After getting cut nearly in half, a premium yoga brand just posted a better-than-feared quarter and announced a CEO swap, sending the stock bouncing. The idea is not to chase every green day, but to use dips for a starter position and let the next few quarters prove whether this is a true comeback or just a relief stretch.

Timing Favors You (Sponsored)

Right now a select group of stocks is quietly showing signs of strength beneath the surface. Data suggests they could be on the verge of fast gains.

A new report identifies 7 trades with the highest potential based on proven signals.

Opportunities like these often appear briefly before the market catches on.

Access the report before the next move begins.

Get Your Free Copy of the 7 Best Stocks Report

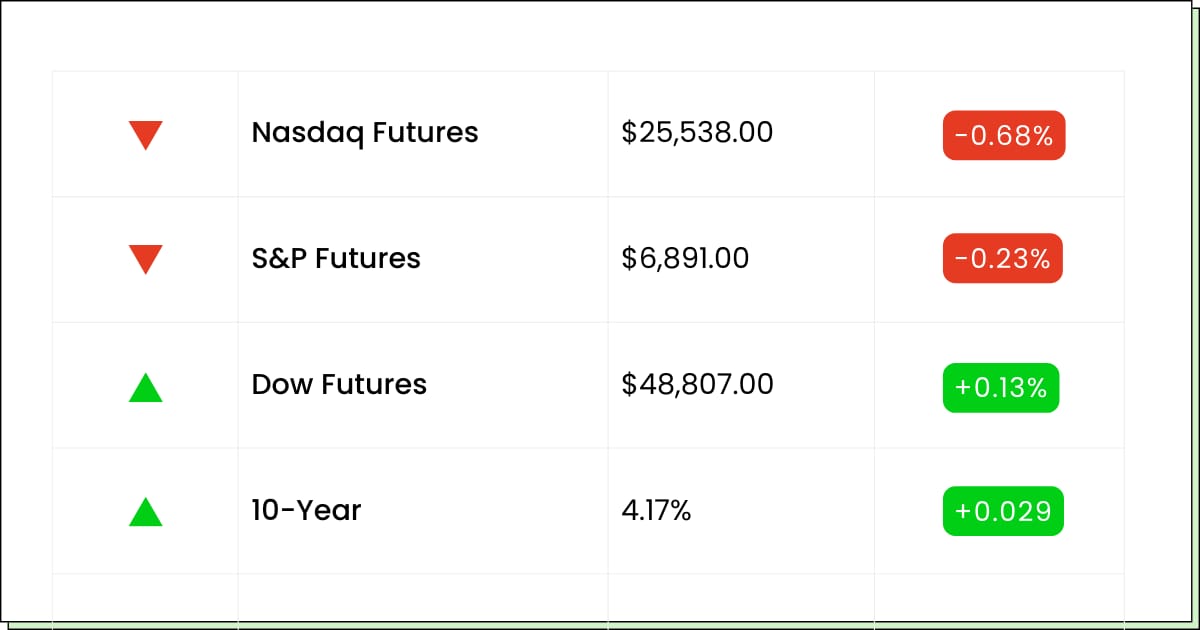

Futures at a Glance📈

Futures are leaning green again as the everything-but-megacap-tech rally keeps rolling. Value and cyclicals are getting the love, small caps are still punching up, and traders are testing what a bull market looks like when the rest of the 493 do some heavy lifting while the AI darlings catch their breath.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Johnson Outdoors [JOUT]

Rent the Runway [RENT]

Economic Reports:

Philadelphia Fed President Anna Paulson speaks: 8:00 am

Cleveland Fed President Beth Hammack speaks: 8:30 am

Wholesale inventories (Sept): 10:00 am

Chicago Fed President Austan Goolsbee speaks: 10:35 am

Tech & Security

Clear Secure Gets TSA Energy And A Medicare Upgrade

Clear Secure Inc’s (NYSE: YOU) not just helping you skip the airport line anymore – it just landed a contract to handle identity verification on Medicare.gov.

That means it’s “are you really you?” tech is about to sit in front of millions of retirees and doctors, not just road warriors with carry-ons. Big stamp of approval, big new use case.

The good news is that government work like this is sticky. Once an agency rips out legacy systems and plugs in a new ID layer, they don’t swap it out on a whim. If the rollout goes smoothly, Clear can point to this deal every time it pitches banks, insurers, and anyone else worried about deepfakes and fraud.

The catch is rollout risk and patience. Government timelines move slower than airport security on a long weekend, and the stock has already perked up on the headline. You want execution, not just press releases, to do the heavy lifting from here.

My Take For You: If you’re curious, a small starter buy you’re willing to hold through a boring implementation phase can make sense; if you’re already in, tighten your “I’m wrong” level and don’t chase every pop.

My Verdict: Real win and real validation, but treat it like a measured growth story, not an overnight moonshot.

Materials

This Silver Name Is Shining Like It Just Got Top Billing

Hecla Mining Co’s (NYSE: HL) had the kind of year most miners only see in their dreams or their old pitch decks. Silver prices woke up, Hecla hit fresh highs, and suddenly this once-sleepy producer is trading more like a momentum tech stock than a dusty metals name.

That’s great if you’ve been along for the ride, but it also means a lot of good news is already baked in. When a stock more than doubles while Wall Street is still debating what it’s really worth, you’re officially in the zone where emotion, flows, and FOMO start driving the bus.

The bigger picture is that if you want silver exposure with real mines instead of just a ticker tied to the metal, this is one of the cleaner ways to do it. Just remember, miners amplify the metal both ways – up and down – and this one’s already sprinting, not stretching.

My Take For You: If you’re new, wait for pullbacks or signs the run is cooling before you size in; if you’re long, consider trimming into strength so you’re playing with more house money than rent money.

My Verdict: Solid vehicle for silver bulls, but a bit hot to floor right now – treat it as a trading position, not a set-and-forget heirloom.

Fast-Changing Market (Sponsored)

A rapid acceleration in AI deployment across the U.S. is creating fresh opportunities for forward-looking investors.

A free breakdown uncovers 9 companies demonstrating measurable growth and deep alignment with this next wave of AI demand.

These aren’t speculative plays they are firms with proven traction and expanding AI footprints.

Early movers may see the greatest advantage.

Download the Free Report

Consumer Discretionary

Lululemon is Trying A Leadership Stretch

Lululemon Athletica Inc (NASDAQ: LULU) just pulled off the awkward combo of beating low expectations and announcing its long-time CEO is heading for the exit. The stock bounced because results weren’t as bad as feared, buybacks are flowing, and a fresh face at the top might reset the story.

Under the hood, it’s still a tale of two closets. The U.S. looks overstuffed and picky, with slower sales and heavier discounting, while international – especially China – is wearing the crown and doing the heavy lifting. Margins are a bit squeezed, tariffs are annoying, but the brand is still profitable and far from irrelevant.

For you, that spells turnaround homework, not impulse buy at the checkout. The opportunity is that the stock’s been cut nearly in half from its glory days; the risk is that fashion, tariffs, and execution all need to line up for the rerating to stick.

My Take For You: If you like comeback stories, a small, patient starter with room to add on proof of a U.S. rebound makes more sense than a full send; if you’re already in from higher levels, use this bounce to rebalance and decide how much of the rehab journey you really want to fund.

My Verdict: Show-me mode. Worth a watch-list star and maybe a toe-dip, but the real upgrade only comes if new leadership proves this isn’t just yesterday’s favorite hoodie.

Poll: What gives you the biggest “money guilt”?

Movers and Shakers

Coeur Mining Inc [CDE]: Premarket Move: +4%

Silver and gold are still the main characters, but Coeur’s playing the glow-up sidekick that suddenly stole a scene.

Strong drilling results plus a much cleaner balance sheet have investors treating it less like a rescue project and more like an actual grown-up miner.

My Take: If you want silver leverage without going full meme, a small starter here on pullbacks makes sense, just remember miners can swing harder than the metal itself.

ACM Research Inc [ACMR]: Premarket Move: +2%

The chip-tool CFO just rang the register on some shares, and the stock basically shrugged and kept walking.

When insiders sell as part of a pre-planned program and the name is still near the highs, it usually says more about paying for life than bailing on the story.

My Take: Don’t panic over scheduled selling. If you like the AI/semicap angle, treat dips as chances to nibble, not reasons to sprint for the exit.

Fermi Inc [FRMI]: Premarket Move: −8%

This next-gen power campus idea sounds like sci-fi—11 gigawatts and fancy cooling systems—but the stock chart looks more like a horror movie.

Big promises, no profits yet, and valuation models yelling you’re paying tomorrow’s price today are keeping gravity in charge.

My Take: Fun to watch, risky to own. If you touch it, tiny position only and be honest that you’re speculating, not building your retirement plan around it.

Free Report Inside (Sponsored)

Analysts are seeing a shift in market behavior and just highlighted 5 companies with unusual strength developing beneath the surface.

After filtering through thousands of stocks, these are the ones showing the

most promising combination of early momentum, earnings acceleration, and technical strength.

Their research has identified major winners before, with gains reaching +498% and +673%.¹

This new list could be just as powerful. But the report is only free until midnight.

Access the 5 Potential Winners Free

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Everything Else

Analysts are warning that Nasdaq’s 100 reshuffle could turn index-tracking into more of an active bet than some passive investors signed up for.

Intel’s quiet testing of tools tied to a sanctioned Chinese unit is another reminder that chip sanctions are more “maze” than “line in the sand.”

Reddit’s lawsuit against Australia’s social media law turns content moderation into a courtroom drama with global platforms watching closely.

A look back at how OpenAI went from nonprofit lab to dueling camps shows just how fast AI idealism can morph into an arms race.

U.S. stocks sitting near records as investors rotate out of tech is your reminder that boring sectors sometimes get the last laugh.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.