Early trial data on a new fat-loss shot just sent this small-cap flying, plus management rang the bell on a $250M raise. For now, this sits firmly in the lotto ticket bucket, which is okay for a toe-in buy, but only with tight rules on size, pullbacks, and headlines. Read on for how we’d play it.

Trade With Authority (Sponsored)

Online investing doesn’t have to be overwhelming. The right platform makes all the difference.

Today’s brokers simplify everything from research to execution.

Fractional shares let you start small.

Clean dashboards help you stay organized. Low-fee trades make it easy to stay active without overspending.

If you want an easier way to invest smarter, check out the platforms built for real people, not experts.

DISCOVER EASY-TO-USE BROKERS

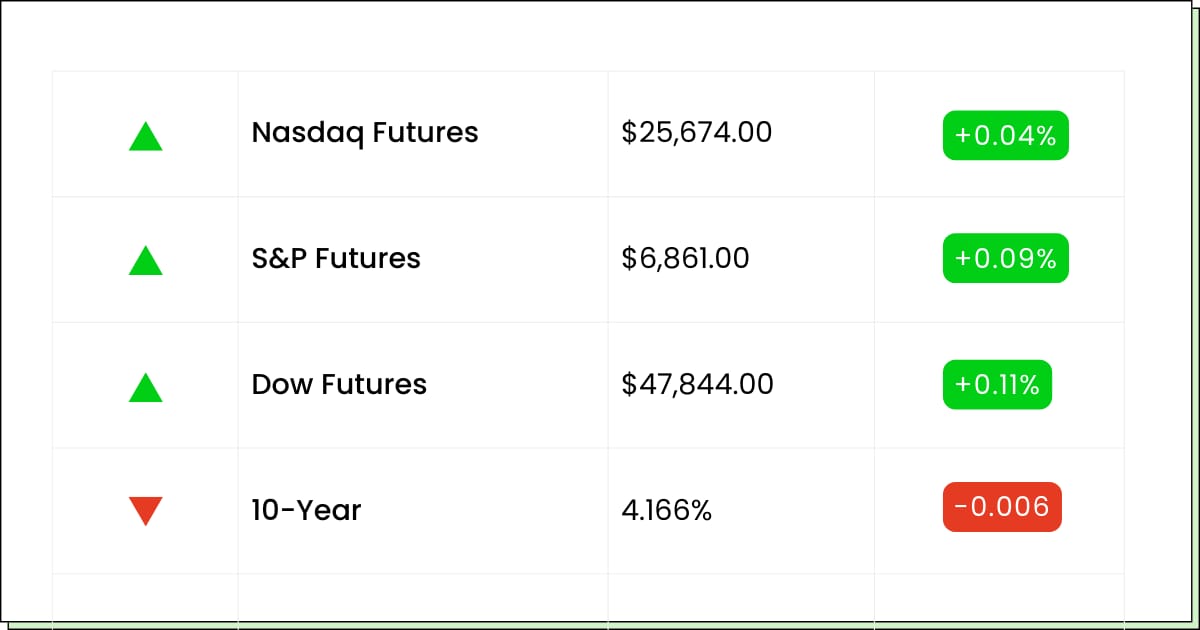

Futures at a Glance📈

Futures are basically treading water as traders chew on Trump’s green light for Nvidia’s China chip sales and what it means for the next leg of the AI trade. Semis are perking up, but everyone’s really waiting on tomorrow’s Fed call and a busy slate of earnings.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

AutoZone [AZO]

Ferguson Enterprises [FERG]

SailPoint [SAIL]

Core & Main [CNM]

Campbell Soup Company [CPB]

Aftermarket Earnings:

Casey’s General Stores [CASY]

AeroVironment [AVAV]

GameStop [GME]

Economic Reports:

NFIB small-business optimism index (Nov): 6:00 am

Job openings, JOLTS (Oct, delayed): 10:00 am

Financials

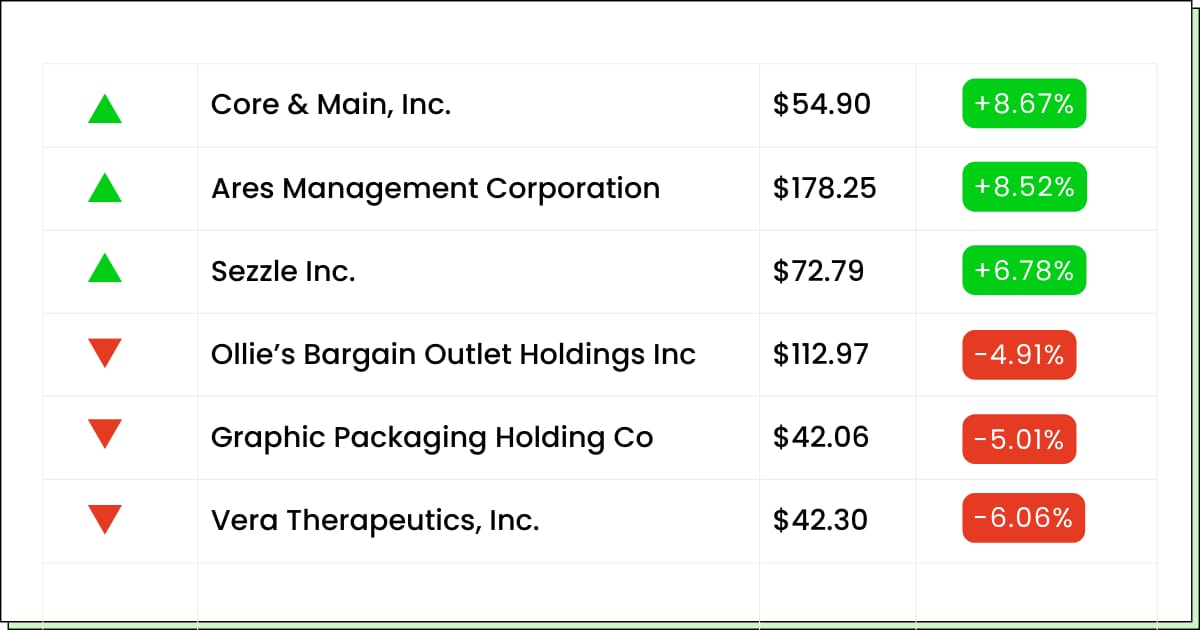

Ares Management Gets an Index Upgrade and a Bigger Stage

Ares Management Corp (NYSE: ARES) just got the golden ticket into the S&P 500, swapping places with the Cheez-It crowd and graduating from nice niche manager to core benchmark holding. Index funds now have to buy it, which is why the stock is popping like someone just turned on a firehose of new demand.

Beneath the headline, the story is simple: a big brand in private markets that throws off income and now gets automatic flows every time someone dumps money into an S&P fund. The catch is that the move has been anything but quiet this year, so a lot of that excitement is already in the price. You’re not the only one who just discovered it.

For you, this is less lottery ticket and more “could live in the boring-but-powerful part of the portfolio” if you can handle the ups and downs that come with credit cycles and headlines. The real game is watching how it trades after the index addition once the forced buying chills out.

My Take For You: If you’re new, start with a small, slow-build position and add only on pullbacks once the S&P 500 dust settles. If you already own it, use this pop to trim a little and let the rest ride as an income-tilted long-term hold.

My Verdict: Quality financial name with index rocket fuel, treat it like a core holding in training, not a meme trade.

Fintech

Sezzle Wants Another Swipe On Your Watchlist

This buy-now-pay-later name Sezzle Inc (NASDAQ: SEZL) has crept back onto screens, climbing again after a messy few months where the chart looked like someone forgot their payment plan. Now the stock’s perking up, the narrative is maybe this thing was left for dead too early.

Underneath the noise, the setup is pretty straightforward: growth is back in gear, profits are real, and some valuation models say there’s still a gap between price and potential.

On the other side of the ledger, they’re spending more to chase new users and always live with the risk that customers stop paying on time. Think interesting small business with good buzz, not bulletproof blue chip.

For you, this is the kind of name where position size matters more than the headline. It can trend nicely when the story is working, but one bad credit update or growth wobble and traders will ghost it faster than a declined card.

My Take For You: If you’re curious, treat it like a speculative side hustle, start small and only add if growth and repayment stay healthy, and have a clear line where you walk away. If you’re already in from lower, consider skimming some profits and letting the rest ride with a stop.

My Verdict: High-upside fintech with drama baked in, fun for a small, hands-on position, not a place to park rent money.

Action Point Approaching (Sponsored)

A select group of five stocks is showing rare strength that’s difficult to ignore.

Fresh technical signals, improving fundamentals, and increasing demand are creating a setup that could lead to meaningful long-term gains.

Many investors won’t see these early developments until the move is already underway.

You can review them today before the crowd reacts.

Unlock the full list.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Biotech

Wave Life Sciences Tries To Surf The Obesity Tsunami

Wave Life Sciences Ltd (NASDAQ: WVE), the little biotech, just went from background noise to front-page name after dropping early obesity drug data that had investors doing a double-take.

One dose, promising fat loss, and better-looking muscle trends than the usual shrink-everything weight-loss meds, that’s the kind of combo that gets Wall Street talking in all caps.

At the same time, management rang the cash register with a big stock offering, beefing up the balance sheet but also diluting everyone who just chased the move.

Classic biotech move with good news, giant spike, then “by the way, we’re selling more shares.” The science story is exciting, but the path from cool Phase 1 data to real-world prescriptions is long, expensive, and full of plot twists.

For you, this is a pure roller coaster with a seatbelt territory. The upside if the drug keeps delivering is obvious, with a new weight-loss option in a gigantic market, but every new data release becomes a make-or-break episode.

You don’t need a PhD to follow the story, just a strong stomach and strict risk limits.

My Take For You: If you’re new, resist the urge to chase the first rip and wait for a calmer pullback. Only use a small, clearly capped slice of your speculative budget. If you’re already sitting on a big win, think about taking some chips off the table and letting the rest ride as a free-ish lottery ticket.

My Verdict: Speculative rocket ship with real potential, great for thrill-seekers who size it small and respect the volatility, a hard pass if you hate clinical-trial drama.

Trivia: Which beverage company once owned Columbia Pictures?

Movers and Shakers

SailPoint Inc [SAIL]: Premarket Move: +4%

SailPoint just rolled out its new “Navigators” pricing, basically turning identity security into more of a choose-your-own-adventure menu instead of a giant annual contract buffet.

The market’s been weirdly grumpy on good news here all year, so even a small green move feels like progress.

My Take: If you like the long-game SaaS story, this is one you ease into on red days and avoid chasing after every product press release pop.

Toll Brothers Inc [TOL]: Premarket Move: −4%

Toll Brothers sold more pricey houses than Wall Street expected, but made a little less per house than the spreadsheet crowd wanted, so the stock’s getting a “nice job, but…” reaction.

After a solid run, this looks more like investors taking some chips off the granite kitchen island than bailing on the housing story.

My Take: If you’ve been waiting to start a position, use dips like this to nibble, but don’t forget this is still a cyclical name.

Astera Labs Inc [ALAB]: Premarket Move: −3%

Astera’s been riding the “everything AI in the data center” wave, with shoutouts next to the big chip names and cloud giants, so a little morning red feels more like a sugar crash than a plot twist.

When a stock sprints this hard, even good headlines can turn into take some profits and breathe moments.

My Take: Treat pullbacks as places to plan, not panic. It’s okay for small, staged buys if you’re bullish on AI plumbing, but don’t size it like a sleepy blue chip.

Hidden Strength Rising (Sponsored)

A brand-new analysis has revealed 7 stocks positioned for potential short-term moves.

These names met strict market performance criteria used by seasoned investors.

Fewer than one in twenty stocks reach this ranking.

Access the full report and review the findings before the month ends.

Click to Unlock the Free 7 Best Stocks Report

Everything Else

U.S. prosecutors say alleged middlemen tried to smuggle restricted Nvidia chips into China, showing export controls still leak.

A fresh look at private credit and public debt flags rising leverage and thinner safety nets.

EU regulators opened an antitrust probe into how Google uses content to train its AI models.

Dutch media say an ASML customer is linked to China’s military, adding pressure on chip-tool exports.

Brookfield and Qatar’s QAI are launching a $20 billion JV to pour more concrete (and capital) into AI infrastructure.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.