A near-200% rally caught traders off guard, but the real intrigue may lie in where this newly public event and travel company goes next.

Operating at the center of Dubai’s booming MICE economy, it's quietly angling for a bigger seat at the table.

Find out why 100K+ engineers read The Code twice a week

Staying behind on tech trends can be a career killer.

But let’s face it, no one has hours to spare every week trying to stay updated.

That’s why over 100,000 engineers at companies like Google, Meta, and Apple read The Code twice a week.

Here’s why it works:

No fluff, just signal – Learn the most important tech news delivered in just two short emails.

Supercharge your skills – Get access to top research papers and resources that give you an edge in the industry.

See the future first – Discover what’s next before it hits the mainstream, so you can lead, not follow.

Markets

Wall Street slipped on Monday as traders booked profits after a strong November, with caution prevailing ahead of key economic data and the Fed’s upcoming rate decision despite rising odds of a cut.

DJIA [-0.90%]

S&P 500 [-0.53%]

Nasdaq [-0.38%]

Russell 2k [-1.14%]

Market-Moving News

Wealth Management

A Power Move Inside Europe’s Most Guarded Banking Fortress

JPMorgan (NASDAQ: JPM) is pushing into one of the world’s most elite markets with a plan to double its Swiss private-banking business again by 2030.

You can already sense how bold this is when you realize the bank doubled the same unit from 2020 to 2024 and is still not slowing down.

Switzerland is the home ground of ultra-wealth management, and JPMorgan wants a much bigger slice of it.

The timing could not be better. After the UBS-Credit Suisse merger, many wealthy families started spreading their assets across more institutions.

You end up seeing why an international giant with brand power and a strong balance sheet becomes attractive in that moment.

A Rare Opening in a Market That Almost Never Moves

Switzerland usually rewards loyalty, stability, and tradition. But the last two years created a gap large enough for JPMorgan to step in.

You might look at the inflows and notice how fast they are accelerating compared to the country’s usual slow pace.

To keep up, the bank is boosting tech, security, and advisory teams and expects to more than double the staff in Zurich and Geneva by 2030.

A New Engine for Long-Term Profit

If JPMorgan lands this expansion, Switzerland becomes one of its most valuable global profit centers.

The move would reset competitive pressure on local giants and shift how the entire European wealth game works.

This move cracks open a banking circle that almost never lets anyone in, and it puts you inside the moment an outsider finally shifts the pace of the entire system.

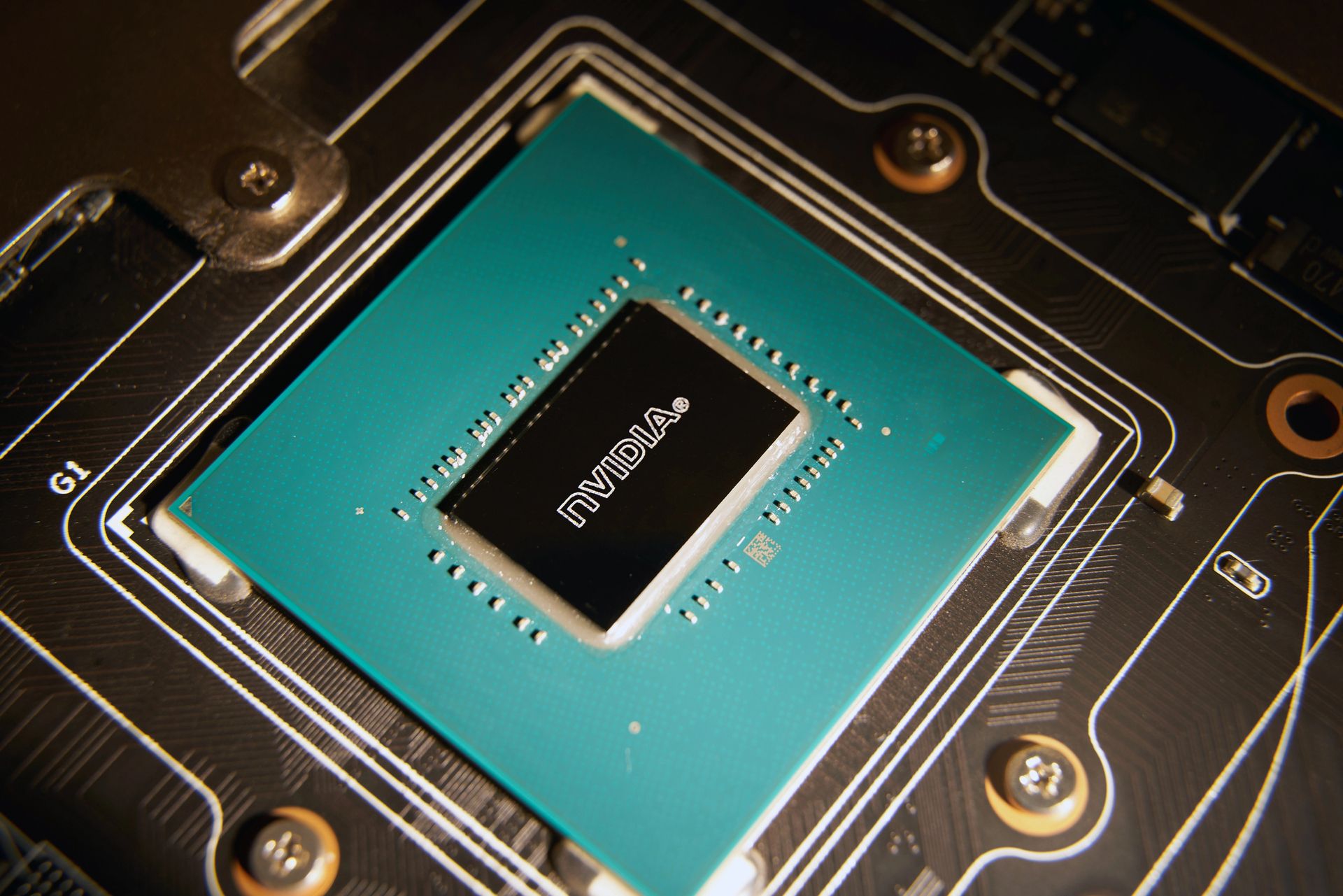

Semiconductors

What Happens When Nvidia Starts Designing the Designers

Nvidia (NASDAQ: NVDA) just made a move that reaches much deeper than GPUs, dropping $2 billion into Synopsys and locking in a long-term partnership.

This is Nvidia stepping straight into the tools that companies use before a chip even exists on a blueprint.

The Chip World’s Hidden Control Room

Synopsys builds the software where every idea, simulation, and layout begins, and Nvidia is now stitching its AI engines into that space.

You start to understand the scale when you picture future chips being shaped with Nvidia’s models guiding the earliest steps.

This puts Nvidia inside automotive design flows, data center planning, robotics hardware, and even consumer devices, long before manufacturing kicks in.

It gives the company influence at a stage competitors rarely touch.

A Faster, Smarter Synopsys Emerges

For Synopsys, this partnership means access to Nvidia’s full AI stack, speeding up the hardest parts of chip creation.

You can imagine how different the process feels when verification and simulation run faster than ever.

With global supply chains shifting and new export rules complicating advanced nodes, accelerated tools become essential.

That turns Synopsys into an even stronger backbone for the whole industry.

A New Moat Built From the Inside Out

This deal signals Nvidia’s intention to control more of the AI hardware lifecycle from idea to production.

You might look back and see this as the moment Nvidia stopped being just a chip maker and became part of the system that designs the entire next generation of silicon.

Free Download Today (Sponsored)

A new report reveals 5 stocks showing strong early momentum and potential for double-digit gains in the next market phase.

Each company has a proven track record of growth and improving technical indicators that could send prices higher.

The report is free only until midnight tonight.

Don’t miss your chance to get in early.

[Access the 5 Fast-Moving Stocks Report – Free Now]

Asset

The Question Everyone’s Asking: Why ETFs, Why Now?

Goldman Sachs (NYSE: GS) just made its boldest asset-management move in years with a $2 billion deal to acquire Innovator Capital Management.

The acquisition instantly pushes Goldman into the top tier of defined-outcome and active ETFs, a space pulling in advisors who want smoother returns and cleaner risk control.

A Category Growing Faster Than Anyone Expected

Innovator brings $28 billion in assets and more than 215 ETF strategies built for advisors managing volatility.

When you look at how quickly defined-outcome ETFs have crossed $55 billion, you start to see why Goldman wanted this platform.

These products sit in the sweet spot between structured notes and traditional ETFs, offering predictable guardrails that younger investors now expect.

You can feel how easily Goldman will scale this once its global sales machine gets behind it.

A New Direction for Goldman’s Future

The deal signals a shift toward fee-based, repeatable products instead of relying on market-cycle trading revenue.

You end up noticing how Goldman is building an ETF identity that can compound for decades, not quarters.

Innovator’s lineup plugs directly into that strategy, giving Goldman instant credibility in one of the few ETF segments compounding more than 40 percent a year.

This is the point where the shift hits you, because it feels like Goldman finally stops chasing the ETF race and starts leading it.

Want to make sure you never miss our post-market roundup?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone right after the closing bell rings.

Email’s great. Texts are faster.

Top Winners and Losers

Ambitions Enterprise Management [AHMA] $14.34 (+198.13%)

Ambitions Enterprise surged in volatile trading despite no official news, as investors speculated on post-IPO momentum and upside in the fast-growing Middle East events and tourism sector.

Leggett & Platt Inc [LEG] $11.94 (+16.33%)

Leggett & Platt jumped after bedding firm Somnigroup proposed a $1.6 billion all-stock acquisition, offering a 30% premium over the company’s recent trading average.

Bausch Health Companies Inc [BHC] $7.07 (+11.40%)

Bausch Health gained after announcing that its Solta Medical unit acquired long-time China distributor Shibo, expanding direct access to the fast-growing aesthetic device market.

SMX (Security Matters) Public Limited Company [SMX] $38.99 (-36.12%)

SMX pulled back in a natural correction after soaring over 800% this week, with traders locking in profits amid a volatile rally.

Skillsoft Corp [SKIL] $8.15 (-18.47%)

Skillsoft fell after Zacks downgraded the stock from “strong buy” to “hold,” citing weak liquidity, high leverage, and continued valuation pressure.

BillionToOne Inc [BLLN] $113.04 (-13.17%)

BillionToOne slipped as Jefferies and Wells Fargo initiated coverage with cautious ratings, warning that the stock’s valuation may be stretched after a 117% YTD rally.

Major Tech Shift (Sponsored)

NVIDIA's revolutionary new invention just solved the #1 chokepoint that's been strangling big AI companies.

And Tech legend Jeff Brown — the Silicon Valley insider who called NVIDIA before it skyrocketed more than 30,000%...

... says a shocking announcement by NVIDIA CEO Jensen Huang could make a lot of early investors rich.

Click here to see NVIDIA's 7 "power partners" set to soar as early as Jan 6, 2026.

Everything Else

Wall Street dipped as rising yields dragged stocks lower, with crypto names taking the most brutal hit.

Eli Lilly trimmed cash prices for Zepbound vials on its direct-to-consumer site, giving weight loss shoppers a cheaper shot at the trend.

Bitcoin and Ether dropped hard as the crypto sell-off kicked back into gear.

Tesla registrations sank across major European markets in November, a sharp reminder that the EV crown can slip fast.

Shopify glitched on Cyber Monday, turning the internet’s busiest checkout day into an accidental stress test for every online seller.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.