Record dry powder and no buybacks say patience pays. I’ll lay out a scale-in plan on red days, a trim rule into relief rallies, and a simple hedge so you ride the fortress balance sheet without guessing the next headline.

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

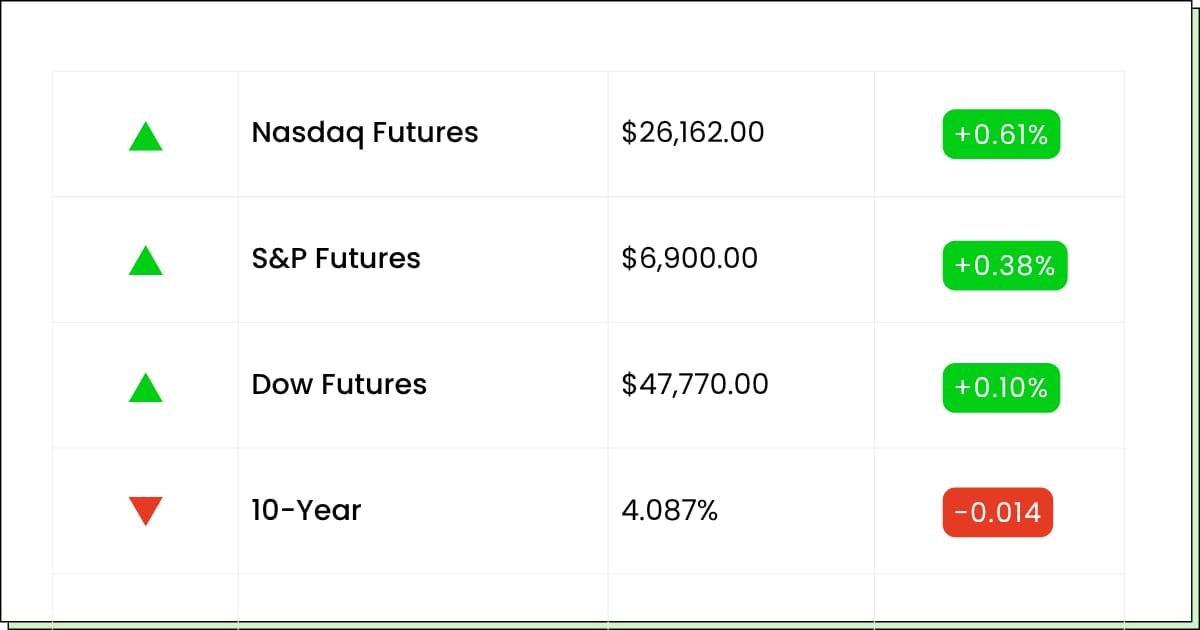

Futures at a Glance 📈

Futures are nudging green to start November, with chips pacing the move and Big Tech jogging behind. AI momentum, a softer U.S.–China tone, and a busy earnings slate have the wind at risk-on’s back, even as the shutdown muddies data drops. Tariff policy heads to the high court, so keep one eye on headlines while you ride the trend.

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Premarket Earnings:

IDEXX Laboratories [IDXX]

Ares Management [ARES]

Public Service Enterprise Group [PEG]

Aftermarket Earnings:

Palantir Technologies [PLTR]

Vertex Pharmaceuticals [VRTX]

Williams Companies [WMB]

Simon Property Group [SPG]

Realty Income [O]

Economic Reports:

S&P Global U.S. Manufacturing PMI (final) (Oct): 9:45 am

ISM Manufacturing (Oct): 10:00 am

Construction spending (Sept): 10:00 am*

Auto sales (Oct): TBA

Speech — San Francisco Fed President Mary Daly: 12:00 pm

Speech — Fed Governor Lisa Cook: 2:00 pm

*Data subject to delay if government shutdown continues.

Semiconductors

Flash Dance For SanDisk As Target Hikes Turn Into A Spotlight

SanDisk Corp (NASDAQ: SNDK) just got the confetti cannon. Fresh target hikes, a friendlier macro breeze, and the crowd finally noticed the turnaround beat. Momentum like this feels great until it starts checking its shoelaces, so the next phase is about proving the story with clean execution rather than just applause.

The setup is classic heat check. When multiple shops sing in harmony, you often get a window where buyers chase and sellers wait. That window is not forever. Earnings rhythm, demand trajectory, and any hint of supply or pricing wobble will matter more than cheerleading. The stock earned a victory lap; now it has to hold the pace without tripping over its own spikes.

For traders, the best friend is a plan. Emotion buys highs and then googles how to sell. Logic lets the chart breathe, trims on strength, and reloads only if the groove resumes.

My Take For You: If you missed the first run, wait for a calm pullback or an obvious higher low. If you are already in, trail gains and avoid turning a fun swing into long-term luggage.

My Verdict: Momentum swing with upside as long as the beat holds. Enjoy the music, keep your shoes by the door.

Crypto & Blockchain

Ether Treasure Chest At BitMine Or Just A Sugar Rush

Bitmine Immersion Technologies Inc (NYSEAMERICAN: BMNR) found the fast lane. A giant crypto stash, a louder growth pitch, and new analyst love sent the name sprinting up the track.

That playbook works while the broader crypto tape flashes green and headlines keep the party going. It also flips quick when risk appetite blinks, because concentration cuts both ways.

Beneath the buzz lives execution risk. Turning a large Ethereum trove into steady staking income while scaling infrastructure takes discipline and real operating chops. Smaller caps can soar on hope and stumble on follow-through.

Add the usual concerns about dilution, volatility, and shifting narratives, and you have a ride that rewards tight risk control more than grand speeches about the future.

If you want exposure to the mood, fine. Just treat it like hot sauce and not the main course. The goal is to leave the table smiling, not searching for antacids.

My Take For You: Size small, define your exit, and harvest wins into strength. Use a time stop as well as a price stop so a sideways drift does not turn a trade into a souvenir.

My Verdict: Speculative joyride. Accept the swings, keep a helmet on, and step off at the first wobble.

Free Until Midnight (Sponsored)

How would it feel to double your money by this time next year?

From thousands of stocks, only 5 have emerged with the best chance to gain +100% or more in the months ahead.

You can see all five of these tickers — absolutely free.

Just download the newly released 5 Stocks Set to Double special report.

While we can’t guarantee future performance, previous editions of this report have delivered gains of +175%, +498%, and even +673¹.

The newest picks could be just as profitable.

Act fast—this opportunity ends at MIDNIGHT TONIGHT.

Download the report now, absolutely free

Start the next year positioned for serious upside.

Financials

Cash Is King And The Oracle’s Wearing A Bigger Crown

Berkshire Hathaway Inc. Class B (NYSE: BRK.B) reminded everyone that patience still pays. Insurance is humming, the railroad keeps grinding, and the cash mountain just grew taller than most skylines. No buybacks again, which is classic Berkshire for prices not being tempting. That restraint frustrates traders who want fireworks, but long-haul compounding rarely needs pyrotechnics.

The leadership handoff sits in the background. Greg Abel is set to steer, Buffett stays chair-side, and the playbook remains steady. That continuity matters more than any single quarter. The message is simple: strong underwriting, disciplined capital allocation, and optionality to pounce when the market finally tosses up bargains.

If you came for sizzle, you will be bored. If you came for durable return engines that throw off cash and avoid dumb risks, you are in the right theater. Berkshire is still the adult in the room, and the room is loud.

My Take For You: New buyers can scale in on quiet days and let time do the heavy lifting. Current holders can keep it core, resist tinkering, and use dips to add rather than trading around the edges.

My Verdict: Long-term anchor. Add on weakness, ignore the daily noise, and let float and discipline do the compounding.

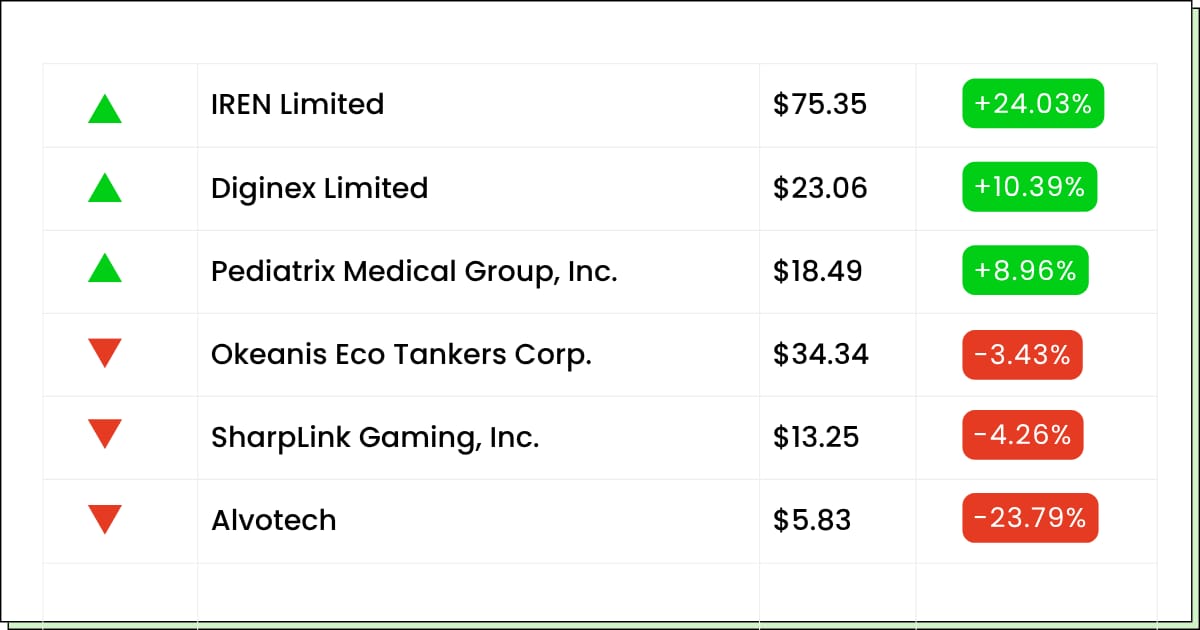

Movers and Shakers

Diginex [DGNX]: Premarket Move: +12%

A seven-for-one split and a shiny AI-adjacent acquisition plan have the small-cap crowd buzzing.

Splits don’t change value, but they do invite more eyeballs, and eyeballs invite momentum. Just know this one’s been sprinting all year and the valuation math reads like a sci-fi novel. Fun trade, touchy brakes.

My Take: If you play it, size tiny, trail a stop, and treat morning spikes as rent money, not retirement.

FuboTV [FUBO]: Premarket Move: +6%

Closing the Hulu + Live TV merger turned a scrappy streamer into a bigger, bendier bundle. More subs, more ad inventory, more ways to package sports without juggling five remotes. Integration still takes time, and big-company parentage means headlines can swing the mood.

My Take: Starter buy okay, then add only if churn trends and margins improve on the next update.

SharpLink Gaming [SBET]: Premarket Move: −5%

Fresh coverage with a bullish stamp meets a market that knows this one rides the crypto roller coaster. The pitch is simple here with a hefty ETH treasury, yield games, and leverage to chain vibes. That can print green days fast, and red ones faster.

My Take: You’re playing hot potato with this one a bit. Keep positions small, take wins on strength, and step aside if crypto cools.

Strategic Supplier (Sponsored)

Elon Musk is accelerating plans for a tiny technology designed to support explosive AI growth.

Behind the scenes, one company is providing a critical piece of this development—yet almost no one is talking about it.

A key event could soon shine light on the partnership, and early curiosity is building fast.

This briefing breaks down the full story while it’s still under the radar.

Watch the exclusive video.

Everything Else

Standard Chartered’s chief says almost all payments will eventually ride on the blockchain rails.

China’s robotaxis keep rolling as Baidu expands service and Waymo watches the world’s biggest test track from afar.

Microsoft’s AI boss says only biological beings are conscious, so your toaster won’t develop feelings, just a better recipe for burnt.

OPEC looks set to green-light another modest increase in output, keeping energy markets on a slow simmer rather than a boil.

The dollar is flirting with a fresh high as traders brace for U.S. data; a firm greenback mood keeps risk appetites measuring their portions.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.