A high-stakes $8-billion merger is shaking up broadcast news and putting political pressure on media giants. A fast-scaling edtech platform just posted double-digit growth and raised its outlook after adding millions of users. And the top name in sports broadcasting has inked a deal with America’s most powerful sports league.

Here’s what traders are watching today.

Fresh Watchlist (Sponsored)

Some stocks don’t just rise — they explode.

A new report reveals 5 stocks with the potential to gain 100%+ in the next 12 months, backed by strong fundamentals and bullish technical signals.

Past picks from this team have soared +175%, +498%, even +673%. ¹

This free report gives direct access to the names and tickers — no fluff, just high-upside plays.

Available free until midnight tonight.

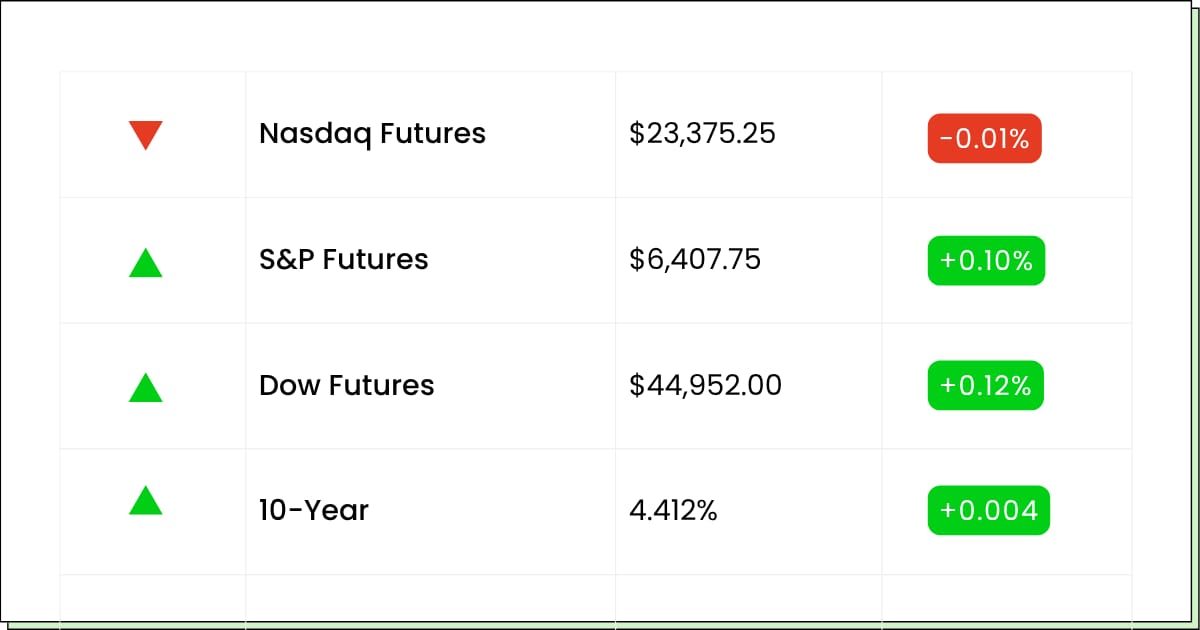

Futures 📈

Want to make sure you never miss a pre-market alert?

Elite Trade Club now offers text alerts — so you get trending stocks and market-moving news sent straight to your phone before the bell.

Email’s great. Texts are faster.

You’ll be first in line when the market starts moving.

What to Watch

Earnings:

HCA Healthcare, Inc. [HCA]: Premarket

Aon plc [AON]: Premarket

Charter Communications, Inc. [CHTR]: Premarket

ENI S.p.A. [E]: Premarket

NatWest Group plc [NWG]: Premarket

Phillips 66 [PSX]: Premarket

First Citizens BancShares, Inc. [FCNCA]: Premarket

Shinhan Financial Group Co Ltd [SHG]: Premarket

Centene Corporation [CNC]: Premarket

Booz Allen Hamilton Holding Corporation [BAH]: Premarket

Saia, Inc. [SAIA]: Premarket

AutoNation, Inc. [AN]: Premarket

OneMain Holdings, Inc. [OMF]: Premarket

Moog Inc. [MOG.B]: Premarket

Moog Inc. [MOG.A]: Premarket

Lear Corporation [LEA]: Premarket

Gentex Corporation [GNTX]: Premarket

Flagstar Financial, Inc. [FLG]: Premarket

Sensient Technologies Corporation [SXT]: Premarket

Portland General Electric Company [POR]: Premarket

First Hawaiian, Inc. [FHB]: Premarket

TriNet Group, Inc. [TNET]: Premarket

Lakeland Financial Corporation [LKFN]: Premarket

Stellar Bancorp, Inc. [STEL]: Premarket

Virtus Investment Partners, Inc. [VRTS]: Premarket

Carter's, Inc. [CRI]: Premarket

Gorman-Rupp Company (The) [GRC]: Premarket

Southside Bancshares, Inc. [SBSI]: Premarket

CPB Inc. [CPF]: Premarket

Wabash National Corporation [WNC]: Premarket

GrafTech International Ltd. [EAF]: Premarket

Economic Reports:

Durable Goods Orders [June]: 8:30 am

Durable Goods Orders ex. Transportation [June]: 8:30 am

AI Trade Shakeup (Sponsored)

The escalating U.S.-China trade tensions are reshaping the AI landscape.

Companies like Nvidia are facing significant revenue hits with the U.S. imposing new export restrictions on advanced AI chips to China.

This shift opens doors for U.S.-based AI companies poised to fill the gap. I’ve identified 9 under-the-radar AI stocks with:

Deep AI integration across their core operations

Strong U.S. manufacturing capabilities

Infrastructure ready to capitalize on policy shifts

Access our FREE report, "Top 9 AI Stocks for This Month" to discover these opportunities before the broader market catches on.

EdTech

Coursera Pops 27% After Strong Q2 and Higher Full-Year Forecast

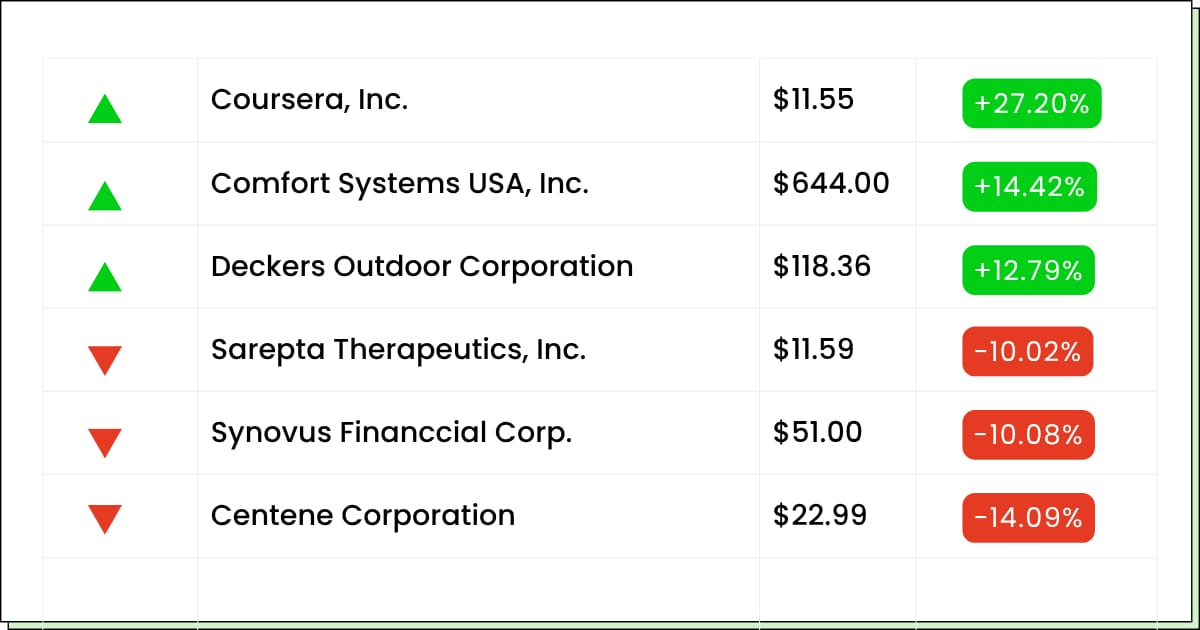

Coursera Inc. (NYSE: COUR) jumped 27% in premarket trading after posting solid second-quarter results and raising its full-year revenue guidance, powered by user growth, expanding enterprise demand, and improved profitability.

Revenue for Q2 reached $187 million, up 10% from a year earlier and ahead of expectations. Net losses narrowed significantly to $7.8 million, down from $22.9 million in Q2 2024.

The company reported free cash flow of $29 million and adjusted EBITDA of $18 million, a 73% year-over-year increase.

Gross profit rose 14% to $102.7 million, while non-GAAP net income grew 40% to $19.3 million.

The total number of registered learners reached 183 million, a 18% increase from last year, with 7.5 million new users added during the quarter.

Enterprise business also continued to scale, with 12% growth in paid customers (now at 1,686) and a net retention rate of 93%.

CEO Greg Hart cited Coursera’s positioning as a skills engine for the AI era, with more individuals and businesses turning to the platform to adapt to the rapid pace of technological change.

For the full year, the company raised its revenue outlook by $17 million to a new range of $738–$746 million, projecting an 8% EBITDA margin, a 200 basis points improvement over 2024.

Today’s surge may be the beginning of a re-rating. COUR has lagged major tech names, but the edtech space is entering a new cycle of relevance as AI disrupts the job market. Traders may look to ride momentum ahead of Q3 guidance in October.

Any commentary about AI certificate offerings or enterprise AI upskilling could reignite bullish momentum.

Media & Sports

Disney Gains Traction as NFL Stake Deal Reshapes ESPN's Future

Walt Disney Co. (NYSE: DIS) held steady near 52-week highs after revealing new details of its agreement with the NFL, which will see the league acquire up to a 10% stake in ESPN in exchange for transferring control of NFL Network and NFL RedZone to Disney.

The move strengthens ESPN’s grip on football coverage while aligning the network directly with the NFL’s strategic interests.

The NFL will remain a minority investor, while Disney consolidates its control over key media assets during a time of intensifying competition among sports streamers.

Jefferies recently upgraded Disney to “Buy” and raised its price target to $144, citing a turnaround in operating income, growing theme park revenue, and subscriber growth for Disney+.

Cruise bookings and travel demand continue to hold up, with two new ships expected to contribute up to $1.5 billion in revenue.

Disney+ subscriber additions have exceeded expectations, fueled by new bundled offerings and its growing ad-supported tier.

Analysts believe the NFL partnership provides additional insulation from future media rights disruption while enhancing ESPN’s monetization potential during live broadcasts.

Journalism watchdogs have raised concerns about editorial conflicts, but Wall Street views the move as a long-term moat for Disney’s sports empire.

DIS shares are up more than 11% year-to-date and continue to trend higher as investors regain confidence in CEO Bob Iger’s turnaround strategy.

This is a huge moment for Disney. The NFL deal adds both strategic insulation and upside optionality as ESPN explores direct-to-consumer streaming.

Keep an eye on Disney’s DTC pivot this fall, as a standalone ESPN app with integrated NFL content could be a breakout product and next-leg growth driver. Short-term, DIS may trade sideways, but pullbacks under $120 could offer a buying window ahead of NFL season kickoff.

Ranked for Growth (Sponsored)

A new investor report reveals 7 stocks with breakout potential in the next 30 days.

These picks come from a proven ranking system that has more than doubled the S&P 500’s return—posting +24.2% average annual gains.

Only the top 5% of stocks even qualify, and these 7 are rated the highest right now.

The opportunity window is closing fast.

Download the full list—free.

Access the “7 Best Stocks for the Next 30 Days” now.

Media

Paramount in the Spotlight After FCC Approves $8.4 Billion Skydance Merger

Paramount Global (NASDAQ: PARA) moved higher in premarket trading after U.S. regulators officially approved its $8.4 billion merger with Skydance Media, setting the stage for a new chapter in the company’s storied history.

The FCC’s decision clears the transfer of CBS, Paramount Pictures, and Nickelodeon to David Ellison’s Skydance, alongside major structural changes to newsroom oversight and editorial standards.

Shares rose about 1% premarket, adding to a 25% year-to-date gain, as investors digested the leadership transition and potential for operational reform under the Skydance–RedBird Capital partnership.

Paramount recently paid a $16 million settlement to resolve a lawsuit filed by Donald Trump over a 60 Minutes segment, which some lawmakers claim was politically tied to the FCC’s merger approval.

As part of the deal, Skydance has pledged to remove all DEI initiatives and install a third-party ombudsman to evaluate bias concerns in CBS reporting.

National Amusements, controlled by Shari Redstone, will relinquish its stake in the company, and Redstone will step down from the board.

The lone dissenting FCC commissioner warned the decision could erode press freedom, while proponents argue the move brings long-term accountability and investment to a struggling media portfolio.

With strong intellectual property and global reach, Paramount’s new leadership faces the challenge of executing a turnaround in a politically polarized media environment.

This deal gives traders a near-term story with long-term implications. Skydance will likely push to cut costs, refocus programming, and leverage Paramount’s film catalog more aggressively, particularly with election-year narratives in play.

PARA remains a headline-driven stock, and the next major catalysts could include board reappointments, restructuring news, and divestitures of streaming assets. Watch for volume to confirm breakouts above the $13.50 resistance level.

Movers and Shakers

Edwards Lifesciences Corp. [EW]

Last Close: $75.80 | Premarket: +7.7%

Edwards Lifesciences [EW] is a global leader in structural heart disease therapies, with particular strength in transcatheter aortic valve replacement (TAVR) and mitral/tricuspid valve technologies (TMTT). The company has treated more than 1.2 million patients globally and continues to lead innovation in minimally invasive cardiovascular care.

EW beat Q2 expectations with $1.53 billion in revenue (10.6% YoY growth) and EPS of $0.67 vs. $0.62 forecast. It raised both full-year sales and EPS guidance, citing 57% growth in its TMTT segment and momentum in global TAVR adoption. Premarket gains are erasing yesterday’s puzzling post-earnings dip.

My Take: Despite premium valuations, EW has earnings momentum, sector leadership, and a huge global runway. With Q3 guidance raised and the GenaValve acquisition pending, this is one of the few large-cap medtech names positioned to outperform in H2. Could see institutional flows pick up if it breaks above $80 with conviction.

Veracyte Inc. [VCYT]

Last Close: $23.59 | Premarket: +6.6%

Veracyte [VCYT] is a genomic diagnostics company specializing in the detection of advanced cancer and diseases through molecular testing. The firm is best known for its lung, thyroid, and prostate testing solutions, which are used across hospital and outpatient settings.

The stock is climbing almost 7% premarket after news broke that it will be added to the S&P SmallCap 600 index before market open on July 29. This inclusion typically leads to a surge in buying from index-tracking funds and ETFs, estimated to drive $30–50 million in passive inflows, and often results in expanded analyst coverage and increased institutional awareness.

My Take: This is a classic “index effect” trade, but with legs. VCYT has been beaten down over 40% YTD, and rebalancing-driven demand could act as a catalyst for a longer re-rating. Keep an eye on volume and close proximity to the July 29 effective date, opportunistic buyers could front-run the move.

Comfort Systems USA [FIX]

Last Close: $562.83 | Premarket: +14.4%

Comfort Systems USA [FIX] provides mechanical contracting services, specializing in HVAC, plumbing, and building automation for commercial and industrial projects, with a growing focus on high-growth areas such as data centers and manufacturing.

Shares jumped more than 14% premarket after the company beat Q2 expectations, reporting $2.17 billion in revenue and exceeding 70% year-over-year EPS growth. Analysts at Stifel, DA Davidson, and UBS raised their price targets, now ranging from $545 to $630, citing FIX’s strong order book, execution in the data center vertical, and structural tailwinds in industrial construction.

My Take: FIX is riding the AI infrastructure boom without being a pure tech stock, and that’s a rare setup. With backlogs growing and margins expanding, this could be one of the stealth compounders of 2025. Accumulating on dips may offer an under-the-radar way to play long-cycle growth in industrial tech infrastructure.

AI (Sponsored)

How many of your stocks DOUBLED in a year or less?

If you're like many investors, your portfolio is seeing some nice gains in this market.

But why settle for "nice" when you could aim for massive?

After filtering through thousands of companies, the experts at Zacks just released their top picks with the best chance to gain +100% or more in the coming year.

You can download the exclusive 5 Stocks Set to Double special report today — absolutely free.

These stocks have:

Rock-solid fundamentals for long-term growth

While we can't guarantee future performance, past editions of this report have posted gains like +175%, +498%, even +673%.¹

Important: This opportunity is only available until MIDNIGHT TONIGHT.

Everything Else

Puma slashes full-year forecast as tariffs hammer U.S. wholesale demand.

Volkswagen profit tumbles 29% after China slowdown and tariffs hit results.

China’s black market for banned Nvidia chips booms amid AI repair demand.

Starlink goes dark in rare global outage, disrupting users worldwide.

LVMH defies the gloom as luxury sales hold up better than feared.

That’s all for today. Thank you for reading. If you have any feedback, please reply to this email.

Best Regards,

— Adam Garcia

Elite Trade Club

Click here to get our daily newsletter straight to your cell for free.

P.S. Just like this newsletter, it's 100% free*, and you can stop at any time by replying STOP.