Launch pads are getting busy, contracts are stacking, and one space player just swapped meme fuel for real thrust. We’ll walk through what’s actually powering the move, the milestones that matter next, and where excitement turns into an actual mission worth watching.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

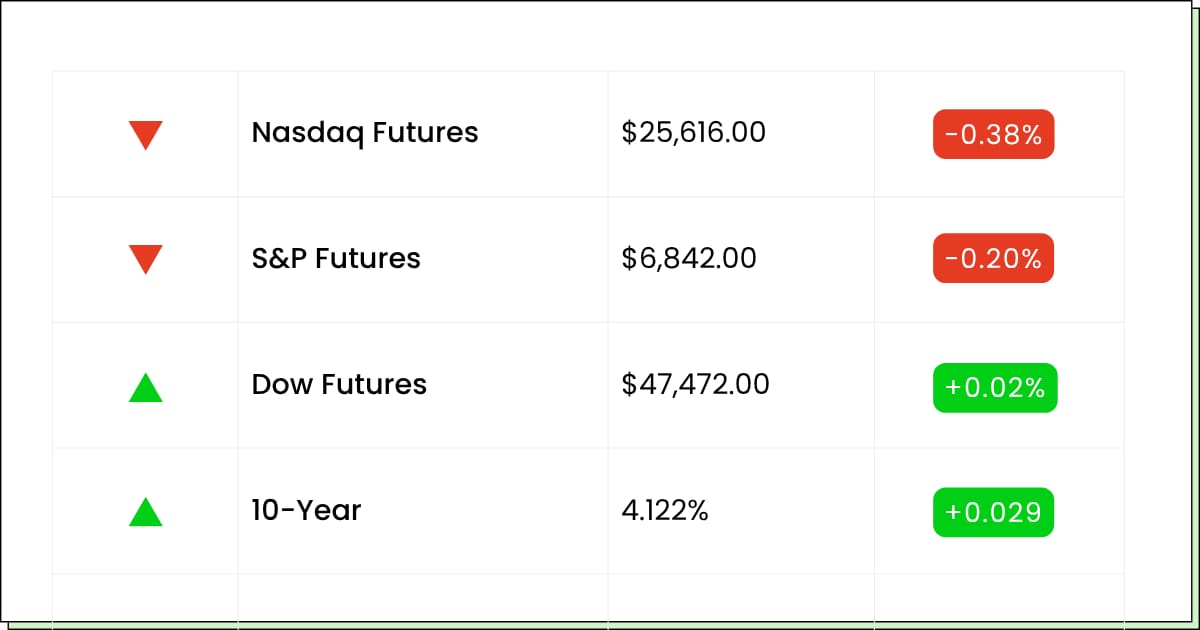

Futures at a Glance📈

Pretty flat today after yesterday’s sprint. AI is catching its breath as a weak guide from an AI infra name and a chipstake sale cool the hype, while dip-buyers eye yesterday’s bounce in the megacaps. The Senate’s shutdown deal keeps hopes alive that Washington reopens and the data firehose turns back on, so traders are leaning patient rather than panicked.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

Sea [SE]

AngloGold Ashanti [AU]

Nebius Group [NBIS]

Fermi [FRMI]

Aftermarket Earnings:

Alcon [ALC]

Oklo [OKLO]

Amdocs [DOX]

CAE [CAE]

Economic Reports:

NFIB optimism index (Oct): 6:00 am

Fed speaker: Gov. Michael Barr (10:25 am)

Veterans Day: U.S. bond market closed

Technology

CoreWeave Catches A Cloud, Then Trips On The Forecast

CoreWeave Inc. (NASDAQ: CRWV) just pulled the classic great quarter, awkward outlook. Revenue ripped, big-name customers kept calling, and the AI buzz is still loud, but the guide came in light, and the stock did a little stomach drop.

Think of it like a packed restaurant where the kitchen suddenly warns that the entrées might take longer. You still want the food, but you’re just less excited to wait.

Under the hood, demand isn’t the issue so much as logistics. New sites, new power, new boxes. It’s a lot of moving parts, and a few of them are moving slower than hoped. The long game still looks big because the AI build-out isn’t a weekend fad, it’s more like remodeling an airport while planes are landing. Messy now, but useful later.

It would be smart for you not to chase the first bounce. Let it breathe for a few sessions and watch whether the stock turns from uh-oh to ok, they’ve got this. You want proof the delays are detours, not dead ends.

My Take For You: Starter position only on calm days. Add slowly if execution headlines improve; step aside if the delay becomes a trend.

My Verdict: Growth story with hiccups, set it in your watchlist to small buy on dips.

Industrials

Jacobs Puts Another Brick In A Very Big Wall

Jacobs Solutions Inc. (NYSE: J) is having a construction montage moment. One day it’s takeover whispers, the next it’s a trophy project in the Middle East that looks like it belongs on a streaming docu-series about megacities.

That means the pipeline keeps filling, and the brand keeps showing up on big blueprints. For us, that’s exactly what you want from an engineering name, with less drama, more backlog, and contracts that take years to finish (in a good way).

It’s not a confetti stock, it’s a calendar stock with steady work, milestone checks, repeat. The occasional rumor can goose the price, but the real juice is long projects that pay the bills rain or shine.

Of course, mega-builds can be messy. Timelines stretch, costs argue, and politics always wants a cameo. That’s why you don’t treat a headline win like instant riches. You let it settle, see the follow-through, and remember this is closer to slow-cooker investing than microwave popcorn.

My Take For You: If you want exposure to global infrastructure, build a position in layers. Add on quiet weeks, trim after rumor-fueled hops, and keep expectations normal.

My Verdict: Solid core holding, so accumulate patiently and let the projects do the talking.

Short-Term Insight (Sponsored)

When short-term strength meets proven data, opportunities can emerge quickly.

This new report reveals 7 stocks already gaining traction that could continue their climb over the next 30 days.

These picks come from an elite group representing less than 5% of all tracked companies — selected for performance, value, and momentum.

Don’t let this list expire before you review it.

Download the 7 Best Stocks Report Free

Aerospace

Rocket Lab Packs More Trips, And The Street Packs Its Bags

Rocket Lab Corp (NASDAQ: RKLB) just showed up with a suitcase full of bookings and a flight schedule that keeps getting busier. The latest update said more launches, more revenue, and a roadmap that sounds less like maybe and more like when. Investors love that kind of punctuality, hence the premarket hop.

The charm here is consistency. Space headlines can be flashy, but customers buying multiple tickets is what pays the bills.

When a company can string together successful rides and grab repeat business, it stops being a meme rocket and starts being a real airline for satellites. That’s the neighborhood Rocket Lab wants to live in.

Still, rockets are rockets. Weather, delays, and one stubborn bolt can humble any plan. If you’re reading this over coffee, treat the post-news pop as a signal, not an invitation to sprint. The better entries show up when the excitement fades and the schedule keeps filling anyway.

My Take For You: Buy on red, not on green. If the cadence stays steady and new contracts keep landing, add. If the itinerary slips, keep your cash in the terminal.

My Verdict: Quality operator for the space bucket. Buy the dips when they come back to earth.

Trivia: What’s the minimum age to open a Roth IRA (with earned income)?

Movers and Shakers

BigBear.ai [BBAI]: Premarket Move: +18%

Earnings came in less bad than feared, and the loss tightened up, so AI-gov buzz is back on the menu. Investors love the we’re in the room story with agencies, even if the checks show up on their own schedule.

Just remember, they also sold stock, and this name can jump like a cat on a Roomba—cute until it slams a wall.

My Take: Momentum play here, not a main course. Starter bite only, skim wins on green, and step off if headlines turn from contracts to delays.

The RealReal [REAL]: Premarket Move: +17%

A fresh price-target bump after a strong quarter has the luxury consignor strutting the runway. KPIs are improving and the feeling is closet spring-cleaning pays.

But it’s still unprofitable, and this thing has a beta like a double espresso. So it’s fun until your hands shake.

My Take: Okay to window-shop with a small buy here. Add only if demand stays hot through holiday returns, and take profits fast if the glam fades.

Life360 [LIF]: Premarket Move: −7%

They’re snapping up an ad-tech shop to boost monetization, which makes sense after a big year, but deals come with luggage. Some growth cooled a touch, so profit-taking is having a day.

Integration risk plus a monster run equals wobble city. No disaster, just a speed bump.

My Take: If you like the story, wait for calmer tape and buy the dip in halves. If you’re long, keep it modest and use a simple “I’m out if it breaks here” line.

Limited Free Access (Sponsored)

A major market move could be forming and a handful of stocks are already showing signs of strength.

After reviewing hundreds of companies, analysts identified 5 with the most upside potential for the next phase of growth.

Each one has a combination of strong financials and market positioning that could lead to exceptional performance.

The full details are available in a new report that’s completely free, but only for a limited time.

[Download the 5 Stocks to Watch Report – Free Now]

Everything Else

SoftBank tapped the brakes on chips and sold its stake in a market favorite for $5.83B.

Gaming and music got a mixed playlist after Sony’s quarter landed with belt-tightening vibes.

Hollywood kept pitching synergies as Paramount–Skydance talked up merger savings again.

Chip leadership shuffled when the Intel CEO personally grabbed the AI reins after a key exec left.

Merchants saw a small win as Visa and Mastercard reached a revised swipe-fee settlement.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.