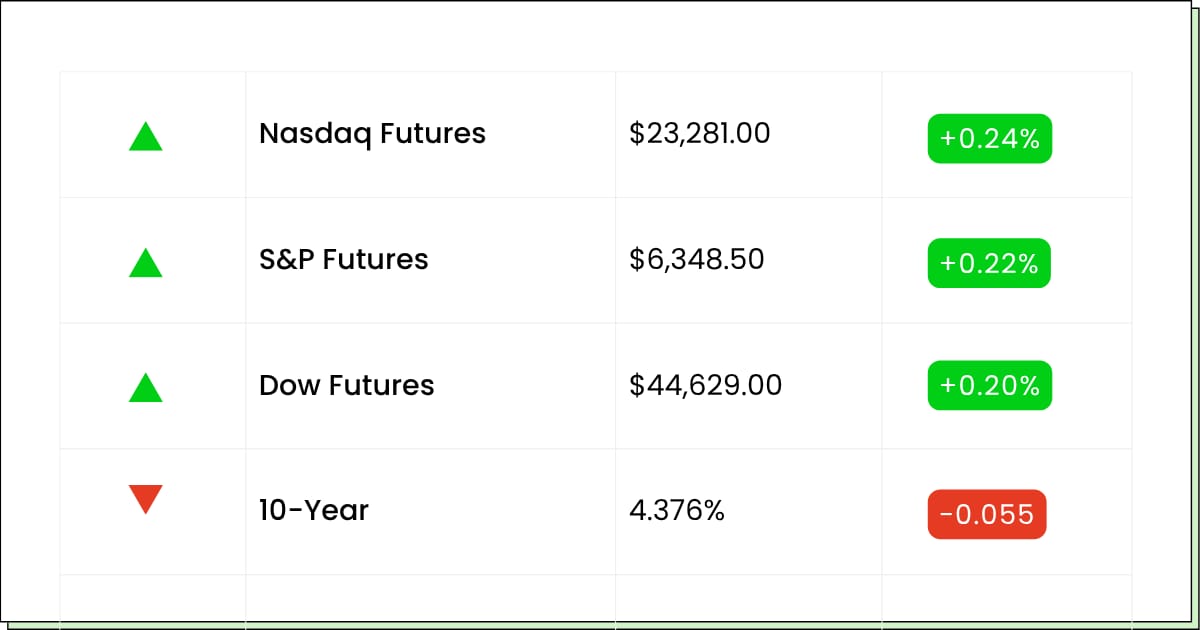

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Verizon Communications Inc. [VZ]: Premarket

Roper Technologies, Inc. [ROP]: Premarket

Ryanair Holdings plc [RYAAY]: Premarket

Domino's Pizza Inc. [DPZ]: Premarket

Cleveland-Cliffs Inc. [CLF]: Premarket

Preferred Bank [PFBC]: Premarket

Dynex Capital, Inc. [DX]: Premarket

HBT Financial, Inc. [HBT]: Premarket

NXP Semiconductors N.V. [NXPI]: Aftermarket

W.R. Berkley Corporation [WRB]: Aftermarket

Steel Dynamics, Inc. [STLD]: Aftermarket

Alexandria Real Estate Equities, Inc. [ARE]: Aftermarket

Crown Holdings, Inc. [CCK]: Aftermarket

Equity Lifestyle Properties, Inc. [ELS]: Aftermarket

AGNC Investment Corp. [AGNC]: Aftermarket

Medpace Holdings, Inc. [MEDP]: Aftermarket

Zions Bancorporation N.A. [ZION]: Aftermarket

BOK Financial Corporation [BOKF]: Aftermarket

RLI Corp. [RLI]: Aftermarket

Calix, Inc. [CALX]: Aftermarket

Agilysys, Inc. [AGYS]: Aftermarket

Arbor Realty Trust [ABR]: Aftermarket

TrustCo Bank Corp NY [TRST]: Aftermarket

SmartFinancial, Inc. [SMBK]: Aftermarket

Washington Trust Bancorp, Inc. [WASH]: Aftermarket

Controladora Vuela Compania de Aviacion, S.A.B. de C.V. [VLRS]: Aftermarket

Home Bancorp, Inc. [HBCP]: Aftermarket

RBB Bancorp [RBB]: Aftermarket

Health In Tech, Inc. [HIT]: Aftermarket

SAGTEC GLOBAL LIMITED [SAGT]: Aftermarket

Economic Reports:

U.S. Leading Economic Indicators [June]: 10:00 am

Timing Advantage (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

Technology

Block Rallies After S&P 500 Confirmation

Block [XYZ] surged nearly 10% in premarket trading after S&P Dow Jones Indices confirmed the company’s inclusion in the S&P 500, replacing Hess Corp effective July 23.

The milestone marks a major moment for the Jack Dorsey-led fintech company and could draw billions in passive investment inflows from index-tracking funds.

Block operates a diverse suite of brands, Square, Cash App, Afterpay, TIDAL, Proto, and Bitkey, all designed to expand access to the economy. Its move into the S&P 500 not only validates the company’s market cap and liquidity but also shows investor recognition of its business relevance and long-term growth strategy.

This isn’t just a sentiment boost. S&P additions typically trigger near-term buying from institutional investors, while also providing longer-term price support due to increased visibility and broader analyst coverage.

Traders also expect this inclusion to strengthen Block’s position as a core fintech holding, particularly with the integration of AI and the growth of decentralized finance.

The S&P 500 nod gives Block a credibility upgrade that can’t be ignored. While execution across its portfolio remains key, this catalyst could reignite broader interest in the stock heading into earnings season and the back half of 2025.

Consumer Discretionary

Domino’s Pizza Grows Sales and Income, but EPS Dips on Higher Tax Bill

Domino’s Pizza [DPZ] posted solid Q2 results Monday morning, showing strong sales momentum and operational efficiency despite a slight decline in EPS.

The global pizza chain reported $3.81 in diluted earnings per share, down from $4.03 a year earlier, primarily due to a higher effective tax rate and losses associated with an investment in DPC Dash. Still, income from operations jumped 14.8% year over year, and revenue climbed 4.3% to $1.15 billion.

Same-store sales increased 3.4% in the U.S. and 2.4% internationally, with global net store growth reaching 178 locations during the quarter.

Domino’s now boasts over 21,500 stores worldwide and continues to lead the U.S. pizza category, aided by partnerships with major delivery aggregators and a broad menu that now includes stuffed crust offerings. Free cash flow surged nearly 44% to $332 million, helping the company fund $150 million in share repurchases.

Despite the EPS dip, the quarter showcased Domino’s operational resilience, with improved supply chain margins and disciplined spending. CEO Russell Weiner highlighted strong momentum in the delivery and carryout channels, and the company declared a quarterly dividend of $1.74, payable in September.

Domino’s is demonstrating its ability to grow in a challenging consumer environment, and the company’s digital strength and global footprint offer durable tailwinds.

With free cash flow accelerating and unit economics looking strong, this pizza leader remains a compelling long-term story.

Shares are up over 6% in premarket trading this morning on the beat.

AI (Sponsored)

AI’s capabilities are growing rapidly—handling layered conversations, correcting itself, and adapting in real time.

This shift is opening up new frontiers for early investors.

A free report just revealed 5 high-potential stocks—including one under-the-radar name with breakout potential.

These tickers are positioned to ride the AI boom in its most advanced form yet.

[See the Top 5 AI Stocks – Free Access]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Real Estate

Opendoor Technologies Rips Higher As Retail Traders Pile In

Opendoor Technologies [OPEN] is having a viral moment. Shares are up over 27% premarket and have surged nearly 200% in the last month, turning the real estate tech firm into the latest meme stock phenomenon.

The move gained traction after hedge fund manager Eric Jackson said betting on Opendoor now feels like backing Coinbase before FTX collapsed, an “only player left” thesis in the iBuyer space.

The excitement started on Reddit, where mentions of Opendoor exploded across WallStreetBets. Retail traders have flooded into bullish call options, creating a familiar setup reminiscent of GameStop’s infamous squeeze in 2021.

However, unlike GameStop, Opendoor is attempting a business model pivot, from a capital-heavy home-flipping model to an agent-assisted, asset-light platform.

Despite the buzz, risks abound. The company continues to post negative earnings, holds a debt-to-equity ratio exceeding 390%, and has an Altman Z-score indicating significant bankruptcy risk.

Analysts remain skeptical, with a wide range of price targets and concerns over execution. Still, Jackson’s bold claim that Opendoor could be a “100-bagger” has provided retail investors with just enough narrative to ignore the financials.

Opendoor is riding a wave of momentum fueled by optimism and online coordination. With earnings due August 5, a surprise EBITDA-positive quarter could fan the flames, or bring this rocket back to Earth. High-risk, high-reward traders should watch closely.

Movers and Shakers

Bitmine Immersion Technologies [BMNR] – Last Close: $42.35

Bitmine Immersion Technologies is a crypto-native infrastructure firm that’s now making headlines for a very different reason: becoming the largest corporate holder of Ethereum. The company disclosed last week that it has accumulated over 300,000 ETH, worth more than $1.1 billion, with ambitions to eventually control 5% of Ethereum’s total supply. Its strategy involves raising capital, staking ETH for yield, and leveraging cash flows from crypto mining.

Shares are up 4.8% after hours as momentum builds behind Bitmine’s aggressive ETH accumulation strategy. With Ethereum rallying and attention shifting to crypto treasury management as a business model, Bitmine may be crafting its own version of the MicroStrategy playbook, except with ETH, rather than BTC.

My Take: This is a bold and highly leveraged bet on Ethereum, but one that's getting serious attention. If ETH holds above $3,500 and retail inflows continue, Bitmine’s model could prove prescient and highly profitable.

Invesco Ltd. [IVZ] – Last Close: $19.92

Invesco is a global asset manager best known for running the massively popular QQQ ETF, which tracks the Nasdaq 100. The stock jumped 15% on Friday after the firm filed to convert QQQ from a unit investment trust into a management company, giving it greater flexibility and potentially unlocking more profit retention from fund operations.

Premarket gains of 2.2% suggest the move is still being digested, and investors may be positioning for long-term upside if the reclassification is approved. A drop in QQQ’s management fee from 0.20% to 0.18% also improves competitiveness in the crowded ETF space.

My Take: This structural shake-up could give Invesco a new lease on earnings growth tied to its most iconic product. It’s a subtle but significant change, and traders seem to be catching on.

Dell Technologies [DELL] – Last Close: $131.24

Dell Technologies is a leading enterprise hardware company with a growing presence in AI servers, edge computing, and enterprise storage. After a string of bullish analyst upgrades, shares climbed nearly 6% Friday and are up modestly again in premarket trading.

The catalyst was a BofA Securities raised its price target to $165, citing Dell’s strong positioning to capitalize on AI infrastructure buildouts. Mizuho and KeyBanc echoed bullish sentiments, citing Dell’s financial strength, server wins, and improving revenue forecasts. Dell is also expected to benefit as capital expenditure (capex) spending ramps back up, offsetting earlier public cloud headwinds.

My Take: Dell has emerged as an unexpected AI winner. If enterprise spending shifts toward ROI-driven upgrades, as analysts expect, this could be one of the stealth AI plays for the second half of 2025.

Crisis Prep (Sponsored)

Two of the most powerful figures in America are clashing—and it’s not just political drama.

Markets are on edge. Volatility is rising. And your retirement savings could be caught in the crossfire.

But in every crisis, there’s one asset that consistently holds its value—and often rises when everything else falls.

This free guide shows how to use a tax-free, IRS-approved method to protect your wealth now.

The next financial shock could come without warning. Make sure you’re ready.

Everything Else

Stellantis warns of a $2.7 billion net loss as tariffs hammer EV exports.

Rising market volatility may be hiding behind the earnings season’s headline beats.

Crypto stocks pop after Trump signs new stablecoin regulation into law.

Hackers are exploiting a Microsoft flaw to target global governments and businesses.

Alaska Airlines restarts operations after a system outage grounded its fleet.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.