One of the strongest charts of the year is getting index love right on cue, which is great for the story but risky for late arrivals. If you already rode the move, use this window to sell into strength, and if you missed it, skip chasing and wait for earnings.

Fast Growing Interest (Sponsored)

He remembers what it was like second-guessing every trade, missing the right moments.

That changed when he developed one indicator that simplified everything.

For 30 years, it helped him know exactly when to get in and when to step aside.

Now, he’s giving that same signal away for free, because he believes every investor deserves a fair shot at trading success.

This isn’t guesswork. It’s clarity.

[Unlock the free indicator today]

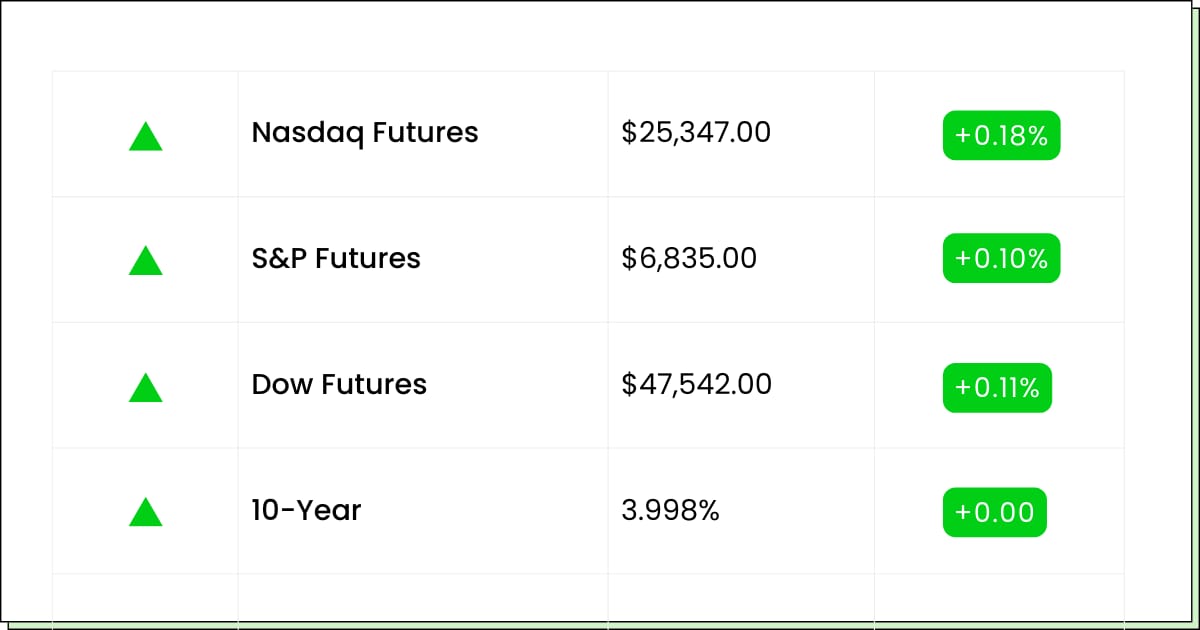

Futures at a Glance📈

Futures are basically napping after the Thanksgiving food coma, with traders deciding whether November’s tech pullback is the start of something bigger or just a breather in the AI story. The Nasdaq’s seven-month hot streak is on the line, but dip shoppers are circling beaten-up names and quietly betting on a year-end rally once everyone’s back from leftover duty.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Chagee Holdings [CHA]

Aftermarket Earnings:

Globus Maritime [GLBS]

Economic Reports:

Chicago Business Barometer (PMI, Nov): 9:45 am

Consumer Discretionary

Abercrombie Tries On A Comeback After A Brutal Markdown

Abercrombie & Fitch Co (NYSE: ANF) just posted another strong quarter, with sales and earnings beating what Wall Street had on the tag, and the stock popped on the news. The twist is you would never guess it from the year-to-date chart, which still looks like someone hit the clearance rack with a chainsaw.

That is what happens when expectations got sky high last year and then reality remembered this is still apparel, not a magic money printer.

The good news is the core story still looks solid. Stores are busy, the brand is less cringe than it was a decade ago, and management sounds confident heading into the holiday. The risk is simple. If the consumer blinks or promos get too aggressive, those nice margins can shrink faster than a sweater in hot water.

So your job is to separate vibe from value. You want to see a couple more quarters of steady, boring execution while the chart calms down from its roller coaster. If that happens, you can treat dips less like falling knives and more like seasonal sales.

My Take For You: If you are not in, this is a watch and wait for pullbacks name, then build a small position as long as growth holds up. If you are already long, use big green days to trim and rebalance so you are not betting your whole wardrobe on one label.

My Verdict: Quality retailer with mood swings. Worth a modest spot for patient shoppers who can handle fashion stock drama and are willing to buy when sentiment, not sales, looks most washed out.

Energy Infrastructure

Fermi Tries To Charge Ahead While The Meter Is Deep In The Red

Fermi Inc (NASDAQ: FRMI) keeps telling a big story about reinventing power and infrastructure, but the latest quarter came with a very real, very ugly loss and a reminder that dreams cost cash.

The stock has been chopped in half this year, which is what happens when timelines slip, projects take time, and investors suddenly remember balance sheets exist.

Now you have the odd mix of heavy red ink and big, smart money poking around in the options and building positions.

That combo sends a simple message. The crowd that loves high stakes is betting this is either a future winner or at least a very lively trade while the company tries to turn all those projects into real revenue.

In the meantime, every headline about funding, permits, or delays can swing the price like a door in a storm. Owning it means signing up for both the engineering story and the finance story at the same time.

So you treat this like a startup in public market clothing. You do not buy it because last quarter looked good; you buy it only if you believe they actually hit their 2026 milestones and land more long-term contracts, and you size it as if it could go on sale again at any moment. Hope is not a plan; position sizing is.

My Take For You: If you are curious, think tiny starter and only with money you are willing to see wobble hard, then add later only if you see real project revenue show up, not just slides. If you are already in and sitting on losses, use any big bounce to cut risk.

My Verdict: High concept, high risk, high volatility. Keep it in the speculative bucket and only for investors who enjoy roller coasters and know how to step off before the ride breaks.

Minutes Matter Now (Sponsored)

Analysts just revealed their top 5 stock recommendations for 2026.

Each company is backed by solid growth trends, market resilience, and high upside potential.

If you missed the last market run, this could be your next opportunity.

The full report is free for a limited time, claim yours before midnight.

[Get the 5 Outperforming Stocks Report – Free Download]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Technology

The SanDisk Memory Rocket Is Joining The Big Kids Table

SanDisk Corp (NASDAQ: SNDK) has had the kind of year that makes other chip names jealous, with the stock up around five times as AI demand turned storage from boring plumbing into the VIP section.

Now the company is getting promoted into the S and P 500, which means every index fund and benchmark hugger suddenly needs a slice, whether they have done the homework or not. That is fuel for more action, but it also means a lot of fast money already showed up.

The inclusion is a stamp of approval on size and relevance, not a promise that the line only goes up from here. Index buying can give one last burst of confetti before reality checks whether earnings and pricing power can keep up with the hype.

At this point, every little wobble in AI spending or memory prices can hit a stock that has been sprinting for months.

Your move is to treat this like showing up late to a very good party. You do not sprint straight to the dance floor with your whole account; you hover near the door, watch how people behave when the music changes, and only join in if the mood stays strong. Chasing every new high is how you end up paying peak cover charge.

My Take For You: If you are flat, be patient and wait for a real pullback or a cooling period before nibbling, then keep it small and let the next couple of quarters prove the growth is sticky. If you are already long from lower, consider banking part of the win.

My Verdict: Leader in a hot lane that could keep winning, but priced for near perfection. Great for disciplined trend riders and profit takers, not for anyone who panics the first time a market darling takes a breather.

Poll: What’s your favorite “small but mighty” financial habit?

Movers and Shakers

FLEX LNG Ltd [FLNG]: Premarket Move: −2%

FLEX just did the greatest hits tour: fresh earnings guide, big dividend, and an equity raise, so the stock’s now taking a little breather after all that attention.

Long ship contracts mean the story is more slow-burn rental income than moonshot, but headlines about offerings can spook the fast money.

My Take: If you like chunky dividends and can handle shipping-cycle mood swings, buy only on red days and size it so a choppy year doesn’t sink your vibe.

American Bitcoin Corp [ABTC]: Premarket Move: +5%

Bitcoin’s back above 91,000, and the miners are waking up like someone just yelled new all-time high in a group chat.

ABTC’s been slapped around the last month, so this bounce is part relief rally, part maybe that selloff went too far.

My Take: Treat it like a roller coaster, not a retirement plan. Starter position at most, take wins on big green days, and don’t hesitate to ghost it if bitcoin turns south.

CleanSpark Inc [CLSK]: Premarket Move: +5%

CleanSpark is trying to rebrand from just a miner to AI-powered compute landlord, and doubling revenue will definitely get screens to light up.

The market loves any story that says “we do bitcoin and AI” in the same sentence, so you’re seeing that mash-up premium kick in.

My Take: Fun name for aggressive money. Nibble if you want AI-crypto crossover exposure, but keep it small and be ready to lock in profits if the story cools.

Exclusive Trend Alert (Sponsored)

Investors are watching closely as 7 select stocks begin to show signs of short-term strength.

Each one met strict criteria for growth, valuation, and momentum — indicators that have historically pointed to potential breakouts.

The opportunity may be short-lived, so timing is everything.

Review the report now and see which stocks could be poised for strong performance this month.

Click Here for the Free 7 Best Stocks Report

Everything Else

Puma jumped after reports that China’s Anta Sports is circling a possible buyout.

Two ETF chiefs say the market’s finally getting a green light away from the crowded AI trade.

Fresh data show India’s economy is still growing briskly even as U.S. tariffs start to bite, keeping New Delhi’s growth story intact but adding a few trade bruises.

Vietnam just handed Huawei and ZTE new 5G deals, signaling warmer China ties and giving Western security hawks one more thing to worry about.

Amazon and Flipkart are rolling out fresh consumer loans in India, turning e-commerce apps into credit rivals for local banks right on shoppers’ home screens.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.