A long-awaited launch just hit the road and grabbed attention fast. The move looks exciting, but the real opportunity shows up after the first wave cools. Here’s what we’re watching next.

Final Review Window (Sponsored)

Many investors are seeing solid gains in today’s market, but solid gains often hide opportunities with far greater potential.

A new analysis highlights the 5 Stocks Set to Double, selected from thousands of companies showing early signs of powerful growth.

These picks feature strong fundamentals and technical indicators that often appear before meaningful upside.

Past editions of this research uncovered gains of +175%, +498%, and +673%.

Download the 5 Stocks Set to Double. Free Today.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

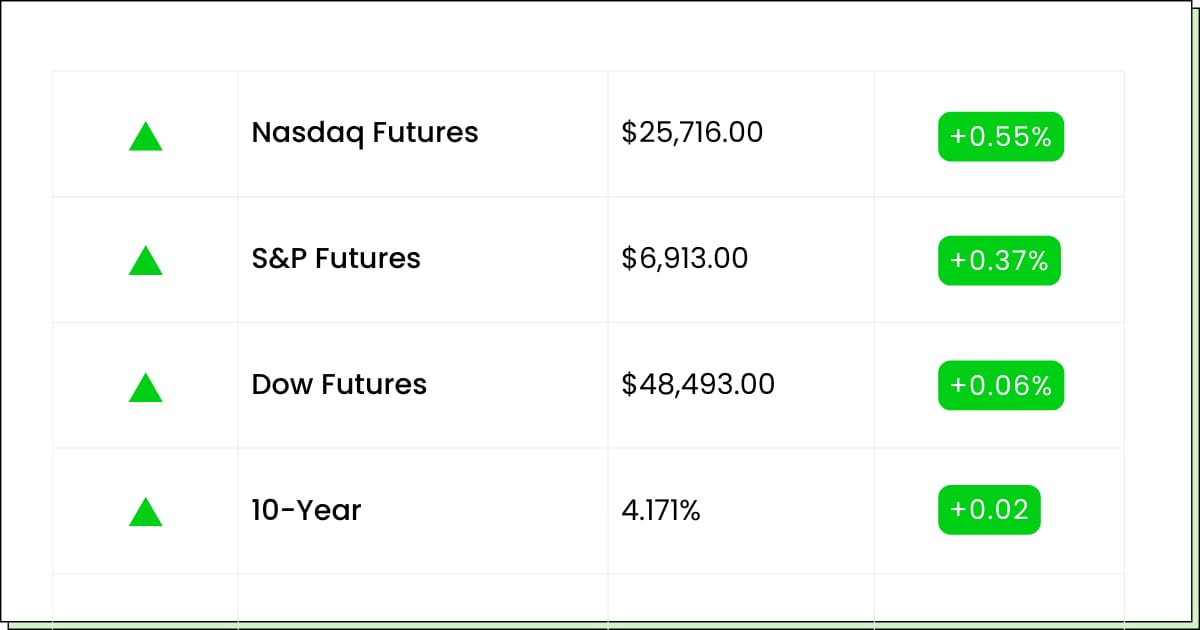

Futures at a Glance 📈

Futures are starting the holiday-shortened week on a brighter note as traders poke at tech again to see if it still has legs before year-end. AI names are back in motion, helping lift the mood after a mixed stretch, but there’s still some side-eye around lofty valuations and whether a real Santa rally shows up. With early closes and thin holiday liquidity ahead, expect more churn than anything.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

Lufax Holding Ltd [LU]

Ennis, Inc. [EBF]

Barnes & Noble Education, Inc. [BNED]

RCI Hospitality Holdings, Inc. [RICK]

Kandi Technologies Group, Inc. [KNDI]

Zenvia Inc. [ZENV]

Economic Reports:

None scheduled

Travel & Leisure

Carnival Finds Its Sea Legs Again, But The Water’s Still Choppy

Carnival Corp (NYSE: CCL) just posted another earnings beat, and the stock popped like the captain finally turned the engines back on. After years of pandemic hangovers and cost cuts, people are clearly booking trips and showing up with sunscreen and credit cards ready.

But don’t confuse better momentum with calm seas. Revenue came in a touch light, which is a reminder that demand is back, but costs and pricing are still doing their own thing. Fuel, labor, and general chaos haven’t magically gone overboard. This is less victory lap, more steady progress.

The bigger story is consistency. Carnival keeps clearing the bar, and that slowly rebuilds trust. Still, cruises are a discretionary splurge. If consumers get jittery, vacations are one of the first things people delay. That doesn’t kill the story, it just means timing matters.

My Take For You: If you’re not in, wait for a pullback or a boring week. If you are in, trim into strength and don’t let buffet confidence become bag-holder energy.

My Verdict: Recovery story still alive. Tradeable and improving, but not a set-it-and-forget-it hold.

Consumer Discretionary

Carvana’s Comeback Tour Is Loud, Fast, And A Little Unhinged

Carvana Co (NYSE: CVNA) has gone from dead-to-rights to top performer faster than anyone expected. The stock has ripped higher, flipped the narrative, and now it’s acting like it never had a rough patch in its life.

The problem with glow-ups is expectations. When a stock runs this far, it doesn’t need bad news to stumble. It just needs slightly less good news. A down day here is basically the market reminding everyone that gravity still exists.

Yes, the business looks cleaner. Yes, costs are down. And yes, getting into big indexes keeps the spotlight on. But this isn’t a bargain rescue play anymore. It’s a momentum darling, and those live and die by sentiment. When the crowd cheers, it flies. When the music pauses, it wobbles.

My Take For You: New money should wait for a cooldown or a base. If you’ve been riding it, take some profits and let the rest run with a tighter leash.

My Verdict: Incredible turnaround, but treat it like a sports car, not a minivan. Fun to drive, dangerous if you nap at the wheel.

Smart Money Knows (Sponsored)

The next market move will not be random.

History shows that during major economic resets certain stocks quietly become traps long before prices collapse.

That setup is forming again and most investors are missing it.

A new analysis identifies five popular stocks that could suffer outsized damage as this shift accelerates. Holding even one of them could undo years of progress.

This is about protection before panic not reaction after losses.

Review the five stocks now before the window closes

Electric Vehicles

Lucid’s Luxury SUV Has Star Power, But Sales Still Need To Show Up

Lucid Group Inc ‘s (NASDAQ: LCID) SUV rollout is a high-stakes moment: great reviews, premium positioning, big expectations. The issue is the boring part that matters most — getting enough vehicles built and delivered without tripping over supply chain speed bumps.

Lucid’s problem isn’t engineering, it’s execution. Amazing cars don’t matter if they don’t leave the factory on time. And while backers have been patient, cash burn doesn’t care about brand aura. Every delay brings the same question: how long does the runway stay open?

The upside is obvious. SUVs are where buyers are, not sedans, and this product finally fits the mainstream preference. The downside is also obvious. The EV market is crowded, incentives are fading, and Lucid needs volume, not applause.

My Take For You: This is a prove-it setup. Wait for deliveries to show real traction before stepping in.

My Verdict: Beautiful product, fragile setup. Worth watching closely, but better for patient traders than casual holders right now.

Poll: You’re comparing two flights. Which sways your choice fastest?

Movers and Shakers

Clearwater Analytics Holdings Inc [CWAN]: Premarket Move: +8%

Private equity just slid CWAN a very official “u up?” text: an $8.4B buyout offer. That puts a lid on downside and turns this into deal-watch mode, not story-time mode.

There’s also a go-shop window, aka CWAN can flirt with other bidders until Jan. 23.

My Take: If you own it, hold for the process and don’t get cute. If you don’t, don’t chase — the pop already paid the early birds.

Rocket Lab Corp [RKLB]: Premarket Move: +4%

Space stocks are doing space stock things. A big Space Force win + a year of clean launches has traders feeling like this rocket still has runway.

Just remember: after a year like this, RKLB can drop on gravity alone.

My Take: Ride it if you’re in, but trail a stop. If you’re new, wait for a dip that doesn’t feel like catching a falling satellite.

Western Union Co [WU]: Premarket Move: −2%

WU is the sleepy dividend uncle at the party while growth names do keg stands.

It’s cheap, it yields a ton, and it still gets side-eyed because the turnaround needs proof, not promises.

My Take: If you want income, nibble small and be patient. If you want speed, this isn’t your lane, it’s more slow-cook than air-fry.

High-Impact Briefing (Sponsored)

AI-driven innovation is expanding beyond the usual market favorites, opening

a new set of opportunities for investors paying attention.

A new FREE breakdown uncovers 9 companies with real revenue traction, active U.S. operations and deep AI alignment.

Each one sits in a rapidly shifting segment that could benefit from renewed regulatory clarity and domestic expansion.

Market interest is rising, and the next wave of capital may move fast.

Access the FREE Report

Everything Else

AI is showing up as the new “we’re streamlining” excuse, with big names from Amazon to Microsoft tying 2025 layoffs to AI efficiency and automation plans.

Google’s Gemini safety lead is basically saying the quiet part out loud, that keeping AI useful and safe is a full-time job, and the guardrails matter as models get stronger.

Elon Musk’s Tesla pay saga is back in the spotlight as the Delaware Supreme Court weighs a fight that could reshape how mega-comp plans get blessed, or sent back.

U.S. lawmakers are pushing the Pentagon to widen a watchlist, urging it to add DeepSeek and Xiaomi over allegations of aiding China.

Nvidia and Intel got a regulatory green light as U.S. antitrust agencies cleared their deal, removing a big “what if” hanging over chip-land plans.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.