Good morning. It's January 21st, and this morning, we’ll look at the earnings reports of 3M, Charles Schwab, and Fifth Third Bank.

Technology

This Nasdaq-listed company is redefining AI in the $124 billion smart glass market.

From cockpit shading systems to energy-efficient building glass, their technology powers global leaders like Boeing, Mercedes-Benz, and National Geographic.

Their projected $240M revenue from aerospace positions them as an AI-driven market disruptor you can’t ignore.

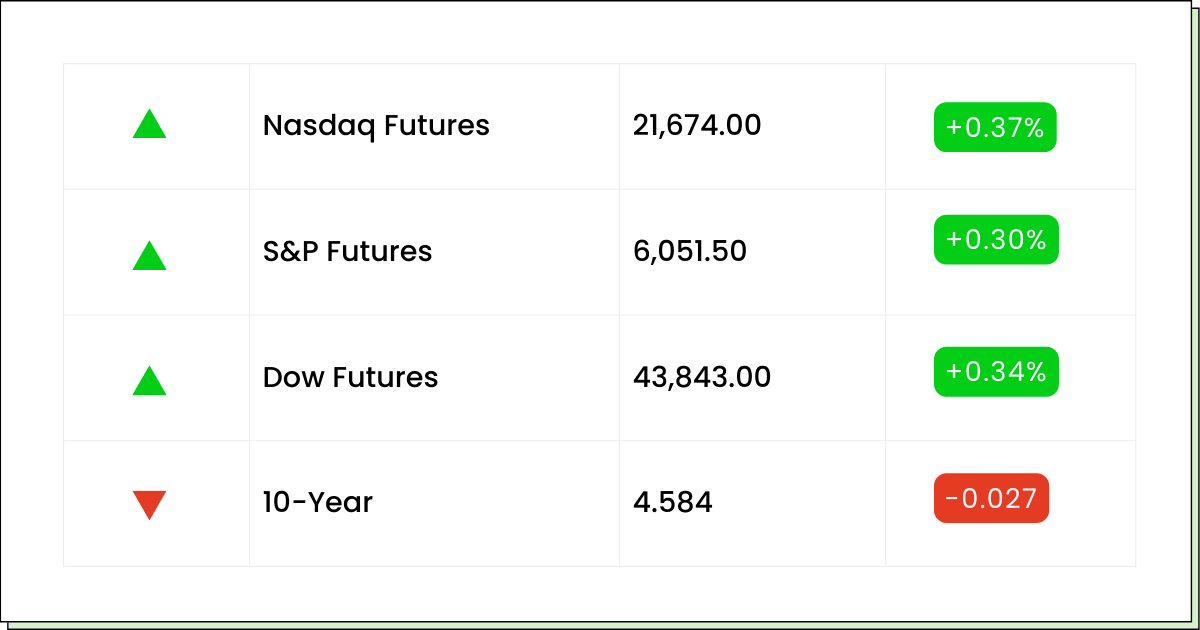

Futures 📈

What to Watch

Earnings:

Charles Schwab [SCHW]: Premarket

3M Company [MMM]: Premarket

Fifth Third [FITB]: Premarket

Netflix [NFLX]: Aftermarket

Interactive Brokers Group [IBKR]: Aftermarket

Capital One Financial [COF]: Aftermarket

United Airlines Holdings [UAL]: Aftermarket

Seagate Technology Holdings [STX]: Aftermarket

Economic Reports:

None scheduled

Industrial Products

3M Shares Rise After Surpassing Quarterly Profit Expectations

3M Co. (NYSE: MMM) reported better-than-expected fourth-quarter earnings this morning, fueled by strong demand for its industrial adhesives, tapes, and electronics products. The company’s adjusted earnings for the quarter are at $1.68 per share, exceeding the consensus estimate of $1.66.

Sales growth in the electronics segment, particularly in automotive and mobile device applications, provided a much-needed boost after months of weaker demand as inflation-weary consumers deferred major purchases.

3M’s stock is climbing 3.5% in premarket trading.

Looking ahead, 3M has set its 2025 adjusted profit outlook in the range of $7.60 to $7.90 per share, aligning closely with analysts' projections of $7.77 per share. The company is focused on its ongoing restructuring initiatives aimed at cost reductions and a sharper focus on high-margin products to drive profitability.

Based in St. Paul, Minnesota, 3M remains optimistic about its future growth, leveraging operational efficiencies and strategic product investments to navigate market uncertainties.

Banking

Fifth Third Q4 EPS Misses, But Revenue and Loan Growth Impress

Fifth Third Bancorp (NASDAQ: FITB) reported fourth-quarter 2024 earnings of $0.85 per share, falling short of analyst expectations of $0.88.

Despite the earnings miss, the Cincinnati-based bank’s growth in loans and fee income is strong. Its net income available to common shareholders is touching $582 million, up from $532 million in the prior quarter and $492 million a year earlier.

Total revenue climbed as net interest income reached $1.44 billion, a 1% sequential increase, driven by loan expansion and effective deposit rate management.

The bank's net interest margin improved to 2.97%, reflecting strategic asset repricing. Noninterest income grew 3% from the previous quarter to $732 million but was down 2% year-over-year.

The bank's efficiency ratio improved to 56.4%, benefiting from a 1% sequential and 16% annual decline in noninterest expenses. However, the quarter’s results were affected by a $0.05 per share hit from litigation costs and contributions to the Fifth Third Foundation.

CEO Tim Spence highlighted the bank’s focus on growth and stability, stating that despite challenges, the company achieved consistent performance across loans, deposits, and fee generation.

Shares of Fifth Third are up 1.3% in premarket trade.

Aviation

Looking for the next big EV opportunity?

The market is expanding rapidly, and one stock is standing out with its innovative approach and strong industry partnerships.

Find out more about this potential game-changer.

Get a full report here.

Banking

Schwab’s Q4 Earnings and Asset Growth Exceed Expectations

Charles Schwab shares are surging more than 5.35% in premarket trading. The brokerage giant’s fourth-quarter adjusted earnings of $1.01 per share are higher than Wall Street's estimate of 91 cents and reflect a 49% increase compared to the same period last year. On an unadjusted basis, earnings are at 94 cents per share.

Revenue for the quarter reached $5.3 billion, marking a 20% year-over-year increase and surpassing the anticipated $5.2 billion. Schwab is also reporting strong asset growth, with core net new assets totaling $115 billion for the quarter and $367 billion for the full year, up from $306 billion in 2023.

This earnings report marks the first under new CEO Rick Wurster, who succeeded Walt Bettinger earlier this year. Wurster has emphasized expanding Schwab’s reach among high-net-worth clients and enhancing services for registered investment advisors. The company is also planning to expand its physical footprint with over a dozen new branch openings.

Analysts remain largely positive on Schwab’s outlook, with key factors including debt reduction efforts and opportunities arising from its TD Ameritrade integration. Despite recent underperformance relative to the S&P 500, Schwab's growth trajectory and strategic initiatives position it well for 2025.

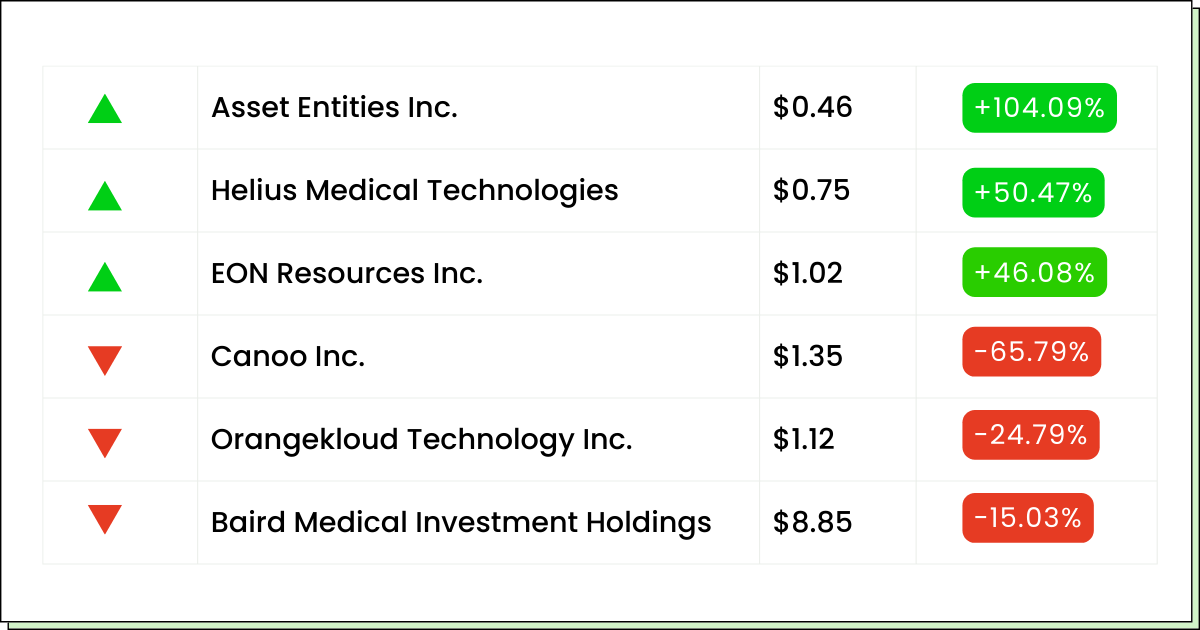

Movers and Shakers

Asset Entities Inc. [ASST] - Last Close: $0.46

Asset Entities Inc. is a tech firm specializing in social media marketing, management, and content delivery.

The company's stock is up over 100% in premarket trading today after it became approved as an official TikTok Shop Partner.

My Take: ASST has fallen more than 75% in value in the last year, and its net income has been negative for the last two years. It might be best to keep this stock in your wait and watch list for now.

Helius Medical Technologies [HSDT] - Last Close: $0.75

Helius Medical Technologies, Inc. is a neurotech company that delivers novel therapeutic neuromodulation approaches for balance and gait deficits.

Its stock is surging more than 50% before the opening bell today because its stroke registrational program to demonstrate the safety and effectiveness of its Portable Neuromodulation Stimulator (PoNS®) has exceeded the initial enrollment target, with 128 participants randomized as of December 31, 2024, surpassing the goal of 90 participants.

My Take: : The advancement in the stroke registrational program might be a game changer for the firm, which is facing significant challenges with its financials. Keep this stock on your radar for future developments.

Redwire Corporation [RDW] - Last Close: $14.75

Redwire Corporation provides solutions for civil, commercial, and national security space missions.

Its stock is surging more than 10% in premarket trading today due to its signing of a definitive agreement to acquire Edge Autonomy, a provider of uncrewed airborne system technology, in a cash and stock deal valued at $925 million.

This strategic acquisition will broaden Redwire's portfolio to include Edge's autonomous airborne systems.

My Take: Redwire’s stock is up more than 400% in the last year. The firm has been growing its revenues steadily, and this acquisition might again be a positive catalyst for growth. Definitely keep your eye on this stock.

iGaming

The iGaming market is rewriting the rules, with New Jersey hitting $2.4B in revenue last year.

One company stands out, delivering $2.13 for every $1 spent and expanding into lucrative markets.

Everything Else

The UK government raised record funds with a 2040 bond sale amid inflation and growth worries.

Trump postponed sweeping tariffs, but Canada and Mexico will face major disruptions next month.

Bitcoin dips and Trump-themed tokens crash amid fading investor optimism.

Smithfield Foods sets sights on a billion-dollar IPO as it returns to the U.S. stock market.

Tata Technologies posted higher-than-expected Q3 profit despite rising expenses.

AI's future lies in systems, not just models, says Mistral CEO at Davos.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.