A high-impact Phase 3 trial just breathed new life into this rare disease biotech, and with both cardiac and skeletal endpoints showing strong efficacy, some investors are betting this stock’s story is just getting started.

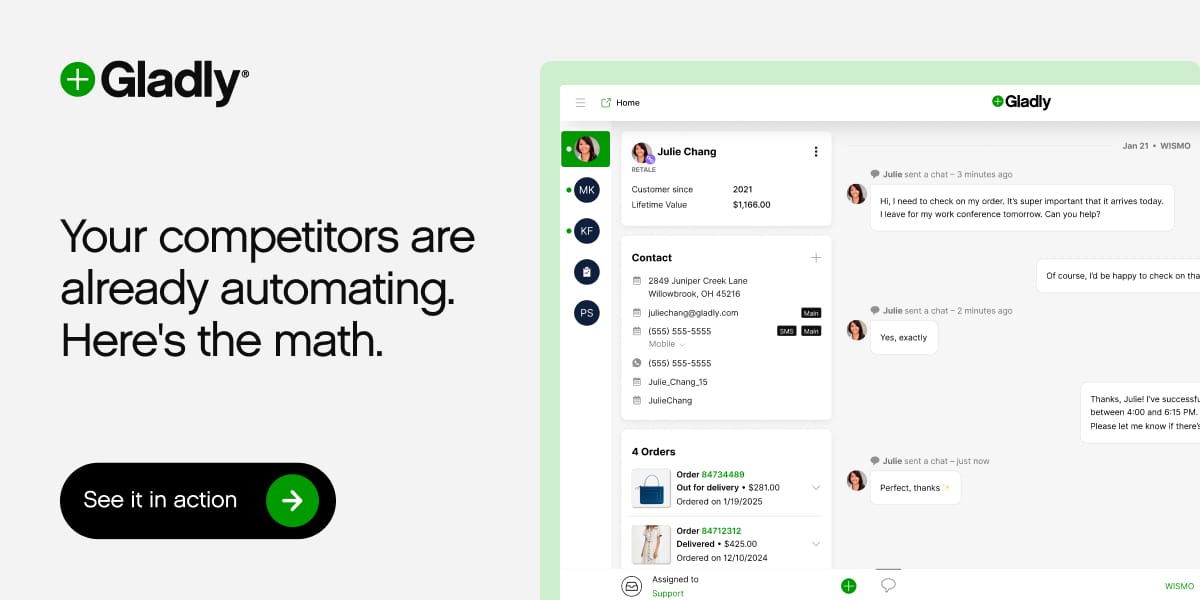

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

Markets

Wall Street rallied after soft labor data fueled 90% odds of a near-term rate cut, supporting equities despite a pullback in major AI names like Microsoft and Nvidia.

DJIA [+0.86%]

S&P 500 [+0.30%]

Nasdaq [+0.17%]

Russell 2k [+1.84%]

Market-Moving News

Enterprise

The AI Boom Finally Meets Reality — And Microsoft Blinks First

Microsoft (NASDAQ: MSFT) is entering a surprising moment after several teams reportedly dialed back internal sales targets for some AI tools.

Inside Azure, the division that powers Microsoft’s entire AI engine, even small target shifts carry a loud message about how hard real-world deployment actually is.

When Early Hype Meets Real Work

Many companies bought AI tools fast, but using them deeply is harder, and Microsoft is now living that reality.

You start noticing how often businesses ask for clarity, training, and proof before they switch big workflows.

This puts pressure on Microsoft to tighten product performance, smooth out integration issues, and prove that AI copilots can move from experiments to everyday tools.

A Reset That Builds a Stronger Future

For Microsoft, the reset marks the moment the AI race stops being a sprint and becomes real engineering.

That reality hits you when the company focuses less on buzz and more on building tools built to survive years, not months.

This moment will influence how Microsoft designs future AI tools, how enterprise clients adopt them, and how the next wave of cloud platforms gets built.

Aerospace

The Hypersonic Race Just Got a New Front Runner

Lockheed Martin (NYSE: LMT) opened its new Hypersonics System Integration Lab in Huntsville, a facility built in just over one year.

The setup puts you inside a workflow where design, building, and testing all run in one place, showing how focused the company has become.

The new setup lets teams move faster and solve problems earlier, a major advantage in a category where timelines and reliability decide who sets the global pace.

Where High Speed Becomes High Stakes

Hypersonics are now a top priority for modern militaries, and this lab positions Lockheed Martin as one of the central players shaping what comes next.

You get a sense of how big this moment is when you see the company tying its future to programs that run for decades.

Hypersonics are now a top priority for modern militaries, and this lab positions Lockheed Martin as one of the central players shaping what comes next.

The scale of the shift reaches you once the company connects its future to programs built to run for decades.

A Long Game With Long Rewards

For LMT, this isn’t real estate; it is a deeper move into high-barrier programs that offer stable demand and recurring revenue.

You end up realizing how this facility strengthens Lockheed’s grip on one of the fastest-growing segments in defense.

As global interest accelerates, the company is building exactly what it needs to stay a primary contractor in the hypersonic race.

Rapid Momentum Shift (Sponsored)

Five stocks just crossed key levels that could position them for major upside in the months ahead.

Analysts are tracking these moves closely as momentum builds faster than expected.

The window to review these setups may be shorter than most investors realize.

Get the full breakdown while the signals are still active.

See the 5 stocks.

Entertainment

What If Netflix Bought an Entire Universe?

Netflix (NASDAQ: NFLX) just made a move that could flip the entire entertainment landscape, reportedly submitting a binding offer valued at nearly $70B to acquire Warner Bros. Discovery.

This is not a content grab; it is a shift toward owning the deepest vault of franchises Hollywood has ever built.

When you look at what this includes, you see Netflix trying to secure IP that lasts generations, not seasons.

It pushes the company into a new tier where the battle is no longer about subscribers, but cultural ownership.

A Bid for Permanent Power

DC, Harry Potter, HBO originals, and decades of Warner Bros. film history would sit inside Netflix’s ecosystem.

You can imagine how differently the industry moves when Netflix controls universes that other studios depend on.

This is the type of swing that creates real moats, not marketing noise.

It turns Netflix from a streamer into a global entertainment institution with control over theaters, licensing, merchandise, and gaming.

A New Entertainment Order Takes Shape

If this deal closes, Netflix stops being one competitor among many and becomes the gravitational center of the industry.

You end up seeing the entire streaming landscape reorganize around one company.

For Netflix, this isn’t about buying shows; it is about buying dominance for the next 20 years.

The kind of dominance that forces rivals to rethink everything from strategy to distribution.

Want to make sure you never miss our post-market roundup?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone right after the closing bell rings.

Email’s great. Texts are faster.

Top Winners and Losers

Capricor Therapeutics, Inc [CAPR] $29.96 (+371.07%)

Capricor surged after its pivotal Phase 3 HOPE‑3 trial showed statistically significant skeletal and cardiac improvements in Duchenne patients, strengthening the case for Deramiocel as a first‑in‑class therapy.

MapLight Therapeutics Inc [MPLT] $16.92 (+31.26%)

MapLight climbed after Jefferies reaffirmed its Buy rating and highlighted strong upside potential for its muscarinic modulator ML‑007C‑MA ahead of Phase II schizophrenia data.

Poet Technologies Inc [POET] $6.01 (+28.42%)

Poet rose after Northland hiked its price target, citing growing optimism for optical‑component suppliers following Marvell’s acquisition of Celestial AI.

Pure Storage Inc [PSTG] $68.82 (-27.34%)

Pure Storage plunged after quarterly results revealed margin pressure and a weaker profit outlook, disappointing investors who had bid the stock up more than 50% year‑to‑date.

iPower Inc [IPW] $10.72 (-14.24%)

iPower slipped after the company issued short‑term promissory notes involving related parties, raising liquidity and dilution concerns despite recent bid‑price compliance.

GitLab Inc [GTLB] $37.83 (-12.77%)

GitLab dropped after delivering mixed guidance that pointed to slowing revenue growth and a decline in net retention, overshadowing its earnings beat.

Poll: How do you feel about credit card points?

Protect Your Gains (Sponsored)

A veteran trader publicly recommended a major winner earlier this year long before most investors noticed and he did it using one simple indicator he’s relied on for decades.

This same indicator helped him spot multiple powerful market moves long before they gained momentum.

Most traders have never even heard of it, yet it has guided him through 30 years of volatile markets with remarkable accuracy.

He’s now giving this indicator away for free, along with a short guide that shows exactly how to use it.

Click now to see the indicator before the next major signal fires.

Everything Else

Fed data shows the central bank has finally stopped bleeding cash, a rare plot twist in an interest rate era that’s been burning holes in its balance sheet.

Delta says the shutdown set it back $200 million, but it still sees demand strong enough to keep planes full.

Novo Nordisk is lining up a December debut for Ozempic in India, aiming to turn weight loss buzz into a blockbuster new market.

Nvidia servers are cranking China’s Moonshoot AI and others to speeds up to ten times faster, turning model training into a sprint instead of a crawl.

Micron is bowing out of the consumer memory business as the global shortage stretches on, choosing to focus on pricier chips instead of budget sticks.

That's it for today! Please, write us back, and let us know what you think of the Closing Bell Roundup. We're always eager to hear feedback!

Thanks for reading. I'll see you at the next open!

Best Regards,

— Adam G.

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.