A fresh reactor push can mean steadier fuel demand ahead. Let the pop cool, buy on down days, and scale only as financing and site work move from talk to action.

Blockchain History (Sponsored)

A quiet revolution is unfolding on Wall Street. A small U.S. firm just became the first to tokenize a dividend-paying security on Ethereum — marking a major step in financial innovation.

With $200 million earmarked for buybacks, 50,000 ETH in reserves, and a $10-per-share trust distribution, it’s showing execution over hype.

Industry insiders say this could be the most significant blockchain milestone of the year.

[Click Here To See the Company Making Blockchain History]

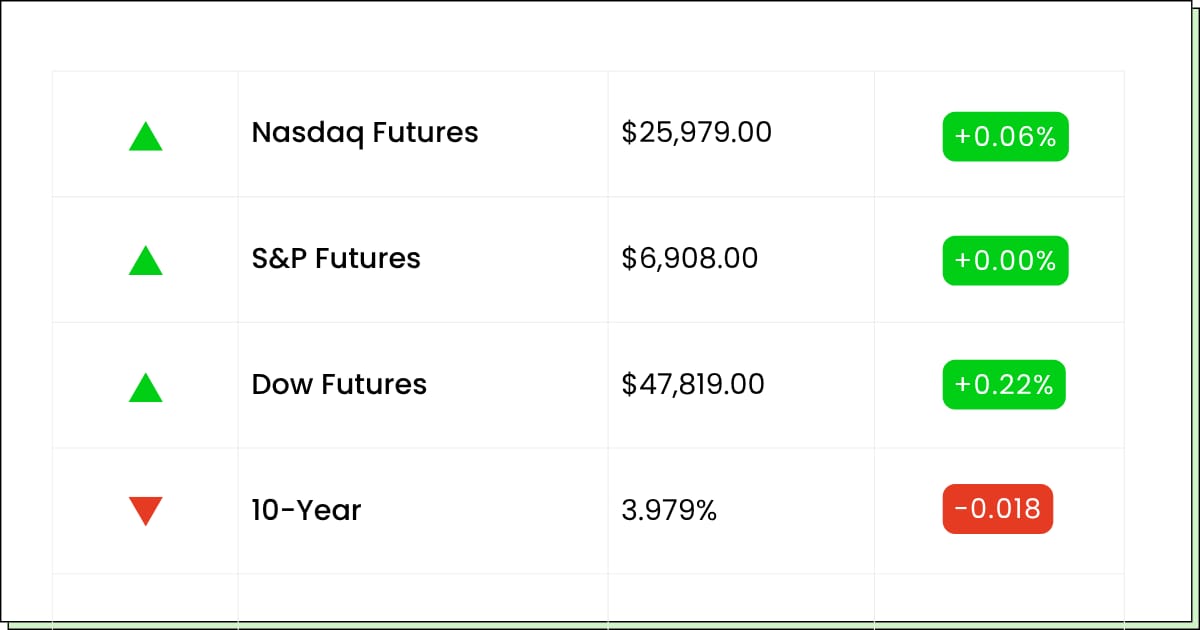

Futures at a Glance📈

Flat is the new up after yesterday’s record spree. Traders are catching their breath ahead of a packed week with Big Tech earnings, a Fed cut watch, and a possible U.S.–China handshake on Thursday. Powell headlines the midweek show, chip names hover near the front, and after-hours movers like Nucor and Cadence keep markets a bit twitchy.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

UnitedHealth Group [UNH]

Novartis [NVS]

NextEra Energy [NEE]

American Tower [AMT]

Royal Caribbean [RCL]

Sherwin-Williams [SHW]

United Parcel Service [UPS]

PayPal [PYPL]

Aftermarket Earnings:

Visa [V]

Booking Holdings [BKNG]

Mondelez International [MDLZ]

Electronic Arts [EA]

Seagate Technology [STX]

Economic Reports:

S&P Case-Shiller Home Price Index (20 cities, Aug): 9:00 am

Consumer Confidence (Oct): 10:00 am

Technology

Amazon Trims The Org Chart While Keeping The Growth Playbook

Reports point to the largest corporate layoff in company history for Amazon. That sounds harsh, but the aim is obvious: fewer layers, faster moves, more dollars pointed at the engines that matter.

Think faster delivery, stickier shopping, a stronger ad machine, and a cloud business that keeps picking up paying customers. We read this as a belt tightened for another long run, not a company in retreat.

Job cuts grab headlines because they are big and personal. What actually decides the stock over time is whether the service gets better while costs get leaner.

If packages still show up quickly, if the website remains the default cart, and if the cash machines keep compounding, then fewer middle seats in the office may be a feature, not a bug.

There will be noise. People will argue about headcount, culture, and morale. Meanwhile, the company will keep measuring delivery times, ad clicks, and shopping baskets. If those numbers keep marching, investors will shrug at the drama and focus on the scoreboard.

My Take For You: If you really want to establish a position in the mega-cap, nibble on down days and keep expectations normal. If you hold it already, keep holding, and watch execution, not headlines.

My Verdict: Still a core compounder for many. Favor dips, judge by service quality and steady growth.

Consumer & Sportswear

Lululemon Puts On Shoulder Pads And A Hoodie At The Same Time

The yoga champ is teaming with the football league for a fresh line of team gear. That opens shelves to superfans who want stretch fabric with city colors, and it gives holiday shoppers a reason to buy something that looks good on the couch and in the stadium.

It is a simple idea with a big audience, and sometimes simple ideas are the ones that ring the register.

The upside is new customers without a brand transplant. Men who never tried the joggers might show up for their team logo, then stick around because the fit feels great. Women get more choices for game day that do not look like borrowed men’s jerseys.

If designs land clean and inventory turns fast, you can imagine reorders, then more leagues, then a real second lane for the brand.

There are risks. Sports partnerships can look tacky if the logos shout too loud, and pricing has to feel premium without feeling precious. But this company knows fabric and fit, and the league knows how to sell fandom. That is a strong pairing heading into gift season.

My Take For You: Watch store buzz and online restocks once the line drops. If you see sellouts, lean in a bit, this is a nice stock at a big discount right now.

My Verdict: Quiet catalyst with holiday tailwind. Worth a look on dips, with more upside if the collab becomes a franchise.

Ends Midnight Tonight (Sponsored)

If you’ve ever wished you caught the next big winner early—this could be your chance.

A new 5-stock report highlights companies with the strongest potential to deliver triple-digit returns in the next year.

Each pick is backed by strong fundamentals and major market catalysts—the same type of setups that have produced big wins in the past.

Previous reports from this team identified stocks that surged as high as +498% and +673%.

This new list could hold the next ones — but access is free only for a limited time.

[Download the 5 Stocks to Double Report – Free Today]

Energy & Industrials

Cameco Plugs Into A Reactor Comeback With Friends In High Places

Cameco just teamed up with a global investment giant and the United States government to speed up Westinghouse reactors.

That means more concrete poured, more turbines spinning, and more long contracts for the fuel that keeps those plants humming. It also lines up nicely with data centers that eat power for breakfast, lunch, and dinner. We love a clear story, and this one reads like green lights and fresh orders.

The bigger win is momentum. Government help can grease the skids on permits, financing, and supply chains that usually move at glacial speed. Westinghouse has the hardware and a track record, Cameco has the fuel and services, and the public sector has the wallet and the whistle.

Put them together, and you shorten timelines while calming the nerves of people who have to sign very large checks.

None of this is instant. Projects still break ground, schedules still slip, and headlines still fling this stock around. But more reactors in the pipeline usually means more fuel demand down the road. Simple as that.

My Take For You: This is a nice stock to start small after big jumps and add only if progress keeps showing up. If you caught it before the jump, keep some powder dry for normal dips and let time work.

My Verdict: Long-haul friendly. Buy on pullbacks and let the build-out do the heavy lifting.

This Nuclear Tailwind Could Lead to Power-Packed Portions for Your Portfolio

Movers and Shakers

PayPal [PYPL]: Premarket Move: +14%

OpenAI just handed this wallet a front-row seat in chat shopping. Think fewer clicks, more checkouts, and lots of merchants showing up where people already talk about what to buy. That’s a clean story the market likes.

Sure, timelines and tech rollouts take longer than press releases suggest. But if even a slice of chat-to-cart becomes real, that’s fresh fuel for a brand that still owns trust at checkout.

My Take: Another OpenAI-related pump. Let it run, don’t chase every uptick. Starter size is fine, and if momentum cools later today, that’s your friendlier add.

Wayfair [W]: Premarket Move: +8%

Furniture might be sleepy, but this one just brewed a double espresso. Revenue grew while the rest of the category yawned, and now the market’s remembering that people still buy couches when the price and delivery look right.

The trick here is simple: keep new customers from becoming one-and-done, and make the unboxing feel premium instead of puzzle-night. If reorder rates and margins behave, the rerate has legs.

My Take: Don’t FOMO the jump. Let the first pullback happen and then consider a small nibble if the tone stays upbeat.

Royal Caribbean [RCL]: Premarket Move: −6%

Blowout summer numbers, higher guidance, and still a sea-sick open. That’s what happens when perfection meets profit-taking after a monster year. The business looks healthy and the stock is just catching its breath.

What matters now is bookings and pricing into winter. If those stay firm, today’s dip is more mood than message.

My Take: Cruise past the first wobble. If the slide slows and chatter stays positive, that’s your chance to inch in.

Blockchain Breakthrough (Sponsored)

A new small-cap player is turning heads after becoming the first U.S. public company to tokenize a dividend-paying security on Ethereum.

With 50,000 ETH in reserve and a $200 million buyback plan underway, this firm isn’t speculating—it’s executing.

Led by a proven financial veteran who scaled a major brokerage to billions, the company is positioned at the intersection of blockchain and Wall Street.

[Tap to Discover the Company Behind This Blockchain Breakthrough]

Everything Else

Cathie Wood says the next big AI jackpot is humanoid robots, with investors eyeing the biggest opportunity since, well, AI itself.

Novartis is walking around with serious deal ammo, as the CEO hints at big M&A if the right targets show up.

Hopes of a U.S.–China truce gave markets a morning sugar rush, with a rally sparked by deal optimism and chips back in the limelight.

Exonerated trader Tom Hayes is suing UBS for $400 million, turning the long LIBOR saga into a new courtroom sequel.

Foxconn is going all-in on AI muscle, planning up to $13.7B for a compute cluster and supercomputing center.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.