Faster delivery and solid revenue growth have this Chinese retail platform back on shoppers’ and investors’ screens. We’ll map out when a starter buy makes sense, what to watch in cloud and AI, and where to draw the exit line if the story cools.

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

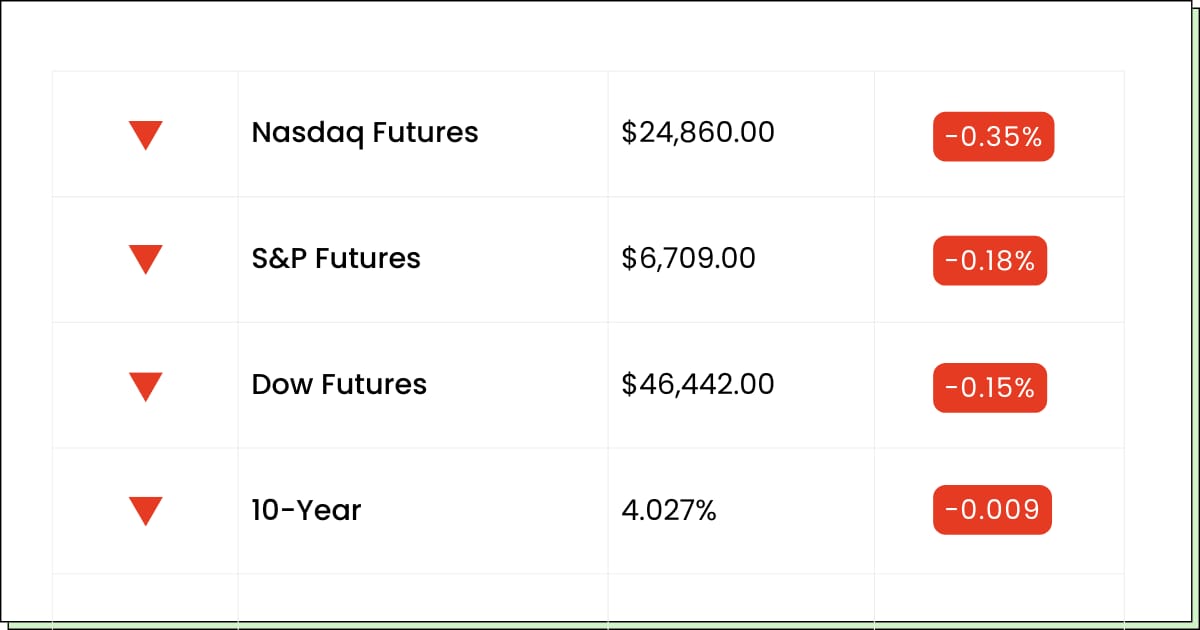

Futures at a Glance📈

Futures are wobbling after yesterday’s AI-powered sprint, with one big chip star taking a breather while other tech names hang onto their gains. Hopes for a December rate cut are still doing most of the heavy lifting, but with November still in the red, traders are trying to decide if this is a setup for a year-end rally or just a fancy head fake.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Alibaba Group [BABA]

Analog Devices [ADI]

Aftermarket Earnings:

Dell Technologies [DELL]

Autodesk [ADSK]

Workday [WDAY]

Zscaler [ZS]

Economic Reports:

U.S. retail sales (Sept, delayed): 8:30 am

Retail sales ex-autos (Sept, delayed): 8:30 am

Producer price index (PPI, Sept, delayed): 8:30 am

Core PPI (Sept): 8:30 am

PPI year over year (Sept): 8:30 am

Core PPI year over year (Sept): 8:30 am

S&P Case-Shiller home price index, 20-city (Sept): 9:00 am

Business inventories (Aug, delayed): 10:00 am

Consumer confidence (Nov): 10:00 am

Pending home sales (Oct): 10:00 am

Automation

Symbotic’s Warehouse Bots Are Doing the Heavy Lifting on Hype

Symbotic Inc (NASDAQ: SYM) just turned in another “robots are busy” quarter, with revenue racing ahead and the stock jumping as warehouses keep handing over more of the night shift to machines. Guidance came in upbeat too, which tells you customers aren’t done signing up for automated everything.

There’s a catch, though. The company is still losing money on paper, which means this is more about building the network now and enjoying the margins later than a cozy dividend story. The good news is they’ve stacked a big cash pile and are moving into new areas like healthcare logistics, so it’s not just one or two big retail logos carrying the dream.

For you, this is a classic growth name with a big story, and likely a bumpy ride. You want to size it so a bad headline is annoying, not life-changing, and treat deep red days as potential entries instead of reasons to panic-sell.

My Take For You: If you like the robots-take-the-warehouse theme, think small starter now and only add if the company keeps landing new customers and showing it can turn scale into steady cash.

My Verdict: High-beta watch-list star with fun upside if you can handle volatility and remember this is a sprint-and-stumble type of name.

Semiconductors

The AI Chip King NVIDIA Is Learning to Share the Spotlight

NVIDIA Corp (NASDAQ: NVDA) woke up to a “we love you, but we’re seeing other chips” headline, with chatter that a major social giant may lean on Google’s custom hardware down the road. The market didn’t love that, and the stock slipped as traders remembered that even kings eventually get neighbors.

Big picture, Nvidia is still the main character in this AI build-out, but customers are hunting for second sources and cheaper options, and that’s exactly what this news signals. It’s less “the story is over” and more “the cast is getting bigger,” which usually means the stock stops going up in a straight line.

For you, the move is to separate a great business from a sometimes-spicy price. If you already have a chunky gain, it’s totally fair to skim some and let the rest ride. If you’ve been waiting to get in, this kind of wobble is your reminder to be patient, pick your spots, and avoid chasing every bounce like it’s the last train.

My Take For You: Current holders should check their position size and consider trimming on strength rather than panic-selling on dips. New money should wait for cleaner pullbacks or a cooling of the AI-bubble chatter before jumping in.

My Verdict: Core-worthy for long-term tech exposure, but treat it like a marathoner and buy in stages, keep expectations sane, and don’t bet the whole portfolio on one pair of running shoes.

Act Before Close (Sponsored)

After reviewing thousands of companies, analysts isolated the 5 Stocks Set to Double based on accelerating performance, improving fundamentals, and strong technical signals.

This newly released report breaks down why these five picks may be positioned for significant moves in the coming year.

While results cannot be guaranteed, past reports uncovered gains reaching +175%, +498%, and +673%.

Access is free until midnight.

Get the Free 5 Stocks Set to Double Report.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

E-Commerce

Alibaba’s One-Hour Army Tries to Close the Confidence Gap

Alibaba Group Holding Ltd (NYSE: BABA) just rolled out a quarter that says, yes, people in China are still shopping, with one-hour delivery and appliance trade-ins helping carts stay full. The stock is perking up as those instant-commerce promos and subsidies push more traffic through its apps.

The twist is some of that fuel is temporary, as a government trade-in help fades, and rivals are tossing around their own discounts. The more durable story is Alibaba using its shopping empire to feed a growing cloud and AI push, trying to be both the mall and the engine room behind it.

For you, the line to walk is simple. Enjoy the proof that the business still has pulse, but don’t forget this is still tied to policy moods and local competition. Big green days are for trimming if you’re already heavy, and pullbacks are for starter positions, not hero trades.

My Take For You: If you’re underexposed to China, a small starter here with a clear “I’m out if this breaks” level can make sense, but if you’re already long, use strength to take some chips off and let the rest ride.

My Verdict: Buy-on-dips candidate, but only as a slice of a diversified book. Not the hill you choose to die on.

Movers and Shakers

Semtech Corp [SMTC]: Premarket Move: −6%

Semtech did the whole beat on earnings, shrug on guidance routine and the stock is giving it the side-eye.

They’re talking up a tighter focus on sexier areas like data centers and industrial IoT, plus maybe dumping a lower-margin wireless unit, but for now, the market’s in a prove-it mood.

My Take: Let this one settle. If it builds a base after the dip, you can nibble; until then, keep it on watch, not on full send.

Keysight Technologies [KEYS]: Premarket Move: +15%

Keysight showed up to earnings with receipts with a clean beat and next-quarter guidance that basically said, yeah, we’re still Him.

Traders love a company that quietly sells the testing gear behind all the fancy chips, and today the market’s finally remembering that the tool makers get paid no matter whose logo wins.

My Take: If you’ve been waiting, don’t chase every cent of the gap. Start with a small position, add only if it holds gains, and skip it entirely if it round-trips the move.

Spotify Technology [SPOT]: Premarket Move: +4%

Spotify’s getting ready to nudge U.S. prices higher again, and investors are basically saying, about time. A couple extra dollars a month from millions of listeners adds up fast, especially when Wall Street’s obsessed with profitable growth instead of just vibes and playlists.

The risk is pushing too hard and annoying users, but so far, streaming music still looks cheap next to your video stack.

My Take: Price hikes plus scale can be a solid combo. Fine to ride the trend with a modest position, but keep an eye on churn and be ready to trim if users start hitting unsubscribe instead of repeat.

Exclusive Trend Alert (Sponsored)

We’re sharing a free copy of our brand-new report: 7 Best Stocks for the Next 30 Days.

For decades, our objective, mathematical stock prediction system has delivered market-beating results, identifying trades with exceptional potential.

This report uncovers the 7 highest-potential stocks from our top-rated selections — fewer than 5% of all stocks qualify.

These could be the most exciting short-term trades in your portfolio.

Act now — download your free copy and be ready for the next move.

[Get the Free Report]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Everything Else

AI leaders are back in focus as fresh cloud and accelerator chatter turns every tick in chip stocks into an AI sentiment check.

SanDisk is joining the S&P 500 post–spinoff, swapping in storage silicon where an old-school ad name used to sit.

A Dutch watchdog is telling Tesla fans to stop pushing for unsupervised “Full Self-Driving,” cooling dreams of hands-free road naps.

TSMC is suing a former executive over security concerns, a fresh reminder that chip expertise now counts as geopolitical ammo.

Apple’s sales team is getting trimmed as the company rejiggers how it sells hardware in a choppier upgrade cycle.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.